Letter Credit Attorney Form

What is the Letter Credit Attorney

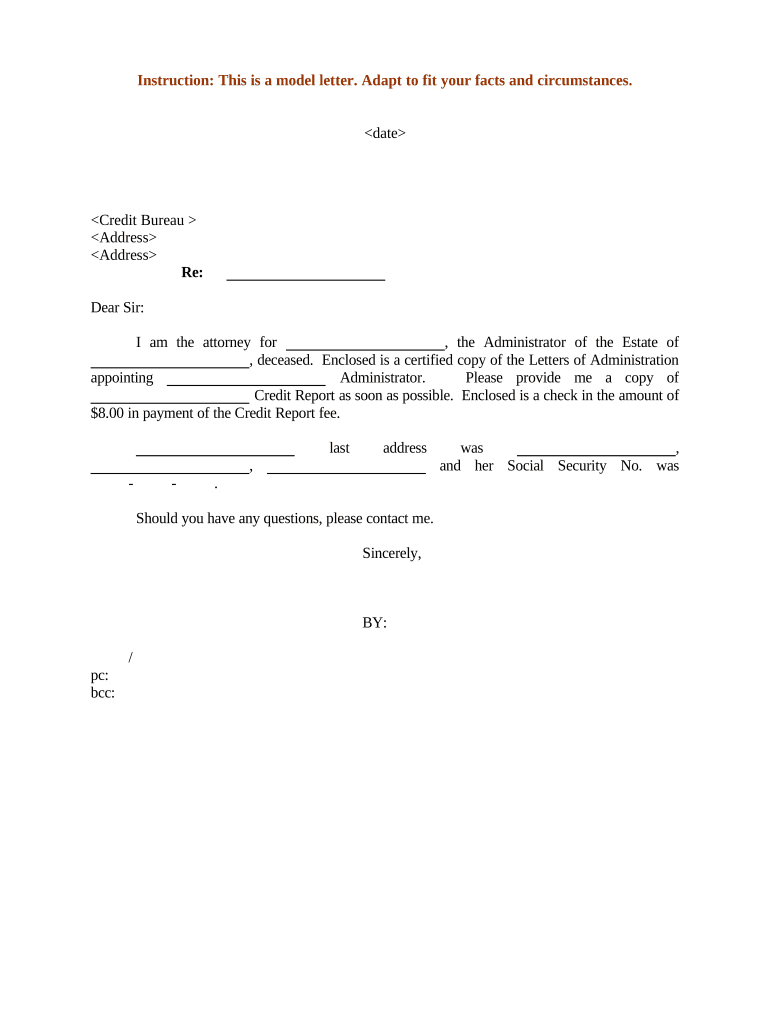

The letter credit attorney is a legal document that authorizes a third party to act on behalf of the principal in matters related to letters of credit. This form is essential in international trade, where letters of credit serve as a guarantee of payment from a buyer’s bank to a seller. By designating an attorney, the principal ensures that their interests are represented effectively in transactions that may involve complex legal and financial obligations.

How to Use the Letter Credit Attorney

Using the letter credit attorney involves several steps to ensure that the document is executed correctly and serves its intended purpose. First, the principal must clearly identify the scope of authority granted to the attorney. This includes specifying the transactions or actions the attorney is authorized to undertake. Next, both parties should sign the document in accordance with applicable laws to ensure its validity. Finally, it is advisable to keep copies of the signed letter credit attorney for record-keeping and future reference.

Steps to Complete the Letter Credit Attorney

Completing the letter credit attorney requires careful attention to detail. Follow these steps:

- Identify the parties involved: Clearly state the names and addresses of the principal and the attorney.

- Define the scope of authority: Specify the actions the attorney is authorized to perform regarding the letter of credit.

- Include relevant details: Add any necessary information, such as the specific letter of credit number and transaction details.

- Sign and date the document: Both the principal and the attorney must sign the letter credit attorney to validate it.

- Store the document securely: Keep copies in a safe location for future reference.

Legal Use of the Letter Credit Attorney

The letter credit attorney is legally binding when executed in accordance with applicable laws and regulations. It must comply with the Uniform Commercial Code (UCC) and any specific state laws governing letters of credit. Proper execution ensures that the attorney can act on behalf of the principal without legal repercussions. It is crucial to consult with a legal professional to ensure compliance with all necessary legal requirements.

Key Elements of the Letter Credit Attorney

Several key elements must be included in the letter credit attorney to ensure its effectiveness:

- Identification of parties: Names and addresses of the principal and attorney.

- Scope of authority: Detailed description of the powers granted to the attorney.

- Transaction details: Information regarding the specific letter of credit and related transactions.

- Signatures: Signatures of both the principal and the attorney, along with the date.

Examples of Using the Letter Credit Attorney

Examples of using the letter credit attorney can help illustrate its practical applications. For instance, a business importing goods from overseas may use this document to authorize a freight forwarder to handle the letter of credit on their behalf. In another scenario, a manufacturer may grant authority to a bank representative to negotiate terms of payment under a letter of credit. These examples highlight the versatility of the letter credit attorney in facilitating international trade transactions.

Quick guide on how to complete letter credit attorney

Complete Letter Credit Attorney effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and electronically sign your documents quickly without delays. Manage Letter Credit Attorney on any platform using airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

The simplest way to modify and electronically sign Letter Credit Attorney with ease

- Locate Letter Credit Attorney and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure private information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Letter Credit Attorney and ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the role of a letter credit attorney?

A letter credit attorney specializes in legal matters pertaining to letters of credit, ensuring that businesses comply with relevant regulations. They guide clients through the complexities of international trade and finance, providing expert advice on the issuance and negotiation of letters of credit.

-

How does airSlate SignNow support the work of a letter credit attorney?

airSlate SignNow streamlines the document signing process, allowing letter credit attorneys to expedite contracts and agreements without sacrificing security. With its intuitive interface, attorneys can easily manage and collaborate on essential documents, enhancing their operational efficiency.

-

What features does airSlate SignNow offer for document management?

AirSlate SignNow offers features such as eSignature, document templates, and secure storage, which are crucial for letter credit attorneys. These tools facilitate the quick execution of agreements and help maintain organized records, integral for managing client documents and supporting compliance.

-

Is there a pricing plan suitable for letter credit attorneys?

Yes, airSlate SignNow provides flexible pricing plans tailored for individual professionals and businesses, including letter credit attorneys. These plans are designed to be cost-effective, providing essential features without unnecessary costs, allowing attorneys to manage their budget efficiently.

-

How can letter credit attorneys ensure document security with airSlate SignNow?

AirSlate SignNow employs industry-standard security measures such as encryption and secure cloud storage, which are essential for letter credit attorneys handling sensitive documents. This ensures that all client information is safeguarded, building trust and maintaining confidentiality when dealing with financial transactions.

-

What benefits does eSigning offer for letter credit attorneys?

ESigning through airSlate SignNow offers letter credit attorneys signNow benefits, including faster turnaround times on agreements and reduced paper usage. This not only increases efficiency but also enhances client satisfaction by accelerating the processing of letter credit arrangements.

-

Can airSlate SignNow integrate with other software used by letter credit attorneys?

Absolutely! airSlate SignNow integrates seamlessly with various CRM and project management tools, making it an excellent choice for letter credit attorneys. This allows attorneys to streamline their workflows and ensure that all client interactions and document handling are interconnected and efficient.

Get more for Letter Credit Attorney

Find out other Letter Credit Attorney

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors