Deed Trust Securing Form

What is the deed trust securing?

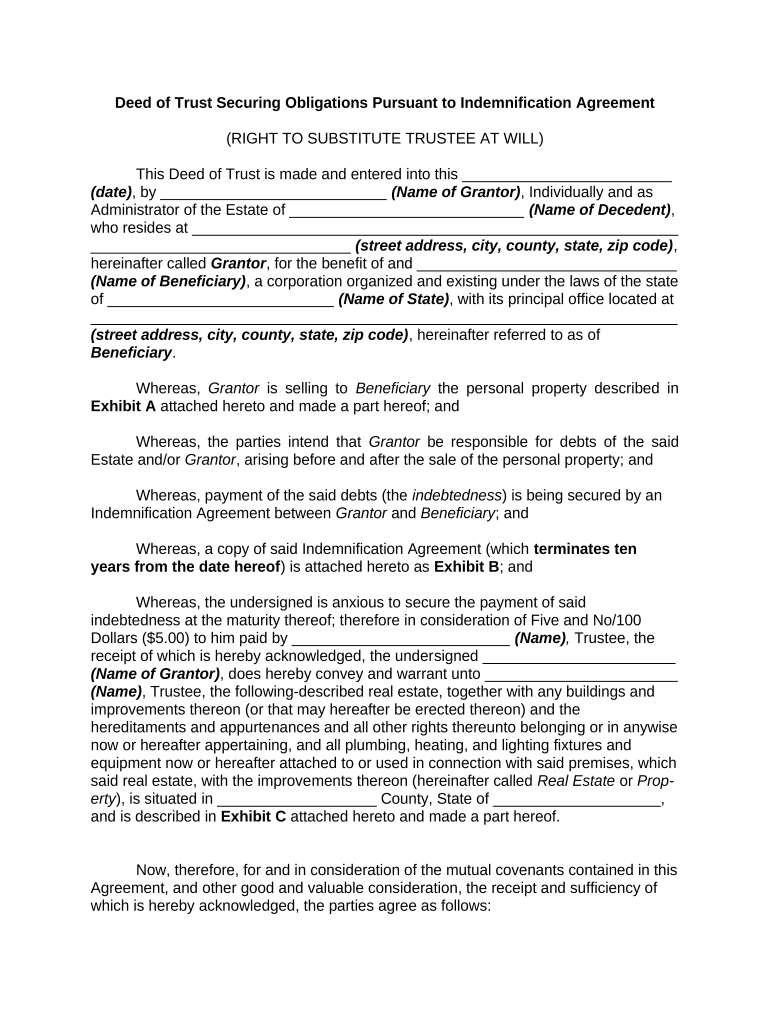

A deed trust securing is a legal instrument that establishes a trust relationship between a borrower and a lender. It serves as a security for a loan, ensuring that the lender has a claim against the property if the borrower defaults on their obligations. This type of deed typically outlines the terms of the loan, including the amount borrowed, interest rates, and repayment schedules. In the event of default, the lender can initiate a foreclosure process to recover the owed amount through the sale of the property.

Key elements of the deed trust securing

The deed trust securing includes several critical components that define the agreement between the parties involved. These elements typically encompass:

- Parties involved: Identification of the borrower, lender, and trustee.

- Property description: A detailed description of the property being secured.

- Loan terms: Specifics regarding the loan amount, interest rate, and repayment schedule.

- Default conditions: Circumstances under which the lender can take action if the borrower fails to meet obligations.

- Trustee's role: The responsibilities of the trustee in managing the trust and executing the deed.

Steps to complete the deed trust securing

Completing a deed trust securing involves several important steps to ensure that the document is legally binding and properly executed. The process generally includes:

- Drafting the deed: Prepare the deed trust securing document, ensuring all necessary details are included.

- Reviewing terms: Both parties should carefully review the terms to confirm mutual understanding and agreement.

- Signing the document: All parties must sign the deed in the presence of a notary public to validate the agreement.

- Recording the deed: Submit the signed deed to the appropriate county office to officially record the trust.

Legal use of the deed trust securing

The legal use of a deed trust securing is governed by state laws and regulations, which can vary significantly. It is essential for both borrowers and lenders to understand their rights and obligations under these laws. A properly executed deed trust can provide legal protection for both parties, ensuring that the lender has recourse in case of default while allowing the borrower to secure necessary financing. Consulting with a legal professional can help clarify any specific legal requirements related to the deed trust securing in a particular state.

Required documents

To complete the deed trust securing process, several documents may be required. These typically include:

- Loan application: Documentation of the borrower's request for financing.

- Credit report: A report assessing the borrower's creditworthiness.

- Property appraisal: An evaluation of the property's market value.

- Identification: Valid identification for all parties involved.

- Deed trust securing document: The completed and signed deed trust securing itself.

Examples of using the deed trust securing

Deed trust securing is commonly used in various scenarios, particularly in real estate transactions. Some examples include:

- Home purchases: Buyers often use a deed trust to secure a mortgage loan for purchasing a home.

- Investment properties: Investors may use a deed trust to finance the acquisition of rental properties.

- Refinancing: Homeowners may utilize a deed trust when refinancing an existing mortgage to secure better terms.

Quick guide on how to complete deed trust securing

Prepare Deed Trust Securing effortlessly on any device

Web-based document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Deed Trust Securing on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Deed Trust Securing with ease

- Locate Deed Trust Securing and click Get Form to begin.

- Use the tools we offer to complete your document.

- Emphasize key sections of your documents or obscure sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional ink signature.

- Verify the details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, the hassle of searching for forms, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Deed Trust Securing to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are trust obligations in the context of electronic signatures?

Trust obligations refer to the legal requirements that businesses must meet when using electronic signatures. airSlate SignNow is designed to ensure that your eSignatures comply with these obligations, providing you with a secure and reliable way to sign documents digitally.

-

How does airSlate SignNow ensure compliance with trust obligations?

airSlate SignNow utilizes advanced encryption and security measures to protect your signed documents, ensuring compliance with trust obligations. Our platform is built to meet regulatory standards, guaranteeing that your eSignatures are legally binding and secure.

-

What pricing plans does airSlate SignNow offer?

airSlate SignNow offers various pricing plans suitable for businesses of all sizes. Each plan is designed to provide value while ensuring that users can meet their trust obligations efficiently and affordably.

-

Can airSlate SignNow integrate with other tools that help manage trust obligations?

Yes, airSlate SignNow seamlessly integrates with various business tools, allowing you to manage your trust obligations effectively. Integrations with CRM systems and cloud storage enhance your workflow while ensuring that you remain compliant with relevant regulations.

-

What features of airSlate SignNow help in fulfilling trust obligations?

Key features such as audit trails, secure storage, and customizable workflows in airSlate SignNow help businesses fulfill their trust obligations. These features provide transparency and accountability, which are critical for compliance.

-

How does airSlate SignNow improve the signing experience while adhering to trust obligations?

airSlate SignNow enhances the signing experience by providing user-friendly interfaces and quick turnaround times, all while adhering to trust obligations. This ensures that documents are signed promptly without sacrificing security and compliance.

-

Is airSlate SignNow suitable for businesses in regulated industries concerning trust obligations?

Absolutely! airSlate SignNow is particularly suitable for businesses in regulated industries such as finance and healthcare, as it is designed to comply with stringent trust obligations. Our platform provides the necessary tools to help you navigate complex compliance requirements.

Get more for Deed Trust Securing

- Notice of disclosure form

- Hr ext gynaecologic cytology non dynacare form

- Claiming disability insurance benefits form

- Dynacare cytology form

- Confirmation of receipt of the homeowner information package

- Form 2 annual information return government of nova scotia

- Medical imaging provider referral forms and instructions

- Mv1425 application for collector vehicle status application for collector vehicle status form

Find out other Deed Trust Securing

- How To Electronic signature Tennessee Healthcare / Medical Word

- Can I Electronic signature Hawaii Insurance PDF

- Help Me With Electronic signature Colorado High Tech Form

- How To Electronic signature Indiana Insurance Document

- Can I Electronic signature Virginia Education Word

- How To Electronic signature Louisiana Insurance Document

- Can I Electronic signature Florida High Tech Document

- Can I Electronic signature Minnesota Insurance PDF

- How Do I Electronic signature Minnesota Insurance Document

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF