Lien Personal Property Form

What is the lien personal property?

A lien on personal property is a legal claim that a creditor has over a debtor's personal assets. This claim serves as security for the repayment of a debt or obligation. In the United States, liens can arise from various situations, such as unpaid loans, taxes, or judgments. The lien grants the creditor the right to take possession of the property if the debtor fails to meet their obligations. Understanding this concept is essential for both debtors and creditors, as it impacts financial transactions and asset management.

How to use the lien personal property

Using a lien on personal property involves several steps. First, the creditor must establish a valid claim, which typically requires documentation of the debt. Next, the creditor files a notice of lien with the appropriate state or local authority, which officially records the claim. This notice must include specific details about the debtor, the property in question, and the amount owed. Once filed, the lien becomes a matter of public record, notifying other potential creditors of the existing claim. It's crucial for creditors to follow the legal procedures to ensure the lien is enforceable.

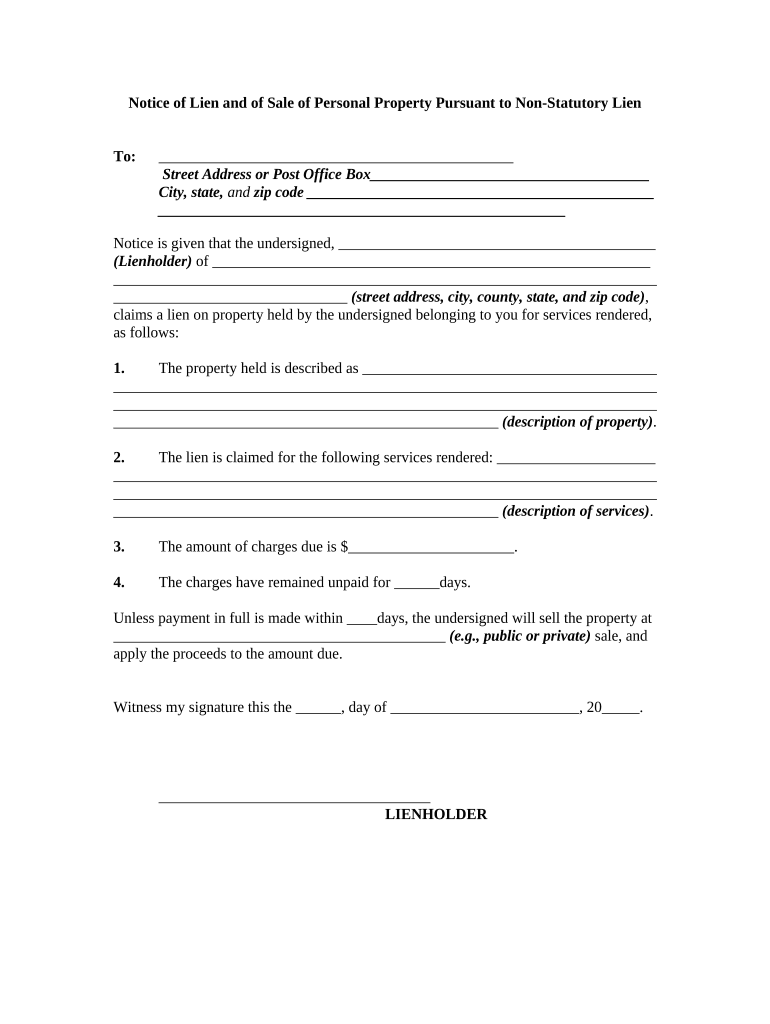

Key elements of the lien personal property

Several key elements define a lien on personal property. These include:

- Debtor Information: The name and address of the person or entity that owes the debt.

- Creditor Information: The name and address of the creditor holding the lien.

- Description of Property: A clear description of the personal property that is subject to the lien.

- Amount Owed: The total amount of the debt secured by the lien.

- Filing Date: The date when the lien is officially recorded.

These elements ensure that the lien is legally recognized and enforceable, protecting the creditor's interests.

Steps to complete the lien personal property

Completing a lien on personal property involves a series of steps that must be followed carefully to ensure compliance with legal requirements:

- Gather necessary documentation, including proof of the debt and identification of the property.

- Prepare the notice of lien, ensuring all required information is included.

- File the notice with the appropriate state or local agency, paying any associated fees.

- Notify the debtor of the lien, as required by law.

- Maintain records of the lien for future reference, including any communications with the debtor.

Following these steps helps ensure that the lien is valid and enforceable.

Legal use of the lien personal property

The legal use of a lien on personal property is governed by state laws, which can vary significantly. Generally, a creditor must have a legitimate claim to the debt and must follow proper procedures to file the lien. This includes providing adequate notice to the debtor and ensuring that the lien is recorded in the appropriate jurisdiction. Failure to comply with legal requirements can result in the lien being deemed invalid. Therefore, it is essential for creditors to be aware of their rights and obligations under the law.

Required documents

To file a lien on personal property, certain documents are typically required. These may include:

- Proof of Debt: Documentation showing the existence and amount of the debt.

- Property Description: Detailed information about the personal property being claimed.

- Notice of Lien: The formal document that is filed with the appropriate authority.

- Identification: Identification of both the debtor and creditor may be necessary.

Having these documents prepared in advance can streamline the filing process and ensure compliance with legal standards.

Quick guide on how to complete lien personal property

Effortlessly Prepare Lien Personal Property on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to obtain the right form and securely store it online. airSlate SignNow provides you with all the tools required to create, edit, and electronically sign your documents quickly and efficiently. Manage Lien Personal Property on any device with the airSlate SignNow applications for Android or iOS, and enhance any document-based workflow today.

How to Edit and Electronically Sign Lien Personal Property with Ease

- Locate Lien Personal Property and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your electronic signature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your updates.

- Select how you wish to send your form: via email, SMS, invite link, or download it to your computer.

Forget about lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device of your choosing. Modify and electronically sign Lien Personal Property to ensure smooth communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a lien on personal property?

A lien on personal property is a legal claim against personal assets to secure the payment of a debt. It allows creditors to take possession of the property if the debt isn't paid. Understanding how liens on personal property work is crucial for individuals and businesses to manage their financial obligations effectively.

-

How does airSlate SignNow facilitate lien personal property documentation?

airSlate SignNow provides an efficient platform for creating and signing documents related to lien personal property. Users can easily draft lien agreements and ensure they are legally binding. The eSignature feature streamlines the process, making it quicker and hassle-free.

-

What are the benefits of using airSlate SignNow for lien personal property contracts?

Using airSlate SignNow for lien personal property contracts offers numerous benefits, including increased efficiency and security. The platform allows for quick turnaround times, reducing paperwork hassle. Additionally, the integration of secure eSignatures ensures that your agreements are legally valid.

-

Is there a free trial available for airSlate SignNow for lien personal property usage?

Yes, airSlate SignNow offers a free trial that allows users to explore its features for handling lien personal property documents. This trial period provides an opportunity to experience the ease of use and efficiency the platform delivers before making a commitment. Sign up today to see how it can benefit your business.

-

What integrations does airSlate SignNow offer for managing lien personal property?

airSlate SignNow integrates seamlessly with various CRM and document management tools, helping you manage lien personal property more effectively. This integration allows for streamlined workflows and better organization of your documents. You can connect with platforms like Salesforce, Google Drive, and more, enhancing your overall experience.

-

How secure is airSlate SignNow for lien personal property transactions?

Security is a priority with airSlate SignNow, especially for sensitive lien personal property transactions. The platform employs robust encryption methods to safeguard your documents and personal information. This ensures that all data remains confidential and protected while allowing you to eSign documents easily.

-

What pricing plans are available for airSlate SignNow for lien personal property users?

airSlate SignNow offers flexible pricing plans tailored to various needs, including options suitable for users managing lien personal property. Plans are designed to accommodate both individual users and larger businesses. You can choose a plan that fits your use case, ensuring cost-effectiveness and value.

Get more for Lien Personal Property

Find out other Lien Personal Property

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement

- How Can I Electronic signature New Mexico Legal Forbearance Agreement

- Electronic signature New Jersey Legal Residential Lease Agreement Fast

- How To Electronic signature New York Legal Lease Agreement

- How Can I Electronic signature New York Legal Stock Certificate

- Electronic signature North Carolina Legal Quitclaim Deed Secure

- How Can I Electronic signature North Carolina Legal Permission Slip

- Electronic signature Legal PDF North Dakota Online

- Electronic signature North Carolina Life Sciences Stock Certificate Fast

- Help Me With Electronic signature North Dakota Legal Warranty Deed

- Electronic signature North Dakota Legal Cease And Desist Letter Online

- Electronic signature North Dakota Legal Cease And Desist Letter Free

- Electronic signature Delaware Orthodontists Permission Slip Free

- How Do I Electronic signature Hawaii Orthodontists Lease Agreement Form

- Electronic signature North Dakota Life Sciences Business Plan Template Now

- Electronic signature Oklahoma Legal Bill Of Lading Fast

- Electronic signature Oklahoma Legal Promissory Note Template Safe

- Electronic signature Oregon Legal Last Will And Testament Online

- Electronic signature Life Sciences Document Pennsylvania Simple

- Electronic signature Legal Document Pennsylvania Online