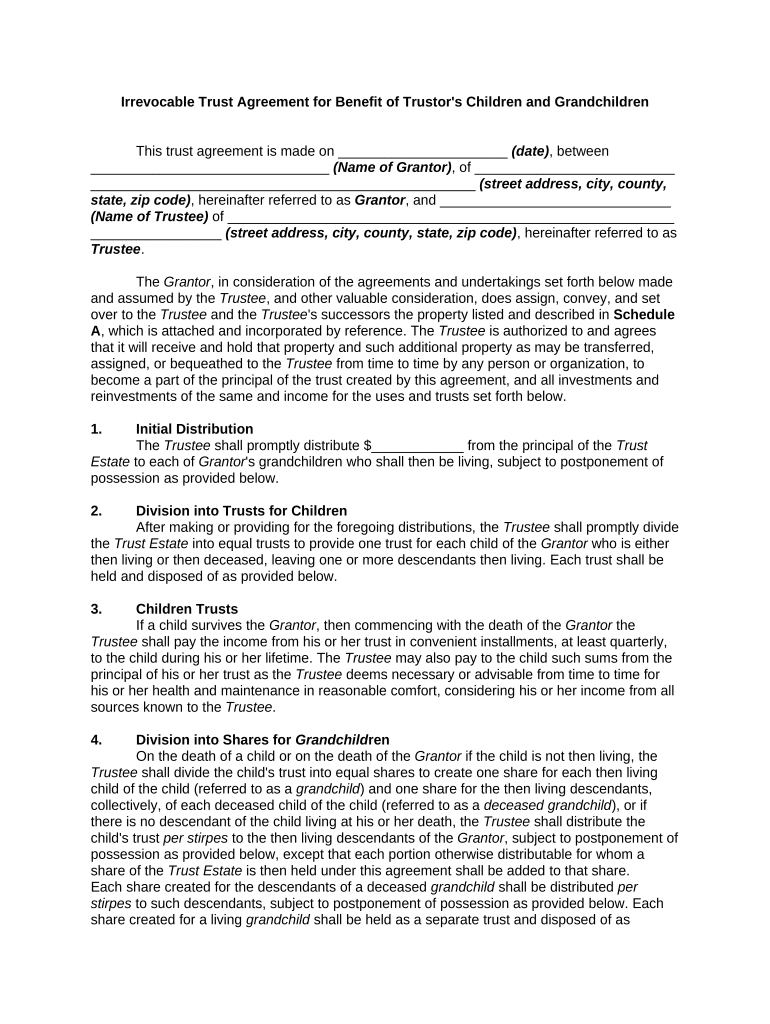

Irrevocable Benefit Form

Understanding the Irrevocable Benefit

The irrevocable benefit is a critical component in estate planning, particularly when it comes to safeguarding assets for future generations. This benefit ensures that certain assets, once designated, cannot be altered or revoked by the grantor. It is often utilized in trusts or insurance policies, providing financial security to grandchildren or other beneficiaries. Understanding the legal implications and the structure of this benefit is essential for anyone looking to secure their family’s financial future.

Steps to Complete the Irrevocable Benefit

Completing the irrevocable benefit form involves several key steps to ensure that it is filled out correctly and meets all legal requirements. Here’s a structured approach to guide you:

- Gather necessary information about the beneficiaries, including names, addresses, and Social Security numbers.

- Review the specific requirements for the irrevocable benefit in your state, as these can vary significantly.

- Fill out the form accurately, ensuring that all sections are completed without omissions.

- Obtain the required signatures from all parties involved, including witnesses if necessary.

- Submit the completed form according to the guidelines provided, whether online or via mail.

Legal Use of the Irrevocable Benefit

The legal use of the irrevocable benefit is governed by various state and federal regulations. It is essential to ensure compliance with these laws to maintain the validity of the benefit. This includes understanding how the benefit interacts with tax laws and estate planning regulations. A well-documented irrevocable benefit can protect assets from creditors and ensure that they are passed down to grandchildren without complications.

Key Elements of the Irrevocable Benefit

Key elements of the irrevocable benefit include:

- Designation of Beneficiaries: Clearly identifying who will receive the benefits.

- Asset Protection: Ensuring that the assets are shielded from creditors and legal claims.

- Tax Implications: Understanding how the benefit affects estate and gift taxes.

- Compliance Requirements: Adhering to state-specific laws and regulations.

Examples of Using the Irrevocable Benefit

There are various scenarios in which an irrevocable benefit can be utilized effectively:

- Establishing a trust for grandchildren to ensure they receive financial support for education.

- Setting up life insurance policies that name grandchildren as irrevocable beneficiaries, providing them with financial security.

- Creating a family limited partnership where assets are held for the benefit of younger generations.

Required Documents for the Irrevocable Benefit

When preparing to complete the irrevocable benefit form, certain documents are typically required:

- Proof of identity for the grantor and beneficiaries.

- Documentation of the assets being transferred or designated.

- Any existing estate planning documents, such as wills or trusts.

- Legal forms specific to your state that may need to be included.

Quick guide on how to complete irrevocable benefit

Complete Irrevocable Benefit seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can easily find the correct form and securely save it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents quickly without delays. Manage Irrevocable Benefit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

The easiest way to modify and eSign Irrevocable Benefit effortlessly

- Find Irrevocable Benefit and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of the documents or redact sensitive information with tools specifically designed for that task by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to deliver your form: via email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Irrevocable Benefit and maintain excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a grandchildren form?

A grandchildren form is a document template that allows you to manage essential information regarding your grandchildren, such as health details, medical history, and emergency contacts. With airSlate SignNow, this form can be easily customized and securely shared with family members. Using a grandchildren form ensures that critical information is organized and accessible at all times.

-

How can I create a grandchildren form with airSlate SignNow?

Creating a grandchildren form with airSlate SignNow is simple and straightforward. You can start from a customizable template or create one from scratch using our intuitive drag-and-drop editor. Once your grandchildren form is set up, you can add fields for necessary information and share it seamlessly with family.

-

Is there a cost associated with using the grandchildren form feature?

airSlate SignNow offers a variety of pricing plans that cater to both individual users and businesses. The grandchildren form feature is included in many of these plans, ensuring you get comprehensive document management at an affordable price. You can try it out with a free trial to see how it fits your needs.

-

What are the benefits of using a grandchildren form?

Using a grandchildren form streamlines the process of gathering and storing vital information about your grandchildren. It allows for organized record-keeping and quick access to critical data during emergencies. Additionally, eSigning capabilities in airSlate SignNow make it easy to get the necessary approvals from family members.

-

Can I integrate my grandchildren form with other applications?

Yes, airSlate SignNow offers several integrations with popular applications and software. This means you can easily sync your grandchildren form with tools you already use for enhanced workflow and efficiency. Check our integrations page to see the full list of compatible applications.

-

Is the grandchildren form secure?

Absolutely, security is a top priority for airSlate SignNow. The grandchildren form, like all documents created through our platform, is protected with encryption and complies with industry standards. Your family's sensitive information will remain safe and secure at all times.

-

Can I edit my grandchildren form after it’s created?

Yes, once created, you have the flexibility to edit your grandchildren form whenever necessary. airSlate SignNow allows you to make updates or modifications easily, ensuring that the information stays current and relevant. You can also resend the form for eSignature after editing.

Get more for Irrevocable Benefit

- Axis bank credit card auto debit deactivation form

- Fillable online v18 v19 ampampamp v20 students fax email print form

- Alliant direct form

- Disclosure ampampamp agreement for savings and transaction accounts form

- News3visa dispute form secu credit union secumd

- Method to obtain a distribution please contact fidelity to determine if you may request a distribution by telephone or by a form

- Vystar credit union membership application vystarcu form

- Aflac payment authorization agreement form

Find out other Irrevocable Benefit

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application

- How To eSign Michigan Life Sciences LLC Operating Agreement

- eSign Minnesota Life Sciences Lease Template Later

- eSign South Carolina Insurance Job Description Template Now

- eSign Indiana Legal Rental Application Free

- How To eSign Indiana Legal Residential Lease Agreement

- eSign Iowa Legal Separation Agreement Easy

- How To eSign New Jersey Life Sciences LLC Operating Agreement

- eSign Tennessee Insurance Rental Lease Agreement Later