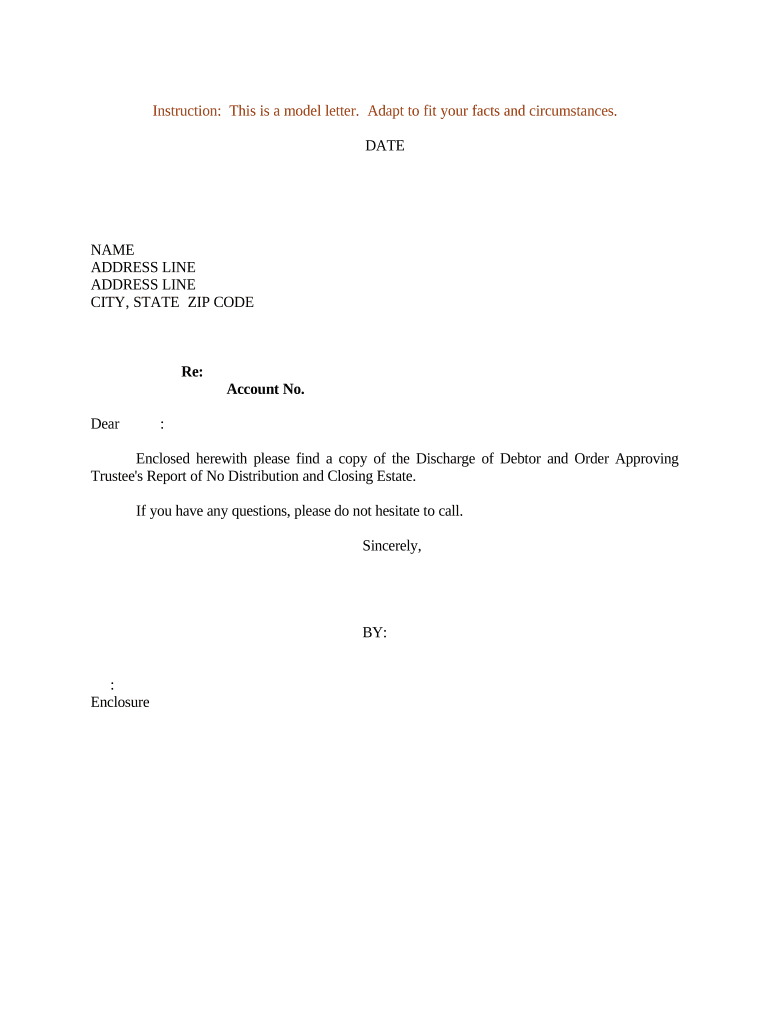

Debtor Form

What is the Debtor?

The term "debtor" refers to an individual or entity that owes money to another party, known as the creditor. In the context of a closing estate, the debtor may be the individual whose estate is being settled after their passing. This involves the management of their financial obligations and assets, ensuring that debts are paid and that the estate is distributed according to legal requirements and the deceased's wishes. Understanding the role of the debtor is crucial for anyone involved in estate management, as it directly impacts the closing process and the responsibilities of the executor or administrator.

Steps to Complete the Debtor

Completing the debtor form involves several key steps to ensure that all necessary information is accurately provided. Here is a streamlined process:

- Gather all relevant financial documents related to the debtor's estate, including debts, assets, and any existing agreements.

- Fill out the debtor form with accurate details, ensuring that names, addresses, and financial figures are correct.

- Review the form for completeness and accuracy, as errors can lead to delays or legal issues.

- Obtain necessary signatures, which may include those of the executor or administrator, to validate the document.

- Submit the completed form through the appropriate channels, whether online, by mail, or in person.

Legal Use of the Debtor

The legal use of the debtor form is essential in the estate closing process. This form serves as an official record of the debts owed by the estate and is crucial for compliance with state laws. It helps ensure that creditors are paid in accordance with legal priorities and that the remaining assets can be distributed to beneficiaries. Proper legal use also protects the executor from potential liabilities that may arise from mismanagement of the estate's debts.

Required Documents

When preparing to complete the debtor form, several documents are typically required to support the information provided. These may include:

- Death certificate of the deceased.

- Will or trust documents outlining the distribution of the estate.

- Financial statements detailing the estate's assets and liabilities.

- Any existing contracts or agreements related to the debts.

- Identification documents for the executor or administrator.

Form Submission Methods

The debtor form can be submitted through various methods, depending on the jurisdiction and specific requirements of the estate. Common submission methods include:

- Online submission through designated state or court websites.

- Mailing the form to the appropriate court or agency.

- In-person delivery at the local probate court or estate administration office.

It is important to verify the preferred method of submission for your specific location to ensure compliance with local regulations.

Penalties for Non-Compliance

Failing to comply with the requirements associated with the debtor form can lead to significant penalties. These may include:

- Fines imposed by the court for late or incorrect submissions.

- Potential legal action from creditors if debts are not addressed properly.

- Delays in the estate closing process, which can prolong the distribution of assets to beneficiaries.

Understanding these penalties highlights the importance of accurately completing and submitting the debtor form in a timely manner.

Quick guide on how to complete debtor 497330805

Effortlessly Prepare Debtor on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed papers, allowing you to locate the right template and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without delays. Manage Debtor on any platform using airSlate SignNow’s Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Debtor effortlessly

- Locate Debtor and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools provided by airSlate SignNow specifically for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal significance as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form: via email, text message (SMS), invitation link, or download it to your PC.

Say goodbye to lost or misplaced documents, tedious form searching, and mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Debtor to ensure excellent communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample closing form?

A sample closing form is a template used to finalize real estate transactions, ensuring all necessary information is included. It typically outlines the terms of the agreement and facilitates a smooth closing process. Using airSlate SignNow, you can customize and eSign your sample closing form efficiently.

-

How can I create a sample closing form with airSlate SignNow?

Creating a sample closing form with airSlate SignNow is simple and straightforward. You can start from scratch or choose from a library of templates, making it easy to customize fields and add necessary clauses. Once ready, you can send the form for eSignature instantly.

-

Is there a cost associated with using a sample closing form on airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans based on your needs. Our plans include options for individuals and teams, providing access to features for creating and sending sample closing forms. You can choose a plan that best fits your budget and requirements.

-

What features does airSlate SignNow offer for sample closing forms?

airSlate SignNow provides features such as customizable templates, automated workflows, and secure eSigning for sample closing forms. Additionally, you can collaborate in real time with stakeholders, ensuring a seamless closing experience. These features streamline the process and save time.

-

Can I integrate airSlate SignNow with other applications for managing sample closing forms?

Yes, airSlate SignNow supports integration with a variety of applications. This allows you to link your sample closing forms with CRM systems, document management tools, and other software you already use. By integrating, you can improve workflow efficiency and data consistency.

-

What are the benefits of using a sample closing form in airSlate SignNow?

Using a sample closing form in airSlate SignNow simplifies the closing process. It reduces the risk of errors, speeds up the signature collection, and keeps all your documents organized in one place. This ultimately results in a more streamlined and less stressful closing experience for all parties involved.

-

How secure is my data when using sample closing forms with airSlate SignNow?

airSlate SignNow prioritizes the security of your data with advanced encryption protocols and compliance with industry standards. Your sample closing forms and all related information are stored securely. You can trust that your documents are safe when using our platform.

Get more for Debtor

- Employer incident investigation report form

- Guide 5218 request to amend valid temporary resident form

- Pdf imm 1444 e application for criminal rehabilitation form

- Undertaking for an application for a work permit exempted form

- D0688 medical grade footwear prescription dva form

- Form 110 spent conviction fill online printable fillable

- Medicare stationery order form human services pdffiller

- Imm 008 application form

Find out other Debtor

- Sign Maine Plumbing LLC Operating Agreement Secure

- How To Sign Maine Plumbing POA

- Sign Maryland Plumbing Letter Of Intent Myself

- Sign Hawaii Orthodontists Claim Free

- Sign Nevada Plumbing Job Offer Easy

- Sign Nevada Plumbing Job Offer Safe

- Sign New Jersey Plumbing Resignation Letter Online

- Sign New York Plumbing Cease And Desist Letter Free

- Sign Alabama Real Estate Quitclaim Deed Free

- How Can I Sign Alabama Real Estate Affidavit Of Heirship

- Can I Sign Arizona Real Estate Confidentiality Agreement

- How Do I Sign Arizona Real Estate Memorandum Of Understanding

- Sign South Dakota Plumbing Job Offer Later

- Sign Tennessee Plumbing Business Letter Template Secure

- Sign South Dakota Plumbing Emergency Contact Form Later

- Sign South Dakota Plumbing Emergency Contact Form Myself

- Help Me With Sign South Dakota Plumbing Emergency Contact Form

- How To Sign Arkansas Real Estate Confidentiality Agreement

- Sign Arkansas Real Estate Promissory Note Template Free

- How Can I Sign Arkansas Real Estate Operating Agreement