Synchrony Bank Direct Deposit Form

What is the Synchrony Bank Direct Deposit Form

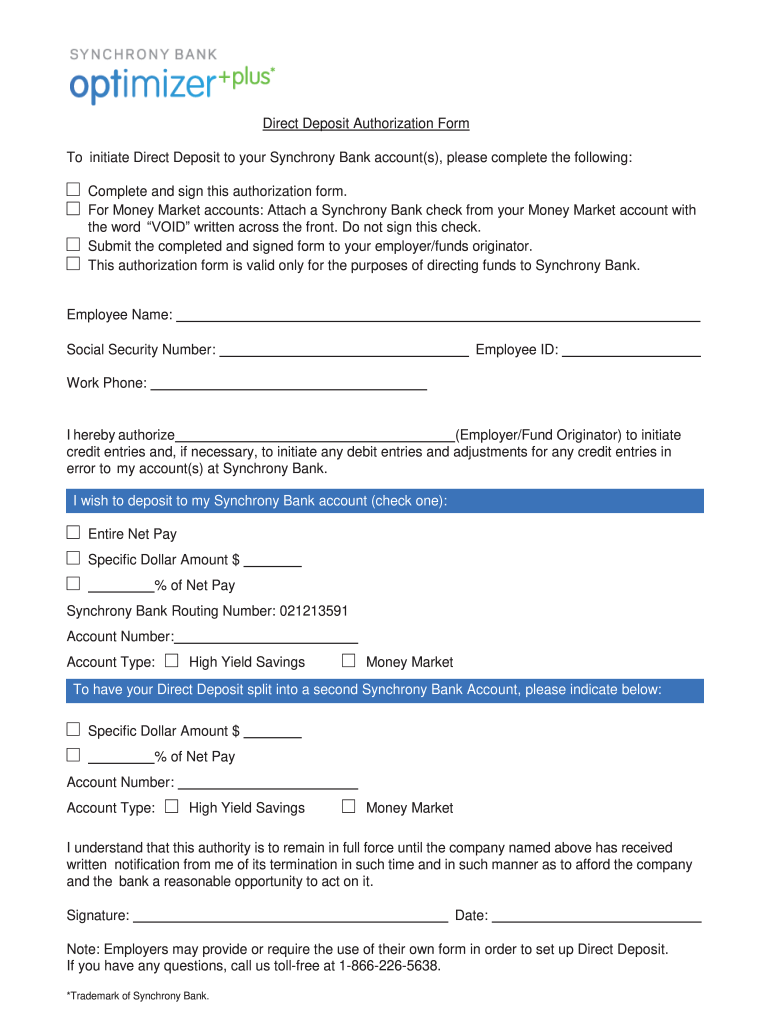

The Synchrony Bank Direct Deposit Form is a document that allows individuals to authorize the direct deposit of funds into their Synchrony Bank account. This form is essential for setting up automatic deposits from employers, government benefits, or other sources directly into a bank account. It typically requires the account holder's personal information, including their name, address, and Synchrony Bank account details, such as the routing number and account number. By using this form, customers can ensure timely and secure deposits without the need for physical checks.

How to use the Synchrony Bank Direct Deposit Form

To use the Synchrony Bank Direct Deposit Form, follow these steps:

- Obtain the form from Synchrony Bank's official website or request it from your employer.

- Fill in your personal information accurately, including your name, address, and Social Security number.

- Provide your Synchrony Bank account number and the corresponding routing number, which is 021213591.

- Sign and date the form to authorize the direct deposit.

- Submit the completed form to your employer or the entity responsible for making the deposits.

Steps to complete the Synchrony Bank Direct Deposit Form

Completing the Synchrony Bank Direct Deposit Form involves several straightforward steps:

- Download or request the form from Synchrony Bank.

- Enter your full name and contact information in the designated fields.

- Input your Synchrony Bank account number and the ABA routing number (021213591).

- Review the information for accuracy to avoid any delays in deposits.

- Sign the form to confirm your authorization for direct deposits.

- Return the form to your employer or the relevant institution.

Key elements of the Synchrony Bank Direct Deposit Form

The Synchrony Bank Direct Deposit Form includes several key elements that are crucial for processing your direct deposit requests:

- Account Holder Information: Your full name, address, and Social Security number.

- Bank Information: The name of the bank (Synchrony Bank), your account number, and the ABA routing number (021213591).

- Authorization Signature: Your signature and date to authorize the transaction.

- Deposit Amount: Some forms may allow you to specify the amount to be deposited, if applicable.

Legal use of the Synchrony Bank Direct Deposit Form

The legal use of the Synchrony Bank Direct Deposit Form requires that the account holder provides accurate and truthful information. By signing the form, the individual grants permission for their funds to be deposited directly into their bank account. This process is governed by various federal regulations, including the Electronic Funds Transfer Act, which ensures consumer protection in electronic transactions. It is important to keep a copy of the completed form for your records and to monitor your bank statements for accuracy following the setup of direct deposits.

Form Submission Methods

The completed Synchrony Bank Direct Deposit Form can be submitted through various methods, depending on the preferences of the employer or institution:

- Online Submission: Some employers may allow electronic submission through their payroll systems.

- Mail: You can send the completed form via postal mail to your employer's payroll department.

- In-Person: Delivering the form directly to your employer may be an option, especially for immediate processing.

Quick guide on how to complete direct deposit authorization form to initiate direct deposit to your

The simplest method to obtain and sign Synchrony Bank Direct Deposit Form

On a company-wide level, ineffective procedures related to paper approvals can take up a signNow amount of work time. Signing documents such as Synchrony Bank Direct Deposit Form is an integral part of operations across various sectors, which is why the effectiveness of each contract’s lifecycle has a substantial impact on the overall efficiency of the organization. With airSlate SignNow, signing your Synchrony Bank Direct Deposit Form is as seamless and swift as it can be. This platform provides you access to the latest version of nearly any form. Even better, you can sign it instantly without having to download external applications to your computer or printing out any hard copies.

Steps to obtain and sign your Synchrony Bank Direct Deposit Form

- Browse our collection by category or use the search bar to find the document you require.

- Check the document preview by clicking on Learn more to confirm it’s the correct one.

- Hit Get form to start editing immediately.

- Fill out your document and include any necessary details using the toolbar.

- Once completed, click the Sign tool to sign your Synchrony Bank Direct Deposit Form.

- Select the signature method that works best for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to complete your edits and move on to document-sharing options as required.

With airSlate SignNow, you have everything you need to manage your documents efficiently. You can locate, complete, modify, and even send your Synchrony Bank Direct Deposit Form in one tab without any hassle. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How does direct deposit work?

Your bank account is unique combination of numbers and your bank has a special code called the routing number. That is the primary information that is needed to initiate the direct deposit; the bank routing number and your bank account number.Usually you would have to fill out a paper form called direct deposit authorization form and that paper will have to have your name, your address, your telephone number, the name of your bank, your bank account number and your bank's routing number along with your signature. Then you would have to return that form to either the HR department or the payroll department for the company that you work for or to the government agency in the event that you are receiving government benefits through direct deposit.It takes about two weeks for direct deposit to be set up. After that, the funds of your paycheck would be deposited into your bank account directly on your payday and your money will be ready for use on that same day without you having the need to cash it deposit your paycheck.

-

Is it fishy if a company wants you to fill out the direct deposit form before you receive any paper work about being hired?

Hi, To give a little more context, if you are worried about completing a direct deposit form, which should be for receiving remuneration of your wages, then request a your employment contract and tell them you will complete the direct deposit form after the employment has been received. Always be open and honest with a potential em0ployer and set parameters for your employment relationship from the get go. you would like to follow procedures. Every Employer will respect you more for that. I do not think it is fishy but a little odd

-

How long does it take for a direct deposit to appear in your account?

Depends on the country and its banking standards. In Norway, where i live, a direct deposit made before the bank’s cut-off-time (usually around 14:00) will appear in the recipient account the same day. Otherwise the next.International transfers between countries that use SWaiFT/IBAN usually take ~2 days.International transfers to or from the US probably takes longer, but not terribly much. If i recall correctly, i’d guess 3–4 days. But it has been several years since i did that last.

-

How do I deposit a personal check written out to me to my online bank account without a direct deposit?

Dear M. Anonymous,Good question. It can be confusing when you are new to online banking (or to checking accounts in general), so I totally understand. For years, I used a local bank. I deposited checks by going to the physical bank. Once I was at the bank, I would give the check to the teller to deposit, or I would put the check (and deposit slip) in the slot outside. This was long before online banking had been invented.My local bank once made a serious mistake in my account, which I resolved after spending many hours at a bank executive’s desk. The executive could not figure out the problem, but I was able to see that it had been my bank’s error that had caused the discrepancy. This sour experience prompted me to look elsewhere for another bank. I decided to use a bank that is primarily online and that is connected with a world-class organization that also provides car and home insurance to U.S. military officers and their dependents. I had done my research long before I ever selected this organization for my banking and car and home insurance.I currently have a bank account at this organization’s excellent online bank based in San Antonio, Texas (I’m in the D.C. area), and the way I prefer to deposit checks to my bank is by regular mail.For a good long while, my bank had a contract with a UPS Store that could scan checks and deposit them electronically into someone’s bank account, but I always felt a little uneasy doing that, and only used this service a few times. It certainly did not feel too secure to have a non-bank-related person touch my checks. Eventually, my bank stopped offering that as an option. (I would love to know the back story of what prompted my bank to stop doing this.)There are at least six ways to deposit checks including using electronic means (see this WikiHow: How to Deposit Checks).PRO TIP: Of course, the best thing for you to do is to go on your bank’s website and find out their process. Their website might even have a generic deposit ticket you can print out if you want to mail it in.Below are the steps I take to deposit checks by mail to my online bank.Endorse the check (that is, write your signature on the back). Under your signature, write “Deposit to” and then write your bank account number. NOTE: Make sure the check is valid.Fill out a deposit ticket (these are included with your checkbook). If you don’t have paper checks or deposit slips, contact your bank to find out how to get one.Put both the endorsed check and deposit ticket in an envelope addressed to the bank. Seal the envelope. My bank provides me with preaddressed envelopes that do not need postage.MAIL the envelope.Wait a few days, and you should see that deposit showing up in your account online.—Sarah M. 9/12/2018ORIGINAL QUESTION: How do I deposit a personal check written out to me to my online bank account without a direct deposit?

-

What time does ADP direct deposit pay checks? How soon after is the money available?

Your company will have their payrolls processed by ADP, ADP in turn will pass the payment to the Banks or CU prior to DUE DATE due date is the day your company has chosen to pay you , usually Thursdays or Fridays. Once the bank or CU have the funds they will post it to your accounts. Most banks it is at the end of night processing and the funds should be available morning of due date. If your paydate is a monday the banks would pre-post your depost friday night as their banking systems run Monday night to Friday Night and have no choice but to provided funds early. Credit unions will post the deposit on the due date as their banking systems run 7/24 and have no need to pre-post.

-

401(k): Is it possible to direct deposit money into your 401k instead of through holding off paycheck?

401k contributions are done through payroll contribution as a deduction."... there's no difference for me between contributing monthly vs. through direct deposit."There is a difference... pretax and posttax dollars and tax consequences.401k contributions... pretax.Direct deposit contributions.. via IRA/Roth IRA... posttax.

-

What time do direct deposits hit my Chase account?

A deposit before 11:00 PM ET is processed on the same business day.Deposits made after 11:00 PM ET are viewable (pending) in your account immediately, but will not be processed until the next business day.Chase posts your transactions to your account at the end of each day beginning with deposits and ends with withdrawals. This avoids overdraft fees as long as at the end of the day you’ve deposited enough to cover your withdrawals before the end of the day, in this case 11:00 PM ET.Bank Time Accounts UpdateChase Between 3 a.m. and 5 a.m.Citigroup, Inc. Between 2 a.m. and 4 a.m.Wells Fargo Between midnight and 3 a.m.Bank of America Between 4 a.m. and 6 a.m.

Create this form in 5 minutes!

How to create an eSignature for the direct deposit authorization form to initiate direct deposit to your

How to make an electronic signature for your Direct Deposit Authorization Form To Initiate Direct Deposit To Your in the online mode

How to generate an eSignature for the Direct Deposit Authorization Form To Initiate Direct Deposit To Your in Google Chrome

How to create an electronic signature for signing the Direct Deposit Authorization Form To Initiate Direct Deposit To Your in Gmail

How to make an electronic signature for the Direct Deposit Authorization Form To Initiate Direct Deposit To Your straight from your mobile device

How to make an eSignature for the Direct Deposit Authorization Form To Initiate Direct Deposit To Your on iOS

How to generate an electronic signature for the Direct Deposit Authorization Form To Initiate Direct Deposit To Your on Android devices

People also ask

-

What are Synchrony Bank forms and how do they work?

Synchrony Bank forms are digital documents that facilitate financial transactions and agreements with Synchrony Bank. These forms are designed to be filled out electronically and can be sent securely for signatures, making the entire process efficient and hassle-free.

-

How can airSlate SignNow help with filling out Synchrony Bank forms?

airSlate SignNow simplifies the process of completing Synchrony Bank forms by allowing users to fill out and eSign documents seamlessly online. Its user-friendly interface ensures that anyone can navigate through the forms quickly and submit them without any delays.

-

What are the pricing options for using airSlate SignNow for Synchrony Bank forms?

airSlate SignNow offers various pricing plans tailored to suit different business needs. By choosing a plan, users can access unlimited eSigning capabilities for documents, including Synchrony Bank forms, which enhances productivity without straining budgets.

-

Are there any integration features for Synchrony Bank forms?

Yes, airSlate SignNow integrates seamlessly with various third-party applications, making it easy to manage Synchrony Bank forms alongside other business processes. These integrations streamline workflows and enhance collaboration across teams.

-

What are the benefits of using airSlate SignNow for Synchrony Bank forms?

Using airSlate SignNow for Synchrony Bank forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security for sensitive information. This electronic solution ensures faster turnaround times and a more organized document management system.

-

Can I track the status of my Synchrony Bank forms once they're sent?

Absolutely! With airSlate SignNow, users can easily track the status of their Synchrony Bank forms through the platform. This feature allows you to see when documents are viewed, signed, and completed, ensuring you stay informed throughout the process.

-

Is it secure to use airSlate SignNow for Synchrony Bank forms?

Yes, airSlate SignNow prioritizes security and compliance, offering robust encryption and secure servers for handling Synchrony Bank forms. Your sensitive data is protected, ensuring peace of mind when sending and signing documents online.

Get more for Synchrony Bank Direct Deposit Form

- Amendment to lease or rental agreement louisiana form

- Warning notice due to complaint from neighbors louisiana form

- Lease subordination agreement louisiana form

- Apartment rules and regulations louisiana form

- Agreed cancellation of lease louisiana form

- Amendment of residential lease louisiana form

- Agreement for payment of unpaid rent louisiana form

- Commercial lease assignment from tenant to new tenant louisiana form

Find out other Synchrony Bank Direct Deposit Form

- eSignature California Life Sciences Contract Safe

- eSignature California Non-Profit LLC Operating Agreement Fast

- eSignature Delaware Life Sciences Quitclaim Deed Online

- eSignature Non-Profit Form Colorado Free

- eSignature Mississippi Lawers Residential Lease Agreement Later

- How To eSignature Mississippi Lawers Residential Lease Agreement

- Can I eSignature Indiana Life Sciences Rental Application

- eSignature Indiana Life Sciences LLC Operating Agreement Fast

- eSignature Kentucky Life Sciences Quitclaim Deed Fast

- Help Me With eSignature Georgia Non-Profit NDA

- How Can I eSignature Idaho Non-Profit Business Plan Template

- eSignature Mississippi Life Sciences Lease Agreement Myself

- How Can I eSignature Mississippi Life Sciences Last Will And Testament

- How To eSignature Illinois Non-Profit Contract

- eSignature Louisiana Non-Profit Business Plan Template Now

- How Do I eSignature North Dakota Life Sciences Operating Agreement

- eSignature Oregon Life Sciences Job Offer Myself

- eSignature Oregon Life Sciences Job Offer Fast

- eSignature Oregon Life Sciences Warranty Deed Myself

- eSignature Maryland Non-Profit Cease And Desist Letter Fast