Letter Employer Loan Form

What is the Letter Employer Loan

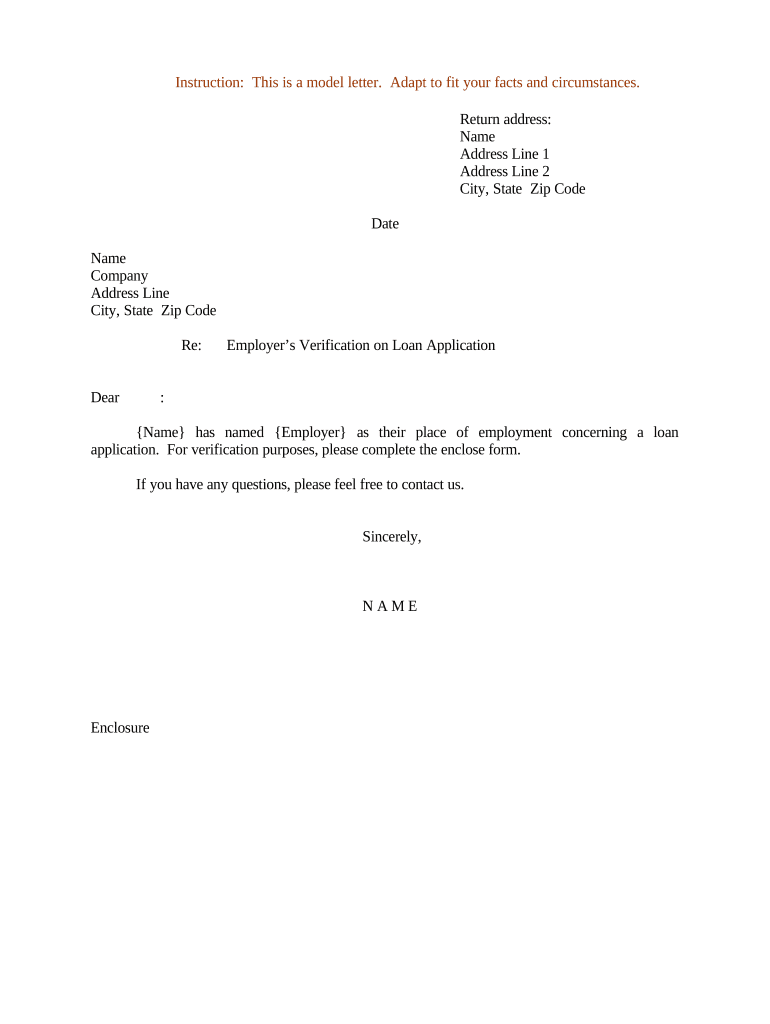

The Letter Employer Loan is a formal document that employers provide to employees who are seeking a loan. This letter typically verifies the employee's employment status, income, and other relevant details that lenders require for loan approval. It serves as an official endorsement of the employee's financial reliability and job stability, which are crucial factors for lenders when assessing loan applications.

Key elements of the Letter Employer Loan

A well-structured Letter Employer Loan should include several key elements to ensure its effectiveness. These elements typically encompass:

- Employer's Information: Name, address, and contact details of the employer.

- Employee's Information: Full name, job title, and employment start date of the employee.

- Employment Status: Confirmation of the employee's current employment status, whether full-time or part-time.

- Income Details: The employee's salary or hourly wage, along with any additional compensation.

- Loan Purpose: A brief statement regarding the purpose of the loan, if applicable.

Steps to complete the Letter Employer Loan

Completing the Letter Employer Loan involves several straightforward steps. Employers should follow these guidelines to ensure the letter meets all necessary requirements:

- Gather Employee Information: Collect all relevant details about the employee, including their job title, employment duration, and income.

- Draft the Letter: Use a professional format to draft the letter, ensuring all key elements are included.

- Review for Accuracy: Double-check the information for accuracy and completeness before finalizing the document.

- Obtain Necessary Signatures: Ensure that the letter is signed by an authorized representative of the company.

- Provide a Copy to the Employee: Once completed, give a copy of the letter to the employee for their records and loan application.

Legal use of the Letter Employer Loan

The Letter Employer Loan is legally recognized as a valid document when it adheres to specific guidelines. It is essential for employers to ensure that the information provided is truthful and accurate, as any discrepancies could lead to legal ramifications. Additionally, the letter should comply with relevant privacy laws, ensuring that the employee's personal information is handled securely and responsibly.

Required Documents

When preparing the Letter Employer Loan, certain documents may be required to support the information provided. These documents can include:

- Employee's Pay Stubs: Recent pay stubs to verify income.

- Tax Forms: W-2 or 1099 forms that reflect the employee's earnings.

- Employment Contract: A copy of the employment agreement, if applicable, to confirm employment terms.

Who Issues the Form

The Letter Employer Loan is typically issued by the human resources department or a designated representative of the employer. It is important that the person issuing the letter has the authority to confirm employment details and is familiar with the company's policies regarding such documentation.

Quick guide on how to complete letter employer loan

Prepare Letter Employer Loan effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed paperwork, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, amend, and electronically sign your documents swiftly without delays. Manage Letter Employer Loan on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

How to amend and electronically sign Letter Employer Loan with ease

- Find Letter Employer Loan and click Get Form to begin.

- Use the tools we provide to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign tool, which takes moments and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about misplaced or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Edit and electronically sign Letter Employer Loan and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a furlough verification letter and why do I need it?

A furlough verification letter serves as official documentation confirming an employee's furlough status and dates. This letter can be essential for various purposes, such as applying for unemployment benefits or verifying employment history. Understanding the specific 'furlough verification letter dates printable' form is crucial for accurate documentation.

-

How can I create a furlough verification letter using airSlate SignNow?

With airSlate SignNow, you can easily create and customize your furlough verification letter using our intuitive templates. Simply input the necessary details and use the 'furlough verification letter dates printable' options to format it as needed. The platform allows you to eSign the document for a legally binding touch.

-

What are the benefits of using airSlate SignNow for furlough verification letters?

Using airSlate SignNow for creating furlough verification letters streamlines the process, saving time and reducing errors. The easy-to-use interface allows for quick access to 'furlough verification letter dates printable' templates. Additionally, it supports secure eSigning, ensuring your letters are legally valid.

-

Are there any costs associated with getting furlough verification letters?

airSlate SignNow offers cost-effective solutions for businesses, with pricing tailored to diverse needs. Depending on your plan, you can access 'furlough verification letter dates printable' features at an affordable rate. For specific pricing details, visit our website or contact our sales team for a customized quote.

-

Can I integrate airSlate SignNow with other applications for furlough documentation?

Yes, airSlate SignNow seamlessly integrates with various applications such as Google Drive, Salesforce, and more. This means you can manage your furlough verification letters and 'furlough verification letter dates printable' files in one centralized location. The integrations enhance workflow efficiency and document management.

-

How do I ensure my furlough verification letter is compliant with employment laws?

To ensure compliance, use airSlate SignNow’s templates that are designed to meet standard employment regulations for furlough verification letters. The 'furlough verification letter dates printable' options guide you in including all necessary information. It’s advisable to double-check specific state laws that may apply to your situation.

-

Is customer support available if I need help with furlough letters?

Absolutely! airSlate SignNow provides comprehensive customer support to assist you with any questions regarding furlough verification letters. Our team is available through multiple channels, ensuring you receive the help you need for all 'furlough verification letter dates printable' inquiries.

Get more for Letter Employer Loan

- Will should be signed by you in front of two witnesses not related to you form

- Example john doe and sally doe form

- Rods valances blinds window shades screens shutters awnings wall to wall carpeting mirrors fixed in place form

- All pages of the will in the places designated form

- How do i deed property to a minor childdeeds legal form

- The self proving affidavit is used to prove the will and make the will subject to form

- Thinking critically 10th edition pdf free download epdfpub form

- New york legal last will and testament form for a widow or

Find out other Letter Employer Loan

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document