Credit Application with Form

What is the credit application with?

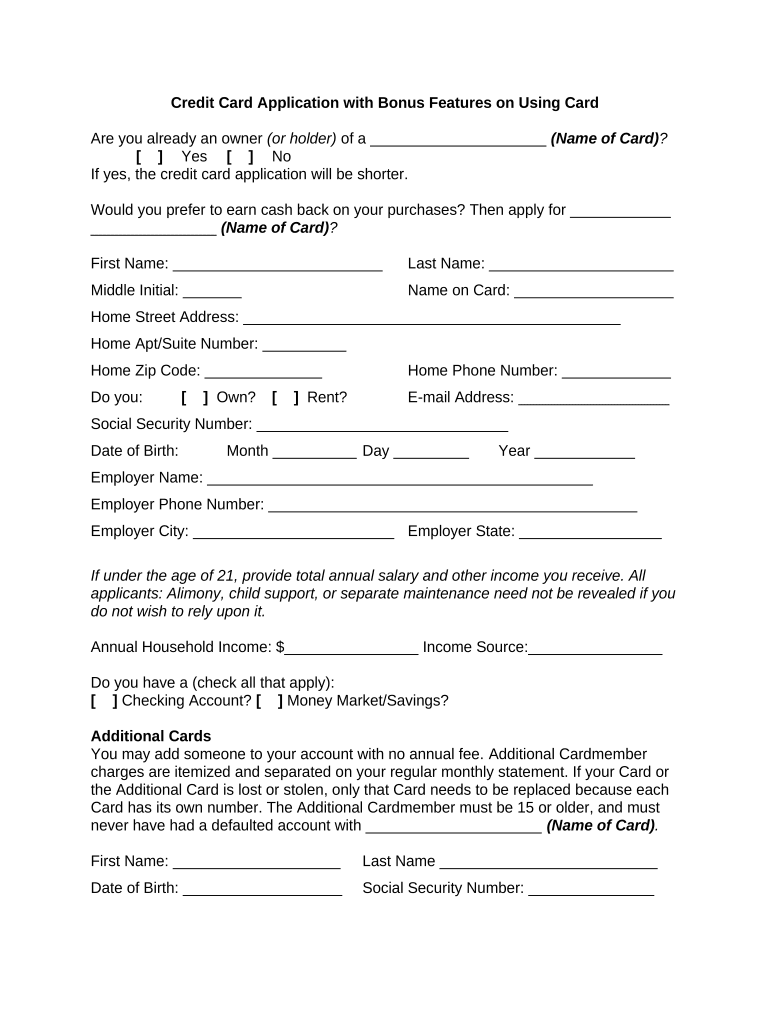

The credit application with form is a crucial document used by individuals and businesses to request credit from lenders or financial institutions. This form typically includes personal and financial information, such as income, employment history, and credit history, which lenders use to assess the applicant's creditworthiness. Understanding the purpose and components of this form is essential for a smooth application process.

Key elements of the credit application with

When completing a credit application with form, several key elements must be included to ensure its validity. These elements typically consist of:

- Personal Information: Full name, address, social security number, and contact details.

- Employment Details: Current employer, job title, length of employment, and income level.

- Financial Information: Monthly expenses, existing debts, and assets.

- Credit History: Previous loans, credit cards, and payment history.

Providing accurate and complete information in these sections is vital for the approval process.

Steps to complete the credit application with

Completing a credit application with form involves several straightforward steps:

- Gather Required Information: Collect all necessary personal, employment, and financial details.

- Fill Out the Form: Carefully enter your information, ensuring accuracy and completeness.

- Review Your Application: Double-check all entries for errors or missing information.

- Submit the Application: Send the completed form to the lender via the chosen method, whether online or by mail.

Following these steps can help streamline the application process and enhance the chances of approval.

Legal use of the credit application with

The credit application with form must comply with various legal standards to be considered valid. In the United States, laws such as the Fair Credit Reporting Act (FCRA) regulate how lenders can use the information provided in the application. Additionally, eSignature laws, like the ESIGN Act and UETA, ensure that electronically signed applications are legally binding. Ensuring compliance with these regulations protects both the applicant and the lender.

How to use the credit application with

Using the credit application with form effectively involves understanding its purpose and how it fits into the broader context of obtaining credit. Applicants should:

- Identify the type of credit being requested, such as personal loans, mortgages, or credit cards.

- Choose a lender that meets their needs and review their specific application requirements.

- Complete the form accurately, providing all requested information to avoid delays.

- Submit the application according to the lender's guidelines, whether electronically or in paper format.

By following these guidelines, applicants can navigate the credit application process with confidence.

Required documents for the credit application with

When submitting a credit application with form, certain documents are often required to support the information provided. Commonly requested documents include:

- Proof of identity, such as a driver's license or passport.

- Recent pay stubs or tax returns to verify income.

- Bank statements to demonstrate financial stability.

- Credit reports, which may be requested by the lender.

Having these documents ready can expedite the application process and improve the likelihood of approval.

Quick guide on how to complete credit application with

Easily Prepare Credit Application With on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the tools to create, modify, and eSign your documents swiftly without delays. Manage Credit Application With on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to Modify and eSign Credit Application With Effortlessly

- Find Credit Application With and click Get Form to initiate the process.

- Use the tools at your disposal to complete your document.

- Emphasize key sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for such tasks.

- Create your eSignature using the Sign function, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of sharing your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Credit Application With to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a credit application with airSlate SignNow?

A credit application with airSlate SignNow is a digital process that allows businesses to easily create, send, and eSign credit applications online. This streamlined approach simplifies the approval process, ensuring that your clients can submit their applications quickly and securely.

-

How does airSlate SignNow benefit businesses using a credit application with?

By using a credit application with airSlate SignNow, businesses can enhance efficiency by reducing paperwork and speeding up processing times. The platform provides a user-friendly interface that fosters better communication with clients, ultimately leading to improved customer satisfaction.

-

What are the pricing options for using a credit application with airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to cater to different business needs when using a credit application with. You can choose from various subscription options that provide features tailored to both small businesses and large enterprises, ensuring you only pay for what you need.

-

Can I customize my credit application with airSlate SignNow?

Yes, you can easily customize your credit application with airSlate SignNow to meet your specific business requirements. The platform allows for the addition or modification of fields, ensuring that the application captures all necessary information in a format that works best for your team.

-

What integration options are available for a credit application with airSlate SignNow?

airSlate SignNow supports various integrations that can enhance your credit application with functionality. You can connect the platform with popular CRMs, accounting software, and other business tools, allowing for seamless data flow and improved operational efficiency.

-

Is it secure to use a credit application with airSlate SignNow?

Absolutely! A credit application with airSlate SignNow includes advanced security features that protect your sensitive data. The platform complies with industry standards and uses encryption to ensure that all documents and signatures are safe from unauthorized access.

-

How can I track the status of my credit application with airSlate SignNow?

You can easily track the status of your credit application with airSlate SignNow through the user dashboard. The platform provides real-time updates on where the application is in the process, allowing you to stay informed and address any issues swiftly.

Get more for Credit Application With

Find out other Credit Application With

- eSignature Colorado Demand for Payment Letter Mobile

- eSignature Colorado Demand for Payment Letter Secure

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile