Living Trust Irrevocable Form

What is the Living Trust Irrevocable

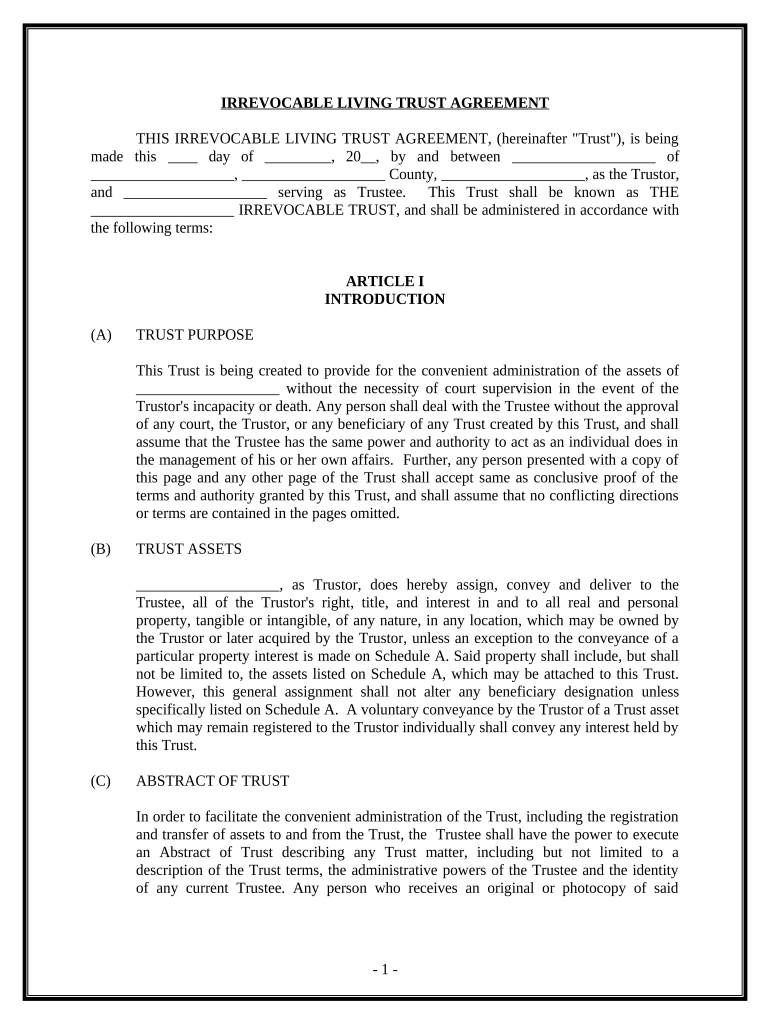

An irrevocable living trust is a legal entity created during a person's lifetime that cannot be altered or revoked once established. This type of trust allows individuals to transfer their assets into the trust, which then becomes the legal owner of those assets. The primary purpose of an irrevocable living trust is to manage and protect assets, often for the benefit of beneficiaries after the grantor's death. By placing assets in this trust, the grantor can potentially reduce estate taxes and avoid probate, ensuring a smoother transition of wealth to heirs.

How to use the Living Trust Irrevocable

Utilizing an irrevocable living trust involves several steps. First, the grantor must determine which assets to place into the trust, such as real estate, bank accounts, or investments. Next, the grantor completes the irrevocable living trust form, which outlines the terms of the trust, including the beneficiaries and the trustee responsible for managing the trust. Once the form is completed, the grantor must transfer ownership of the selected assets to the trust. This transfer is crucial, as it legally reassigns ownership and ensures that the trust can manage those assets according to its terms.

Steps to complete the Living Trust Irrevocable

Completing the irrevocable living trust form involves a systematic approach:

- Identify the assets to be included in the trust.

- Choose a trustee who will manage the trust and its assets.

- Fill out the irrevocable living trust form, detailing the terms and conditions.

- Sign the form in the presence of a notary public to ensure its legal validity.

- Transfer ownership of the designated assets to the trust by executing the necessary documents.

Following these steps carefully is essential to ensure that the trust is legally binding and effective in achieving the grantor's goals.

Legal use of the Living Trust Irrevocable

The legal use of an irrevocable living trust is governed by state laws, which can vary significantly. Generally, this type of trust is used for estate planning purposes, allowing individuals to manage their assets during their lifetime and dictate how those assets should be distributed after their death. It is important to ensure that the trust complies with state-specific requirements, such as witnessing and notarization, to avoid any legal challenges in the future. Additionally, an irrevocable living trust can provide protection against creditors and may have tax advantages, making it a valuable tool in estate planning.

Required Documents

To establish an irrevocable living trust, several documents are typically required:

- The completed irrevocable living trust form.

- A list of assets being transferred to the trust.

- Identification documents for the grantor and trustee.

- Any additional documents required for transferring specific assets, such as deeds for real estate.

Gathering these documents beforehand can streamline the process and ensure that the trust is set up correctly.

Eligibility Criteria

Eligibility to create an irrevocable living trust generally includes being of legal age, which is typically eighteen years in most states, and having the mental capacity to understand the implications of establishing a trust. Additionally, the grantor must have assets to transfer into the trust. There are no specific income or asset thresholds that must be met; however, it is advisable for individuals to consider their financial situation and estate planning goals before proceeding.

Quick guide on how to complete living trust irrevocable

Complete Living Trust Irrevocable effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It serves as an ideal sustainable substitute for conventional printed and signed documents, as you can access the correct format and securely save it online. airSlate SignNow provides you with all the tools necessary to generate, edit, and eSign your documents swiftly without delays. Manage Living Trust Irrevocable on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

The easiest way to modify and eSign Living Trust Irrevocable with ease

- Obtain Living Trust Irrevocable and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or redact confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to send your form via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and eSign Living Trust Irrevocable and guarantee effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an irrevocable living trust form?

An irrevocable living trust form is a legal document that allows you to place your assets into a trust that cannot be altered or revoked once established. This form is utilized to protect assets from taxes and creditors while ensuring a clear distribution plan for beneficiaries. Understanding this form is crucial for effective estate planning.

-

How can I create an irrevocable living trust form using airSlate SignNow?

To create an irrevocable living trust form with airSlate SignNow, simply use our user-friendly document builder. You can customize templates to meet your specific needs and add necessary details. Once finalized, the form can be easily eSigned by all parties involved, streamlining the process.

-

What are the benefits of using an irrevocable living trust form?

The benefits of using an irrevocable living trust form include asset protection, tax advantages, and the avoidance of probate. This form ensures that your wishes are followed exactly as you intended, providing clarity and security for your beneficiaries. It’s a proactive approach to managing your estate.

-

Is there a fee to use the irrevocable living trust form through airSlate SignNow?

Yes, there is a fee associated with using the irrevocable living trust form through airSlate SignNow; however, it is competitively priced to ensure affordability. This fee covers access to our comprehensive suite of features, including document storage, eSignature capabilities, and legal compliance guidance. Invest in peace of mind with our cost-effective solutions.

-

Can I integrate my irrevocable living trust form with other software?

Absolutely! airSlate SignNow offers seamless integrations with various applications, allowing you to link your irrevocable living trust form with accounting software, CRM systems, and more. This feature enhances workflow efficiency, ensuring that your documents are easily accessible across platforms.

-

What features does the airSlate SignNow platform offer for irrevocable living trust forms?

The airSlate SignNow platform includes features such as customizable templates, automated workflows, and secure eSigning for your irrevocable living trust forms. You can also track document status in real-time and store your documents securely in the cloud. These features simplify the management of your legal documents.

-

Who should consider using an irrevocable living trust form?

Anyone looking to effectively manage their estate and protect their assets should consider using an irrevocable living trust form. This includes individuals with signNow assets, high-net-worth families, and those looking to ensure their estate is distributed according to their wishes. Consulting with a legal professional can also enhance your understanding.

Get more for Living Trust Irrevocable

- West contra costa unified school district interdistrict transfer renewal form

- Sick leave pool request packet stephen f austin state university form

- Eligibility affidavit form

- Roanoke chowan community college transcript request form

- Meningitis waiver form 1 cal u

- Osu 1098t form

- Supplemental eligibility form loma linda university llu

- Marist transcript request form

Find out other Living Trust Irrevocable

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now