Mortgage Securing Guaranty of Performance of Lease

What is the Mortgage Securing Guaranty Of Performance Of Lease

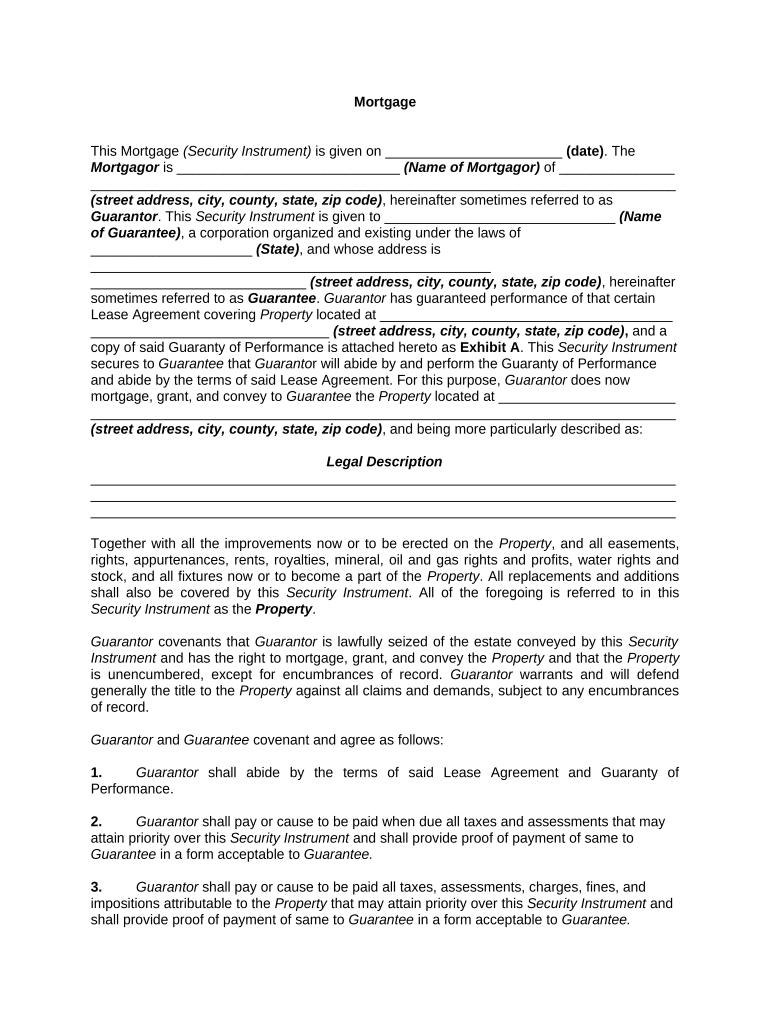

The Mortgage Securing Guaranty of Performance of Lease is a legal document that provides assurance to landlords or property owners that a tenant will fulfill their lease obligations. This guaranty acts as a safeguard, protecting the landlord from potential losses due to tenant defaults. It typically involves a third party, often a financial institution or another entity, that agrees to cover the lease payments if the tenant fails to do so. This document is essential in commercial real estate transactions, where significant financial investments are at stake.

Key Elements of the Mortgage Securing Guaranty Of Performance Of Lease

Several critical components must be included in the Mortgage Securing Guaranty of Performance of Lease to ensure its effectiveness:

- Parties Involved: Clearly identify the landlord, tenant, and guarantor.

- Lease Details: Include specific terms of the lease agreement, such as duration, rental amount, and payment schedule.

- Guarantor's Obligations: Outline the conditions under which the guarantor will fulfill the lease obligations.

- Legal Compliance: Ensure that the document adheres to state laws and regulations governing lease agreements.

- Signatures: Require signatures from all parties involved to validate the agreement.

Steps to Complete the Mortgage Securing Guaranty Of Performance Of Lease

Completing the Mortgage Securing Guaranty of Performance of Lease involves several important steps:

- Gather Necessary Information: Collect details about the lease, parties involved, and the guarantor.

- Draft the Document: Use clear and concise language to draft the guaranty, ensuring all key elements are included.

- Review for Accuracy: Carefully review the document for any errors or omissions.

- Obtain Signatures: Ensure that all parties sign the document in the appropriate sections.

- Store Securely: Keep the signed document in a safe place, ensuring it is easily accessible if needed in the future.

Legal Use of the Mortgage Securing Guaranty Of Performance Of Lease

The legal use of the Mortgage Securing Guaranty of Performance of Lease is governed by various laws and regulations. It is crucial to ensure that the document complies with the Uniform Commercial Code (UCC) and any applicable state laws. The guaranty must be executed properly to be enforceable in court. This includes ensuring that all parties have the legal capacity to enter into the agreement and that the document is signed voluntarily and without coercion.

How to Use the Mortgage Securing Guaranty Of Performance Of Lease

Using the Mortgage Securing Guaranty of Performance of Lease involves several practical steps:

- Assess Tenant Risk: Evaluate the financial stability of the tenant to determine the need for a guaranty.

- Negotiate Terms: Discuss and agree upon the terms of the guaranty with the potential guarantor.

- Execute the Document: Ensure that the document is signed by all relevant parties before the lease commences.

- Monitor Compliance: Regularly check that the tenant is adhering to lease terms to mitigate potential issues.

Examples of Using the Mortgage Securing Guaranty Of Performance Of Lease

Examples of situations where the Mortgage Securing Guaranty of Performance of Lease is beneficial include:

- A commercial landlord requiring a guaranty from a startup business with limited financial history.

- A property owner seeking assurance from a corporate tenant with a substantial lease commitment.

- A residential landlord requesting a guaranty from a parent or guardian for a student tenant.

Quick guide on how to complete mortgage securing guaranty of performance of lease

Prepare Mortgage Securing Guaranty Of Performance Of Lease with ease on any device

Digital document administration has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, amend, and electronically sign your documents swiftly without complications. Manage Mortgage Securing Guaranty Of Performance Of Lease on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to amend and electronically sign Mortgage Securing Guaranty Of Performance Of Lease effortlessly

- Locate Mortgage Securing Guaranty Of Performance Of Lease and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes mere moments and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form navigation, and mistakes that require printing new document copies. airSlate SignNow meets all your document management demands in just a few clicks from your chosen device. Modify and electronically sign Mortgage Securing Guaranty Of Performance Of Lease to ensure effective communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mortgage Securing Guaranty Of Performance Of Lease?

A Mortgage Securing Guaranty Of Performance Of Lease is a legal instrument that ensures that lease obligations are fulfilled, providing security to landlords. This document guarantees that the tenant will perform under the lease terms, safeguarding the landlord’s interests.

-

How can airSlate SignNow assist in managing a Mortgage Securing Guaranty Of Performance Of Lease?

airSlate SignNow streamlines the process of creating, sending, and electronically signing a Mortgage Securing Guaranty Of Performance Of Lease. With its user-friendly interface, you can quickly prepare necessary documents, saving time and ensuring compliance with legal standards.

-

What are the pricing options for using airSlate SignNow for a Mortgage Securing Guaranty Of Performance Of Lease?

airSlate SignNow offers various pricing plans tailored to meet diverse business needs. These plans generally include features relevant to managing documents like a Mortgage Securing Guaranty Of Performance Of Lease, ensuring cost-effectiveness without sacrificing functionality.

-

What are the key features of airSlate SignNow related to lease agreements?

Key features of airSlate SignNow for lease agreements include document templates, real-time collaboration, and status tracking. These functionalities help users effectively manage and execute a Mortgage Securing Guaranty Of Performance Of Lease, ensuring clarity and efficiency throughout the process.

-

What are the benefits of using airSlate SignNow for my Mortgage Securing Guaranty Of Performance Of Lease?

Using airSlate SignNow for your Mortgage Securing Guaranty Of Performance Of Lease offers enhanced security, faster execution, and reduced paper usage. Additionally, it allows for seamless tracking and management, making the entire process more reliable and streamlined.

-

Can airSlate SignNow integrate with other applications for lease management?

Yes, airSlate SignNow supports integrations with various business applications, allowing for efficient management of your Mortgage Securing Guaranty Of Performance Of Lease. Integrating with CRM and document management tools streamlines workflows and enhances operational efficiency.

-

Is it easy to use airSlate SignNow for creating a Mortgage Securing Guaranty Of Performance Of Lease?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making the creation of a Mortgage Securing Guaranty Of Performance Of Lease straightforward. Its intuitive interface ensures that even users with minimal technical skills can navigate the platform with ease.

Get more for Mortgage Securing Guaranty Of Performance Of Lease

Find out other Mortgage Securing Guaranty Of Performance Of Lease

- How Do I Electronic signature Montana Business Operations Presentation

- How To Electronic signature Alabama Charity Form

- How To Electronic signature Arkansas Construction Word

- How Do I Electronic signature Arkansas Construction Document

- Can I Electronic signature Delaware Construction PDF

- How Can I Electronic signature Ohio Business Operations Document

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document