Gift Property Form

What is the gift property?

The gift property refers to the transfer of ownership of real estate or personal property from one individual to another without any exchange of money or consideration. This can include various types of assets, such as land, homes, or valuable items. The act of gifting property can have significant tax implications for both the giver and the recipient, making it essential to understand the legal and financial aspects involved.

Steps to complete the gift property

Completing the gift property process involves several key steps to ensure that the transfer is legally binding and properly documented. Here are the primary steps to consider:

- Determine the value: Assess the fair market value of the property being gifted to understand any potential tax implications.

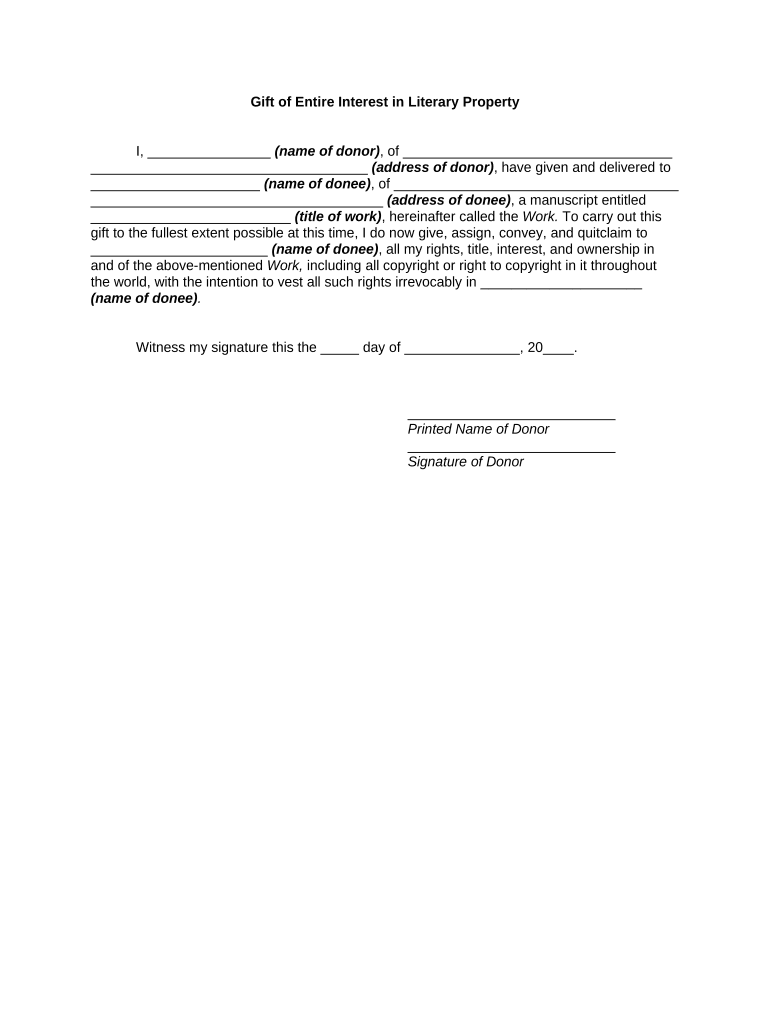

- Prepare the necessary documentation: Gather required documents, including the deed, gift letter, and any relevant tax forms.

- Sign the gift property form: Ensure that both the giver and the recipient sign the appropriate forms to validate the transfer.

- File with the appropriate authorities: Submit any required forms to local or state agencies to officially record the gift.

Legal use of the gift property

The legal use of gift property involves adhering to specific laws and regulations that govern property transfers. In the United States, the IRS allows individuals to gift a certain amount each year without incurring gift tax. Understanding these limits is crucial for both parties involved in the transaction. Additionally, it is important to ensure that the property is free of liens or encumbrances to avoid legal complications.

IRS Guidelines

The IRS provides guidelines regarding the taxation of gifted property. Individuals can gift up to a specified annual exclusion amount without triggering gift tax. For 2023, this amount is set at $17,000 per recipient. Gifts exceeding this limit may require the filing of a gift tax return (Form 709). It is essential to keep accurate records of all transactions and valuations to comply with IRS regulations.

Required documents

When completing the gift property transfer, several documents are necessary to ensure the process is legally sound. Key documents include:

- Gift deed: A legal document that outlines the transfer of property from the giver to the recipient.

- Gift letter: A letter that states the intent to gift the property and confirms that no consideration is exchanged.

- Tax forms: Any relevant IRS forms, such as Form 709, if the gift exceeds the annual exclusion limit.

Form submission methods

Submitting the gift property form can be done through various methods, depending on local regulations. Common submission methods include:

- Online submission: Many states offer online portals for filing property transfer documents.

- Mail: Forms can often be mailed to the appropriate local or state agency.

- In-person: Some jurisdictions may require or allow in-person submissions at designated offices.

Examples of using the gift property

Gift property can be utilized in various scenarios, including:

- Transferring a family home to a child as part of estate planning.

- Gifting a vacation property to relatives for shared use.

- Donating real estate to a charitable organization for tax benefits.

Quick guide on how to complete gift property 497331140

Prepare Gift Property seamlessly on any device

Web-based document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed papers, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the essential tools to create, modify, and eSign your documents swiftly without any hold-ups. Manage Gift Property on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and eSign Gift Property effortlessly

- Locate Gift Property and click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Highlight relevant sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate the worry of missing or lost documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from your chosen device. Edit and eSign Gift Property and ensure smooth communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a gift property and how does it work?

A gift property refers to real estate that is transferred from one person to another without any exchange of money. Using airSlate SignNow, you can easily eSign documents related to the gifting of property, ensuring a smooth and legally binding transfer. This process simplifies the complexities involved in real estate transactions.

-

What are the benefits of using airSlate SignNow for gift property transactions?

AirSlate SignNow provides a user-friendly platform for executing gift property transactions efficiently. It allows for faster document signing, reduces paperwork errors, and ensures compliance with legal requirements. With its digital tools, you can also track document status in real-time.

-

Are there any fees associated with gifting property using airSlate SignNow?

While airSlate SignNow offers a cost-effective solution for eSigning documents, there may be additional fees associated with the actual transfer of gift property, such as taxes or recording fees. Always consult with a legal or financial advisor to understand the full costs involved. Utilizing our platform will save you money on paper and ink costs.

-

Can I integrate airSlate SignNow with other software when handling gift property?

Yes, airSlate SignNow offers various integrations with popular software, enhancing your ability to manage gift property transactions. You can connect with CRM systems, document management tools, and storage solutions to create a streamlined workflow. This makes it easier to track your documents related to gift property.

-

How secure is airSlate SignNow for handling gift property documents?

AirSlate SignNow prioritizes the security of your documents, utilizing advanced encryption protocols for all eSignatures and data handling. When dealing with gift property, you can be assured that your sensitive information remains confidential and protected under stringent security standards. Regular audits further enhance our commitment to safety.

-

What types of documents can I sign relating to gift property?

You can sign various documents related to gift property using airSlate SignNow, including deed transfers, gift letters, and affidavits. Our platform supports multiple file formats, ensuring that you can handle all your documentation needs in one place. This versatility simplifies the gifting process for real estate owners.

-

Is there customer support available for gift property transactions?

Absolutely! AirSlate SignNow provides extensive customer support to assist you with any questions related to gift property transactions. Whether you need help with eSigning or navigating our platform, our dedicated team is here to guide you through the process. You can signNow out via chat, email, or phone.

Get more for Gift Property

- Reporting date annual registration fee form for floridadisaster

- Community service project proposal pdf form

- Collaborative problem solving amp comprehensive evaluation student rating form broward k12 fl

- Palm beach county school district forms

- Orange county public schools student number form

- Student information form pdf

- Georgia state defense force uniform

- Atlanta police department lgbt advisory board consent form i atlantapd

Find out other Gift Property

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed