Medicaid Income Trust Form

What is the Medicaid Income Trust

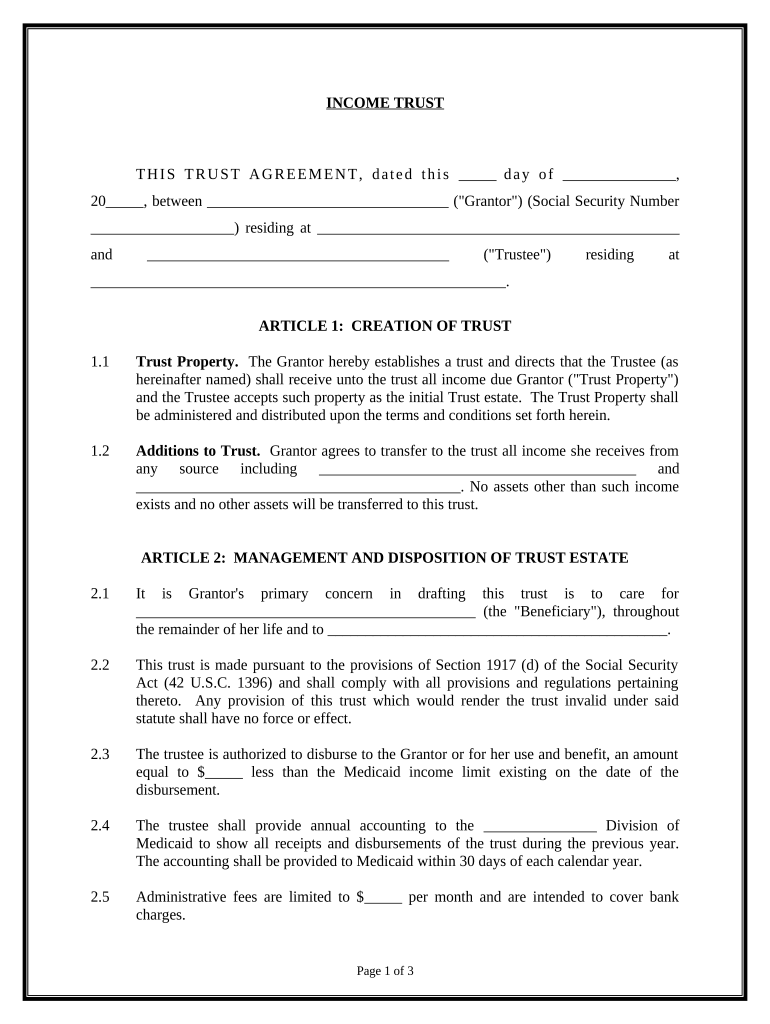

The Medicaid Income Trust is a financial tool designed to help individuals qualify for Medicaid benefits while preserving some of their income. This trust allows individuals to place excess income into a trust, which is not counted when determining eligibility for Medicaid. By doing so, it helps ensure that individuals can receive necessary medical care without depleting their personal assets. The trust must meet specific legal requirements to be considered valid under state and federal regulations.

How to use the Medicaid Income Trust

Using a Medicaid Income Trust involves several steps to ensure compliance with legal requirements. First, individuals must establish the trust and designate a trustee to manage it. Next, they should transfer their excess income into the trust on a regular basis. It is crucial to keep accurate records of all transactions and ensure that the trust operates within the guidelines set by Medicaid. Consulting with a legal or financial professional can provide guidance on the proper management of the trust to maintain eligibility for benefits.

Steps to complete the Medicaid Income Trust

Completing a Medicaid Income Trust involves a systematic approach:

- Consult a professional: Seek advice from an attorney or financial advisor experienced in Medicaid planning.

- Draft the trust document: Create a legally binding document that outlines the terms of the trust, including the trustee's powers and responsibilities.

- Fund the trust: Transfer excess income into the trust as specified in the agreement.

- Maintain records: Keep detailed records of all transactions and communications related to the trust.

- Review periodically: Regularly assess the trust's compliance with Medicaid regulations and make adjustments as necessary.

Key elements of the Medicaid Income Trust

Several key elements are essential for the effective operation of a Medicaid Income Trust:

- Trustee: The person or entity responsible for managing the trust's assets.

- Beneficiary: The individual who benefits from the trust, typically the person seeking Medicaid eligibility.

- Income limits: Specific thresholds must be adhered to regarding the amount of income that can be placed in the trust.

- Distribution rules: Guidelines governing how and when the income can be distributed from the trust.

- Compliance: Adherence to state and federal regulations to ensure the trust does not jeopardize Medicaid eligibility.

State-specific rules for the Medicaid Income Trust

Each state in the U.S. has its own regulations regarding Medicaid Income Trusts, which can significantly impact their structure and operation. It is essential to understand the specific rules applicable in your state, as these can dictate the income limits, allowable distributions, and the process for establishing the trust. Consulting with a local attorney who specializes in elder law or Medicaid planning can provide clarity on state-specific requirements and help ensure compliance.

Eligibility Criteria

To qualify for a Medicaid Income Trust, individuals must meet certain eligibility criteria. Generally, applicants must demonstrate that their income exceeds the allowable limits set by Medicaid. Additionally, they must show that the trust is established for the purpose of qualifying for Medicaid benefits. Other factors, such as age, disability status, and residency, may also influence eligibility. Understanding these criteria is crucial for effective planning and trust management.

Quick guide on how to complete medicaid income trust

Prepare Medicaid Income Trust effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed paperwork, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents efficiently without delays. Manage Medicaid Income Trust on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to edit and eSign Medicaid Income Trust with ease

- Find Medicaid Income Trust and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize crucial parts of your documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Generate your eSignature with the Sign tool, which only takes a few seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Medicaid Income Trust and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a medicaid income trust?

A Medicaid income trust is a legal arrangement that allows individuals to manage their income to qualify for Medicaid benefits. By diverting excess income into a trust, applicants may ensure they meet Medicaid's income limits. This approach can help protect assets while receiving necessary health care services.

-

How can airSlate SignNow assist with Medicaid income trust documentation?

airSlate SignNow simplifies the process of signing and managing documents related to your Medicaid income trust. Our platform allows you to securely eSign and store critical paperwork electronically. This enhances accessibility and efficiency, ensuring you can focus on what matters—your health and wellbeing.

-

What are the benefits of using a Medicaid income trust?

Utilizing a Medicaid income trust can help you retain more of your assets while ensuring eligibility for Medicaid services. This structure can prevent the loss of important resources required for your care. It’s an effective way to manage your financial situation while adhering to Medicaid requirements.

-

Is there a cost associated with establishing a Medicaid income trust?

The costs associated with establishing a Medicaid income trust can vary based on legal services and documentation needs. Typically, you may incur costs for attorney fees or financial advice on setting it up properly. It's wise to consider these expenses as part of the long-term savings and benefits provided by the trust.

-

What features does airSlate SignNow offer that support Medicaid income trust management?

airSlate SignNow offers features like secure electronic signing, document templates, and cloud storage that are crucial for managing Medicaid income trust documentation. These tools allow you to quickly access, share, and sign important documents. Our user-friendly interface ensures that the process is straightforward and efficient.

-

Can I integrate airSlate SignNow with other platforms for Medicaid income trust management?

Yes, airSlate SignNow easily integrates with various platforms and applications to enhance your Medicaid income trust management. Whether you use project management tools or financial software, our integrations ensure that your workflows are seamless. This connectivity allows for better organization of your important documents.

-

What do I need to qualify for a Medicaid income trust?

To qualify for a Medicaid income trust, you generally need documentation of your income and assets to demonstrate eligibility for Medicaid benefits. It's crucial to ensure that your trust is structured properly to meet state regulations. Consulting with a legal professional can help you navigate the specific requirements.

Get more for Medicaid Income Trust

Find out other Medicaid Income Trust

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors