Irrevocable Living Trust Form California

What is the Irrevocable Living Trust Form California

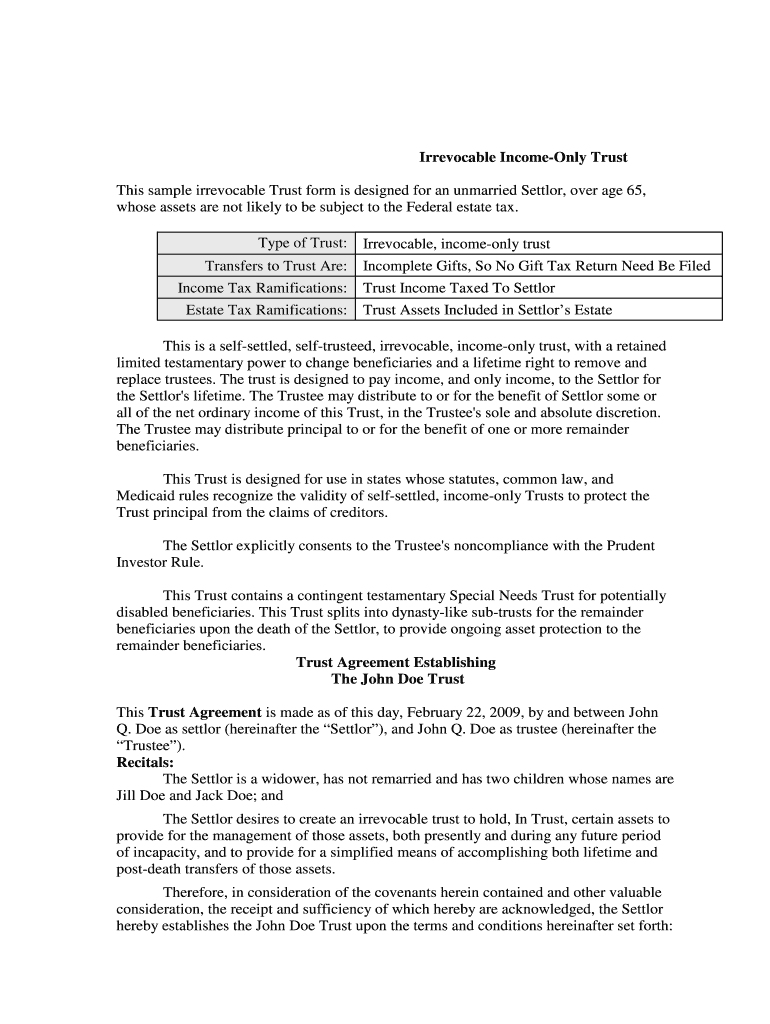

The irrevocable living trust form in California is a legal document that establishes a trust, which cannot be altered or revoked once it is created. This type of trust allows individuals to transfer their assets into the trust, providing benefits such as avoiding probate, protecting assets from creditors, and ensuring that the assets are distributed according to the grantor's wishes after their death. The irrevocable nature of this trust means that the grantor relinquishes control over the assets placed in the trust, which can lead to significant tax advantages and estate planning benefits.

How to use the Irrevocable Living Trust Form California

Using the irrevocable living trust form in California involves several key steps. First, individuals must gather all necessary information regarding their assets, beneficiaries, and any specific instructions for asset distribution. Next, they should complete the form accurately, ensuring that all required fields are filled out. Once the form is completed, it must be signed and notarized to ensure its legal validity. Afterward, the trust should be funded by transferring assets into it. It is advisable to consult with a legal professional to ensure compliance with state laws and to address any specific concerns.

Steps to complete the Irrevocable Living Trust Form California

Completing the irrevocable living trust form in California involves a series of organized steps:

- Gather necessary information about your assets, including property, bank accounts, and investments.

- Identify beneficiaries who will receive the assets held in the trust.

- Fill out the irrevocable living trust form, ensuring all details are accurate and comprehensive.

- Sign the form in the presence of a notary public to validate the document.

- Transfer ownership of your assets into the trust, which may require additional paperwork for certain types of assets.

Legal use of the Irrevocable Living Trust Form California

The legal use of the irrevocable living trust form in California is governed by state laws, particularly the California Probate Code. This form must comply with specific legal requirements to be considered valid. For instance, the trust must be signed by the grantor and notarized. Additionally, the assets transferred into the trust must be clearly identified. The irrevocable living trust can be used for various purposes, including estate planning, tax reduction, and asset protection, making it a versatile tool for individuals looking to manage their estate effectively.

Key elements of the Irrevocable Living Trust Form California

Key elements of the irrevocable living trust form in California include:

- Grantor Information: Details about the individual creating the trust.

- Trustee Designation: The person or entity responsible for managing the trust.

- Beneficiary Designation: Individuals or entities that will benefit from the trust.

- Asset Description: A detailed list of assets being placed into the trust.

- Distribution Instructions: Specific directions on how and when assets should be distributed to beneficiaries.

State-specific rules for the Irrevocable Living Trust Form California

California has specific rules regarding the irrevocable living trust form that must be adhered to for the trust to be valid. These rules include requirements for notarization, the necessity of having a clear statement of intent, and compliance with the California Probate Code. Additionally, the trust must be funded properly, meaning that assets must be legally transferred into the trust's name. Understanding these state-specific regulations is crucial for ensuring that the trust operates as intended and remains legally enforceable.

Quick guide on how to complete ca irrevocable living trust form

Complete Irrevocable Living Trust Form California seamlessly on any gadget

Web-based document management has gained traction with both businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed paperwork, as you can easily locate the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and electronically sign your documents promptly without delays. Handle Irrevocable Living Trust Form California on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to modify and electronically sign Irrevocable Living Trust Form California effortlessly

- Find Irrevocable Living Trust Form California and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to preserve your changes.

- Choose how you want to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Irrevocable Living Trust Form California to ensure excellent communication at every step of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How can I convince my parents to make an irrevocable trust so I avoid probate (I live out of state)?

If you want to avoid probate, the most efficient way to do that is to create a revocable (not irrevocable) living trust and then to transfer all of one’s assets to its Trustee (as well as creating what is known as a pour-over Will).Richard Wills, retired probate attorney originally licensed in CA & WA

-

How much money makes setting up an Irrevocable Living Trust make sense?

People establish trusts for a variety of reasons, such as for estate planning, gift/estate tax planning, support or charitable purposes. Once a trust is established, then people typically "fund" them with assets, such as investment accounts, real estate, etc. The trustee then uses/maintains the trust assets according to its terms. It's important to realize that Irrevocable Trusts (as opposed to revocable or grantor trusts) have their own income tax reporting requirements. For this reason, using an irrevocable trust solely to save money usually isn't the best approach. If you have other tax or estate planning reasons that coincide with saving money, then you might want to consider signNowing out to an attorney who can evaluate your needs/goals and recommend a workable trust arrangement.

-

How do I fill out the IT-2104 form if I live in NJ?

Do you work only in NY? Married? Kids? If your w-2 shows NY state withholding on your taxes, fill out a non-resident NY tax return which is fairly simple. If it doesn't, you don't fill out NY at all. If it shows out NYC withholding you enter that as well on the same forms.Then you would fill out your NJ returns as well with any withholding for NJ. Make sure to put any taxes paid to other states on your reciprocal states (nj paid, on NY return and vice versa)

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

Create this form in 5 minutes!

How to create an eSignature for the ca irrevocable living trust form

How to make an electronic signature for your Ca Irrevocable Living Trust Form in the online mode

How to generate an eSignature for the Ca Irrevocable Living Trust Form in Google Chrome

How to create an eSignature for signing the Ca Irrevocable Living Trust Form in Gmail

How to make an electronic signature for the Ca Irrevocable Living Trust Form straight from your smart phone

How to generate an electronic signature for the Ca Irrevocable Living Trust Form on iOS devices

How to create an eSignature for the Ca Irrevocable Living Trust Form on Android devices

People also ask

-

What is an Irrevocable Living Trust Form in California?

An Irrevocable Living Trust Form California is a legal document that transfers ownership of your assets into a trust, which cannot be altered or revoked after creation. This form helps in estate planning, ensuring that your assets are managed according to your wishes after your death. By using the Irrevocable Living Trust Form California, you can also minimize estate taxes and protect your assets from creditors.

-

How can airSlate SignNow help with my Irrevocable Living Trust Form California?

airSlate SignNow streamlines the process of creating and managing your Irrevocable Living Trust Form California by offering an easy-to-use eSigning platform. You can fill out, sign, and send your trust documents securely and efficiently, saving you time and reducing the risk of errors. Our platform ensures that your documents are legally binding and compliant with California laws.

-

What are the benefits of using an Irrevocable Living Trust Form California?

The benefits of using an Irrevocable Living Trust Form California include asset protection, tax savings, and control over how your assets are distributed after your death. This trust structure helps avoid probate, providing a quicker and more private transfer of assets to your beneficiaries. Additionally, it can protect your assets from creditors and ensure your wishes are upheld.

-

Is there a cost associated with obtaining an Irrevocable Living Trust Form California via airSlate SignNow?

Yes, there is a cost associated with using airSlate SignNow to create your Irrevocable Living Trust Form California. However, our pricing is competitive and designed to provide signNow savings compared to traditional legal services. You can choose from various subscription plans that fit your needs, ensuring you only pay for what you use.

-

Can I customize my Irrevocable Living Trust Form California using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your Irrevocable Living Trust Form California to fit your specific needs. You can add or remove clauses, specify beneficiaries, and include any unique provisions that reflect your wishes, all while ensuring compliance with California laws.

-

What integrations does airSlate SignNow offer for managing my Irrevocable Living Trust Form California?

airSlate SignNow integrates seamlessly with various applications such as Google Drive, Dropbox, and Microsoft Office, facilitating easy access and management of your Irrevocable Living Trust Form California documents. These integrations enable you to store, share, and collaborate on your trust documents effectively, enhancing your overall workflow.

-

How secure is my information when using the Irrevocable Living Trust Form California on airSlate SignNow?

Your information is highly secure when using the Irrevocable Living Trust Form California on airSlate SignNow. We employ advanced encryption and security protocols to protect your data during transmission and storage. Additionally, our platform is compliant with industry standards, ensuring that your sensitive information remains confidential.

Get more for Irrevocable Living Trust Form California

- Salary verification form for potential lease kansas

- Ks landlord tenant form

- Notice of default on residential lease kansas form

- Landlord tenant lease co signer agreement kansas form

- Application for sublease kansas form

- Kansas post 497307546 form

- Letter from landlord to tenant with directions regarding cleaning and procedures for move out kansas form

- Property manager agreement kansas form

Find out other Irrevocable Living Trust Form California

- Sign South Dakota Sales Invoice Template Free

- How Can I Sign Nevada Sales Proposal Template

- Can I Sign Texas Confirmation Of Reservation Or Order

- How To Sign Illinois Product Defect Notice

- Sign New Mexico Refund Request Form Mobile

- Sign Alaska Sponsorship Agreement Safe

- How To Sign Massachusetts Copyright License Agreement

- How Do I Sign Vermont Online Tutoring Services Proposal Template

- How Do I Sign North Carolina Medical Records Release

- Sign Idaho Domain Name Registration Agreement Easy

- Sign Indiana Domain Name Registration Agreement Myself

- Sign New Mexico Domain Name Registration Agreement Easy

- How To Sign Wisconsin Domain Name Registration Agreement

- Sign Wyoming Domain Name Registration Agreement Safe

- Sign Maryland Delivery Order Template Myself

- Sign Minnesota Engineering Proposal Template Computer

- Sign Washington Engineering Proposal Template Secure

- Sign Delaware Proforma Invoice Template Online

- Can I Sign Massachusetts Proforma Invoice Template

- How Do I Sign Oklahoma Equipment Purchase Proposal