Terminate Trust Form

What is the Terminate Trust

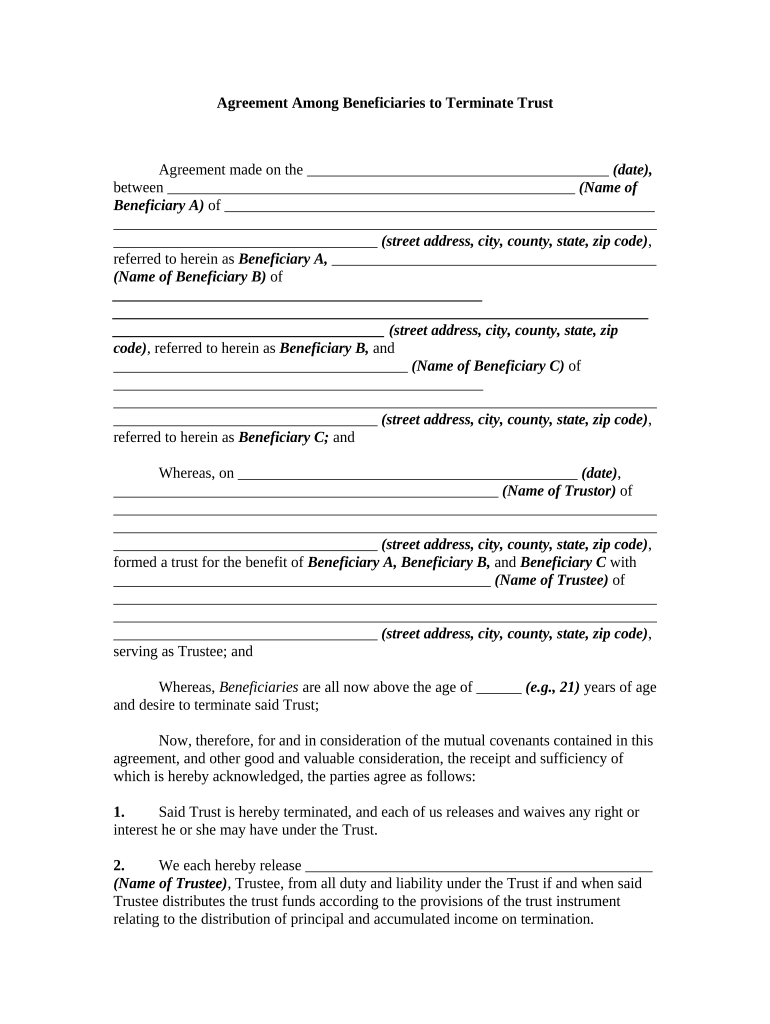

A terminate trust is a legal arrangement that allows the trust to be dissolved and its assets distributed according to the terms set forth in the trust document. This process can occur for various reasons, including the expiration of the trust term, the achievement of specific goals, or the death of the grantor. Understanding the nature of a terminate trust is essential for beneficiaries and trustees to ensure compliance with legal requirements and proper distribution of assets.

Steps to complete the Terminate Trust

Completing the process to terminate a trust involves several key steps:

- Review the Trust Document: Begin by thoroughly reviewing the trust agreement to understand the specific terms and conditions for termination.

- Notify Beneficiaries: Inform all beneficiaries about the intention to terminate the trust, ensuring they are aware of their rights and entitlements.

- Gather Required Documents: Collect all necessary documentation, including financial statements, asset lists, and any other relevant records.

- Consult Legal Counsel: It is advisable to seek legal advice to navigate any complexities and ensure compliance with state laws.

- Execute the Termination: Follow the procedures outlined in the trust document to formally terminate the trust, which may involve signing documents and obtaining necessary approvals.

- Distribute Assets: Finally, distribute the trust assets to the beneficiaries as specified in the trust agreement.

Legal use of the Terminate Trust

The legal use of a terminate trust is governed by state laws and the specific terms outlined in the trust document. In the United States, trusts must adhere to regulations established under the Uniform Trust Code, which provides guidelines for trust administration and termination. Ensuring that the termination process complies with these legal frameworks is crucial to avoid disputes and ensure that the rights of all parties are protected.

State-specific rules for the Terminate Trust

Each state in the U.S. may have unique regulations regarding the termination of trusts. For instance, Indiana and Kentucky have specific laws that dictate the reasonable timeframes and processes for terminating a trust. It is important for trustees and beneficiaries to familiarize themselves with their state’s laws to ensure compliance and avoid potential legal issues. Consulting with a local attorney who specializes in trust law can provide valuable insights into state-specific requirements.

Required Documents

To successfully terminate a trust, certain documents are typically required. These may include:

- The original trust agreement or a copy of it.

- Financial statements detailing the trust’s assets and liabilities.

- Identification documents for all beneficiaries.

- Any amendments made to the trust since its inception.

- Legal correspondence related to the trust, if applicable.

Having these documents prepared in advance can streamline the termination process and help avoid delays.

Examples of using the Terminate Trust

There are various scenarios where terminating a trust may be appropriate. For example, a trust established for minor children may be terminated once they reach adulthood, allowing for the distribution of assets. Another instance might involve a trust created for a specific purpose that has been fulfilled, such as funding a college education. Understanding these examples can help trustees and beneficiaries recognize when it may be time to consider terminating a trust.

Quick guide on how to complete terminate trust

Effortlessly Prepare Terminate Trust on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, edit, and eSign your documents swiftly without any delays. Manage Terminate Trust on any device using the airSlate SignNow apps for Android or iOS, and simplify any document-related process today.

How to Edit and eSign Terminate Trust with Ease

- Obtain Terminate Trust and click on Get Form to begin.

- Utilize our provided tools to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or mislaid documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Terminate Trust while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I consider before deciding to terminate trust agreements?

Before you decide to terminate trust agreements, ensure you understand the implications on the involved parties and the assets. It’s essential to review all relevant documents and consult with a legal professional to avoid potential legal issues when you terminate trust arrangements.

-

How can airSlate SignNow help me when I need to terminate trust documents?

airSlate SignNow provides a seamless platform for securely signing and sending documents related to terminating trusts. With our user-friendly interface, you can streamline the process of managing legal documents, ensuring all necessary parties can eSign easily and efficiently.

-

Is there a specific process for terminating a trust using airSlate SignNow?

Yes, to terminate a trust using airSlate SignNow, you can create and upload your termination documents, then send them to the required signers. The platform facilitates real-time tracking of signatures, ensuring that the entire process is transparent and efficient.

-

What features does airSlate SignNow offer for managing trust termination?

airSlate SignNow offers features such as customizable templates, automated reminders, and real-time tracking. These tools make it easier to manage the entire process of terminating trust documents, helping you stay organized and compliant.

-

Are there any costs associated with terminating trust documents using airSlate SignNow?

airSlate SignNow offers flexible pricing plans that can accommodate your budget needs. Depending on the features required to complete your trust termination documents, you may choose a plan that is cost-effective and suits your business requirements.

-

Can I integrate airSlate SignNow with other software to manage trust terminations?

Absolutely! airSlate SignNow integrates with various third-party applications such as CRM and document management systems. This integration allows you to enhance your workflows when terminating trust agreements and ensures all your documents are linked and accessible.

-

What are the benefits of using airSlate SignNow for terminating trusts?

Using airSlate SignNow for terminating trusts provides enhanced security, ease of use, and efficiency. With electronic signatures and secure document handling, you can terminate trust agreements quickly while ensuring compliance with legal standards.

Get more for Terminate Trust

Find out other Terminate Trust

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple