Franchise Taxes Form

What is the Franchise Taxes

Franchise taxes are fees imposed by state governments on businesses for the privilege of operating within that state. These taxes are not based on income but rather on a business's net worth, capital stock, or the number of shares issued. The specific structure and rates of franchise taxes can vary significantly from state to state, making it essential for businesses to understand their obligations based on their location.

Key elements of the Franchise Taxes

Understanding the key elements of franchise taxes helps businesses navigate their tax responsibilities effectively. Important components include:

- Tax Base: This can be determined by factors such as total revenue, assets, or the number of shares issued.

- Tax Rate: Each state sets its own tax rate, which can vary based on the business structure and size.

- Filing Requirements: Businesses must file annual reports and pay franchise taxes by specific deadlines to remain compliant.

- Exemptions: Some businesses may qualify for exemptions or reduced rates based on their activities or size.

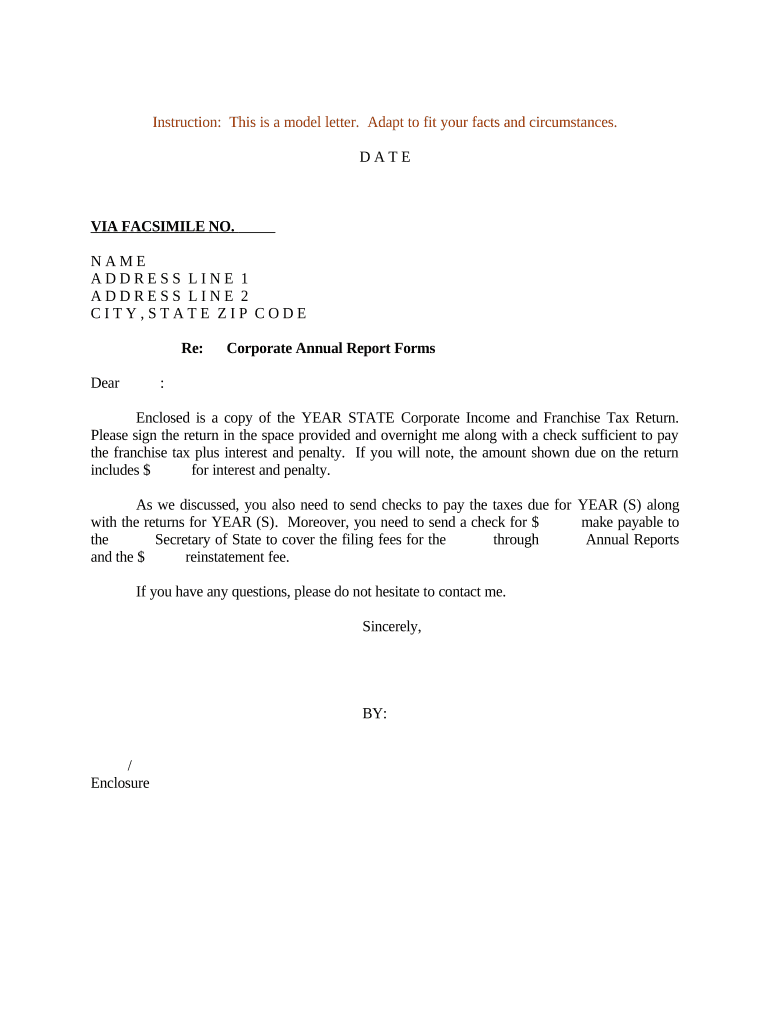

Steps to complete the Franchise Taxes

Completing franchise taxes involves several steps to ensure compliance. Here’s a general outline:

- Determine Tax Liability: Assess your business's tax base according to your state's requirements.

- Gather Required Documents: Collect financial statements, previous tax returns, and any additional documentation needed for accurate reporting.

- Complete the Tax Form: Fill out the appropriate franchise tax form, ensuring all information is accurate and complete.

- Submit the Form: File your completed form either online, by mail, or in person, depending on state regulations.

- Pay the Tax: Ensure payment is made by the deadline to avoid penalties.

Filing Deadlines / Important Dates

Filing deadlines for franchise taxes vary by state, but most require annual filings. Common deadlines include:

- Annual Report Due Dates: Typically coincide with the anniversary of the business's formation or registration.

- Payment Deadlines: Payments are often due on the same date as the annual report.

- Extensions: Some states allow for extensions, but it's crucial to check specific state rules to avoid penalties.

Required Documents

To file franchise taxes accurately, businesses need to prepare several key documents, including:

- Financial Statements: Balance sheets and income statements that reflect the business's financial status.

- Previous Tax Returns: Past filings can provide a reference point for current calculations.

- State-Specific Forms: Each state may have unique forms that must be completed.

Penalties for Non-Compliance

Failure to comply with franchise tax requirements can lead to significant penalties, including:

- Late Fees: Additional charges may accrue if payments are not made on time.

- Interest on Unpaid Taxes: Interest may accumulate on any outstanding balances, increasing the total amount owed.

- Loss of Good Standing: Non-compliance can affect a business's standing with the state, potentially impacting its ability to operate legally.

Quick guide on how to complete franchise taxes

Complete Franchise Taxes seamlessly on any device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents quickly and without holdups. Manage Franchise Taxes on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to edit and eSign Franchise Taxes effortlessly

- Obtain Franchise Taxes and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of your documents or obscure sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searches, or mistakes that require reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Franchise Taxes and ensure smooth communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter payment agreement?

A sample letter payment agreement is a template that outlines the terms and conditions regarding payment between parties. Using airSlate SignNow, you can customize this template to suit your specific needs, ensuring clarity and legal compliance in your transactions.

-

How can airSlate SignNow help me create a sample letter payment agreement?

airSlate SignNow makes it easy to create a sample letter payment agreement by providing customizable templates and an intuitive editing interface. You can quickly fill in the necessary details, ensuring that your agreement reflects the unique terms of your negotiation.

-

Is there a cost to use airSlate SignNow for creating a sample letter payment agreement?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan includes features for creating, sending, and eSigning documents, including the ability to create a sample letter payment agreement efficiently.

-

What features does airSlate SignNow offer for managing sample letter payment agreements?

airSlate SignNow includes features such as document templates, electronic signatures, built-in authentication, and tracking tools, all of which enhance the management of your sample letter payment agreements. These features allow for increased efficiency and security when handling important agreements.

-

Can I integrate airSlate SignNow with other business tools to manage sample letter payment agreements?

Absolutely! airSlate SignNow integrates seamlessly with popular business tools like Google Workspace, Salesforce, and Zapier, allowing you to streamline the creation and management of your sample letter payment agreements. This connectivity enhances productivity and simplifies your workflows.

-

What benefits do I gain from using airSlate SignNow for my sample letter payment agreements?

By using airSlate SignNow for your sample letter payment agreements, you benefit from a cost-effective solution that saves time and reduces paperwork. The platform also enhances security and ensures that your agreements are legally binding with eSignatures.

-

How secure are the agreements signed using airSlate SignNow?

Agreements signed using airSlate SignNow are highly secure, employing encryption and various authentication methods to protect sensitive information. This security ensures that your sample letter payment agreements are safe from unauthorized access and tampering.

Get more for Franchise Taxes

- Bcps field trip permission form rule 6800 form i

- Rule 6800 form g overnight field tripforeign study program

- Student service hours record card form

- Salary review request form baltimore city public schools pcab baltimorecityschools

- Rule 6800 form f baltimore county public schools bcps

- Idexx equine tests form

- Recommended bedbug infestation disclosuredoc form

- Fillable utility bill template form

Find out other Franchise Taxes

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors