Receipt Template for Distribution of Decedent Minnesota Form

Understanding the Beneficiary Receipt of Distribution Form

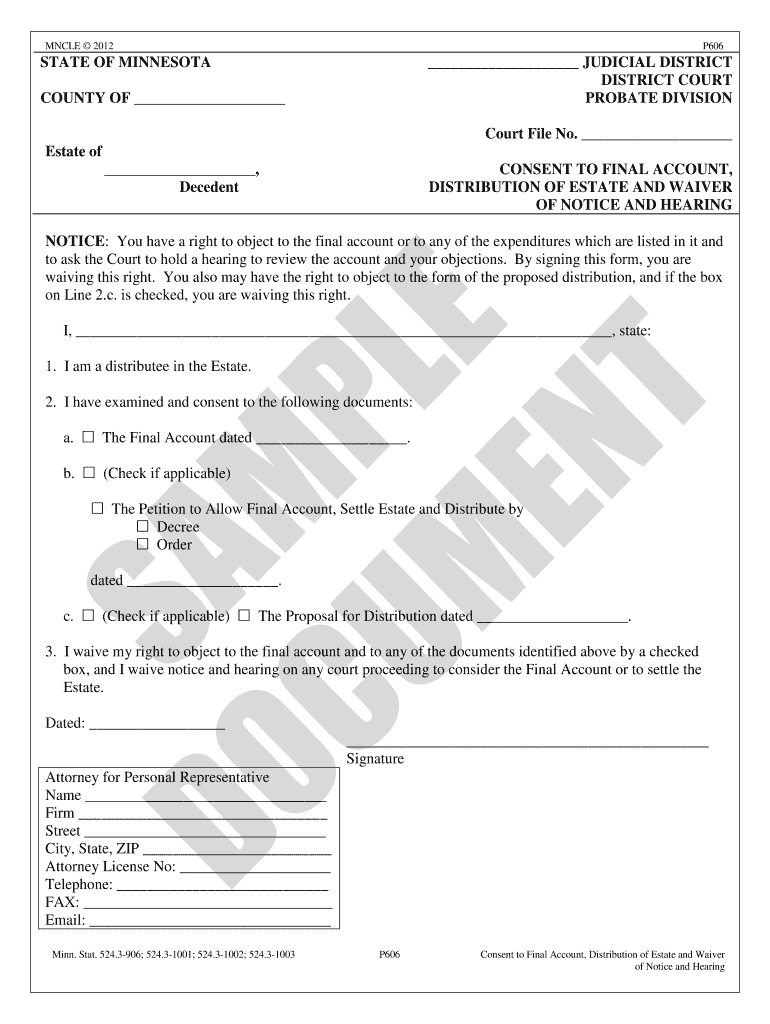

The beneficiary receipt of distribution form serves as a crucial document that acknowledges the receipt of assets from an estate or trust. This form is typically used by beneficiaries to confirm that they have received their share of the estate's distribution. It is essential for maintaining clear records and ensuring that all parties involved understand the distribution process. This form can be particularly important in legal contexts, as it provides evidence of the transactions made between the estate and the beneficiaries.

Steps to Complete the Beneficiary Receipt of Distribution Form

Completing the beneficiary receipt of distribution form involves several key steps to ensure accuracy and compliance with legal requirements. Begin by entering the name of the estate or trust, followed by the name of the beneficiary receiving the distribution. Clearly state the amount or value of the assets received, along with any relevant details regarding the type of distribution, such as cash, property, or securities. It is important to include the date of receipt and to sign the form, as this signature confirms the beneficiary's acknowledgment of the distribution. Make sure to keep a copy of the completed form for personal records.

Legal Use of the Beneficiary Receipt of Distribution Form

The legal use of the beneficiary receipt of distribution form is significant in the context of estate management. This document serves as proof that the beneficiary has received their entitled share, which can be crucial in case of disputes or audits. The form may also be required by courts or financial institutions to finalize the distribution process. By using this form, beneficiaries can protect themselves and ensure that their rights are upheld in the distribution of estate assets.

Key Elements of the Beneficiary Receipt of Distribution Form

Several key elements must be included in the beneficiary receipt of distribution form to ensure its validity. These elements typically include:

- Beneficiary's Name: The full legal name of the beneficiary receiving the distribution.

- Estate or Trust Name: The name of the estate or trust from which the distribution is made.

- Details of Distribution: A clear description of the assets received, including their value.

- Date of Distribution: The date on which the beneficiary received the assets.

- Signature: The beneficiary's signature, which confirms the receipt of the distribution.

Examples of Using the Beneficiary Receipt of Distribution Form

There are various scenarios in which the beneficiary receipt of distribution form may be utilized. For instance, when a beneficiary receives cash from an estate, they would complete the form to acknowledge the receipt of funds. Similarly, if a beneficiary inherits property, they would use the form to confirm the transfer of ownership. These examples illustrate the form's versatility and importance in documenting the distribution process, ensuring transparency and accountability among all parties involved.

Obtaining the Beneficiary Receipt of Distribution Form

Obtaining the beneficiary receipt of distribution form can be done through several avenues. Many estate planning attorneys provide this form as part of their services. Additionally, it may be available through online legal resources or estate management software. It is important to ensure that the form complies with state-specific regulations, as requirements may vary. Always verify that the version of the form you are using is up to date and meets legal standards.

Quick guide on how to complete receipt template for distribution of decedent minnesota form

Effortlessly Prepare Receipt Template For Distribution Of Decedent Minnesota Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a sustainable alternative to conventional printed and signed paperwork, as you can obtain the correct format and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Manage Receipt Template For Distribution Of Decedent Minnesota Form seamlessly on any platform using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest method to modify and electronically sign Receipt Template For Distribution Of Decedent Minnesota Form with ease

- Locate Receipt Template For Distribution Of Decedent Minnesota Form and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign feature, which takes only seconds and possesses the same legal validity as a conventional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method for sending your form—via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choice. Modify and electronically sign Receipt Template For Distribution Of Decedent Minnesota Form to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

FAQs

-

How should I fill out Form W-8BEN from Nepal (no tax treaty) for a receipt royalty of a documentary film?

You are required to complete a Form W-8BEN if you are a non-resident alien and earned Royalty income (in this case) from a US-based source.The purpose of the form is to alert the IRS to the fact you are earning income from the US, even though you are not a citizen or a resident of the US. The US is entitled to tax revenues from your US-based earnings and would, without the form, have no way of knowing about you or your income.To ensure they receive their “fair” share, they require the payor to withhold 30% of the payment due to you, before issuing a check for the remainder to you. If they don’t withhold and/don’t report the payment to you, they may not be able to deduct the payment as an expense, and are subject to penalties for failing to withhold - not to mention forced to pay the 30% amount over and above what they pay to you. They therefore will not release any payment without receiving the Form W-8BEN.Now, Nepal happens not to have a tax treaty with the US. If it did and you were subject to Nepalese taxes on that income, you could claim a credit for the taxes paid to another country, up to the entire amount of the tax. Even still, you are entitled to file a US Form 1040N, as the withholding is charged on the gross proceeds and there may be expenses that can be deducted from that amount before arriving at the actual tax due. In that way, you may be entitled to a refund of some or all of the backup withholding.That is another reason why you file the form - it allows you to file a return in order to apply for a refund.In order to complete the form, you can go to the IRS website to read the instructions, or simply go here: https://www.irs.gov/pub/irs-pdf/...

-

How can I fill out Google's intern host matching form to optimize my chances of receiving a match?

I was selected for a summer internship 2016.I tried to be very open while filling the preference form: I choose many products as my favorite products and I said I'm open about the team I want to join.I even was very open in the location and start date to get host matching interviews (I negotiated the start date in the interview until both me and my host were happy.) You could ask your recruiter to review your form (there are very cool and could help you a lot since they have a bigger experience).Do a search on the potential team.Before the interviews, try to find smart question that you are going to ask for the potential host (do a search on the team to find nice and deep questions to impress your host). Prepare well your resume.You are very likely not going to get algorithm/data structure questions like in the first round. It's going to be just some friendly chat if you are lucky. If your potential team is working on something like machine learning, expect that they are going to ask you questions about machine learning, courses related to machine learning you have and relevant experience (projects, internship). Of course you have to study that before the interview. Take as long time as you need if you feel rusty. It takes some time to get ready for the host matching (it's less than the technical interview) but it's worth it of course.

-

What happens to all of the paper forms you fill out for immigration and customs?

Years ago I worked at document management company. There is cool software that can automate aspects of hand-written forms. We had an airport as a customer - they scanned plenty and (as I said before) this was several years ago...On your airport customs forms, the "boxes" that you 'need' to write on - are basically invisible to the scanner - but are used because then us humans will tend to write neater and clearer which make sit easier to recognize with a computer. Any characters with less than X% accuracy based on a recognition engine are flagged and shown as an image zoomed into the particular character so a human operator can then say "that is an "A". This way, you can rapidly go through most forms and output it to say - an SQL database, complete with link to original image of the form you filled in.If you see "black boxes" at three corners of the document - it is likely set up for scanning (they help to identify and orient the page digitally). If there is a unique barcode on the document somewhere I would theorize there is an even higher likelihood of it being scanned - the document is of enough value to be printed individually which costs more, which means it is likely going to be used on the capture side. (I've noticed in the past in Bahamas and some other Caribbean islands they use these sorts of capture mechanisms, but they have far fewer people entering than the US does everyday)The real answer is: it depends. Depending on each country and its policies and procedures. Generally I would be surprised if they scanned and held onto the paper. In the US, they proably file those for a set period of time then destroy them, perhaps mining them for some data about travellers. In the end, I suspect the "paper-to-data capture" likelihood of customs forms ranges somewhere on a spectrum like this:Third world Customs Guy has paper to show he did his job, paper gets thrown out at end of shift. ------> We keep all the papers! everything is scanned as you pass by customs and unique barcodes identify which flight/gate/area the form was handed out at, so we co-ordinate with cameras in the airport and have captured your image. We also know exactly how much vodka you brought into the country. :)

-

How do I fill out the form of DU CIC? I couldn't find the link to fill out the form.

Just register on the admission portal and during registration you will get an option for the entrance based course. Just register there. There is no separate form for DU CIC.

Create this form in 5 minutes!

How to create an eSignature for the receipt template for distribution of decedent minnesota form

How to create an electronic signature for the Receipt Template For Distribution Of Decedent Minnesota Form online

How to create an eSignature for your Receipt Template For Distribution Of Decedent Minnesota Form in Chrome

How to generate an electronic signature for putting it on the Receipt Template For Distribution Of Decedent Minnesota Form in Gmail

How to create an electronic signature for the Receipt Template For Distribution Of Decedent Minnesota Form right from your smart phone

How to create an electronic signature for the Receipt Template For Distribution Of Decedent Minnesota Form on iOS devices

How to generate an electronic signature for the Receipt Template For Distribution Of Decedent Minnesota Form on Android

People also ask

-

What is a beneficiary receipt of distribution form?

A beneficiary receipt of distribution form is a document used to confirm that a beneficiary has received a distribution from an estate, trust, or other financial accounts. This form provides essential proof for both beneficiaries and administrators, ensuring clarity and compliance in the distribution process.

-

How does airSlate SignNow facilitate the use of a beneficiary receipt of distribution form?

airSlate SignNow allows users to easily create, send, and eSign beneficiary receipt of distribution forms electronically. With an intuitive interface, you can streamline the distribution process, making it faster and more efficient for both administrators and beneficiaries.

-

Is there a cost associated with creating a beneficiary receipt of distribution form on airSlate SignNow?

airSlate SignNow offers competitive pricing plans that provide access to all features, including creating and managing beneficiary receipt of distribution forms. Depending on your needs, you can choose a plan that best suits your budget while enjoying unlimited document transactions.

-

What features does airSlate SignNow offer for beneficiary receipt of distribution forms?

AirSlate SignNow includes various features ideal for beneficiary receipt of distribution forms, such as templates, customizable fields, and eSignature capabilities. These features ensure that the forms are not only compliant but also tailored to your specific requirements.

-

Can I integrate airSlate SignNow with other applications for managing my beneficiary receipt of distribution forms?

Yes, airSlate SignNow offers seamless integrations with various applications including CRMs, cloud storage, and project management tools. This allows you to manage your beneficiary receipt of distribution forms alongside other important documents and workflows.

-

How does using a beneficiary receipt of distribution form benefit my business?

Utilizing a beneficiary receipt of distribution form helps streamline the distribution process, reduce administrative errors, and ensure compliance with legal requirements. With airSlate SignNow, you can enhance operational efficiency while providing a transparent process for beneficiaries.

-

Is it easy to customize a beneficiary receipt of distribution form on airSlate SignNow?

Absolutely! airSlate SignNow offers an easy-to-use editor that allows you to customize your beneficiary receipt of distribution forms. You can add relevant information, personalize branding, and adjust fields to meet your specific needs, all without any technical skills required.

Get more for Receipt Template For Distribution Of Decedent Minnesota Form

- Louisiana identity 497309392 form

- Louisiana theft form

- Identity theft by known imposter package louisiana form

- Organizing your personal assets package louisiana form

- Louisiana organized form

- Essential documents for the organized traveler package with personal organizer louisiana form

- Postnuptial agreements package louisiana form

- Louisiana recommendation 497309399 form

Find out other Receipt Template For Distribution Of Decedent Minnesota Form

- Help Me With eSignature Wisconsin Pet Custody Agreement

- eSign Virginia Stock Transfer Form Template Easy

- How To eSign Colorado Payment Agreement Template

- eSign Louisiana Promissory Note Template Mobile

- Can I eSign Michigan Promissory Note Template

- eSign Hawaii Football Registration Form Secure

- eSign Hawaii Football Registration Form Fast

- eSignature Hawaii Affidavit of Domicile Fast

- Can I eSignature West Virginia Affidavit of Domicile

- eSignature Wyoming Affidavit of Domicile Online

- eSign Montana Safety Contract Safe

- How To eSign Arizona Course Evaluation Form

- How To eSign California Course Evaluation Form

- How To eSign Florida Course Evaluation Form

- How To eSign Hawaii Course Evaluation Form

- How To eSign Illinois Course Evaluation Form

- eSign Hawaii Application for University Free

- eSign Hawaii Application for University Secure

- eSign Hawaii Medical Power of Attorney Template Free

- eSign Washington Nanny Contract Template Free