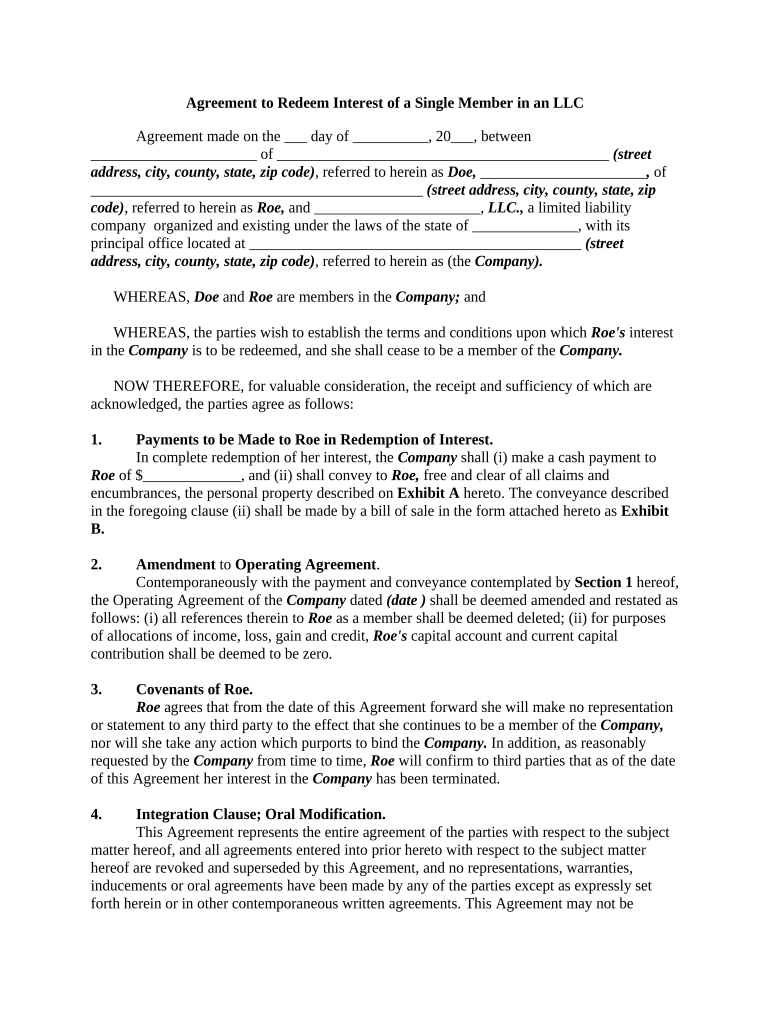

Single Member Llc Form

What is the Single Member LLC

A single member LLC, or limited liability company, is a business structure that provides personal liability protection to its owner while allowing for flexible tax treatment. This entity is particularly popular among entrepreneurs and small business owners in the United States. The single member LLC combines the benefits of a corporation and a sole proprietorship, allowing the owner to enjoy limited liability for business debts and obligations. This means that personal assets are generally protected from business liabilities, making it an attractive option for those looking to minimize risk.

How to Obtain the Single Member LLC

To establish a single member LLC, the owner must follow several steps. First, choose a unique name for the LLC that complies with state regulations. Next, file the Articles of Organization with the appropriate state agency, which typically requires basic information about the business and its owner. Depending on the state, there may be additional requirements, such as obtaining an Employer Identification Number (EIN) from the IRS, even if the LLC has no employees. Lastly, ensure compliance with local regulations, such as business licenses or permits.

Steps to Complete the Single Member LLC

Completing the formation of a single member LLC involves a series of important steps:

- Choose a name that meets state requirements and is not already in use.

- Designate a registered agent to receive legal documents on behalf of the LLC.

- File the Articles of Organization with the state, including necessary fees.

- Create an operating agreement, even if it's not legally required, to outline the management structure and operational procedures.

- Obtain an EIN from the IRS for tax purposes.

- Comply with any additional state or local requirements, such as permits or licenses.

Legal Use of the Single Member LLC

The legal use of a single member LLC is defined by state laws and regulations. This business structure allows the owner to operate their business while enjoying limited liability protection. It is essential to maintain the LLC's status by adhering to state requirements, such as filing annual reports and paying necessary fees. Additionally, the owner should keep personal and business finances separate to uphold the liability protection afforded by the LLC structure.

IRS Guidelines

The IRS treats single member LLCs as disregarded entities for federal tax purposes. This means that the income and expenses of the LLC are reported on the owner's personal tax return, typically using Schedule C. However, the owner can elect to have the LLC taxed as a corporation if it is more beneficial. It is crucial to maintain accurate records and comply with all tax obligations to avoid penalties and ensure the LLC's continued good standing.

Required Documents

When forming a single member LLC, several key documents are necessary:

- Articles of Organization: This document officially establishes the LLC with the state.

- Operating Agreement: While not always required, this document outlines the management and operational procedures of the LLC.

- Employer Identification Number (EIN): Required for tax purposes, even if the LLC has no employees.

- State-specific forms: Additional documents may be required based on local regulations.

Eligibility Criteria

To qualify for a single member LLC, the owner must meet certain eligibility criteria. The individual must be at least eighteen years old and a legal resident of the United States. Additionally, the LLC must have a unique name that complies with state naming rules and cannot be similar to existing businesses. It is also important that the owner maintains the LLC's status by fulfilling all legal obligations, such as filing annual reports and paying any required fees.

Quick guide on how to complete single member llc

Complete Single Member Llc effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the correct format and securely store it online. airSlate SignNow provides all the tools you require to create, modify, and electronically sign your documents swiftly without delays. Manage Single Member Llc on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Single Member Llc with ease

- Locate Single Member Llc and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or conceal sensitive data with the tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you would like to send your form, through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Modify and eSign Single Member Llc and ensure excellent communication throughout every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a single member LLC?

A single member LLC, or limited liability company, is a business structure with one owner that provides personal liability protection. This means the owner's personal assets are typically protected from business debts and liabilities. It's a popular choice for solo entrepreneurs seeking both flexibility and protection.

-

How does airSlate SignNow support the needs of a single member LLC?

airSlate SignNow offers an easy-to-use platform for single member LLCs to manage and eSign important documents efficiently. With a streamlined process for document creation and signing, it saves time and reduces the hassle associated with paperwork. This is ideal for owners who are managing every aspect of their business.

-

What are the pricing options for airSlate SignNow for my single member LLC?

airSlate SignNow provides various pricing tiers tailored to suit the needs of single member LLCs. These plans are designed to be cost-effective while offering essential features that enhance document management. You can choose from monthly or annual subscriptions, ensuring flexibility for your budget.

-

What features does airSlate SignNow offer that are beneficial for a single member LLC?

Key features of airSlate SignNow include templates, real-time tracking, and cloud storage, making it an excellent choice for single member LLCs. These functionalities allow seamless handling of contracts and agreements, which is essential for maintaining a professional image. Plus, eSigning capabilities enhance the speed and efficiency of your operations.

-

Can I integrate airSlate SignNow with other tools I use as a single member LLC?

Yes, airSlate SignNow offers multiple integrations with popular tools and software programs that are beneficial for single member LLCs. This means you can connect it to your CRM, project management tools, and email services to streamline your workflow. These integrations help maximize efficiency and enhance your document management process.

-

Why should a single member LLC consider using airSlate SignNow over other eSignature solutions?

A single member LLC should consider airSlate SignNow because it combines affordability with user-friendly features tailored for individual owners. Unlike other eSignature solutions, airSlate SignNow focuses on providing a customizable experience, which is essential for tailoring document workflows to unique business needs. This helps single member LLCs save time and resources while ensuring compliance.

-

Is airSlate SignNow secure for handling sensitive documents for a single member LLC?

Absolutely! airSlate SignNow prioritizes security, providing robust encryption and compliance with global security standards. For a single member LLC, safeguarding sensitive documents is crucial, and airSlate SignNow ensures that your information remains confidential and protected during the signing process. This gives peace of mind to business owners handling private data.

Get more for Single Member Llc

Find out other Single Member Llc

- How To eSignature Indiana Legal Lease Agreement

- eSignature Kansas Legal Separation Agreement Online

- eSignature Georgia Lawers Cease And Desist Letter Now

- eSignature Maryland Legal Quitclaim Deed Free

- eSignature Maryland Legal Lease Agreement Template Simple

- eSignature North Carolina Legal Cease And Desist Letter Safe

- How Can I eSignature Ohio Legal Stock Certificate

- How To eSignature Pennsylvania Legal Cease And Desist Letter

- eSignature Oregon Legal Lease Agreement Template Later

- Can I eSignature Oregon Legal Limited Power Of Attorney

- eSignature South Dakota Legal Limited Power Of Attorney Now

- eSignature Texas Legal Affidavit Of Heirship Easy

- eSignature Utah Legal Promissory Note Template Free

- eSignature Louisiana Lawers Living Will Free

- eSignature Louisiana Lawers Last Will And Testament Now

- How To eSignature West Virginia Legal Quitclaim Deed

- eSignature West Virginia Legal Lease Agreement Template Online

- eSignature West Virginia Legal Medical History Online

- eSignature Maine Lawers Last Will And Testament Free

- eSignature Alabama Non-Profit Living Will Free