Letter Denying Credit Form

What is the letter denying credit?

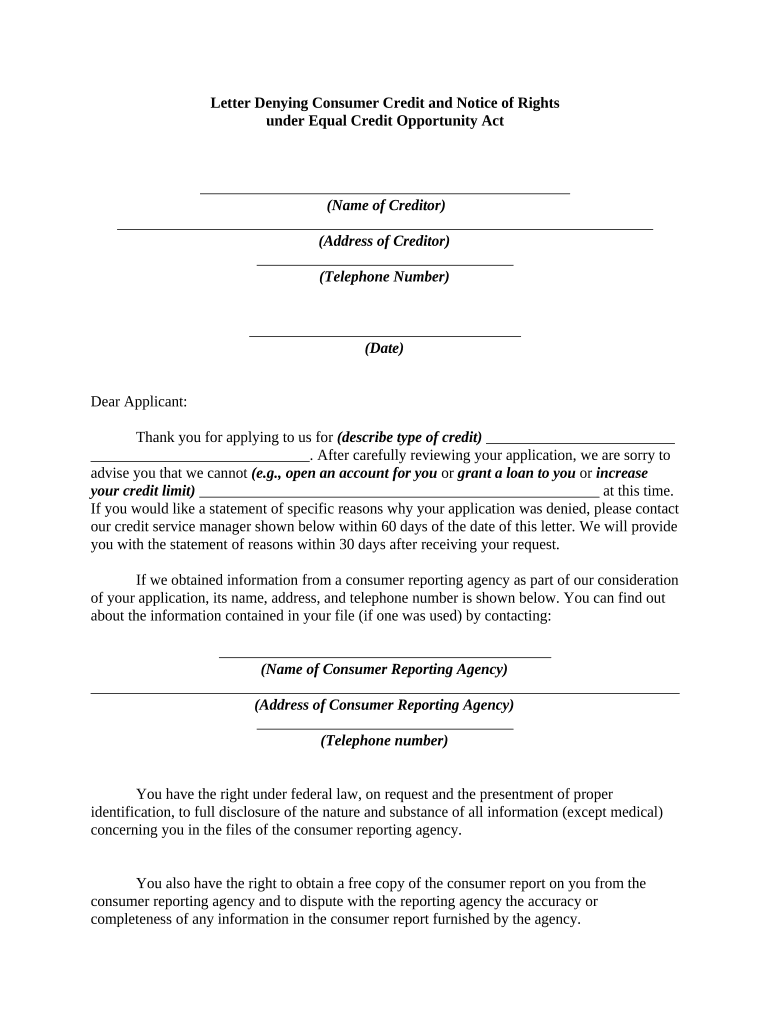

The letter denying credit is a formal document provided by lenders to inform applicants that their request for credit has been declined. This letter outlines the reasons for the denial, which may include factors such as insufficient credit history, low credit scores, or failure to meet income requirements. Under the Equal Credit Opportunity Act, lenders are required to provide this notice to ensure transparency and fairness in the credit application process.

Key elements of the letter denying credit

A letter denying credit typically includes several crucial components to ensure clarity and compliance with legal standards. These elements often consist of:

- Applicant's information: Name, address, and other identifying details.

- Lender's information: Name of the financial institution, contact details, and representative.

- Reason for denial: A clear explanation of why the credit application was rejected, such as credit score issues or insufficient income.

- Consumer rights: Information about the applicant's rights under the Fair Credit Reporting Act, including the right to dispute inaccuracies in their credit report.

- Next steps: Guidance on what the applicant can do next, such as checking their credit report or reapplying in the future.

How to use the letter denying credit

When you receive a letter denying credit, it is essential to understand how to use it effectively. First, review the reasons for denial carefully. This information can help you identify areas for improvement in your credit profile. If the denial was due to inaccuracies in your credit report, you can dispute those errors with the credit bureau. Additionally, you may want to consider seeking advice from a financial counselor to improve your creditworthiness before reapplying.

Steps to complete the letter denying credit

Completing a letter denying credit involves several important steps to ensure it meets legal requirements. Follow these steps:

- Gather information: Collect all necessary details about the applicant and the credit application.

- Draft the letter: Use a clear and professional tone, ensuring all key elements are included.

- Review for accuracy: Double-check all information for correctness, especially the reasons for denial.

- Send the letter: Deliver the letter to the applicant via mail or electronically, ensuring compliance with any relevant regulations.

Legal use of the letter denying credit

The legal use of the letter denying credit is governed by various regulations, including the Equal Credit Opportunity Act and the Fair Credit Reporting Act. These laws require lenders to provide a written explanation when credit is denied, ensuring that applicants understand their rights. Failure to comply with these regulations can result in penalties for the lender, making it crucial to follow legal guidelines when issuing a denial letter.

Examples of using the letter denying credit

Examples of using the letter denying credit can vary based on individual circumstances. For instance, if an applicant is denied due to a low credit score, the letter may provide specific details about the score and suggest steps for improvement. Alternatively, if the denial results from insufficient income, the letter might encourage the applicant to seek additional income sources or consider applying for a smaller loan amount in the future. These examples illustrate how the letter can serve as a tool for applicants to understand and address their credit challenges.

Quick guide on how to complete letter denying credit

Easily Prepare Letter Denying Credit on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to obtain the required form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Letter Denying Credit on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to Edit and eSign Letter Denying Credit Effortlessly

- Locate Letter Denying Credit and click on Get Form to begin.

- Use the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form—by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your choice. Edit and eSign Letter Denying Credit and guarantee exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter denying credit?

A letter denying credit is a formal document sent to a borrower to inform them that their credit application has been declined. This letter typically outlines the reasons for the denial and provides information on how to improve their credit status. Using airSlate SignNow, you can easily create, send, and eSign such letters in a cost-effective manner.

-

How does airSlate SignNow help in creating a letter denying credit?

airSlate SignNow offers customizable templates that simplify the process of creating a letter denying credit. You can quickly fill in the necessary details and send it securely to the applicant. This feature not only saves time but ensures that your correspondence is professional and compliant with legal standards.

-

What are the benefits of using airSlate SignNow for letter denying credit?

Using airSlate SignNow to manage your letter denying credit allows for efficient processing and tracking of documents. You benefit from enhanced security, reducing the risk of unauthorized access, and you can easily integrate it with other business tools for better workflow management. This leads to improved customer service as your responses are timely and organized.

-

Is airSlate SignNow affordable for my business needs?

Yes, airSlate SignNow offers various pricing plans designed to fit different business budgets. Each plan includes features that allow you to create and send a letter denying credit, making it a cost-effective solution for enhancing your document management processes. You can choose a plan that best fits your organization's scale and needs.

-

Can I track the status of a letter denying credit sent through airSlate SignNow?

Absolutely! airSlate SignNow provides tracking features that allow you to see when a letter denying credit has been opened and signed. This real-time tracking ensures that you stay updated on the document's status, allowing for timely follow-ups and better communication with applicants.

-

What kind of integrations does airSlate SignNow support?

airSlate SignNow integrates seamlessly with various business applications, including CRM systems, cloud storage solutions, and email services. This means you can automate the process of sending a letter denying credit alongside your existing workflows, enhancing overall efficiency and productivity in your operations.

-

Is it easy to eSign a letter denying credit with airSlate SignNow?

Yes, eSigning a letter denying credit with airSlate SignNow is incredibly easy. The platform allows users to sign documents electronically with just a few clicks, making the signing process fast and efficient. This convenience helps you maintain communication momentum with applicants, ensuring they receive timely feedback regarding their credit applications.

Get more for Letter Denying Credit

- Unless submitting with practitioner enrollment form

- 2017 2018 undergraduate catalog peru state college form

- This application is for term 10 term 20 term 100 and universal life insurance and available benefits and riders form

- Ach authorization for recurring deposittransfer farm bureau bank form

- Place pro sticker here form

- Day and ross bol form

- I authorize abington hospital abington lansdale hospital other form

- Notification of disputed item form notification of disputed item form

Find out other Letter Denying Credit

- eSignature Alabama Business Operations Cease And Desist Letter Now

- How To eSignature Iowa Banking Quitclaim Deed

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney