Patelco Credit Union Dispute Dept Ph Number 2012-2026

Steps to complete the Patelco direct deposit form

Completing the Patelco direct deposit form is a straightforward process that requires careful attention to detail. Follow these steps to ensure accuracy:

- Begin by downloading the Patelco direct deposit form from the official Patelco website or accessing it through your online banking account.

- Fill in your personal information, including your name, address, and account number. Ensure that all details are accurate to avoid delays.

- Provide your employer’s information, including their name and address, as well as your employee identification number if applicable.

- Indicate the type of deposit you wish to set up, whether it is for your paycheck, government benefits, or other income sources.

- Sign and date the form to authorize Patelco to initiate direct deposits into your account.

- Submit the completed form to your employer or the agency responsible for processing your payments. Keep a copy for your records.

Required Documents for the Patelco direct deposit form

To successfully complete the Patelco direct deposit form, you may need to provide certain documents. These typically include:

- A valid government-issued identification, such as a driver's license or passport.

- Your Patelco account number and routing number, which can be found on your checks or through your online banking portal.

- Proof of income or employment, such as a recent pay stub or benefits statement, if required by your employer.

Form Submission Methods

Once you have completed the Patelco direct deposit form, you can submit it through various methods. The common submission methods include:

- Online: If your employer offers online payroll services, you may be able to submit the form electronically through their portal.

- Mail: Print the completed form and mail it to your employer’s payroll department.

- In-Person: Deliver the form directly to your employer’s HR or payroll office for immediate processing.

Legal use of the Patelco direct deposit form

The Patelco direct deposit form is a legally binding document that authorizes your employer or payment provider to deposit funds directly into your bank account. It is important to ensure that:

- The form is filled out accurately to prevent any unauthorized transactions.

- You retain a copy of the signed form for your records, as it serves as proof of your authorization.

- You are aware of your rights regarding direct deposits, including the ability to revoke authorization if necessary.

Penalties for Non-Compliance

Failure to comply with the requirements of the Patelco direct deposit form can lead to several consequences, including:

- Delays in receiving payments, which may affect your financial stability.

- Potential fees from your employer for incorrect or incomplete submissions.

- Legal repercussions if the form is misused or if unauthorized transactions occur.

Eligibility Criteria

To be eligible for setting up direct deposit with Patelco, you typically need to meet the following criteria:

- Be a member of Patelco Credit Union with an active account.

- Have a reliable source of income that can be deposited directly into your account.

- Provide accurate and complete information on the direct deposit form.

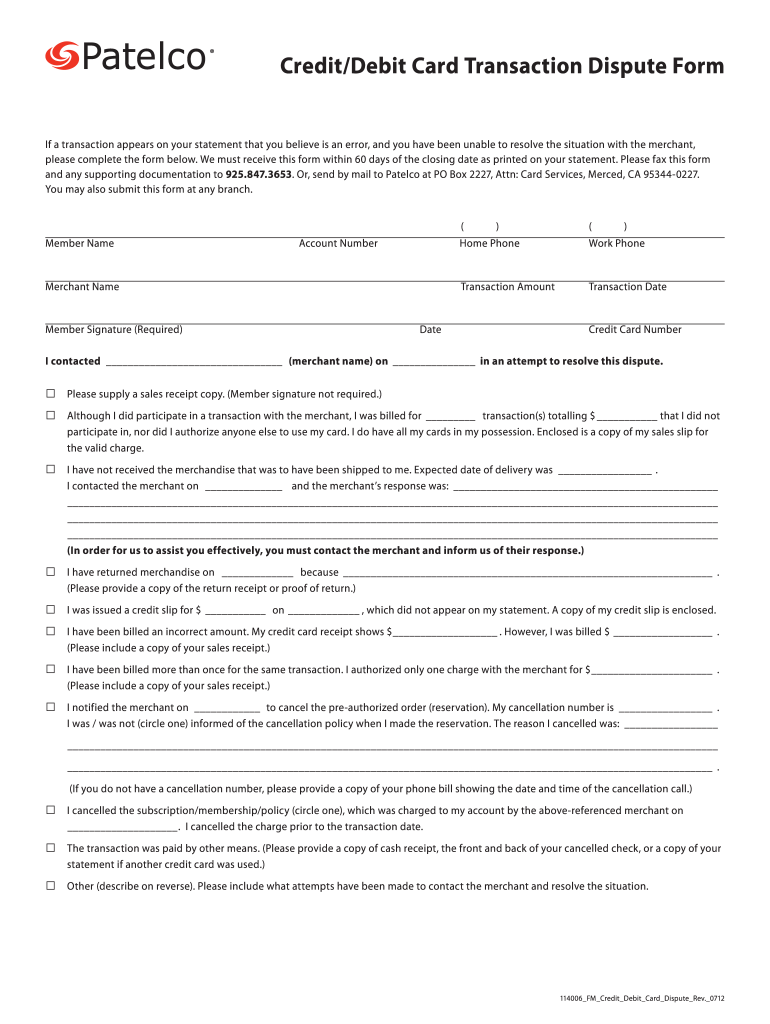

Quick guide on how to complete creditdebit card transaction dispute form patelco credit union patelco

The simplest method to locate and sign Patelco Credit Union Dispute Dept Ph Number

Across the broad scope of your enterprise, ineffective procedures concerning paper approvals can take up a signNow amount of work hours. Signing documents such as Patelco Credit Union Dispute Dept Ph Number is a standard component of operations in any organization, which is why the effectiveness of each agreement’s lifecycle plays a crucial role in the overarching performance of the business. With airSlate SignNow, signing your Patelco Credit Union Dispute Dept Ph Number can be as straightforward and quick as possible. This platform provides you with the most recent version of nearly any form. Even better, you can sign it right away without needing to install external applications on your computer or printing physical copies.

Steps to acquire and sign your Patelco Credit Union Dispute Dept Ph Number

- Explore our library by category or utilize the search box to locate the document you require.

- View the form preview by clicking Learn more to confirm it’s the correct one.

- Press Get form to begin editing immediately.

- Fill out your form and add any necessary information using the toolbar.

- Once finished, click the Sign tool to sign your Patelco Credit Union Dispute Dept Ph Number.

- Select the signature option that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to complete editing and proceed to document-sharing options as required.

With airSlate SignNow, you possess everything you need to handle your documents efficiently. You can find, complete, edit, and even send your Patelco Credit Union Dispute Dept Ph Number in one tab without any difficulty. Enhance your processes with a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How much does it cost to push money to a customer's credit/debit card as the primary transaction?

Unfortunately, there's no quick/easy answer to this.Offermatic and companies like it most likely use statement credits. These are done through issuing banks. I'm not entirely sure what the pricing for this is. There's another mechanism by which money can be sent to a credit or debit card directly (funds can be made available anywhere btw. a few minutes to a few days, depending on the financial institutions involved). In the case of Visa cards (which is all I can really speak to at the moment), this kind of functionality is called an Original Credit Transaction (OCT). It is only offered through partnered financial institutions. In other words, you can't just start pushing money to cards magically, because it requires the participation of the issuing bank at a minimum (i.e. whoever issued the card has to put the money into said card's account). You'd most likely get this kind of service through your acquiring bank, who might provide it as part of a bundle of services.Visa doesn't quote pricing directly to merchants or consumers, because this kind of functionality would likely be included as part of a suite of services from an acquirer. It is up to that acquirer (or other financial institution) to price its products and product bundles.

-

Why do certain US banks/credit unions require 10/12 debit card transactions per month to give higher interest rates?

There are probably several different things that would motivate a bank or credit union to reward a customer with a higher interest rate in return for that customer using their debit card a relatively high number of time per month. I've offered four below that are probably among (or perhaps the) most popular and logical.1) Interchange. Each time a purchase is made using a debit card, the merchant is charged a set of fees. About 85% of those fees is paid to the card issuer as an "interchange reimbursement fee", which is determined by the card network (i.e. Visa, MasterCard, Discover). Thanks to the Dodd-Frank Wall Street Reform Act of 2010 and a small but important piece of that legislation known as the "Durbin Amendment", the interchange fee was capped at $.21 plus 0.05% (of the purchase amount). For smaller banks and credit unions (specifically, those with less than $10B in assets), the fees can be higher - generally around $.10 plus 1.2%. For a $50 purchase, that's $.46 for a large bank and $.70 for a smaller bank or credit union. In short, more transactions = more fee income. Keep in mind also that because your transactions are generating fee income, the net cost to the bank is less than if you put the money into a certificate of deposit or savings account at an equal interest rate. Please note that fees for cash withdrawals at ATMs go the other direction so you won't see many banks encouraging or rewarding that behavior.2) Deposits. More transactions probably means more deposits to fund those transactions. Thanks to a few different factors, most banks have plenty of deposits these days but that can change in a hurry when the stock and bond markets are performing well. Since deposits equate to capital and the more capital a bank (or credit union) has, the more it can give out in loans, financial institutions generally want more deposits.3) Top of wallet and stickiness. These may be closely related to 1) Interchange above but, because the end result is a bit different, I'm offering the pair as a separate reason for the issuer. Put simply, if you are signNowing for your debit card 10-12 times a month, its probably a relatively safe bet that you consider it your "go-to" card and will use it before considering any other card in your wallet or purse. If the issuer has done its job properly, that also means that you are building a strong affiliation with your issuer's brand, will be less likely to jump ship over some minor customer service error and are probably a good candidate for other bank products and services - like a new car loan.4) Reduced check processing costs. Handling paper and even paperless "imaged" checks can be costly for any financial institution. While the overall volume of checks has been steadily decreasing over the past decade anyway, I'm guessing that there are still a few smaller banks and credit unions that would like to see further reductions of checks, especially if those reductions are coupled with fee-generating electronic transactions. I'm NOT suggesting this is a major consideration but there's probably enough substance here to warrant at least a mention in the business case justification.

-

How does Square customize the transaction details that appear on credit/debit card statements to include details from individual merchants?

Some credit card processors support a field called a 'descriptor' which essentially lets the merchant/POS pass along details about the transaction to the consumer's statement. This is often used for B2B transactions for corporate cards and obviously companies like Square and LevelUp that aggregate transactions have found it to be useful as well to minimize disputes and make it easier for consumers to know what the charge is for.

-

How safe are the four-digit PINs used to secure debit and credit card transactions?

Four-digit PINs may be the norm today, but sadly, they can be misused when in the wrong hands. While cracking the PIN itself may be a rather difficult task, the sad part is that people tend to use the same PIN across cards.The same PIN is also in plain sight when you’re at a restaurant and keying in the PIN number. Let’s say you forget to take your card back from the restaurant, what’s stopping the waiter from misusing your card if he managed to note down your PIN?What’s stopping the people around you from misusing your card when you’re not noticing if they know what your PIN is?One way you can beat this system is by changing you PIN regularly, but that is hardly an easy process as you’d either need to find an ATM or get in touch with your bank, if they allow it.This is why I like to make payments with the Zeta Super Card, which allows me to change my PIN on the fly straight from the Zeta app.

-

My debit card is not linking to my PayPal account. When I click on link debit/credit card, it only shows a form for credit card. How do I add my debit card?

you can use your debit card to link in place of credit card.Requirements of India Debit Card to Accept PayPalMake sure all your details are entered correctly.which include debit card number, expiry date, CVV, address. Otherwise, your card gets declined.Only Visa or Master Card (visa recommended)Maintain sufficient balance.if your card is declined, then probably you have insufficient balance. Maintain at least 5$ in your account. Also, you should maintain your bank account’s minimum balance, otherwise the card doesn’t work.Must be International EMV chip card.An older international debit card may not an EMV chip card. But now all bank issue international EMV chip card as per RBI regulations.Activate International UsageMost of the banks come with activated international usage, but some banks require activation of international usage through SMS, phone call, or contacting them through the branch (e.g. SBI).Its just a piece of my blog I write brief about the paypal card decline problem & there solution in my blog. check the linkIndia Debit Card that work with PayPal 2017 | PayPal Card declined problem (SOLVED)

-

How much does it cost large retail companies to process debit/credit cards in the U.K. per transaction?

This varies dramatically between the agreements set up by the retailer and the card processor. Since the advent of EFTPOS and PDQ telephone line links, and of course now the internet, the price has fallen.Prior to EFTPOS and PDQ, the whole operation was with a voucher in duplicate, singed through a carbon paper; the top part going to the cardholder, the lower part being put through the till as a sales voucher, much in the same way as a cheque would be accepted. There was a floor limit set by all the card issuers at the time, about £50 per transaction which had to be cleared manually by a telephone call to the issuer.We used to get warning messages come over the computer to warn branches of missing or stolen cards which as a cashier or clearing clerk you would check and if required retain to be sent back to the issuer for destruction. The Police were given a copy of the form and a description of the person presenting would be taken down as best as possible so the information passed around the banks. The retailers had another system.In fact there were a great number of shop floor staff in particular who made a living out of this, since one of their “tricks” was to take the card and signature slip, and then tell the purchaser that the floor limit had been dropped and it needed telephone clearance. This of course was a lie, but actually beneficial to the card company, shop, and in particular the person who captured the card.The person who took the card would then come back to the till about 5 minuets later, having disappeared behind a door or in to a warehouse part of the store. Then re-appear. If the customer had fled, then the chances were that they were a fraudster (and often were). The advantage to the shop assistant was that she/he got a reward for capturing the card from the Credit Card issuer. At that time there were only four: Access, AMEX, Barclay Card and Carte Blanc.This reward was £50 per card. At that time the wages for a shop floor assistant was about £100 per week. So they only had to capture two cards in the same week, and they had doubled their salary !In the late 1980s early 1990s EFTPOS and PDQ were communing on line more rapidly although with the sheer voloume of work these were only issued to large operators like large department stores and Supermarkets. As the telephone capacities increased smaller operations were allowed to use this on-line system, and of course now anybody who allows the use of any on-line clearing from debit to credit card, has this facility.This has really been possible by Broadband Internet since it can carry the data and the advantage of course that EVERY transaction is analysed and cleared. If required the card “captured”. To that end there is no reward for the cashier assistant as the computer captured it; in some ways sad, since as I say a number of staff made a lot of money out of their trick, so lost that income (tax-free too !) but as a by-product did actually stop a lot of fraud.As I say the new PDQ and EFTPOS Systems have now taken that way but equally they have increased security since now every transaction is picked up cleared and a withhold message comes up on the screen.

-

How long does it take for WePay to pay out on credit card and bank transactions?

It typically takes 1-5 business days for money to signNow your bank account. Visit the link below for more info:When will I get my money?

Create this form in 5 minutes!

How to create an eSignature for the creditdebit card transaction dispute form patelco credit union patelco

How to make an eSignature for the Creditdebit Card Transaction Dispute Form Patelco Credit Union Patelco in the online mode

How to make an electronic signature for the Creditdebit Card Transaction Dispute Form Patelco Credit Union Patelco in Google Chrome

How to make an eSignature for signing the Creditdebit Card Transaction Dispute Form Patelco Credit Union Patelco in Gmail

How to generate an eSignature for the Creditdebit Card Transaction Dispute Form Patelco Credit Union Patelco straight from your mobile device

How to make an electronic signature for the Creditdebit Card Transaction Dispute Form Patelco Credit Union Patelco on iOS devices

How to generate an eSignature for the Creditdebit Card Transaction Dispute Form Patelco Credit Union Patelco on Android devices

People also ask

-

What is the patelco direct deposit form?

The patelco direct deposit form is a document that allows you to set up automatic deposit of your paycheck or benefit payments directly into your Patelco account. This form facilitates the secure and timely transfer of funds, ensuring you always have access to your money without delay.

-

How can I complete my patelco direct deposit form using airSlate SignNow?

You can easily complete your patelco direct deposit form using airSlate SignNow by uploading the document to our platform. Use our intuitive eSigning tools to fill in the required information, sign it electronically, and securely send it to your employer or benefitting organization.

-

Are there any costs associated with using the patelco direct deposit form on airSlate SignNow?

Using the patelco direct deposit form on airSlate SignNow is part of our affordable eSigning service. We offer a range of pricing plans that accommodate various needs, ensuring you can manage your documents without breaking the bank.

-

What are the advantages of using airSlate SignNow for my patelco direct deposit form?

By using airSlate SignNow for your patelco direct deposit form, you gain the benefits of quick and efficient document handling. Our platform enhances security, allows for easy tracking, and streamlines the entire process, giving you peace of mind as you manage your financial documents.

-

Can I integrate airSlate SignNow with my payroll system for the patelco direct deposit form?

Yes, airSlate SignNow offers integrations with various payroll systems, making it easier to handle your patelco direct deposit form. This integration allows for seamless data transfer, ensuring that your financial information remains accurate and up to date with each payroll period.

-

Is the patelco direct deposit form secure when using airSlate SignNow?

Absolutely! The patelco direct deposit form is processed securely on airSlate SignNow using top-notch encryption and compliance standards. Your data's safety is our priority, giving you confidence in submitting sensitive financial information electronically.

-

How long does it take to process the patelco direct deposit form once submitted?

The processing time for your patelco direct deposit form can vary depending on your employer or the financial institution. Typically, once you submit your form, it can take a few business days for the information to be processed and for direct deposits to begin.

Get more for Patelco Credit Union Dispute Dept Ph Number

- Name change notification form louisiana

- Commercial building or space lease louisiana form

- Louisiana relative caretaker legal documents package louisiana form

- Louisiana standby temporary guardian legal documents package louisiana form

- Louisiana bankruptcy forms

- Louisiana chapter 13 form

- Louisiana western district bankruptcy guide and forms package for chapters 7 or 13 louisiana

- Bill of sale with warranty by individual seller louisiana form

Find out other Patelco Credit Union Dispute Dept Ph Number

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later

- How To Electronic signature Oklahoma Finance & Tax Accounting Operating Agreement

- Electronic signature Arizona Healthcare / Medical NDA Mobile

- How To Electronic signature Arizona Healthcare / Medical Warranty Deed

- Electronic signature Oregon Finance & Tax Accounting Lease Agreement Online

- Electronic signature Delaware Healthcare / Medical Limited Power Of Attorney Free

- Electronic signature Finance & Tax Accounting Word South Carolina Later

- How Do I Electronic signature Illinois Healthcare / Medical Purchase Order Template

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Online

- Electronic signature Louisiana Healthcare / Medical Quitclaim Deed Computer

- How Do I Electronic signature Louisiana Healthcare / Medical Limited Power Of Attorney

- Electronic signature Maine Healthcare / Medical Letter Of Intent Fast

- How To Electronic signature Mississippi Healthcare / Medical Month To Month Lease