Forgivable Loan Form

What is the forgivable loan form

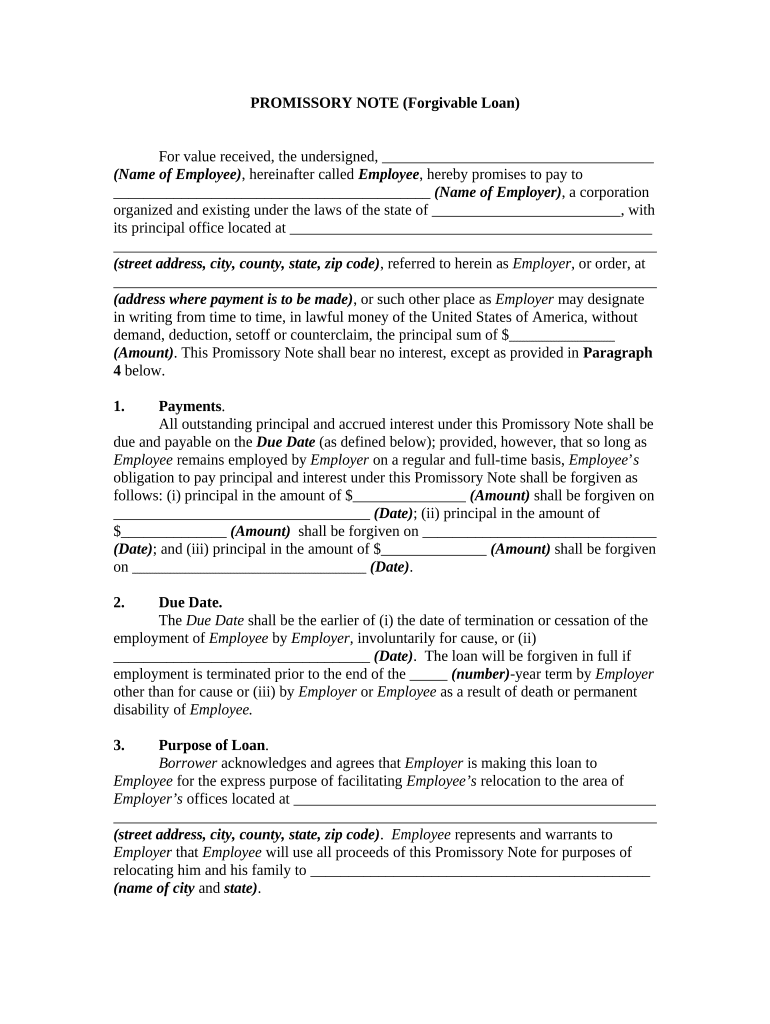

The forgivable loan form is a legal document that outlines the terms and conditions under which a loan may be forgiven. This type of loan is often used in various financial assistance programs, particularly those aimed at supporting small businesses or individuals in need. The agreement typically specifies the loan amount, the purpose of the loan, and the criteria that must be met for the loan to be forgiven. Understanding the details of this form is essential for both lenders and borrowers to ensure compliance and clarity regarding repayment obligations.

Steps to complete the forgivable loan form

Completing the forgivable loan form involves several key steps to ensure accuracy and compliance. Here’s a straightforward guide:

- Gather necessary information: Collect personal and financial details, including income statements and identification.

- Fill out the form: Carefully enter the required information, ensuring that all sections are completed accurately.

- Review the terms: Read through the terms and conditions to understand the obligations and criteria for forgiveness.

- Sign and date: Provide your signature and date the form to validate your agreement.

- Submit the form: Follow the submission guidelines, whether online or via mail, as specified by the lender.

Legal use of the forgivable loan form

The legal use of the forgivable loan form hinges on compliance with federal and state regulations. To be considered legally binding, the form must meet certain requirements, including proper signatures and adherence to the terms outlined within the document. It is important for both parties to understand their rights and responsibilities as defined in the agreement. Additionally, the forgivable loan must serve a legitimate purpose, such as supporting economic development or aiding in recovery from financial hardship.

Key elements of the forgivable loan form

Several key elements are essential in a forgivable loan form to ensure clarity and enforceability. These elements include:

- Loan amount: The total sum being borrowed.

- Interest rate: Any applicable interest rates, if the loan is not fully forgivable.

- Forgiveness criteria: Specific conditions that must be met for the loan to be forgiven, such as maintaining employment levels or using funds for designated purposes.

- Repayment terms: Details on how and when repayments will be made if forgiveness criteria are not met.

- Signatures: Signatures of both the borrower and lender to validate the agreement.

How to obtain the forgivable loan form

Obtaining the forgivable loan form can vary depending on the lender or the specific program offering the loan. Generally, forms can be accessed through the following methods:

- Online: Many lenders provide downloadable versions of the forgivable loan form on their websites.

- In-person: Borrowers can request the form directly from the lender's office or designated financial institution.

- Financial assistance programs: Some government or nonprofit organizations may offer the form as part of their loan application process.

Eligibility criteria

Eligibility criteria for a forgivable loan can differ based on the lender and the specific program. Common criteria may include:

- Business size: Many programs target small businesses, often defined by employee count or annual revenue.

- Use of funds: The loan must be used for specific purposes, such as payroll, rent, or other operational expenses.

- Financial need: Applicants may need to demonstrate financial hardship or a specific economic need to qualify.

- Compliance with terms: Borrowers must agree to meet the conditions outlined in the loan agreement to qualify for forgiveness.

Quick guide on how to complete forgivable loan form

Complete Forgivable Loan Form seamlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the necessary form and securely keep it online. airSlate SignNow provides all the resources you require to create, modify, and eSign your files swiftly without delays. Handle Forgivable Loan Form on any gadget with airSlate SignNow Android or iOS applications and enhance any document-focused operation today.

The simplest way to alter and eSign Forgivable Loan Form effortlessly

- Find Forgivable Loan Form and then click Get Form to initiate.

- Leverage the tools we offer to finalize your document.

- Highlight signNow sections of the documents or obscure sensitive information with instruments that airSlate SignNow provides specifically for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form hunting, or mistakes that necessitate reprinting new copies. airSlate SignNow fulfills all your requirements in document management in just a few clicks from your chosen device. Modify and eSign Forgivable Loan Form and guarantee excellent communication at any point in the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a forgivable loan template?

A forgivable loan template is a pre-designed document used to outline the terms and conditions of a loan that can be forgiven under specific circumstances. Using a forgivable loan template helps businesses simplify the process of creating these documents while ensuring compliance with legal standards.

-

How can I create a forgivable loan template with airSlate SignNow?

Creating a forgivable loan template with airSlate SignNow is straightforward. Simply choose a customizable template from our library, fill in the necessary details, and tailor it to your specific needs before sharing it for electronic signatures.

-

Are there any costs associated with using a forgivable loan template?

airSlate SignNow offers various pricing plans, which include access to our forgivable loan template and other features. Depending on the plan you choose, the pricing will vary, but we ensure a cost-effective solution for all your document management needs.

-

What are the benefits of using a forgivable loan template?

Using a forgivable loan template saves you time and reduces the risk of errors in loan documentation. It streamlines the loan issuance process, making it easier to track compliance and increases efficiency for businesses managing multiple loans.

-

Can I customize a forgivable loan template?

Yes, you can fully customize a forgivable loan template using airSlate SignNow. You can edit the text, add specific loan conditions, and even change the branding to reflect your company's identity, ensuring that the template meets your unique business requirements.

-

Does the forgivable loan template integrate with other software?

airSlate SignNow’s forgivable loan template seamlessly integrates with various third-party applications, including CRM systems and accounting software. This integration allows you to streamline data flow between platforms, enhancing your overall operational efficiency.

-

Is there support available for users of the forgivable loan template?

Absolutely! airSlate SignNow provides dedicated customer support to assist users with any inquiries related to the forgivable loan template. Whether you have questions about customization or technical issues, our support team is here to help you.

Get more for Forgivable Loan Form

Find out other Forgivable Loan Form

- How To Sign Oklahoma Notice of Rescission

- How To Sign Maine Share Donation Agreement

- Sign Maine Share Donation Agreement Simple

- Sign New Jersey Share Donation Agreement Simple

- How To Sign Arkansas Collateral Debenture

- Sign Arizona Bill of Lading Simple

- Sign Oklahoma Bill of Lading Easy

- Can I Sign Massachusetts Credit Memo

- How Can I Sign Nevada Agreement to Extend Debt Payment

- Sign South Dakota Consumer Credit Application Computer

- Sign Tennessee Agreement to Extend Debt Payment Free

- Sign Kentucky Outsourcing Services Contract Simple

- Sign Oklahoma Outsourcing Services Contract Fast

- How Can I Sign Rhode Island Outsourcing Services Contract

- Sign Vermont Outsourcing Services Contract Simple

- Sign Iowa Interview Non-Disclosure (NDA) Secure

- Sign Arkansas Resignation Letter Simple

- Sign California Resignation Letter Simple

- Sign Florida Leave of Absence Agreement Online

- Sign Florida Resignation Letter Easy