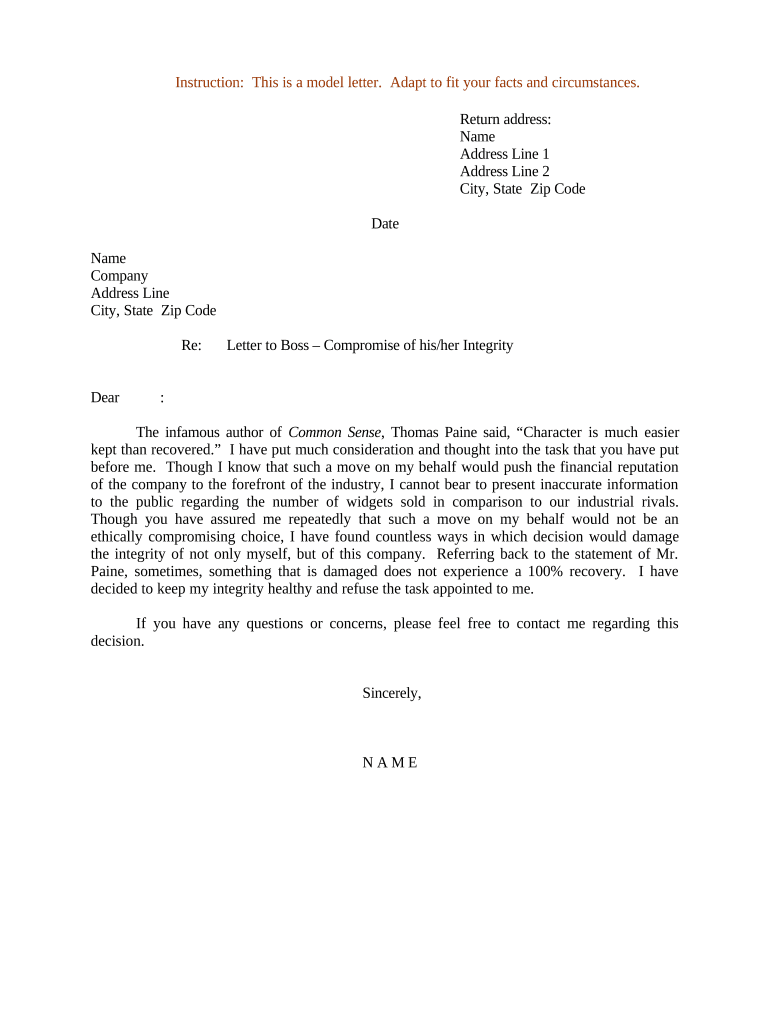

Sample Letter Compromise Form

What is the Sample Letter Compromise

A sample letter compromise is a formal document used to negotiate a settlement with the Internal Revenue Service (IRS) regarding tax debts. This letter typically outlines the taxpayer's financial situation and proposes a reduced amount to settle the outstanding tax liabilities. It serves as an essential tool for individuals seeking relief through the IRS Fresh Start Program, which aims to help taxpayers manage their debts more effectively.

Key Elements of the Sample Letter Compromise

When drafting a letter of compromise, certain key elements must be included to ensure its effectiveness. These elements typically consist of:

- Personal Information: Include your name, address, Social Security number, and any relevant tax identification numbers.

- Financial Details: Provide a clear overview of your financial situation, including income, expenses, and assets.

- Offer Amount: Specify the amount you are willing to pay to settle the tax debt.

- Rationale: Explain why you believe the proposed amount is fair and justified based on your financial circumstances.

- Supporting Documentation: Mention any attached documents that support your claims, such as income statements or expense reports.

Steps to Complete the Sample Letter Compromise

Completing a sample letter compromise involves several important steps to ensure that your submission is thorough and persuasive. Follow these steps:

- Gather Financial Information: Collect all necessary financial documents that outline your income, expenses, and assets.

- Draft the Letter: Use a clear and professional tone while including all key elements mentioned above.

- Review and Edit: Carefully proofread the letter for clarity and accuracy, ensuring that all information is correct.

- Attach Supporting Documents: Include any relevant documentation that supports your financial claims.

- Submit the Letter: Send the completed letter to the appropriate IRS address, either via mail or electronically if permitted.

IRS Guidelines

The IRS has established specific guidelines for submitting a letter of compromise. These guidelines include:

- Ensuring that the offer is reasonable based on your financial situation.

- Providing all requested documentation to support your claims.

- Following the proper submission methods, which may vary depending on your specific case.

- Understanding that the IRS may take time to review your offer and respond accordingly.

Eligibility Criteria

To qualify for submitting a sample letter compromise, taxpayers must meet certain eligibility criteria. These criteria typically include:

- Demonstrating an inability to pay the full tax debt.

- Providing accurate financial information to support the offer.

- Being compliant with all filing and payment requirements for the current tax year.

Application Process & Approval Time

The application process for a letter of compromise involves submitting the letter along with supporting documents to the IRS. After submission, the IRS will review the offer, which can take several months. Taxpayers should be prepared for potential follow-up requests for additional information during this period. Approval times may vary based on the complexity of the case and the workload of the IRS.

Quick guide on how to complete sample letter compromise

Complete Sample Letter Compromise effortlessly on any device

Digital document management has become increasingly favored by companies and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and physically signed documents, allowing you to find the appropriate form and securely store it online. airSlate SignNow provides all the resources necessary to create, edit, and electronically sign your documents swiftly without complications. Handle Sample Letter Compromise on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and electronically sign Sample Letter Compromise effortlessly

- Find Sample Letter Compromise and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Generate your electronic signature using the Sign tool, which only takes seconds and holds the same legal validity as a traditional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that require new document copies to be printed. airSlate SignNow addresses all your document management requirements within a few clicks from your selected device. Modify and electronically sign Sample Letter Compromise to ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an offer in compromise letter template?

An offer in compromise letter template is a structured document that taxpayers can use to negotiate a settlement with the IRS for unpaid taxes. This template streamlines the process, ensuring that all necessary details are included, which can signNowly improve the chances of acceptance. Utilizing an offer in compromise letter template simplifies the daunting task of preparing such a letter.

-

How can I create an offer in compromise letter template with airSlate SignNow?

Creating an offer in compromise letter template with airSlate SignNow is straightforward. Simply log in to our platform, choose the template feature, and customize your document to fit your specific tax situation. Our easy-to-use interface ensures that your template is ready for eSignature and quick submission.

-

What are the benefits of using an offer in compromise letter template?

Using an offer in compromise letter template helps you save time and reduces the risk of error when drafting your letter to the IRS. This template is designed with legal requirements in mind, ensuring compliance and increasing your chances of a favorable outcome. Additionally, it allows for easy customization to address your unique financial situation.

-

Is there a cost associated with obtaining an offer in compromise letter template?

AirSlate SignNow provides affordable pricing plans that include access to customizable legal templates, including the offer in compromise letter template. Depending on your chosen subscription, you can access a variety of templates without incurring excessive costs. Visit our pricing page for detailed information.

-

Can I integrate the offer in compromise letter template with other applications?

Yes, airSlate SignNow offers various integrations that enable you to use the offer in compromise letter template seamlessly with other applications you may already use. You can easily integrate with tools such as Google Drive, Dropbox, and other document management systems. This feature enhances workflow efficiency and convenience.

-

Are there any features specific to the offer in compromise letter template?

The offer in compromise letter template comes with several user-friendly features that cater specifically to tax negotiations. These features include guided prompts and sections tailored to common scenarios, ensuring you include all necessary information. Additionally, you can customize the template to fit your unique situation.

-

Can I get assistance with my offer in compromise letter template?

Absolutely! AirSlate SignNow provides customer support that can help guide you through the process of creating your offer in compromise letter template. Our support team is knowledgeable and ready to assist with any questions you might have, ensuring you are well-equipped to submit a strong letter.

Get more for Sample Letter Compromise

Find out other Sample Letter Compromise

- eSign Alaska Plumbing Memorandum Of Understanding Safe

- eSign Kansas Orthodontists Contract Online

- eSign Utah Legal Last Will And Testament Secure

- Help Me With eSign California Plumbing Business Associate Agreement

- eSign California Plumbing POA Mobile

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free