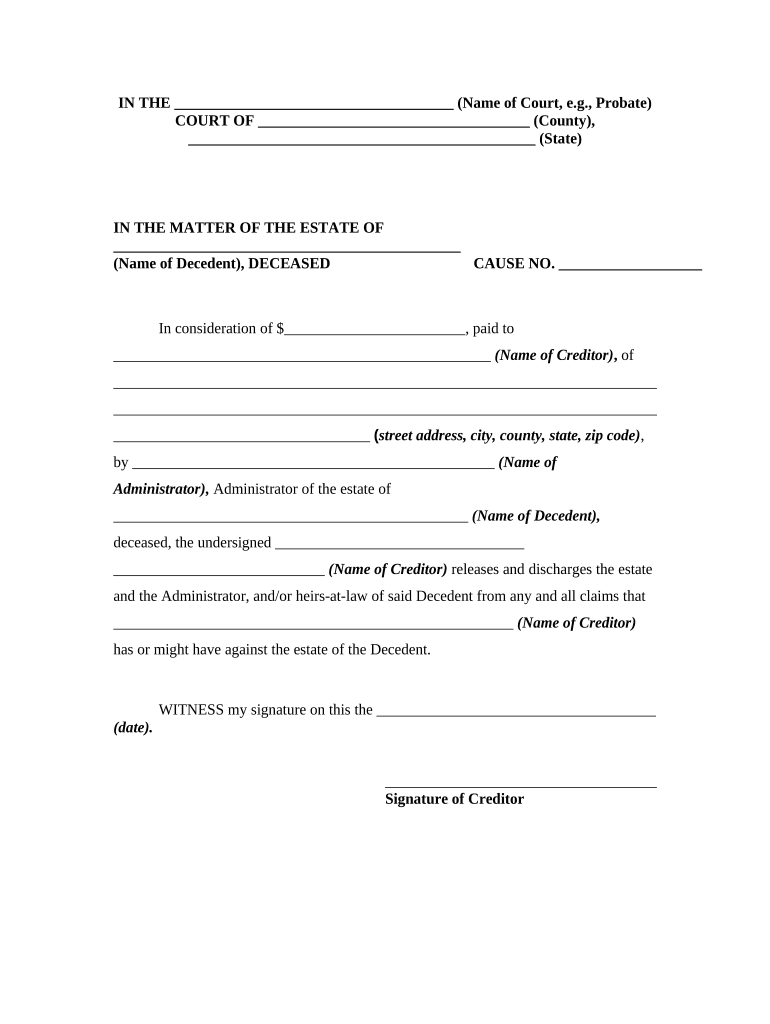

Claims Against Estate Form

What is the claims against estate?

The claims against estate refer to formal requests made by creditors to collect debts owed by a deceased person's estate. This legal process ensures that all outstanding obligations are settled before the distribution of assets to beneficiaries. Understanding this concept is crucial for both creditors and heirs, as it defines the rights and responsibilities of each party during the probate process. The claims can encompass various types of debts, including loans, unpaid bills, and other financial obligations incurred by the deceased.

Steps to complete the claims against estate

Completing the claims against estate involves several important steps to ensure accuracy and compliance with legal requirements. First, gather all necessary documentation, such as the deceased's financial records and any relevant contracts. Next, fill out the claims against estate form, ensuring that all information is complete and accurate. After completing the form, submit it to the probate court handling the estate. It is essential to adhere to any filing deadlines set by the court to avoid losing the right to collect the debt. Finally, keep copies of all submitted documents for your records.

Key elements of the claims against estate

Several key elements must be included in the claims against estate to ensure they are legally valid. These elements typically include the name and contact information of the creditor, a detailed description of the debt, and the amount owed. Additionally, the claim should reference any supporting documentation, such as contracts or invoices. It is also important to specify the date the debt was incurred and any relevant interest that may apply. Providing complete and accurate information can significantly affect the outcome of the claim.

Legal use of the claims against estate

The legal use of claims against estate is governed by state probate laws, which dictate how creditors can seek payment from a deceased person's estate. Creditors must file their claims within a specified period, often referred to as the claims period, which varies by state. If a claim is approved, the estate will be required to pay the debt before any distributions are made to beneficiaries. Understanding the legal framework surrounding these claims can help creditors navigate the process more effectively and ensure their rights are protected.

Filing deadlines / Important dates

Filing deadlines for claims against estate are critical to the probate process. Each state has its own regulations regarding how long creditors have to submit their claims after the estate has been opened. Typically, this period ranges from three to six months, but it can vary. Missing the deadline may result in the loss of the right to collect the debt. It is advisable for creditors to be proactive and submit their claims as soon as possible after the probate process begins to avoid any complications.

Who issues the form?

The claims against estate form is typically issued by the probate court handling the estate of the deceased. Each state may have its own version of the form, and it is essential for creditors to use the correct form applicable to the jurisdiction where the probate is taking place. Some courts may also provide the form online, allowing for easier access and submission. Ensuring that the correct form is used can help streamline the claims process and reduce the likelihood of errors or delays.

Quick guide on how to complete claims against estate

Complete Claims Against Estate effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, as you can locate the suitable form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Claims Against Estate on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to modify and eSign Claims Against Estate effortlessly

- Locate Claims Against Estate and click on Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Edit and eSign Claims Against Estate and guarantee excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a claims estate creditor?

A claims estate creditor is a party that holds a claim against an estate, typically arising from debts owed by a deceased individual. Understanding how claims are managed is crucial for both debtors and creditors in estate proceedings. airSlate SignNow can help facilitate the documentation process involved in managing these claims efficiently.

-

How does airSlate SignNow help with claims estate creditor processes?

airSlate SignNow provides businesses with a streamlined platform to send, sign, and manage documents related to claims estate creditor activities. The intuitive interface allows for easy document collaboration, ensuring all necessary claims are properly documented and signed. This not only speeds up the process but also enhances compliance in estate management.

-

Is there a cost associated with using airSlate SignNow for claims estate creditor documents?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those dealing with claims estate creditor documents. Each plan provides access to essential features that help manage documents securely and efficiently. You can choose a plan that best fits your budget and the scale of your operations.

-

What features can I expect from airSlate SignNow for managing claims estate creditor?

airSlate SignNow includes several features tailored for claims estate creditor management, such as document templates, eSignature capabilities, and real-time tracking of document status. These features work together to ensure that your claims documentation process is not only efficient but also compliant with legal requirements. Plus, you can easily store and retrieve documents whenever needed.

-

Can airSlate SignNow integrate with other software for claims estate creditor tasks?

Absolutely! airSlate SignNow offers integrations with various software solutions that can help streamline your claims estate creditor tasks. Whether you are using CRM systems, cloud storage, or project management tools, these integrations can help centralize your operations, enhance collaboration, and simplify the overall management of estate claims.

-

What are the benefits of using airSlate SignNow for claims estate creditor documentation?

Using airSlate SignNow for claims estate creditor documentation enhances efficiency and reduces the risk of errors in the documentation process. The platform ensures that all stakeholders can access, sign, and track claims-related documents securely. Additionally, it saves time and costs associated with traditional paper-based processes.

-

How secure is my data when using airSlate SignNow for claims estate creditor purposes?

airSlate SignNow prioritizes security, employing advanced encryption and data protection measures for all claims estate creditor documentation. Your documents are stored securely in compliance with industry standards, ensuring that sensitive information remains confidential and protected from unauthorized access.

Get more for Claims Against Estate

Find out other Claims Against Estate

- Help Me With eSign Ohio Car Dealer Document

- How To eSign Ohio Car Dealer Document

- How Do I eSign Oregon Car Dealer Document

- Can I eSign Oklahoma Car Dealer PDF

- How Can I eSign Oklahoma Car Dealer PPT

- Help Me With eSign South Carolina Car Dealer Document

- How To eSign Texas Car Dealer Document

- How Can I Sign South Carolina Courts Document

- How Do I eSign New Jersey Business Operations Word

- How Do I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Document

- Can I eSign Hawaii Charity Document

- Help Me With eSign Hawaii Charity Document

- How Can I eSign Hawaii Charity Presentation

- Help Me With eSign Hawaii Charity Presentation

- How Can I eSign Hawaii Charity Presentation

- How Do I eSign Hawaii Charity Presentation

- How Can I eSign Illinois Charity Word

- How To eSign Virginia Business Operations Presentation