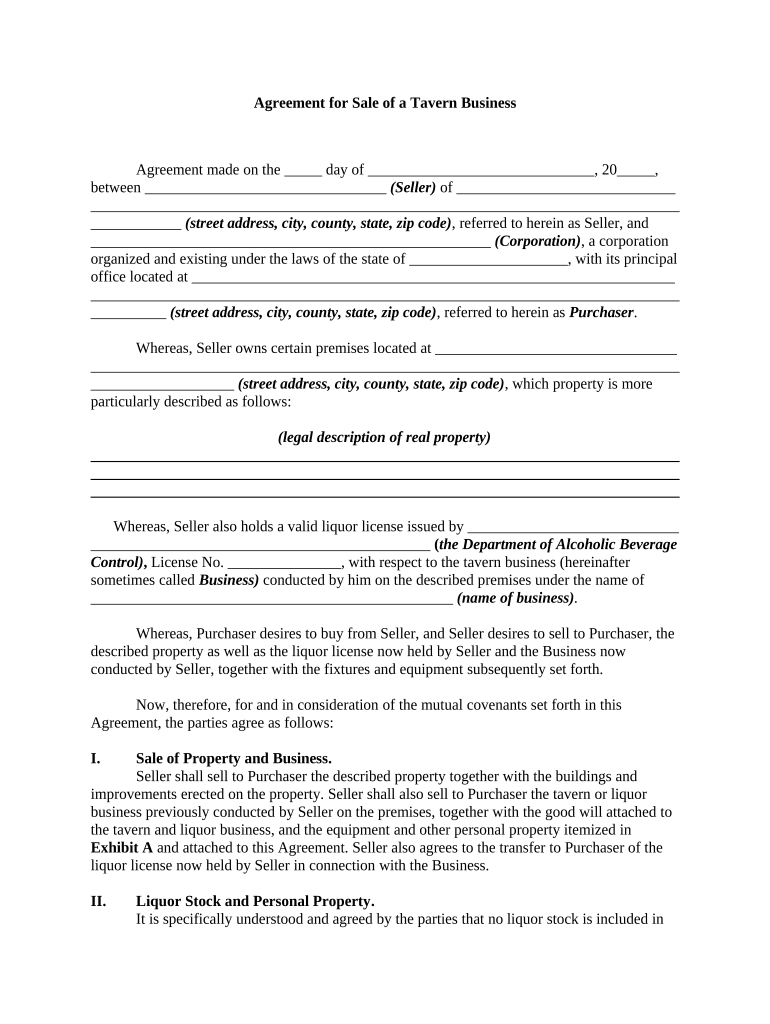

Sale of Business Form

What is the sale of business?

The sale of business refers to the process of transferring ownership of a business entity from one party to another. This can involve various types of assets, including physical property, intellectual property, and customer contracts. The sale can occur for numerous reasons, such as retirement, financial difficulties, or a strategic decision to focus on other ventures. Understanding the intricacies of this process is essential for both buyers and sellers to ensure a smooth transition and compliance with legal requirements.

Key elements of the sale of business

Several key elements are critical to the successful sale of a business. These include:

- Valuation: Determining the fair market value of the business is essential. This can involve analyzing financial statements, market conditions, and asset values.

- Due diligence: Both parties should conduct thorough due diligence to assess the business's financial health, legal standing, and operational capabilities.

- Sales agreement: A legally binding document outlining the terms of the sale, including price, payment terms, and contingencies, is crucial.

- Transfer of assets: This includes the physical and intangible assets being sold, which must be clearly defined in the agreement.

- Regulatory compliance: Ensuring adherence to local, state, and federal laws governing business transactions is vital.

How to use the sale of business

Utilizing the sale of business form effectively involves several steps. First, gather all necessary documentation related to your business, including financial statements, tax returns, and asset lists. Next, ensure that you have a clear understanding of the terms you wish to include in the sales agreement. This may involve consulting with a legal professional to draft or review the agreement. Once the form is filled out, ensure that all parties involved sign it electronically to maintain legal compliance and streamline the process.

Steps to complete the sale of business

Completing the sale of business involves a series of structured steps:

- Conduct a business valuation to determine an appropriate sale price.

- Prepare the necessary documentation, including financial records and legal agreements.

- Engage potential buyers and negotiate terms of the sale.

- Conduct due diligence to verify the buyer's qualifications and intentions.

- Finalize the sales agreement, ensuring all legal requirements are met.

- Complete the transfer of ownership, including the signing of documents.

Legal use of the sale of business

For the sale of business to be legally valid, it must comply with various laws and regulations. This includes ensuring that the sales agreement is properly executed, which may involve electronic signatures that meet the requirements of the ESIGN Act and UETA. Additionally, both parties should be aware of any state-specific regulations that may affect the transaction, such as licensing requirements or tax implications. Consulting with legal professionals can help navigate these complexities and ensure compliance.

Required documents for the sale of business

Several documents are typically required for the sale of business, including:

- Sales agreement: Outlines the terms and conditions of the sale.

- Financial statements: Provide insight into the business's profitability and financial health.

- Tax returns: Offer a historical view of the business's financial performance.

- Asset list: Details the physical and intangible assets included in the sale.

- Disclosure documents: Ensure transparency regarding any potential liabilities or risks associated with the business.

State-specific rules for the sale of business

Each state may have unique regulations governing the sale of business. These can include specific licensing requirements, tax obligations, and disclosure laws. It is important for both buyers and sellers to familiarize themselves with the rules applicable in their state to avoid potential legal issues. Consulting with a local attorney or business advisor can provide valuable insights into these regulations and help ensure a compliant transaction.

Quick guide on how to complete sale of business

Prepare Sale Of Business effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute for conventional printed and signed papers, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, alter, and eSign your documents swiftly without complications. Manage Sale Of Business on any device using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to edit and eSign Sale Of Business without any hassle

- Locate Sale Of Business and then click Get Form to begin.

- Employ the tools we provide to complete your form.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your selected device. Edit and eSign Sale Of Business and guarantee exceptional communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is airSlate SignNow's role in the sale of business transactions?

airSlate SignNow plays a crucial role in the sale of business transactions by providing a secure and efficient way to manage and eSign essential documents. This streamlines the process, ensuring that all parties can easily review and approve contracts related to the sale of business. The platform’s user-friendly interface simplifies complex paperwork, making it easier to close deals swiftly.

-

How can airSlate SignNow help speed up the sale of business process?

airSlate SignNow accelerates the sale of business process by allowing users to create, send, and eSign documents in real time. With features like document templates and bulk sending capabilities, you can avoid delays caused by traditional printing and mailing methods. This leads to faster approvals and a quicker closing of business sales.

-

What are the pricing options for airSlate SignNow in relation to the sale of business?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes, making it a cost-effective solution for the sale of business. Each plan includes various features that are essential for efficiently managing document workflows. You can choose a plan based on your specific needs, whether it's basic eSignature capabilities or advanced integrations.

-

What features does airSlate SignNow offer for the sale of business documentation?

Features of airSlate SignNow that are beneficial for the sale of business include customizable templates, in-person signing options, and real-time tracking of document status. These capabilities ensure that all relevant documents are prepared correctly and that all stakeholders remain informed throughout the process. It's designed to enhance the overall efficiency of business transactions.

-

What benefits does airSlate SignNow provide during the sale of business?

The benefits of using airSlate SignNow during the sale of business include improved compliance, enhanced security, and reduced paperwork. By digitizing and streamlining document management, businesses can minimize errors and legal issues that commonly arise in traditional processes. Consequently, this leads to a smoother and more reliable sale of business.

-

Can airSlate SignNow integrate with other tools for the sale of business?

Yes, airSlate SignNow offers seamless integrations with various business tools, enhancing its usability during the sale of business. Whether you use CRM systems, accounting software, or project management tools, airSlate SignNow can connect and sync information to ensure a coherent workflow. This flexibility makes it a valuable asset for managing business sales.

-

How secure is airSlate SignNow for documents related to the sale of business?

Security is a top priority for airSlate SignNow, especially for sensitive documents involved in the sale of business. The platform employs advanced encryption and secure servers to protect data from unauthorized access. Additionally, compliance with industry standards ensures that your documents are handled with utmost confidentiality and integrity.

Get more for Sale Of Business

- Child support addendum kansas judicial council kansasjudicialcouncil form

- 1 motion to modify child support 2 short form domestic relations kansasjudicialcouncil

- Protection order violations matrix battered womens justice project kansasjudicialcouncil form

- In the district court of county kansas kansas judicial council kansasjudicialcouncil form

- Packet f response to dissolution with missoula county kansasjudicialcouncil form

- 102 informaci n para abuelos sus derechos y responsabilidades kansasjudicialcouncil

- Juvenile court local rules of procedure butler county ohio kansasjudicialcouncil form

- 5113 1 332 in the district court of county kansas in kansasjudicialcouncil form

Find out other Sale Of Business

- How To eSignature Connecticut Legal LLC Operating Agreement

- eSignature Connecticut Legal Residential Lease Agreement Mobile

- eSignature West Virginia High Tech Lease Agreement Template Myself

- How To eSignature Delaware Legal Residential Lease Agreement

- eSignature Florida Legal Letter Of Intent Easy

- Can I eSignature Wyoming High Tech Residential Lease Agreement

- eSignature Connecticut Lawers Promissory Note Template Safe

- eSignature Hawaii Legal Separation Agreement Now

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy