Mortgage Loan Commitment for Home Equity Line of Credit Form

What is the Mortgage Loan Commitment For Home Equity Line Of Credit

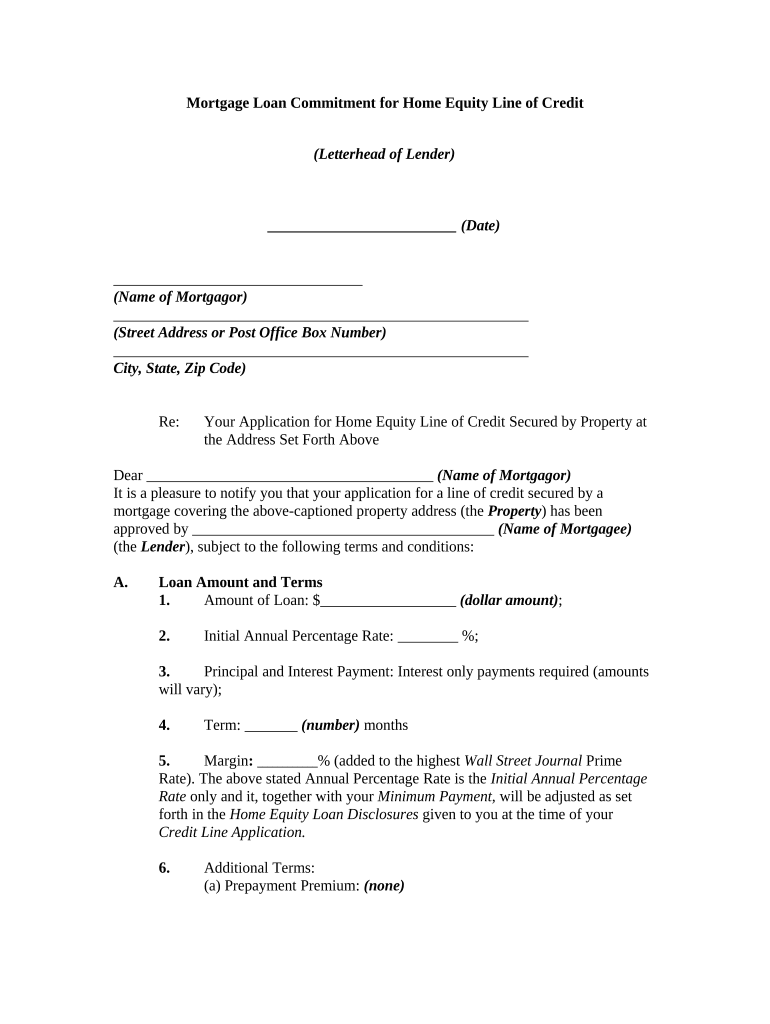

The Mortgage Loan Commitment for Home Equity Line of Credit (HELOC) is a formal agreement from a lender that outlines the terms and conditions under which a borrower can access funds based on their home equity. This commitment serves as a promise from the lender to provide a specified amount of credit, which the borrower can draw upon as needed. The commitment typically includes details such as the interest rate, repayment terms, and any fees associated with the line of credit.

How to Obtain the Mortgage Loan Commitment For Home Equity Line Of Credit

To obtain a Mortgage Loan Commitment for a HELOC, borrowers must first apply with a lender. This process generally involves the following steps:

- Gather necessary documentation, including income verification, credit history, and property details.

- Submit the application along with the required documents to the lender.

- Undergo a credit evaluation and property appraisal conducted by the lender.

- Receive the loan commitment once the lender approves the application.

It is essential to compare offers from different lenders to find the most favorable terms.

Steps to Complete the Mortgage Loan Commitment For Home Equity Line Of Credit

Completing the Mortgage Loan Commitment for a HELOC involves several key steps:

- Review the loan commitment document carefully to understand the terms.

- Ensure all personal and property information is accurate.

- Sign the document electronically or in person, depending on the lender's requirements.

- Return the signed commitment to the lender to finalize the agreement.

Following these steps helps ensure a smooth process for accessing home equity funds.

Key Elements of the Mortgage Loan Commitment For Home Equity Line Of Credit

Several key elements are crucial in a Mortgage Loan Commitment for a HELOC:

- Credit Limit: The maximum amount the borrower can access.

- Interest Rate: The rate applied to the borrowed amount, which may be fixed or variable.

- Repayment Terms: Details on how and when the borrower must repay the borrowed funds.

- Fees: Any associated costs, such as application fees or closing costs.

Understanding these elements is vital for borrowers to manage their home equity responsibly.

Legal Use of the Mortgage Loan Commitment For Home Equity Line Of Credit

The legal use of the Mortgage Loan Commitment for a HELOC is governed by various regulations, including federal and state laws. It is important for borrowers to ensure that the commitment complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act and the Uniform Electronic Transactions Act (UETA). These laws validate electronic signatures and ensure that eDocuments hold the same legal weight as traditional paper documents.

Required Documents for the Mortgage Loan Commitment For Home Equity Line Of Credit

When applying for a Mortgage Loan Commitment for a HELOC, borrowers typically need to provide several documents:

- Proof of income, such as pay stubs or tax returns.

- Details about existing debts and financial obligations.

- Information about the property, including its value and current mortgage balance.

- Credit history or authorization for the lender to obtain a credit report.

Having these documents ready can expedite the application process and improve the chances of approval.

Quick guide on how to complete mortgage loan commitment for home equity line of credit

Effortlessly Prepare Mortgage Loan Commitment For Home Equity Line Of Credit on Any Device

Digital document management has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without interruption. Manage Mortgage Loan Commitment For Home Equity Line Of Credit on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to Modify and Electronically Sign Mortgage Loan Commitment For Home Equity Line Of Credit with Ease

- Obtain Mortgage Loan Commitment For Home Equity Line Of Credit and click Get Form to begin.

- Utilize the provided tools to complete your document.

- Emphasize important sections of the documents or conceal sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all information and click the Done button to save your modifications.

- Choose how you would like to send your form, via email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Mortgage Loan Commitment For Home Equity Line Of Credit and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Mortgage Loan Commitment For Home Equity Line Of Credit?

A Mortgage Loan Commitment For Home Equity Line Of Credit is a formal document issued by a lender to a borrower, stating that they are approved for a certain amount of credit secured against their home. This commitment ensures that funds will be available when needed, making it easier to access home equity for various financial needs.

-

How does airSlate SignNow assist with signing a Mortgage Loan Commitment For Home Equity Line Of Credit?

With airSlate SignNow, you can easily eSign your Mortgage Loan Commitment For Home Equity Line Of Credit from anywhere, at any time. Our platform provides a simple interface for signing and sharing documents securely, streamlining the process and saving you valuable time.

-

What are the costs associated with a Mortgage Loan Commitment For Home Equity Line Of Credit?

The costs for a Mortgage Loan Commitment For Home Equity Line Of Credit may vary based on lender fees, interest rates, and closing costs. Using airSlate SignNow can help reduce additional expenses by eliminating the need for physical paperwork and in-person signings, making it a cost-effective solution.

-

What features does airSlate SignNow offer for managing Home Equity Line Of Credit documents?

airSlate SignNow offers features like customizable templates, document tracking, and cloud storage to manage your Home Equity Line Of Credit paperwork efficiently. These features enhance your organization and enable easy access to your Mortgage Loan Commitment at all times.

-

What are the benefits of using airSlate SignNow for a Mortgage Loan Commitment For Home Equity Line Of Credit?

Using airSlate SignNow for your Mortgage Loan Commitment For Home Equity Line Of Credit provides convenience, efficiency, and enhanced security. Our platform helps you complete transactions faster and with less hassle, which is critical in managing your home equity needs.

-

Can I integrate airSlate SignNow with other financial tools for handling my Mortgage Loan Commitment For Home Equity Line Of Credit?

Yes, airSlate SignNow can be integrated with various financial and accounting tools, enhancing your ability to manage your Mortgage Loan Commitment For Home Equity Line Of Credit alongside other financial documents. This integration allows for seamless workflow and improved productivity.

-

Is it safe to eSign my Mortgage Loan Commitment For Home Equity Line Of Credit with airSlate SignNow?

Absolutely! airSlate SignNow employs industry-leading security measures, including encryption and secure cloud storage, ensuring your Mortgage Loan Commitment For Home Equity Line Of Credit is protected. You can trust that your sensitive information is safe and confidential.

Get more for Mortgage Loan Commitment For Home Equity Line Of Credit

- Schwans pay card form

- Business credit account application amp agreement cover page form

- Farmers bank amp trust business credit card application form

- Smart custodial form

- Personal use program form rgf environmental group

- Independent contractor application form bnelrodb

- Fairvue plantation architectural review board arb plan submittal form

- New eligibility form kvs ro hyderabad

Find out other Mortgage Loan Commitment For Home Equity Line Of Credit

- How To eSign New York Legal Form

- How Can I eSign North Carolina Non-Profit Document

- How To eSign Vermont Non-Profit Presentation

- How Do I eSign Hawaii Orthodontists PDF

- How Can I eSign Colorado Plumbing PDF

- Can I eSign Hawaii Plumbing PDF

- How Do I eSign Hawaii Plumbing Form

- Can I eSign Hawaii Plumbing Form

- How To eSign Hawaii Plumbing Word

- Help Me With eSign Hawaii Plumbing Document

- How To eSign Hawaii Plumbing Presentation

- How To eSign Maryland Plumbing Document

- How Do I eSign Mississippi Plumbing Word

- Can I eSign New Jersey Plumbing Form

- How Can I eSign Wisconsin Plumbing PPT

- Can I eSign Colorado Real Estate Form

- How To eSign Florida Real Estate Form

- Can I eSign Hawaii Real Estate Word

- How Do I eSign Hawaii Real Estate Word

- How To eSign Hawaii Real Estate Document