Charitable Trust Form

What is the charitable remainder trust?

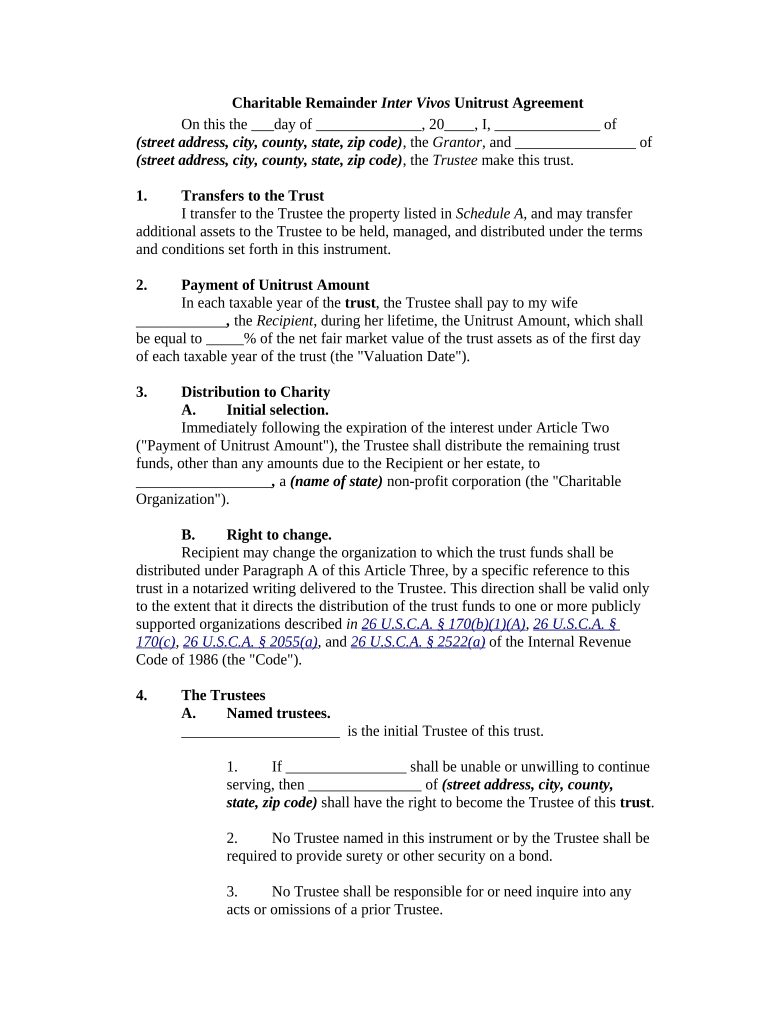

A charitable remainder trust is a financial arrangement that allows individuals to donate assets to a charitable organization while retaining the right to receive income from those assets for a specified period. This type of trust is designed to provide donors with both tax benefits and a steady income stream. The trust can be structured as a charitable remainder unitrust or a charitable remainder annuity trust, depending on how the income is calculated. Upon the trust's termination, the remaining assets are transferred to the designated charity.

Steps to complete the charitable remainder trust

Completing a charitable remainder trust involves several important steps to ensure that the trust is established correctly and complies with legal requirements. The following steps outline the process:

- Determine the type of charitable remainder trust that best suits your financial goals.

- Consult with a financial advisor or attorney who specializes in estate planning to understand the implications of your decision.

- Draft the trust agreement, specifying the terms, beneficiaries, and the charitable organization that will receive the remainder.

- Fund the trust by transferring assets, such as cash, securities, or real estate, into the trust.

- Execute the trust agreement, ensuring that all parties involved sign the document.

- File any necessary tax forms with the IRS to establish the trust's tax-exempt status.

Legal use of the charitable remainder trust

The legal use of a charitable remainder trust is governed by specific regulations that ensure the trust operates within the framework of U.S. tax laws. To maintain its tax-exempt status, the trust must meet certain criteria, including:

- The trust must be irrevocable, meaning the donor cannot alter or revoke it once established.

- The trust must provide for a charitable organization to receive the remaining assets after the income period ends.

- The income distributed to the donor or beneficiaries must be a fixed percentage of the trust's assets, calculated annually.

IRS guidelines for charitable remainder trusts

The Internal Revenue Service (IRS) provides guidelines that govern the establishment and operation of charitable remainder trusts. These guidelines outline the tax benefits available to donors, including deductions for the charitable contribution and potential capital gains tax avoidance on appreciated assets. Key points include:

- Donors can claim a charitable deduction based on the present value of the remainder interest that will go to charity.

- The trust must comply with the requirements set forth in Internal Revenue Code Section 664.

- Annual reporting is required to maintain compliance with IRS regulations.

Required documents for establishing a charitable remainder trust

To establish a charitable remainder trust, several key documents are necessary to ensure that the trust is legally binding and meets all regulatory requirements. These documents typically include:

- A trust agreement that outlines the terms and conditions of the trust.

- Documentation of the assets being transferred into the trust.

- IRS Form 5227, which is used to report the trust's income and distributions.

- Any additional state-specific forms required for trust registration.

Eligibility criteria for charitable remainder trusts

Eligibility for establishing a charitable remainder trust generally requires that the donor is an individual or entity with the legal capacity to create a trust. Additionally, the following criteria should be considered:

- The donor must have assets to contribute to the trust.

- The donor should have a charitable intent, as the trust must benefit a recognized charitable organization.

- The donor must comply with federal and state regulations regarding trust formation and operation.

Quick guide on how to complete charitable trust

Easily Prepare Charitable Trust on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents quickly and without delays. Handle Charitable Trust on any platform using airSlate SignNow's Android or iOS applications and streamline your document-related tasks today.

The Easiest Way to Alter and eSign Charitable Trust Effortlessly

- Obtain Charitable Trust and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Mark important sections of the documents or redact sensitive information using the tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details, then hit the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), an invite link, or download it to your computer.

Move on from lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign Charitable Trust to ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a charitable remainder trust online?

A charitable remainder trust online is a financial tool that allows individuals to donate assets to charity while retaining an income stream for themselves. Using airSlate SignNow, you can easily manage this process online, ensuring your charitable giving is both effective and efficient.

-

How can I set up a charitable remainder trust online using airSlate SignNow?

Setting up a charitable remainder trust online with airSlate SignNow is quick and straightforward. Simply follow our guided workflow, upload the necessary documents, and utilize our eSignature capabilities to finalize the trust effectively.

-

What are the benefits of using airSlate SignNow for charitable remainder trusts?

Using airSlate SignNow offers numerous benefits for managing charitable remainder trusts online, including cost-effectiveness, a user-friendly interface, and secure document storage. Our platform streamlines the process, ensuring you can focus on your philanthropic goals without hassle.

-

Are there any fees associated with setting up a charitable remainder trust online?

Yes, airSlate SignNow charges a nominal fee for the use of its platform when setting up a charitable remainder trust online. These fees are competitive and provide great value considering the efficiency and features our solution offers.

-

Can I integrate other tools with airSlate SignNow for managing my charitable remainder trust?

Absolutely! airSlate SignNow supports various integrations that enhance your ability to manage a charitable remainder trust online. You can connect with accounting, CRM, or other financial tools to create a more seamless experience.

-

Is it secure to create a charitable remainder trust online with airSlate SignNow?

Yes, security is a top priority at airSlate SignNow. Our platform employs industry-standard encryption and secure data storage, ensuring that your charitable remainder trust online and all associated documents are fully protected.

-

What features does airSlate SignNow offer for managing charitable remainder trusts?

airSlate SignNow provides a wide range of features for managing charitable remainder trusts online, including customizable templates, eSignature functionality, and automated workflows. These features simplify the process and enhance overall efficiency.

Get more for Charitable Trust

Find out other Charitable Trust

- Sign Connecticut Real Estate Business Plan Template Simple

- How To Sign Wisconsin Plumbing Cease And Desist Letter

- Sign Colorado Real Estate LLC Operating Agreement Simple

- How Do I Sign Connecticut Real Estate Operating Agreement

- Sign Delaware Real Estate Quitclaim Deed Secure

- Sign Georgia Real Estate Business Plan Template Computer

- Sign Georgia Real Estate Last Will And Testament Computer

- How To Sign Georgia Real Estate LLC Operating Agreement

- Sign Georgia Real Estate Residential Lease Agreement Simple

- Sign Colorado Sports Lease Agreement Form Simple

- How To Sign Iowa Real Estate LLC Operating Agreement

- Sign Iowa Real Estate Quitclaim Deed Free

- How To Sign Iowa Real Estate Quitclaim Deed

- Sign Mississippi Orthodontists LLC Operating Agreement Safe

- Sign Delaware Sports Letter Of Intent Online

- How Can I Sign Kansas Real Estate Job Offer

- Sign Florida Sports Arbitration Agreement Secure

- How Can I Sign Kansas Real Estate Residential Lease Agreement

- Sign Hawaii Sports LLC Operating Agreement Free

- Sign Georgia Sports Lease Termination Letter Safe