Checking Balance Form

What is the Checking Balance Form

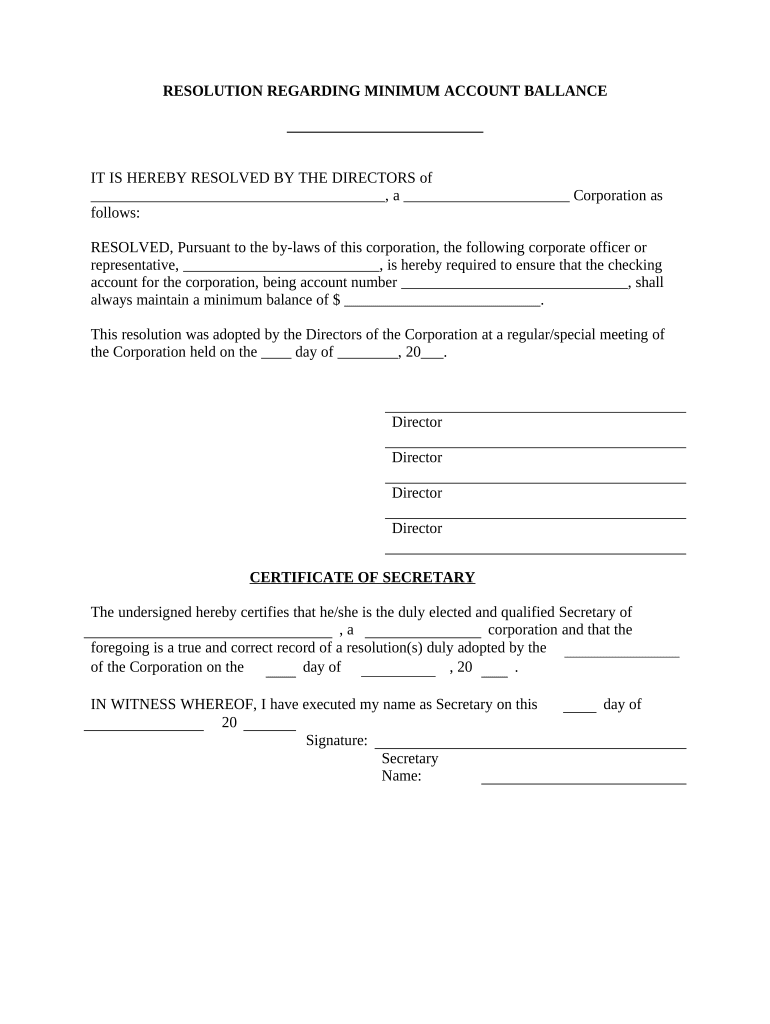

The checking balance form is a document used to request information about the current balance of a checking account. This form is essential for individuals and businesses to keep track of their finances and ensure they meet any minimum account balance corporate requirements. It is commonly used by banks and financial institutions to provide account holders with a clear overview of their account status.

How to use the Checking Balance Form

To effectively use the checking balance form, start by obtaining the form from your financial institution's website or customer service. Fill in the required fields, which typically include your account number, personal identification information, and the specific request for balance details. Once completed, submit the form according to your institution's guidelines, which may include online submission, mailing, or in-person delivery.

Steps to complete the Checking Balance Form

Completing the checking balance form involves several straightforward steps:

- Gather necessary information, including your account number and personal identification.

- Access the form from your bank's website or request a physical copy.

- Fill in all required fields accurately.

- Review the form for any errors or omissions.

- Submit the form through the designated method provided by your bank.

Legal use of the Checking Balance Form

The checking balance form is legally binding when completed in accordance with your financial institution's requirements. Compliance with relevant laws, such as the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensures that electronic submissions are valid. It is important to ensure that all provided information is accurate and that the form is signed appropriately to maintain its legal standing.

Key elements of the Checking Balance Form

Key elements of the checking balance form typically include:

- Account holder’s name and contact information.

- Account number associated with the checking account.

- Requested balance information and any specific timeframes.

- Signature of the account holder to authorize the request.

Form Submission Methods

The checking balance form can be submitted through various methods, depending on the policies of your financial institution. Common submission methods include:

- Online submission through the bank's secure portal.

- Mailing the completed form to the bank's designated address.

- Delivering the form in person at a local branch.

Quick guide on how to complete checking balance form

Effortlessly prepare Checking Balance Form on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an excellent eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents quickly without delays. Manage Checking Balance Form on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign Checking Balance Form effortlessly

- Obtain Checking Balance Form and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Form your eSignature with the Sign tool, which takes mere seconds and holds the same legal significance as a traditional handwritten signature.

- Check all the details and then hit the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Checking Balance Form while ensuring effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a checking balance form?

A checking balance form is a document that allows users to easily verify and manage their account balances. This form can be electronically signed and processed using airSlate SignNow, ensuring security and convenience. By utilizing a checking balance form, businesses can streamline their financial monitoring.

-

How can I use a checking balance form with airSlate SignNow?

With airSlate SignNow, you can create and send a checking balance form to clients or team members for eSignature. Simply upload your document template, customize it as needed, and send it out for signature. This process saves time and ensures that your checking balance form is completed accurately and securely.

-

Is there a cost associated with using the checking balance form feature?

airSlate SignNow offers competitive pricing plans that include access to the checking balance form feature. Depending on your chosen plan, you may also benefit from additional functionalities like document templates and integrations. Contact our sales team for detailed pricing information tailored to your business needs.

-

What are the main benefits of using a checking balance form?

Using a checking balance form through airSlate SignNow simplifies financial tracking and enhances accuracy. It ensures timely updates and reduces the risk of human error in balance verification. Furthermore, the ability to eSign documents saves both time and resources, allowing for more efficient business operations.

-

Can I integrate the checking balance form with other software?

Yes, airSlate SignNow provides seamless integrations with various software platforms, allowing you to connect your checking balance form with tools you already use. Whether it's CRM software, payment processing systems, or other financial applications, our integrations ensure a smooth workflow and enhanced productivity.

-

What makes airSlate SignNow a reliable choice for checking balance forms?

airSlate SignNow is known for its easy-to-use interface, robust security features, and reliable customer support. Businesses can trust that their checking balance form data is protected through encryption and compliance with privacy standards. Our dedication to customer satisfaction ensures that help is always available when needed.

-

How do I create a customized checking balance form?

Creating a customized checking balance form in airSlate SignNow is straightforward. Use our intuitive drag-and-drop editor to add necessary fields, logos, and branding elements. You can personalize your form to fit your business needs while ensuring it remains compliant and professional.

Get more for Checking Balance Form

Find out other Checking Balance Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal

- How Can I eSign Florida Lease Amendment

- eSign Georgia Lease Amendment Free

- eSign Arizona Notice of Intent to Vacate Easy