Creditor Debt Form

What is creditor debt?

Creditor debt refers to the amount of money that a debtor owes to a creditor. This debt can arise from various financial transactions, including loans, credit card purchases, or other forms of credit extended by a lender. Understanding creditor debt is essential for both individuals and businesses, as it impacts financial health, credit scores, and the ability to secure future financing. It is crucial to differentiate between secured and unsecured creditor debts, as secured debts are backed by collateral, while unsecured debts are not.

Key elements of creditor debt

Several key elements define creditor debt:

- Principal Amount: This is the original sum of money borrowed or owed, excluding interest and fees.

- Interest Rate: This is the cost of borrowing, expressed as a percentage of the principal amount, which can be fixed or variable.

- Payment Terms: These are the conditions under which the debt must be repaid, including the payment schedule and any penalties for late payments.

- Collateral: For secured debts, collateral is an asset pledged by the debtor that the creditor can claim if the debt is not repaid.

- Credit Terms: These outline the conditions under which credit is extended, including limits on borrowing and repayment expectations.

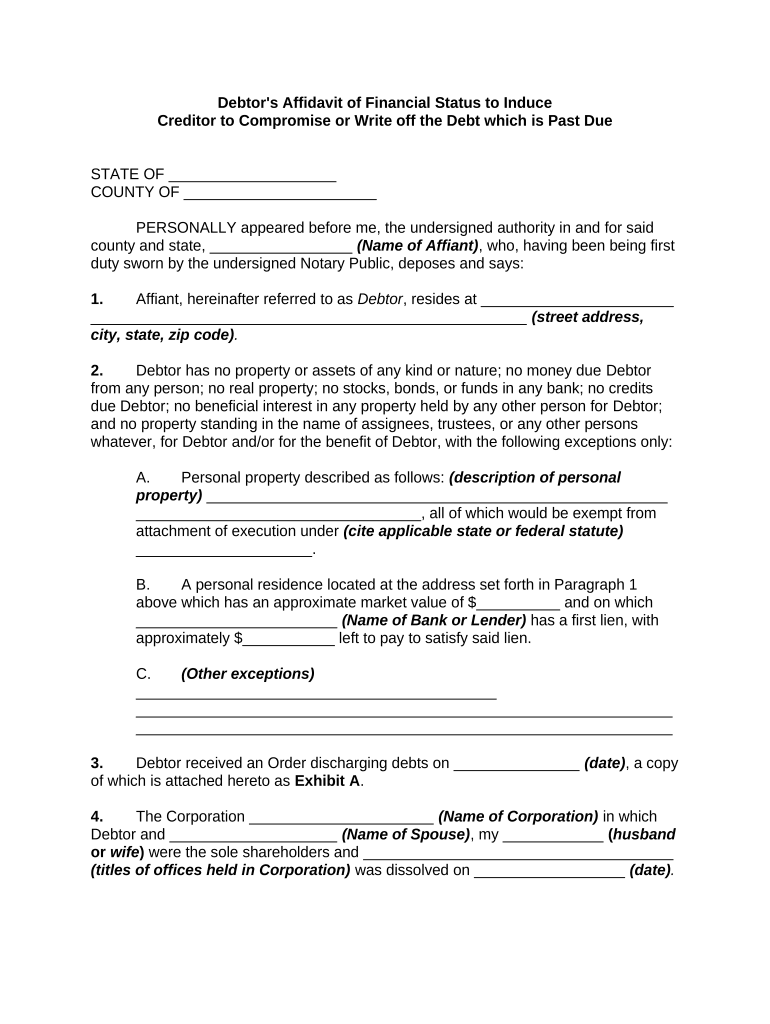

Steps to complete the debtor form

Completing a debtor form involves several steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary personal and financial information, including identification, income details, and outstanding debts.

- Fill Out the Form: Accurately enter the information into the debtor form, ensuring that all fields are completed as required.

- Review for Accuracy: Double-check all entries for accuracy to avoid discrepancies that could lead to complications.

- Sign and Date: Provide your signature and the date to validate the form. This step is crucial for legal compliance.

- Submit the Form: Follow the specified submission method, whether online, by mail, or in person, to ensure the form is received by the appropriate party.

Legal use of creditor debt

The legal use of creditor debt involves adhering to regulations that govern lending and borrowing practices. Creditors must comply with the Fair Debt Collection Practices Act (FDCPA), which protects consumers from abusive debt collection practices. Additionally, creditors have the right to pursue legal action to recover debts, which may involve filing a lawsuit or obtaining a judgment against the debtor. Understanding these legal frameworks is vital for both creditors and debtors to navigate their rights and responsibilities effectively.

Examples of using creditor debt

Creditor debt can manifest in various scenarios, including:

- Personal Loans: Individuals may take out personal loans for various purposes, such as home improvements or medical expenses.

- Credit Cards: Consumers often use credit cards to make purchases, leading to revolving debt that must be managed carefully.

- Business Financing: Companies may incur creditor debt through loans or lines of credit to fund operations or expansion efforts.

- Mortgages: Homebuyers typically incur significant creditor debt when purchasing property through mortgage loans.

State-specific rules for creditor debt

Each state in the U.S. has its own regulations regarding creditor debt, which can affect interest rates, collection practices, and bankruptcy laws. For instance, some states may impose limits on the interest rates that creditors can charge, while others may have specific procedures for debt collection. It is important for both creditors and debtors to understand their state's laws to ensure compliance and protect their rights. Consulting with a legal professional can provide clarity on these regulations.

Quick guide on how to complete creditor debt 497331643

Complete Creditor Debt seamlessly on any device

Digital document management has gained traction among companies and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, enabling you to access the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents promptly without interruptions. Manage Creditor Debt on any device using airSlate SignNow Android or iOS applications and streamline any document-related procedure today.

How to edit and eSign Creditor Debt effortlessly

- Locate Creditor Debt and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your updates.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your preference. Edit and eSign Creditor Debt to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a debtor form in airSlate SignNow?

A debtor form in airSlate SignNow is a digital document that allows businesses to formalize agreements with debtors. It facilitates the collection of necessary information and signatures securely and efficiently. This means you can manage debtor agreements without the hassle of paperwork.

-

How can I create a debtor form using airSlate SignNow?

Creating a debtor form with airSlate SignNow is simple and straightforward. You can use our template library or create a custom form from scratch. The intuitive interface allows you to add fields, specify signer roles, and customize the design to fit your branding.

-

What are the benefits of using an electronic debtor form?

Using an electronic debtor form offers numerous benefits, including faster processing times and reduced paperwork. airSlate SignNow ensures real-time tracking of document status, enhancing communication with debtors. Plus, it's a cost-effective solution that minimizes overhead costs associated with traditional paperwork.

-

Is airSlate SignNow secure for handling debtor forms?

Yes, airSlate SignNow employs robust security measures to protect your debtor forms and sensitive information. We use encryption, advanced authentication processes, and comply with industry standards. You can confidently manage your documents knowing that they are secure.

-

Are there any integrations available for debtor forms?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, helping you streamline your workflow. Whether you're using CRM systems or project management tools, you can easily incorporate debtor forms into your existing processes.

-

What pricing plans are available for using debtor forms?

airSlate SignNow offers flexible pricing plans that accommodate businesses of all sizes. Depending on your needs, you can choose a plan that includes the features for creating and managing debtor forms. Trial options are also available, allowing you to explore the solution before making a commitment.

-

Can I use debtor forms on mobile devices?

Yes, airSlate SignNow makes it easy to use debtor forms on mobile devices. Our platform is fully responsive, allowing you to create, send, and sign forms from your smartphone or tablet. This ensures that your document management is accessible, no matter where you are.

Get more for Creditor Debt

Find out other Creditor Debt

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast