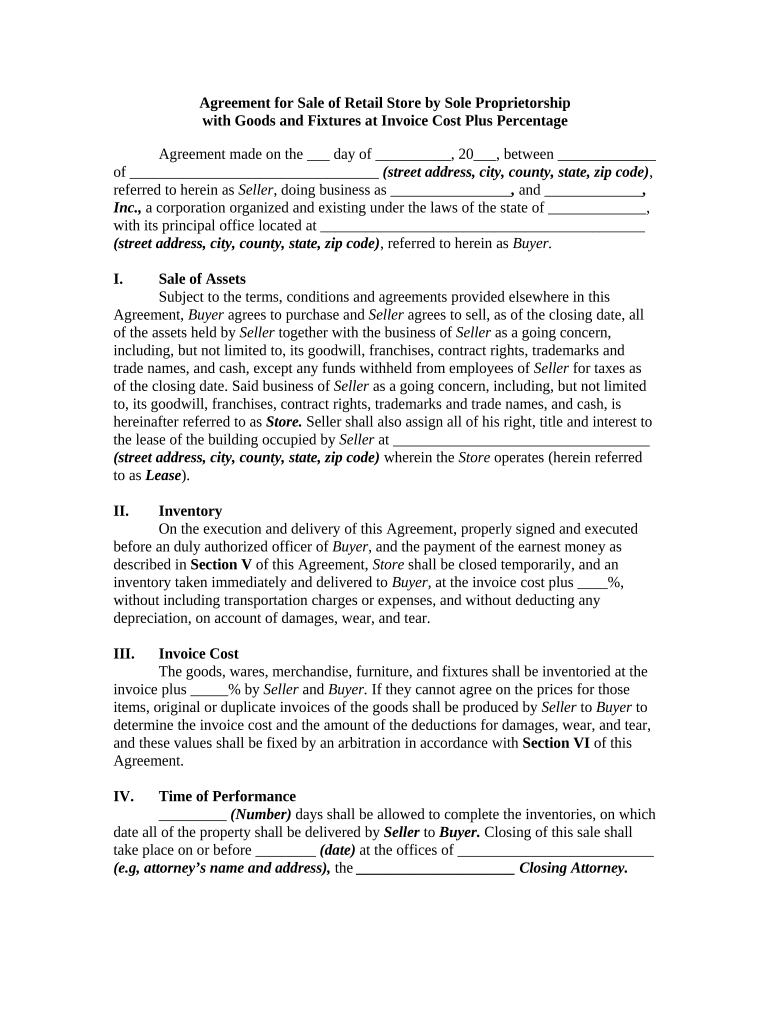

Proprietorship Cost Form

What is the proprietorship cost?

The proprietorship cost refers to the expenses associated with establishing and maintaining a sole proprietorship. This includes initial setup costs, such as registering the business name, obtaining necessary licenses and permits, and any legal fees. Ongoing expenses may encompass taxes, insurance, and operational costs. Understanding these costs is crucial for anyone considering starting a retail sole proprietorship, as they can significantly impact profitability and financial planning.

Steps to complete the proprietorship cost

Completing the proprietorship cost involves several key steps:

- Identify your expenses: List all potential costs, including registration fees, permits, and insurance.

- Research state requirements: Each state may have different regulations and fees associated with sole proprietorships.

- Prepare necessary documentation: Gather all documents needed for registration and compliance, such as identification and tax forms.

- Complete the registration process: Submit your application to the appropriate state or local agency, ensuring all fees are paid.

- Maintain records: Keep detailed records of all expenses and income for accurate financial management and tax reporting.

Legal use of the proprietorship cost

Understanding the legal implications of the proprietorship cost is essential for compliance. This includes adhering to local, state, and federal regulations regarding business registration and taxation. Sole proprietors must ensure that all costs associated with their business are documented and reported accurately. Failure to comply with legal requirements can result in penalties or fines, making it crucial to stay informed about applicable laws and regulations.

Required documents

To establish a sole proprietorship, certain documents are typically required:

- Business registration form: This may vary by state and is necessary for legal recognition.

- Tax identification number: Obtain a federal Employer Identification Number (EIN) if hiring employees.

- Permits and licenses: Depending on the nature of the business, local permits or licenses may be necessary.

- Proof of identity: Personal identification, such as a driver's license or passport, is often required.

IRS guidelines

The Internal Revenue Service (IRS) provides specific guidelines for sole proprietorships regarding taxation. Sole proprietors report business income and expenses on their personal tax returns using Schedule C. It is important to understand allowable deductions, such as business expenses, to accurately calculate taxable income. Additionally, sole proprietors must pay self-employment taxes, which cover Social Security and Medicare contributions.

State-specific rules for the proprietorship cost

State regulations can significantly affect the proprietorship cost. Each state has its own requirements for business registration, fees, and tax obligations. It is vital for sole proprietors to research their state’s specific rules to ensure compliance. This may include varying costs for licenses, permits, and taxes, which can influence overall business expenses.

Quick guide on how to complete proprietorship cost

Complete Proprietorship Cost seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, as you can find the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Proprietorship Cost on any gadget with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Proprietorship Cost effortlessly

- Find Proprietorship Cost and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Choose how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your requirements in document management in just a few clicks from a device of your choice. Edit and eSign Proprietorship Cost and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sole proprietorship and how can I store it securely?

A sole proprietorship is a business owned and operated by one individual. To store your sole proprietorship documents securely, airSlate SignNow offers a reliable platform for eSigning and managing important documents safely. Our solution ensures that your business information is protected while allowing easy access whenever needed.

-

How does airSlate SignNow help me manage my sole proprietorship efficiently?

airSlate SignNow provides features tailored for sole proprietorships, such as customizable templates and easy document sharing. This helps streamline your business processes, ensuring that you can focus on growth while efficiently managing your paperwork related to your store sole proprietorship.

-

What are the pricing options available for airSlate SignNow for a sole proprietorship?

We offer affordable pricing plans designed specifically for small businesses and sole proprietorships. Whether you need basic eSigning capabilities or advanced features for document management, airSlate SignNow has a plan that can fit your budget, making it easy to store your sole proprietorship documents without breaking the bank.

-

Are there any integrations available to support my sole proprietorship?

Yes, airSlate SignNow integrates with various business tools to accommodate your sole proprietorship needs. You can connect it with popular apps such as Google Drive, Dropbox, and CRM systems, simplifying how you store and manage documents related to your store sole proprietorship.

-

What benefits does airSlate SignNow provide for my sole proprietorship?

By utilizing airSlate SignNow, your sole proprietorship can experience greater efficiency, lower operational costs, and improved document security. Our easy-to-use platform allows you to store sole proprietorship documents and streamline your workflow, giving you more time to focus on your business goals.

-

Is it easy to get started with airSlate SignNow for my sole proprietorship?

Absolutely! Getting started with airSlate SignNow for your sole proprietorship is simple and quick. You can sign up, set up your account, and start uploading and storing your sole proprietorship documents within minutes, allowing you to begin benefiting from our features right away.

-

Can I use airSlate SignNow on mobile devices for my sole proprietorship?

Yes, airSlate SignNow is fully accessible on mobile devices, making it easy to manage and store your sole proprietorship documents on-the-go. With our mobile app, you can eSign documents, track their status, and stay organized, ensuring your business runs smoothly wherever you are.

Get more for Proprietorship Cost

- Public service company tax hawaii department of taxation form

- Form n 139 rev 2018 moving expenses forms 2018

- Form itps coa rev 2018 change of address form forms 2018

- Form n 884 rev 2018 forms 2018

- Form n 323 2018 carryover of tax credits forms 2018

- State death tax chart resourcesthe american college of form

- Abl 107 south carolina department of revenue scgov form

- Adv mva1 form

Find out other Proprietorship Cost

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later

- Sign Connecticut Lawers Limited Power Of Attorney Online

- Sign Hawaii Lawers Cease And Desist Letter Easy

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free