Donation or Gift to Charity of Personal Property Form

What is the Donation Or Gift To Charity Of Personal Property

The donation or gift to charity of personal property refers to the act of giving tangible items, such as clothing, electronics, or vehicles, to a charitable organization. This process allows individuals to support causes they care about while potentially receiving tax benefits. Personal property donations can include a wide range of items, provided they are in good condition and have a fair market value. Understanding the definition and implications of this type of donation is essential for individuals looking to contribute effectively.

How to use the Donation Or Gift To Charity Of Personal Property

Using the donation or gift to charity of personal property involves several straightforward steps. First, identify the items you wish to donate and ensure they are suitable for the charity's needs. Next, research local charities to find one that aligns with your values and mission. Once you have selected a charity, you may need to fill out a donation form, which can often be done online or in person. It is important to keep records of your donation, including receipts, as these may be needed for tax purposes.

Steps to complete the Donation Or Gift To Charity Of Personal Property

Completing the donation or gift to charity of personal property involves a series of steps:

- Assess the items you wish to donate and determine their fair market value.

- Choose a charitable organization that accepts personal property donations.

- Contact the charity to confirm their acceptance policies and any specific requirements.

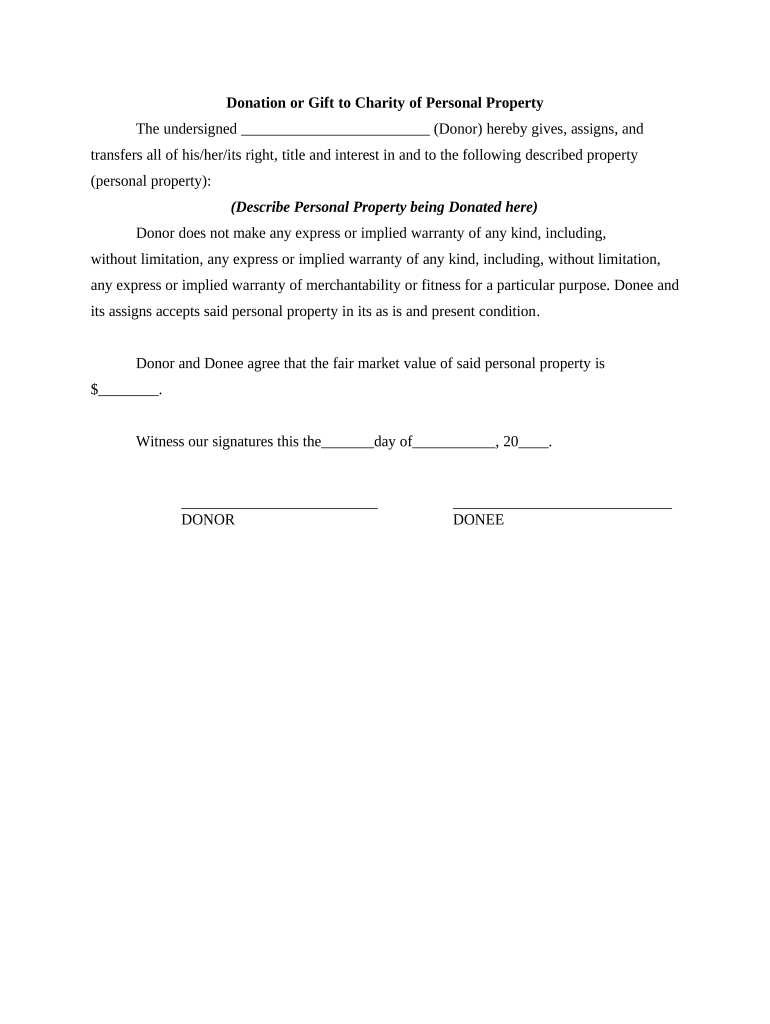

- Fill out the necessary donation form, providing details about the items and their value.

- Submit the form and arrange for the delivery or pickup of the items.

- Keep a copy of the donation receipt for your records.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for donating personal property to charity. Donors can typically deduct the fair market value of the items donated on their tax returns, provided they itemize deductions. It is important to obtain a written acknowledgment from the charity for donations over a certain value. Additionally, if the donated items exceed a specific threshold, donors may need to complete Form 8283, which requires additional details about the items and their valuation.

Key elements of the Donation Or Gift To Charity Of Personal Property

Several key elements define the donation or gift to charity of personal property:

- Fair market value: The value of the items at the time of donation, which is crucial for tax deductions.

- Written acknowledgment: A receipt or letter from the charity confirming the donation, which is necessary for tax records.

- Condition of items: Donated items should be in good condition to qualify for tax deductions.

- Charity eligibility: The organization must be a qualified charity under IRS regulations to ensure tax deductibility.

Legal use of the Donation Or Gift To Charity Of Personal Property

The legal use of the donation or gift to charity of personal property is governed by both federal and state laws. Donors must ensure that the charity is recognized as a tax-exempt organization under Section 501(c)(3) of the Internal Revenue Code. Additionally, donors should be aware of state-specific regulations that may affect the donation process. Following legal guidelines helps protect both the donor and the charity, ensuring that the donation is valid and eligible for tax benefits.

Quick guide on how to complete donation or gift to charity of personal property

Prepare Donation Or Gift To Charity Of Personal Property effortlessly on any device

Managing documents online has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed papers, as you can locate the appropriate form and safely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Donation Or Gift To Charity Of Personal Property on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Donation Or Gift To Charity Of Personal Property without any hassle

- Obtain Donation Or Gift To Charity Of Personal Property and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and eSign Donation Or Gift To Charity Of Personal Property and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is meant by a Donation Or Gift To Charity Of Personal Property?

A Donation Or Gift To Charity Of Personal Property refers to the transfer of ownership of valuable items, such as art, vehicles, or real estate, to a charitable organization. This act not only benefits the charity by providing them with assets they can use to further their mission but also offers potential tax deductions for the donor. It's important to properly document these donations to ensure they are recognized by the IRS.

-

What are the tax implications of making a Donation Or Gift To Charity Of Personal Property?

When making a Donation Or Gift To Charity Of Personal Property, donors may be eligible for tax deductions based on the fair market value of the donated items. It's essential to obtain a professional appraisal for high-value donations to maximize tax benefits. Always consult a tax professional to understand your specific situation and ensure compliance with IRS regulations.

-

How do I find the right charity for my Donation Or Gift To Charity Of Personal Property?

To find the right charity for your Donation Or Gift To Charity Of Personal Property, consider organizations that align with your values and support causes you are passionate about. Research potential charities through platforms like GuideStar or Charity Navigator to assess their credibility and impact. Ensure the charity is recognized as a tax-exempt organization by the IRS.

-

Can I donate personal property items that are not in perfect condition?

Yes, you can donate personal property items that are not in perfect condition; however, the tax deduction may be affected by the item's condition. A Donation Or Gift To Charity Of Personal Property is still valuable to charities, as they may be able to refurbish or recycle the items. Make sure to disclose the condition of the item when making the donation.

-

Are there any restrictions on the types of personal property I can donate?

There are some restrictions on the types of personal property that can be donated, particularly items that are hazardous or illegal. Charitable organizations often provide guidelines on what they can accept, so check with them beforehand. A Donation Or Gift To Charity Of Personal Property is often most beneficial when it consists of tangible goods that the charity can utilize or sell.

-

Do I need to provide receipts for my Donation Or Gift To Charity Of Personal Property?

Yes, it is crucial to obtain a receipt for your Donation Or Gift To Charity Of Personal Property. This documentation serves as proof of the donation for tax purposes and can help validate its fair market value. Always keep a copy of the receipt for your records, especially for larger donations.

-

What is the process for making a Donation Or Gift To Charity Of Personal Property?

The process for making a Donation Or Gift To Charity Of Personal Property typically involves selecting a charity, evaluating the items you wish to donate, and contacting the charity to arrange for pickup or drop-off. Many organizations also provide forms for detailing the items being donated. After the donation, you will receive a receipt, which is necessary for tax purposes.

Get more for Donation Or Gift To Charity Of Personal Property

- Member appointment form

- Email new jersey state disability claim your standard form

- The medicaid program will pay providers of non institutional pediatric continuous private duty form

- Parentguardian single use permission form

- Fillable online ranking the states by fiscal condition fax form

- Mdhhs application for health coverage ampamp help paying costs form

- Form 433 a oic rev 4 2020 collection information statement for wage earners and

- For additional information refer to publication 1854 quothow to prepare a collection information statement

Find out other Donation Or Gift To Charity Of Personal Property

- eSignature North Dakota Quitclaim Deed Fast

- How Can I eSignature Iowa Warranty Deed

- Can I eSignature New Hampshire Warranty Deed

- eSign Maryland Rental Invoice Template Now

- eSignature Utah Warranty Deed Free

- eSign Louisiana Assignment of intellectual property Fast

- eSign Utah Commercial Lease Agreement Template Online

- eSign California Sublease Agreement Template Safe

- How To eSign Colorado Sublease Agreement Template

- How Do I eSign Colorado Sublease Agreement Template

- eSign Florida Sublease Agreement Template Free

- How Do I eSign Hawaii Lodger Agreement Template

- eSign Arkansas Storage Rental Agreement Now

- How Can I eSign Texas Sublease Agreement Template

- eSign Texas Lodger Agreement Template Free

- eSign Utah Lodger Agreement Template Online

- eSign Hawaii Rent to Own Agreement Mobile

- How To eSignature Colorado Postnuptial Agreement Template

- How Do I eSignature Colorado Postnuptial Agreement Template

- Help Me With eSignature Colorado Postnuptial Agreement Template