Notice Default under Form

What is the Notice Default Under

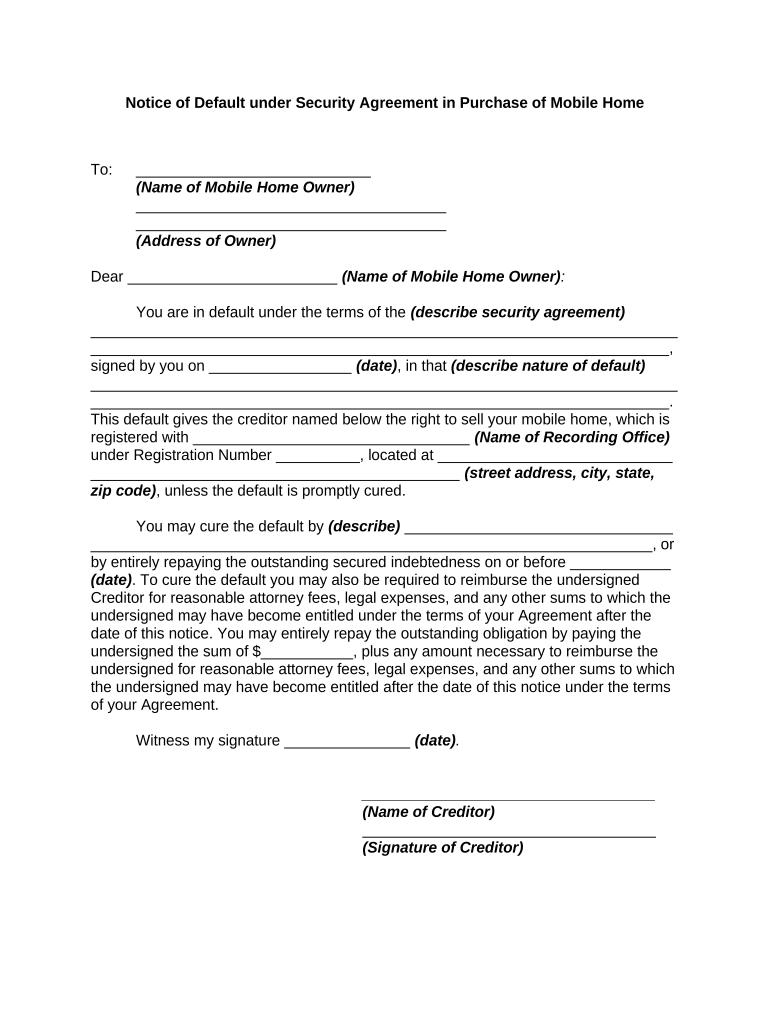

The Notice Default Under is a formal document that notifies a borrower of their failure to meet the obligations outlined in a loan agreement, particularly in the context of mobile home financing. This notice is crucial as it serves as an official warning that the borrower is in default, which could lead to serious consequences, including foreclosure. Understanding the specifics of this notice is essential for both lenders and borrowers to navigate the complexities of mobile home financing.

Key Elements of the Notice Default Under

Several key elements must be included in the Notice Default Under to ensure it is legally binding and clear. These elements typically include:

- Borrower's Information: Full name and contact details of the borrower.

- Lender's Information: Name and address of the lending institution.

- Loan Details: Information about the loan, including the amount borrowed and the terms of the agreement.

- Default Description: A clear explanation of how the borrower has defaulted, including missed payments or other breaches of the agreement.

- Remedy Period: A specified time frame within which the borrower can rectify the default before further action is taken.

Steps to Complete the Notice Default Under

Completing the Notice Default Under involves several important steps to ensure accuracy and compliance with legal standards. The process typically includes:

- Gather Information: Collect all relevant details about the loan and the borrower.

- Draft the Notice: Use clear and concise language to outline the default and include all required elements.

- Review Legal Requirements: Ensure the notice complies with state laws and regulations regarding default notices.

- Send the Notice: Deliver the notice to the borrower using a method that provides proof of receipt, such as certified mail.

Legal Use of the Notice Default Under

The legal use of the Notice Default Under is governed by state laws, which dictate how and when a lender must issue such a notice. It is essential for lenders to adhere to these regulations to avoid potential legal challenges. The notice must be clear and provide the borrower with adequate information about their rights and obligations. Failure to comply with legal requirements can result in delays in the foreclosure process or other legal repercussions.

How to Obtain the Notice Default Under

Obtaining the Notice Default Under can typically be done through several avenues. Borrowers or lenders may access templates online, or they may consult with legal professionals to draft a notice that meets specific legal requirements. Additionally, many state governments provide resources or official forms that can be used to create a compliant notice. It is advisable to ensure that any template used is up-to-date and reflects current laws.

State-Specific Rules for the Notice Default Under

State-specific rules for the Notice Default Under can vary significantly, impacting the content and process of issuing the notice. Each state has its own regulations regarding the timing, delivery method, and required content of the notice. It is important for both lenders and borrowers to familiarize themselves with their state's laws to ensure compliance and to understand their rights and responsibilities in the event of a default.

Quick guide on how to complete notice default under

Complete Notice Default Under seamlessly on any device

Online document management has become widely adopted by businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without delays. Handle Notice Default Under on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

How to alter and eSign Notice Default Under effortlessly

- Obtain Notice Default Under and click on Get Form to begin.

- Utilize the tools at your disposal to complete your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from the device of your choice. Modify and eSign Notice Default Under and guarantee exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a default mobile home and how does it affect my business?

A default mobile home refers to a standard or basic model that provides essential features at an affordable price. Understanding the default mobile home options can help businesses choose a solution that meets their needs without unnecessary extras. This can streamline operations and reduce costs associated with document management and e-signatures.

-

How much does a default mobile home solution cost with airSlate SignNow?

The cost of a default mobile home solution with airSlate SignNow varies depending on the specific features and package chosen. Typically, pricing is structured to be budget-friendly for businesses, allowing for scalable options. You can expect competitive rates that align with standard mobile home solutions in the industry.

-

What features are included in the default mobile home package from airSlate SignNow?

The default mobile home package includes essential features like e-signing, template creation, and document sharing. These tools are designed to enhance workflow efficiency and ensure secure document handling. AirSlate SignNow continuously updates its features to meet user needs and provide a reliable solution.

-

What are the benefits of choosing airSlate SignNow's default mobile home solution?

Choosing the default mobile home solution from airSlate SignNow offers numerous benefits, including ease of use, cost-effectiveness, and efficient document management. Users can quickly send and sign documents from any mobile device, ensuring flexibility for businesses on the go. This solution ultimately enhances productivity and accelerates transaction times.

-

Is airSlate SignNow’s default mobile home solution suitable for small businesses?

Yes, airSlate SignNow's default mobile home solution is particularly well-suited for small businesses looking for affordable, user-friendly document management. The straightforward design and pricing structure cater to startups and small enterprises that require reliable e-signature capabilities without excessive costs. This empowers small businesses to streamline their operations effectively.

-

Can I integrate the default mobile home solution with other applications?

Absolutely! The default mobile home solution from airSlate SignNow offers integration capabilities with various applications such as CRM systems, cloud storage services, and productivity tools. This allows for a seamless workflow and enhances the overall functionality of your document management processes. Integrations help businesses save time and improve efficiency.

-

How secure is the default mobile home solution for handling my documents?

Security is a top priority for airSlate SignNow's default mobile home solution. The platform uses advanced security protocols, including encryption and secure authentication, to protect your documents. With these robust measures in place, businesses can confidently handle sensitive information knowing it is safeguarded against unauthorized access.

Get more for Notice Default Under

Find out other Notice Default Under

- eSign Iowa Standard rental agreement Free

- eSignature Florida Profit Sharing Agreement Template Online

- eSignature Florida Profit Sharing Agreement Template Myself

- eSign Massachusetts Simple rental agreement form Free

- eSign Nebraska Standard residential lease agreement Now

- eSign West Virginia Standard residential lease agreement Mobile

- Can I eSign New Hampshire Tenant lease agreement

- eSign Arkansas Commercial real estate contract Online

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template