Collection Agency's Return of Claim as Uncollectible Form

What is the Collection Agency's Return Of Claim As Uncollectible

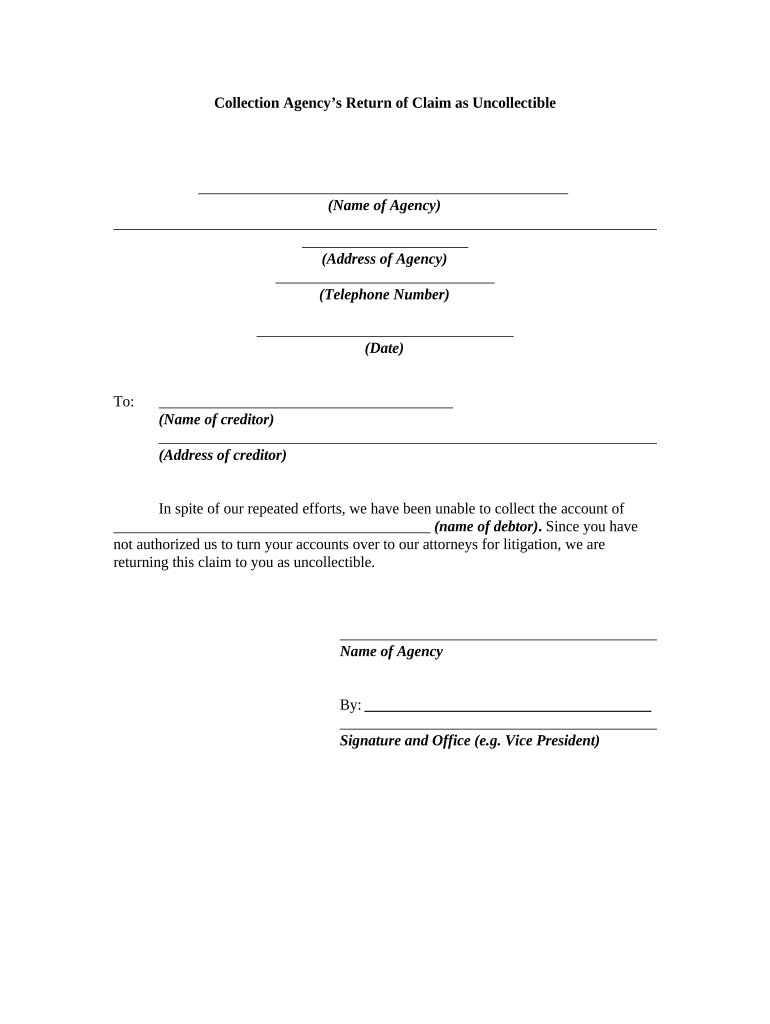

The Collection Agency's Return Of Claim As Uncollectible is a formal document used by collection agencies to report debts that are deemed uncollectible. This form indicates that the agency has exhausted all reasonable efforts to collect the debt, and it is no longer viable to pursue further collection actions. By filing this form, the agency officially closes the case, allowing for potential tax deductions or write-offs related to the uncollectible debt.

Steps to complete the Collection Agency's Return Of Claim As Uncollectible

Completing the Collection Agency's Return Of Claim As Uncollectible involves several key steps:

- Gather all relevant information about the debt, including the debtor's details and the amount owed.

- Document the collection efforts made, such as communication attempts and payment plans offered.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the completed form for accuracy and compliance with any applicable regulations.

- Submit the form through the appropriate channels, whether electronically or via mail.

Legal use of the Collection Agency's Return Of Claim As Uncollectible

The legal use of the Collection Agency's Return Of Claim As Uncollectible is crucial for ensuring compliance with federal and state laws. This form must be used in accordance with the Fair Debt Collection Practices Act (FDCPA), which governs the actions of collection agencies. Proper use of the form protects the agency from potential legal repercussions and provides a clear record of the debt's status.

Key elements of the Collection Agency's Return Of Claim As Uncollectible

Several key elements must be included in the Collection Agency's Return Of Claim As Uncollectible to ensure its validity:

- Debtor's full name and contact information.

- Details of the debt, including the original creditor and the amount owed.

- Documentation of collection efforts undertaken by the agency.

- Signature of an authorized representative from the collection agency.

Examples of using the Collection Agency's Return Of Claim As Uncollectible

Examples of using the Collection Agency's Return Of Claim As Uncollectible include scenarios where a collection agency has made multiple attempts to collect a debt but has received no response from the debtor. In such cases, the agency may file the form to officially categorize the debt as uncollectible, which can help in financial reporting and tax filings. Another example is when a debtor has declared bankruptcy, making it impossible for the agency to recover the owed amount.

Form Submission Methods (Online / Mail / In-Person)

The Collection Agency's Return Of Claim As Uncollectible can typically be submitted through various methods:

- Online submission via the collection agency's designated portal, which may offer a streamlined process.

- Mailing the completed form to the appropriate regulatory body or original creditor.

- In-person submission at designated offices, if required by specific state regulations.

Eligibility Criteria

To file the Collection Agency's Return Of Claim As Uncollectible, certain eligibility criteria must be met:

- The debt must be verified and documented as uncollectible.

- The collection agency must have made reasonable efforts to collect the debt.

- The agency must be in compliance with all relevant state and federal regulations.

Quick guide on how to complete collection agencys return of claim as uncollectible 497330024

Complete Collection Agency's Return Of Claim As Uncollectible effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents swiftly without any hassle. Manage Collection Agency's Return Of Claim As Uncollectible on any device using the airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

The easiest way to modify and eSign Collection Agency's Return Of Claim As Uncollectible effortlessly

- Obtain Collection Agency's Return Of Claim As Uncollectible and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Select important sections of your documents or redact sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature with the Sign tool, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and then click the Done button to finalize your changes.

- Decide how you would like to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document versions. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Modify and eSign Collection Agency's Return Of Claim As Uncollectible and ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Collection Agency's Return Of Claim As Uncollectible?

A Collection Agency's Return Of Claim As Uncollectible is a formal notification that a debt owed is deemed impossible to collect after various attempts. This process helps businesses clear their accounts receivable and maintain accurate financial records. Utilizing tools like airSlate SignNow can streamline the documentation involved in this process.

-

How can airSlate SignNow assist with the Collection Agency's Return Of Claim As Uncollectible process?

airSlate SignNow simplifies the process of documenting a Collection Agency's Return Of Claim As Uncollectible by enabling users to create and eSign necessary documents efficiently. With its user-friendly interface, businesses can quickly format, send, and receive confirmations, thereby expediting the claims process.

-

What are the pricing options for airSlate SignNow in relation to managing uncollectible claims?

airSlate SignNow offers flexible pricing plans tailored to different business needs, including those focused on managing a Collection Agency's Return Of Claim As Uncollectible. Customers can choose a plan that suits their volume of transactions and budget while benefitting from features designed to streamline documentation.

-

Are there any integrations available with airSlate SignNow for handling uncollectible claims?

Yes, airSlate SignNow integrates seamlessly with various platforms, allowing users to manage a Collection Agency's Return Of Claim As Uncollectible alongside their existing workflows. These integrations can enhance efficiency by connecting your document processes with accounting and customer relationship management software.

-

What features does airSlate SignNow provide for businesses dealing with uncollectible claims?

airSlate SignNow provides features such as custom templates, secure eSigning, and real-time tracking, which are essential for managing a Collection Agency's Return Of Claim As Uncollectible. These features not only streamline the documentation process but also improve compliance and reduce turnaround time.

-

How does using airSlate SignNow benefit my organization in the claims process?

By using airSlate SignNow, organizations can benefit from a cost-effective and efficient process for a Collection Agency's Return Of Claim As Uncollectible. Improved efficiency in document handling reduces the risk of errors and enhances communication during disputes, thereby fostering stronger client relationships.

-

Can I customize documents for a Collection Agency's Return Of Claim As Uncollectible using airSlate SignNow?

Absolutely! airSlate SignNow allows users to customize documents specifically for a Collection Agency's Return Of Claim As Uncollectible. This means you can ensure that all necessary details are included and formatted according to your business requirements, ensuring clarity and professionalism.

Get more for Collection Agency's Return Of Claim As Uncollectible

- Scheduling a group visit to the chazen todays date form

- Emergency financial assistance program student progress report form

- Residence questionnaire form

- Non photo student id card request form

- Health insurance waiver form for tufts universitys boston amp grafton campuses 2018 2019

- 218 755 2020 fax 218 755 4409 form

- Campbell university immunizations form

- Arac cover sheet college of humanities and sciences has vcu form

Find out other Collection Agency's Return Of Claim As Uncollectible

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors