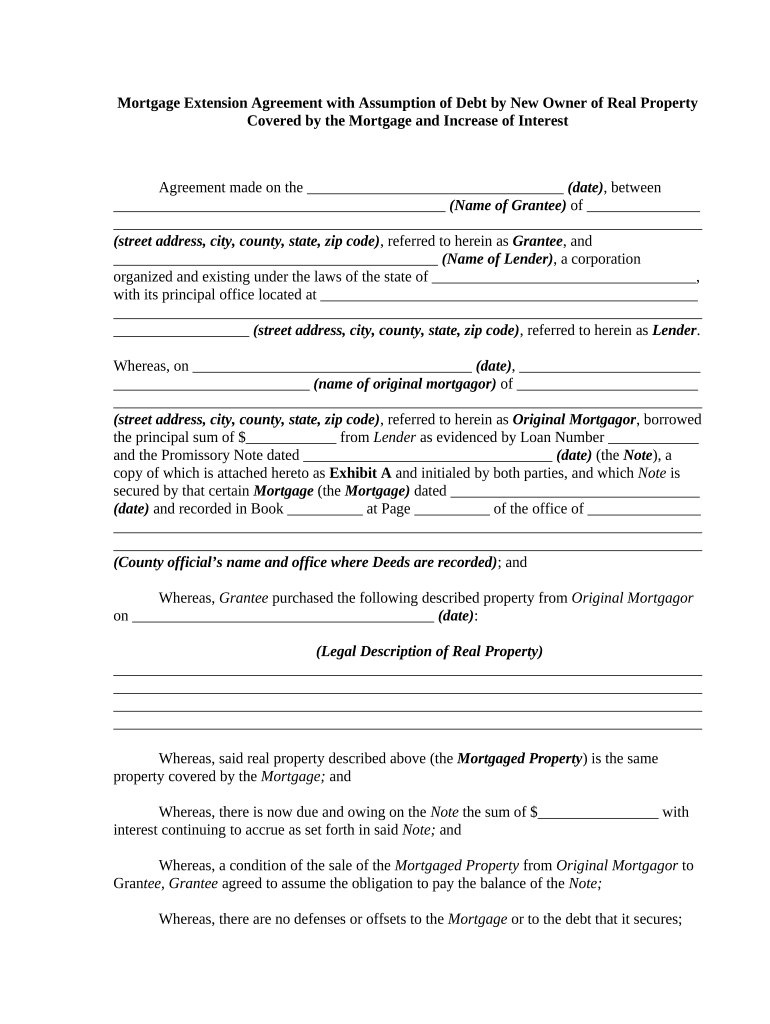

Mortgage Extension Form

What is the mortgage extension?

A mortgage extension is a legal agreement between a borrower and a lender that allows the borrower to extend the term of their existing mortgage. This can provide additional time to pay off the loan, often resulting in lower monthly payments. The extension may be beneficial for those facing financial difficulties or seeking to avoid foreclosure. It is essential to understand the terms of the extension, including any potential fees or changes in interest rates.

How to use the mortgage extension

Using a mortgage extension involves several steps. First, the borrower should contact their lender to discuss the possibility of extending their mortgage. This conversation should cover the reasons for the extension and any potential impacts on the loan's terms. Once an agreement is reached, the borrower may need to complete specific documentation, including the mortgage extension form. It is crucial to review all terms carefully before signing to ensure understanding and compliance.

Steps to complete the mortgage extension

Completing a mortgage extension typically involves the following steps:

- Contact your lender to express your interest in a mortgage extension.

- Gather necessary financial documents, such as income statements and current mortgage details.

- Complete the mortgage extension form provided by your lender.

- Review the terms of the extension, including any changes to interest rates or payment schedules.

- Sign the form electronically or in person, ensuring all required signatures are obtained.

- Submit the completed form to your lender for processing.

Legal use of the mortgage extension

The legal use of a mortgage extension is governed by state laws and the terms set forth in the mortgage agreement. It is important to ensure that the extension complies with relevant regulations, such as those outlined in the Truth in Lending Act and other consumer protection laws. A properly executed mortgage extension can be legally binding, provided all parties adhere to the agreed-upon terms and conditions.

Required documents

To successfully complete a mortgage extension, several documents may be required, including:

- Current mortgage statement

- Proof of income (pay stubs, tax returns)

- Identification (driver's license, social security number)

- Completed mortgage extension form

Having these documents ready can streamline the process and help ensure a smooth transaction.

Who issues the form?

The mortgage extension form is typically issued by the lender or financial institution that holds the mortgage. Each lender may have its version of the form, so it is important to obtain the correct document directly from them. This ensures that the form meets all necessary legal requirements and reflects the specific terms of the mortgage extension agreement.

Quick guide on how to complete mortgage extension 497330071

Manage Mortgage Extension seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly replacement for conventional printed and signed documents, allowing you to access the right form and securely store it online. airSlate SignNow equips you with all necessary tools to create, modify, and eSign your documents swiftly without delays. Manage Mortgage Extension on any device using airSlate SignNow Android or iOS applications and streamline any document-related task today.

How to modify and eSign Mortgage Extension effortlessly

- Find Mortgage Extension and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your document, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, exhausting searches for forms, or mistakes that necessitate printing new copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Edit and eSign Mortgage Extension to ensure clear communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage extension and how can it benefit me?

A mortgage extension is an agreement that allows a borrower to extend the term of their existing mortgage loan. This can be beneficial as it may lower monthly payments, improve cash flow, and provide extra time to secure better financial options.

-

How does airSlate SignNow facilitate the mortgage extension process?

airSlate SignNow streamlines the mortgage extension process by enabling users to create, send, and eSign documents quickly. This ease of use reduces the time it takes to finalize a mortgage extension, allowing for a more efficient and hassle-free experience.

-

What are the costs associated with getting a mortgage extension?

Costs for a mortgage extension can vary depending on lender fees and any associated closing costs. Using airSlate SignNow, businesses can minimize administrative costs related to document handling, making the process more affordable.

-

Can I integrate airSlate SignNow with my current mortgage management system?

Yes, airSlate SignNow offers integrations with various mortgage management systems, enabling seamless document flow between platforms. This integration can signNowly enhance the efficiency of managing your mortgage extension documents.

-

Is eSigning my mortgage extension documents secure?

Absolutely! airSlate SignNow uses advanced encryption technologies to ensure that all eSigning processes, including mortgage extension agreements, are secure and compliant. Your documentation is protected against unauthorized access, assuring peace of mind.

-

How quickly can I complete a mortgage extension using airSlate SignNow?

With airSlate SignNow, the mortgage extension process can be completed in a matter of minutes. The platform's user-friendly interface and fast eSigning capabilities signNowly reduce the turnaround time compared to traditional methods.

-

What features make airSlate SignNow ideal for handling mortgage extension documents?

airSlate SignNow provides multiple features such as customizable templates, automated workflows, and centralized document storage, which are ideal for handling mortgage extension documents. These features streamline document preparation and enhance overall efficiency.

Get more for Mortgage Extension

- Building and safety divisionpermit application center form

- Form stabilized

- Admissions and financial aid state university of new york form

- Plumbing permit city form

- Career pathway renewal application form

- Societ per azioni capitale sociale 659 form

- Broward county human services family success details form

- Schedule e form char410

Find out other Mortgage Extension

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares

- How To eSign Hawaii Unlimited Power of Attorney

- How To eSign Louisiana Unlimited Power of Attorney

- eSign Oklahoma Unlimited Power of Attorney Now

- How To eSign Oregon Unlimited Power of Attorney

- eSign Hawaii Retainer for Attorney Easy

- How To eSign Texas Retainer for Attorney

- eSign Hawaii Standstill Agreement Computer

- How Can I eSign Texas Standstill Agreement

- How To eSign Hawaii Lease Renewal