Buy Sell Agreement Form

What is the Buy Sell Agreement?

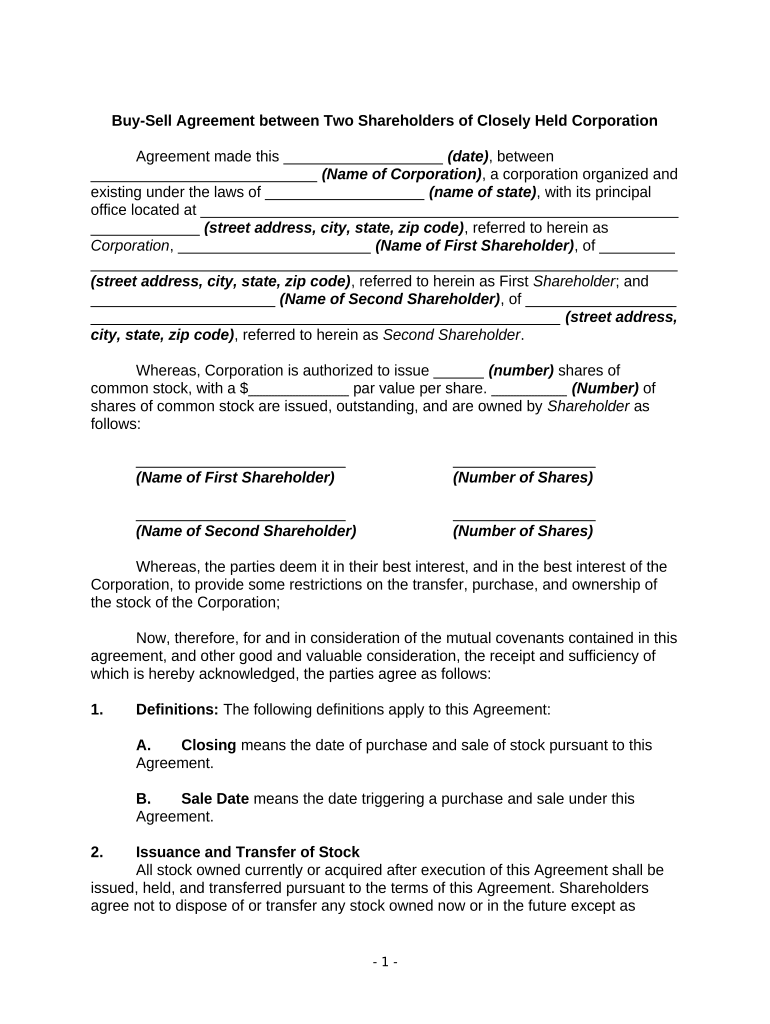

A buy sell agreement is a legally binding contract between shareholders that outlines the terms under which shares can be bought or sold. This agreement is crucial for closely held corporations, as it ensures that the ownership of the company remains within a defined group of individuals. It typically addresses various scenarios, such as the death of a shareholder, retirement, or voluntary exit from the company. By clearly defining the process for transferring shares, the agreement helps prevent disputes and ensures a smooth transition of ownership.

Key Elements of the Buy Sell Agreement

Several key elements should be included in a buy sell shareholders agreement to ensure its effectiveness and clarity. These elements typically encompass:

- Valuation Method: The agreement should specify how the shares will be valued at the time of sale, which could involve a predetermined formula or an independent appraisal.

- Triggering Events: It is essential to outline the events that will trigger the buy sell provisions, such as death, disability, or voluntary resignation of a shareholder.

- Payment Terms: The agreement should detail how and when payment will be made for the shares, including any installment plans or financing options.

- Right of First Refusal: This clause allows existing shareholders to purchase shares before they are offered to outside parties, maintaining control within the group.

Steps to Complete the Buy Sell Agreement

Completing a buy sell agreement involves several important steps to ensure that it is thorough and legally binding. These steps include:

- Consultation with Legal Advisors: Engage with legal professionals who specialize in corporate law to draft or review the agreement.

- Identify Shareholders: List all current shareholders and their respective ownership percentages to ensure clarity in the agreement.

- Define Terms: Clearly outline the terms of the agreement, including valuation methods, triggering events, and payment terms.

- Review and Revise: Allow all shareholders to review the draft and suggest revisions to ensure mutual understanding and agreement.

- Sign and Notarize: Once all parties agree on the terms, the document should be signed and, if necessary, notarized to enhance its legal standing.

Legal Use of the Buy Sell Agreement

The legal use of a buy sell agreement is paramount in protecting the interests of shareholders and the business. This agreement is recognized under U.S. law, provided it meets specific legal requirements. It serves as a binding document that can be enforced in court, ensuring that the terms are upheld in the event of a dispute. Additionally, compliance with relevant state laws and regulations is essential to maintain the agreement's validity.

How to Use the Buy Sell Agreement

Using a buy sell agreement effectively involves understanding its provisions and applying them when necessary. Shareholders should refer to the agreement during significant events such as a shareholder's death or decision to sell their shares. The agreement provides a roadmap for executing these transactions, ensuring that all parties follow the established procedures. Regularly reviewing and updating the agreement is also important to reflect any changes in ownership or business structure.

Examples of Using the Buy Sell Agreement

Real-world scenarios illustrate the importance of a buy sell agreement. For instance, if a shareholder passes away, the agreement dictates how their shares are to be valued and transferred to the remaining shareholders. Another example is when a shareholder wishes to retire; the agreement outlines the process for selling their shares back to the company or to other shareholders. These examples highlight how the agreement serves as a crucial tool for maintaining stability in a closely held corporation.

Quick guide on how to complete buy sell agreement 497331620

Effortlessly Prepare Buy Sell Agreement on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to access the necessary forms and securely store them online. airSlate SignNow provides all the tools you need to swiftly create, modify, and eSign your documents without delays. Access Buy Sell Agreement on any device using the airSlate SignNow Android or iOS applications and enhance your document-related processes today.

Modifying and eSigning Buy Sell Agreement with Ease

- Find Buy Sell Agreement and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight important sections of the documents or obscure sensitive information using the tools that airSlate SignNow specifically offers for this purpose.

- Create your signature with the Sign feature, which only takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method for delivering your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate issues with lost or mislaid files, tedious form searches, or mistakes that require printing new copies of documents. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Buy Sell Agreement to ensure excellent communication at any stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a buy sell agreement shareholders?

A buy sell agreement shareholders is a legally binding contract that outlines how shares of a company will be bought and sold among shareholders. This agreement helps maintain smooth ownership transitions and protects the interests of all parties involved. By having a buy sell agreement shareholders in place, businesses can prevent disputes and ensure an orderly process during ownership changes.

-

Why should I have a buy sell agreement shareholders?

Having a buy sell agreement shareholders is crucial for managing the sale and transfer of shares, especially in the event of a shareholder's departure, death, or disability. This agreement establishes clear terms and conditions that facilitate fair transactions and avoid potential conflicts among shareholders. Thus, ensuring business continuity and clarity in ownership matters.

-

How much does it cost to implement a buy sell agreement shareholders?

The cost of implementing a buy sell agreement shareholders can vary based on complexity and customization needs. Generally, businesses can expect to pay for legal consultations, document preparation, and potential revisions. Investing in a buy sell agreement shareholders can save companies signNow costs in the long run by minimizing conflicts and legal disputes.

-

What features should I look for in a buy sell agreement shareholders template?

When choosing a buy sell agreement shareholders template, look for features that include clear definitions of triggering events, valuation methods for shares, and payment terms. Additionally, ensure that it includes clauses for dispute resolution and complies with local laws. A well-structured template provides a solid foundation for your buy sell agreement shareholders.

-

Can I customize my buy sell agreement shareholders?

Yes, you can customize your buy sell agreement shareholders to fit the specific needs and dynamics of your business. It’s crucial to tailor the agreement to reflect your company's goals, shareholder relationships, and particular circumstances. Consult with a legal expert to ensure that your customized buy sell agreement shareholders is comprehensive and effective.

-

What are the benefits of using airSlate SignNow for my buy sell agreement shareholders?

Using airSlate SignNow for your buy sell agreement shareholders simplifies the process of drafting, signing, and managing the agreement electronically. The platform offers ease of use, cost-effectiveness, and secure storage for all your important documents. This ensures that your buy sell agreement shareholders is accessible and safely stored, streamlining the workflow.

-

How can airSlate SignNow integrate with my existing tools for managing a buy sell agreement shareholders?

airSlate SignNow provides integrations with a wide range of business applications, making it easy to incorporate your buy sell agreement shareholders into existing workflows. Whether you use CRM systems, accounting software, or email platforms, airSlate SignNow ensures that your documents can be managed seamlessly across different tools. This enhances productivity and simplifies management.

Get more for Buy Sell Agreement

- Fillable online environmental rule adoptionamendment form

- Was8 form 2019

- 2014 2019 form nd sfn 58701 fill online printable fillable

- Ms004 form

- Entity name give the exact name of the llc foreign llcs give name in domicile state or country form

- Annexe a antecedents declaration canada form

- Ap led lightingled outdoor lighting ampamp accessories form

- Letter of authorization service ontario form

Find out other Buy Sell Agreement

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed