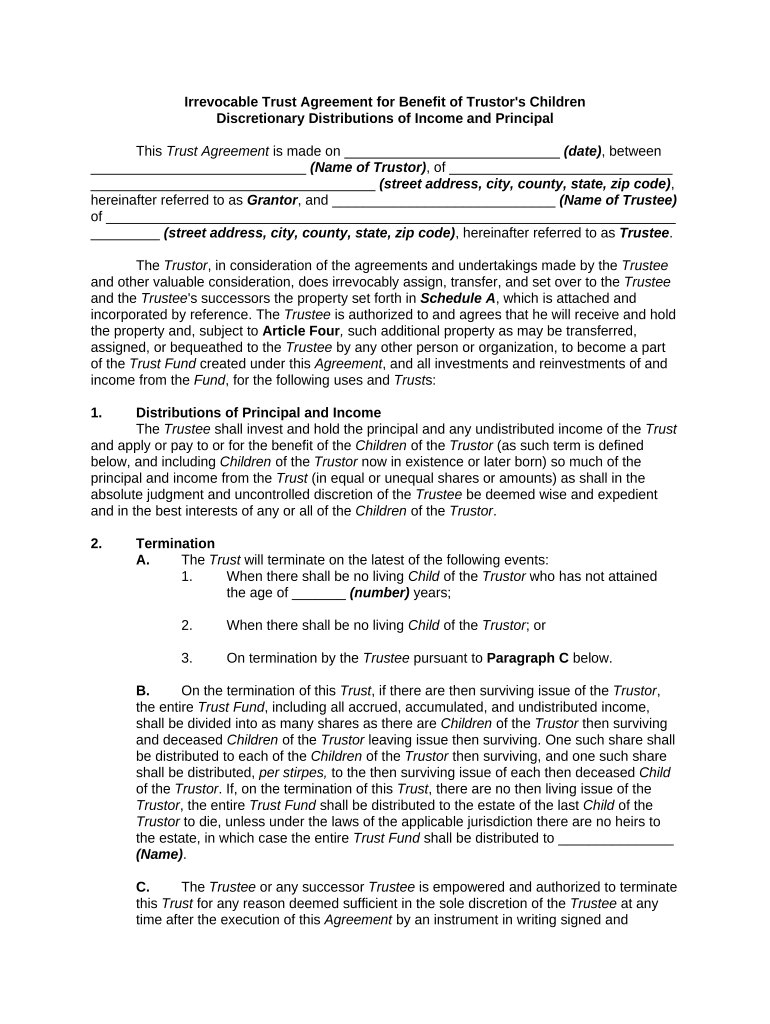

Trust Discretionary Income Form

What is the Trust Discretionary Income

The trust discretionary income refers to the income generated by a trust that the trustee has the authority to distribute at their discretion among the beneficiaries. This type of income is not automatically allocated but instead depends on the trustee's judgment regarding the needs and circumstances of the beneficiaries. Understanding the nature of trust discretionary income is essential for both trustees and beneficiaries, as it impacts financial planning and tax obligations.

How to use the Trust Discretionary Income

Using trust discretionary income effectively involves several key considerations. Beneficiaries should be aware that the trustee may choose to distribute income based on various factors, such as financial need, educational expenses, or health-related costs. It is advisable for beneficiaries to maintain open communication with the trustee about their needs and any changes in circumstances that may affect income distribution. Additionally, proper documentation should be maintained to ensure transparency and compliance with trust agreements.

Steps to complete the Trust Discretionary Income

Completing the trust discretionary income form requires careful attention to detail. Here are the steps to follow:

- Gather necessary documents, including the trust agreement and financial statements.

- Identify the beneficiaries and their respective needs.

- Consult with legal or financial advisors if needed to ensure compliance with regulations.

- Fill out the trust discretionary income form accurately, ensuring all required fields are completed.

- Review the completed form for accuracy before submission.

- Submit the form to the appropriate parties, whether electronically or via mail.

Legal use of the Trust Discretionary Income

The legal use of trust discretionary income is governed by the terms outlined in the trust agreement and relevant state laws. Trustees must adhere to fiduciary duties, acting in the best interests of the beneficiaries while following the guidelines set forth in the trust document. Understanding these legal obligations is crucial for both trustees and beneficiaries to ensure that distributions are made lawfully and ethically.

Key elements of the Trust Discretionary Income

Key elements of trust discretionary income include the following:

- Trustee Authority: The trustee has the discretion to determine how much income is distributed and to whom.

- Beneficiary Needs: Distributions are often based on the specific needs of beneficiaries, which may vary over time.

- Trust Agreement Terms: The trust document outlines the guidelines for income distribution and any limitations.

- Tax Implications: Beneficiaries may be subject to taxes on distributed income, depending on their individual tax situations.

IRS Guidelines

The IRS provides specific guidelines regarding the taxation of trust discretionary income. Generally, the income generated by the trust is taxable to the beneficiaries when it is distributed. It is important for beneficiaries to report this income accurately on their tax returns. Trustees should also be aware of their responsibilities in reporting distributions and ensuring compliance with IRS regulations to avoid potential penalties.

Quick guide on how to complete trust discretionary income

Finish Trust Discretionary Income effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and safely store it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents quickly without delays. Manage Trust Discretionary Income on any device using airSlate SignNow Android or iOS applications and enhance any document-centered process today.

How to alter and eSign Trust Discretionary Income without stress

- Obtain Trust Discretionary Income and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize relevant sections of the documents or censor sensitive details with tools specifically designed for this purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Trust Discretionary Income and ensure excellent communication at any point in the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is trust discretionary income?

Trust discretionary income refers to the income that a trustee can decide to distribute to beneficiaries at their discretion. This type of income is often considered for tax purposes and financial planning. Understanding how trust discretionary income works can help individuals in structuring their financial portfolios effectively.

-

How can airSlate SignNow support transactions involving trust discretionary income?

airSlate SignNow provides an efficient and secure platform for eSigning documents related to trust discretionary income transactions. By simplifying the signature collection process, businesses can quickly complete legal agreements that manage distributions. This improves efficiency and ensures compliance with financial regulations.

-

Is there a cost associated with using airSlate SignNow for trust discretionary income agreements?

Yes, airSlate SignNow offers various pricing plans tailored to fit different business needs, including those managing trust discretionary income. Our plans are designed to be cost-effective while providing the necessary features. You can choose a plan that suits your budget and requirements for secure document handling.

-

What features does airSlate SignNow offer for managing trust discretionary income documentation?

airSlate SignNow offers features such as document templates, automated workflows, and secure storage, which are essential for managing documents related to trust discretionary income. These features streamline the eSigning process, help to reduce errors, and ensure documents are stored securely. This is crucial for trusts that require meticulous record-keeping.

-

How does airSlate SignNow ensure the security of documents related to trust discretionary income?

Security is a top priority for airSlate SignNow, especially when managing sensitive documents related to trust discretionary income. We use advanced encryption and compliance with industry standards to safeguard all transactions. Trusted security measures help establish confidence among users, ensuring that their documents are safe and secure.

-

Can airSlate SignNow integrate with other platforms for managing trust discretionary income?

Yes, airSlate SignNow seamlessly integrates with various platforms to enhance efficiency when managing trust discretionary income. This includes popular tools for accounting and legal documentation. Such integrations ensure that your workflow is uninterrupted and that important financial data is easily accessible.

-

What are the benefits of using airSlate SignNow for trust discretionary income documents?

Using airSlate SignNow for trust discretionary income documents offers numerous benefits, including time savings, reduced paperwork, and increased accuracy. The platform's user-friendly interface allows for easy document management and eSigning, making the process hassle-free. Additionally, digital records improve transparency and streamline audits.

Get more for Trust Discretionary Income

- His victoria a4 general referral sheet new version phcivfrm0015 01 20 32376 form

- Activity participation record form

- Wesley admission form

- Full rate mailing statement 485078069 form

- No pool safety certificate form

- Kiama high school form

- Attendance form

- Form 36 notice of no pool safety certificate real estate training

Find out other Trust Discretionary Income

- eSign Alabama Car Dealer Executive Summary Template Fast

- eSign Arizona Car Dealer Bill Of Lading Now

- How Can I eSign Alabama Car Dealer Executive Summary Template

- eSign California Car Dealer LLC Operating Agreement Online

- eSign California Car Dealer Lease Agreement Template Fast

- eSign Arkansas Car Dealer Agreement Online

- Sign Montana Courts Contract Safe

- eSign Colorado Car Dealer Affidavit Of Heirship Simple

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter