Exchange Addendum to Contract Tax Exchange Section 1031 Form

What is the Exchange Addendum To Contract Tax Exchange Section 1031

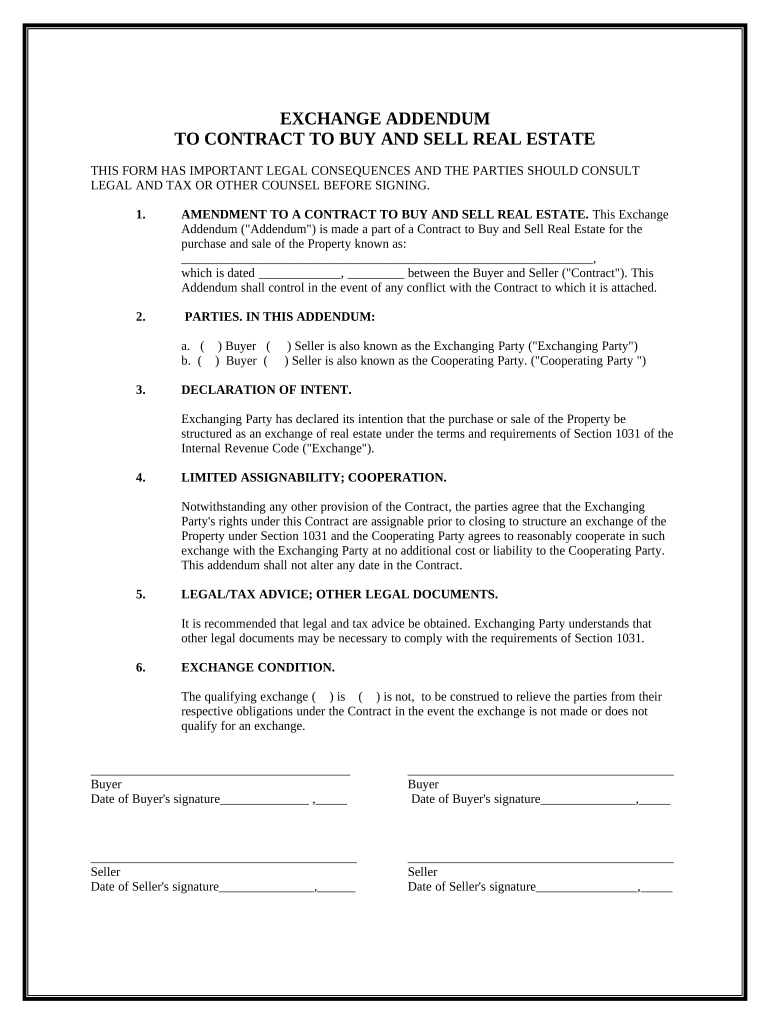

The Exchange Addendum To Contract Tax Exchange Section 1031 is a legal document that facilitates tax-deferred exchanges of real estate under Section 1031 of the Internal Revenue Code. This addendum is crucial for property owners looking to defer capital gains taxes when selling one investment property and acquiring another. By utilizing this addendum, parties involved in the transaction can outline the terms and conditions necessary for qualifying for tax deferral, ensuring compliance with IRS regulations. It serves as a formal agreement that specifies the properties involved, the timelines for the exchange, and the responsibilities of each party.

How to use the Exchange Addendum To Contract Tax Exchange Section 1031

Using the Exchange Addendum To Contract Tax Exchange Section 1031 involves several key steps. First, both parties must agree to the terms outlined in the addendum, which includes identifying the properties involved in the exchange. Next, the addendum should be attached to the main contract to ensure it is legally binding. It is essential to include all necessary details, such as the identification of the replacement property and the timelines for the exchange process. Once completed, all parties must sign the addendum to validate the agreement. This document should then be stored with other transaction records for future reference and compliance verification.

Steps to complete the Exchange Addendum To Contract Tax Exchange Section 1031

Completing the Exchange Addendum To Contract Tax Exchange Section 1031 involves a structured process. Here are the main steps:

- Identify the properties involved: Clearly define the relinquished property and the replacement property.

- Draft the addendum: Include all pertinent details, such as the exchange timeline and identification requirements.

- Review the terms: Ensure both parties understand and agree to the conditions outlined in the addendum.

- Sign the addendum: All involved parties must sign to make the document legally binding.

- Attach to the main contract: Ensure the addendum is included with the primary contract documentation.

Legal use of the Exchange Addendum To Contract Tax Exchange Section 1031

The legal use of the Exchange Addendum To Contract Tax Exchange Section 1031 is governed by the stipulations set forth in Section 1031 of the Internal Revenue Code. To be valid, the exchange must meet specific criteria, including the requirement that both properties involved must be held for investment or productive use in a trade or business. Additionally, the addendum must clearly outline the terms of the exchange, including timelines for identifying and acquiring the replacement property. Proper execution of this addendum ensures that the transaction qualifies for tax deferral, protecting both parties from potential tax liabilities.

Key elements of the Exchange Addendum To Contract Tax Exchange Section 1031

Several key elements must be included in the Exchange Addendum To Contract Tax Exchange Section 1031 to ensure its effectiveness:

- Identification of properties: Clearly specify the relinquished and replacement properties.

- Exchange timeline: Outline the deadlines for identifying and acquiring the replacement property.

- Responsibilities of parties: Define the obligations of each party involved in the exchange.

- Compliance with IRS regulations: Ensure the addendum meets all legal requirements under Section 1031.

- Signatures: Include signatures from all parties to validate the agreement.

IRS Guidelines

The IRS provides specific guidelines regarding the use of the Exchange Addendum To Contract Tax Exchange Section 1031. These guidelines outline the requirements for a valid exchange, including the necessity for both properties to be held for investment purposes. The IRS also stipulates the timeframes within which the replacement property must be identified and acquired, typically within 45 days for identification and 180 days for completion of the exchange. Adhering to these guidelines is essential for ensuring that the transaction qualifies for tax deferral benefits.

Quick guide on how to complete exchange addendum to contract tax free exchange section 1031

Complete Exchange Addendum To Contract Tax Exchange Section 1031 effortlessly on any gadget

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as it allows you to find the appropriate form and safely store it online. airSlate SignNow provides all the resources you need to create, modify, and eSign your documents rapidly without delays. Manage Exchange Addendum To Contract Tax Exchange Section 1031 on any gadget with airSlate SignNow Android or iOS applications and simplify any document-based process today.

How to modify and eSign Exchange Addendum To Contract Tax Exchange Section 1031 with ease

- Find Exchange Addendum To Contract Tax Exchange Section 1031 and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, exhausting searches for forms, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Exchange Addendum To Contract Tax Exchange Section 1031 and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Exchange Addendum To Contract Tax Exchange Section 1031?

The Exchange Addendum To Contract Tax Exchange Section 1031 is a legal document that facilitates the tax-deferred exchange of properties under IRS Code Section 1031. This addendum outlines the terms under which the exchange will occur, ensuring compliance with tax regulations and protecting the interests of all parties involved.

-

How does airSlate SignNow assist with the Exchange Addendum To Contract Tax Exchange Section 1031?

airSlate SignNow simplifies the process of creating and signing the Exchange Addendum To Contract Tax Exchange Section 1031 by providing user-friendly templates and eSignature capabilities. Our platform ensures that all documents are legally binding and securely stored, making it easier for businesses to manage their transactions.

-

What are the benefits of using airSlate SignNow for the Exchange Addendum To Contract Tax Exchange Section 1031?

Using airSlate SignNow for the Exchange Addendum To Contract Tax Exchange Section 1031 offers several benefits, such as reducing paperwork, minimizing errors, and speeding up transaction times. Additionally, the platform’s mobile-friendly design allows users to sign documents from anywhere, enhancing convenience and efficiency in property exchanges.

-

Is airSlate SignNow cost-effective for businesses handling the Exchange Addendum To Contract Tax Exchange Section 1031?

Yes, airSlate SignNow provides a cost-effective solution for businesses managing the Exchange Addendum To Contract Tax Exchange Section 1031. Our pricing plans are designed to fit various budgets, allowing you to maximize your investment while ensuring compliance with tax regulations and streamlining the signing process.

-

Can I integrate airSlate SignNow with other software for processing the Exchange Addendum To Contract Tax Exchange Section 1031?

Absolutely! airSlate SignNow offers seamless integrations with various third-party applications, enhancing your existing workflows related to the Exchange Addendum To Contract Tax Exchange Section 1031. This means you can easily connect with CRM systems, accounting software, and more to streamline all aspects of property management.

-

What features does airSlate SignNow provide for the Exchange Addendum To Contract Tax Exchange Section 1031?

airSlate SignNow includes features such as customizable document templates, secure cloud storage, and advanced eSignature capabilities specific to the Exchange Addendum To Contract Tax Exchange Section 1031. Our platform ensures user-friendly navigation and allows for tracking of document status, making the process more efficient and organized.

-

How can I ensure compliance when using the Exchange Addendum To Contract Tax Exchange Section 1031 with airSlate SignNow?

With airSlate SignNow, compliance is built into the process of handling the Exchange Addendum To Contract Tax Exchange Section 1031. Our platform provides legally compliant eSignatures, audit trails, and secure storage, ensuring that your transactions meet all necessary legal requirements and are protected against potential disputes.

Get more for Exchange Addendum To Contract Tax Exchange Section 1031

Find out other Exchange Addendum To Contract Tax Exchange Section 1031

- Can I eSign Hawaii Follow-Up Letter To Customer

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now