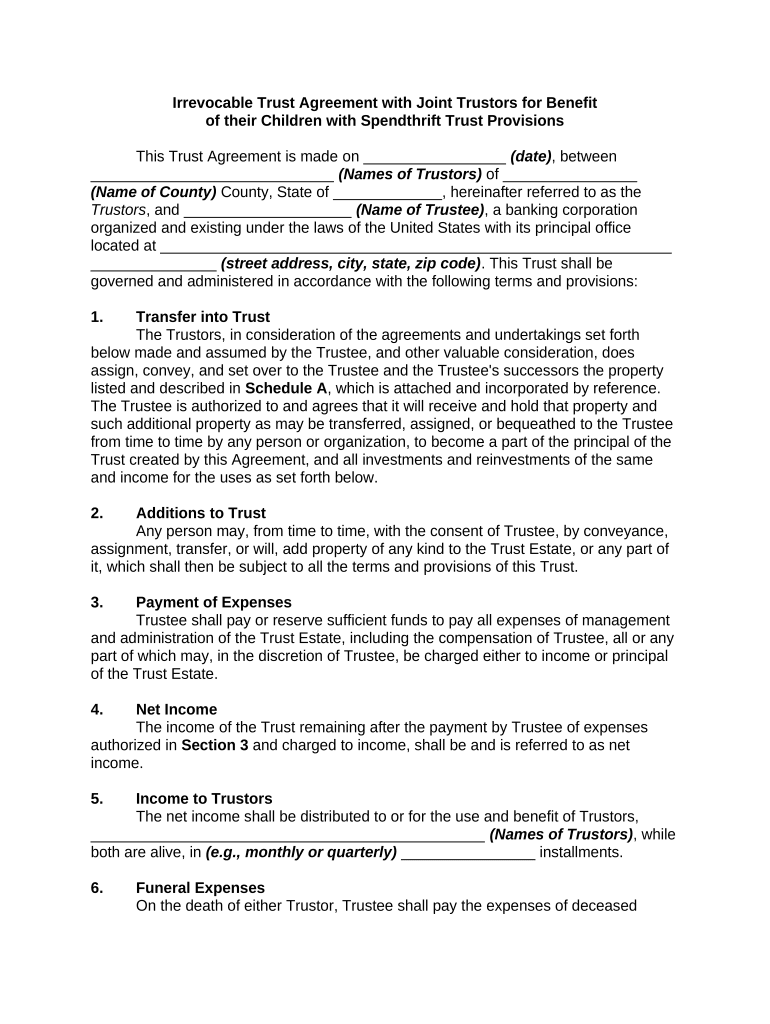

Irrevocable Trust Spendthrift Form

What is the irrevocable trust spendthrift?

An irrevocable trust spendthrift is a specific type of trust designed to protect the assets placed within it from creditors while providing beneficiaries with controlled access to those assets. Once established, the grantor cannot modify or terminate the trust without the consent of the beneficiaries. This type of trust is particularly beneficial for individuals who want to ensure that their assets are managed responsibly and safeguarded against potential financial mismanagement or legal claims.

Key elements of the irrevocable trust spendthrift

Several key elements define an irrevocable trust spendthrift, making it a unique financial tool:

- Asset Protection: The assets in the trust are shielded from creditors, ensuring that beneficiaries cannot lose their inheritance due to personal debts.

- Controlled Distributions: The trust can dictate how and when beneficiaries receive distributions, promoting responsible financial behavior.

- Irrevocability: Once the trust is established, the grantor relinquishes control, making it crucial to consider all aspects before creation.

- Tax Implications: The trust may have specific tax benefits or obligations that should be understood prior to formation.

How to use the irrevocable trust spendthrift

Using an irrevocable trust spendthrift involves several steps to ensure proper setup and compliance with legal requirements:

- Consult a Legal Professional: Engage with an estate planning attorney to discuss your objectives and ensure the trust aligns with your goals.

- Draft the Trust Document: Work with your attorney to create a comprehensive trust document that outlines the terms, beneficiaries, and trustee responsibilities.

- Fund the Trust: Transfer assets into the trust, which may include cash, real estate, or investments, ensuring that all assets are properly titled in the name of the trust.

- Manage the Trust: The appointed trustee will manage the assets according to the terms of the trust, making distributions as specified.

Steps to complete the irrevocable trust spendthrift

Completing an irrevocable trust spendthrift involves a systematic approach:

- Identify the assets you wish to place in the trust.

- Choose a reliable trustee who will manage the trust responsibly.

- Draft the trust agreement with the help of a qualified attorney.

- Sign the trust document in accordance with state laws, ensuring all necessary witnesses are present.

- Fund the trust by transferring ownership of the assets to the trust.

Legal use of the irrevocable trust spendthrift

The legal use of an irrevocable trust spendthrift is governed by state laws, which may vary significantly. It is essential to understand the legal framework in your state to ensure compliance. The trust must be established with clear terms and must adhere to the requirements for irrevocability. Additionally, the trust must be properly funded and managed according to its provisions to maintain its legal standing and benefits.

Eligibility criteria

To establish an irrevocable trust spendthrift, certain eligibility criteria must be met:

- The grantor must be of legal age and mentally competent to create the trust.

- Assets transferred into the trust must be legally owned by the grantor.

- The trust must have identifiable beneficiaries who will receive the benefits of the trust.

- The trust must comply with state-specific laws regarding irrevocable trusts.

Quick guide on how to complete irrevocable trust spendthrift 497331656

Effortlessly Prepare Irrevocable Trust Spendthrift on Any Device

Online document management has gained traction among organizations and individuals alike. It serves as an ideal green alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents rapidly without holdups. Manage Irrevocable Trust Spendthrift on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and eSign Irrevocable Trust Spendthrift with Ease

- Find Irrevocable Trust Spendthrift and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you prefer to send your form: via email, SMS, or invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious form searches, or errors requiring the printing of new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Edit and eSign Irrevocable Trust Spendthrift to ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an irrevocable trust benefit?

An irrevocable trust benefit refers to the advantages afforded to the grantor and beneficiaries when an irrevocable trust is established. This type of trust offers benefits such as asset protection, tax advantages, and avoidance of probate, ensuring that the intended heirs receive their inheritance without interference.

-

How does using airSlate SignNow enhance the management of irrevocable trust documents?

Using airSlate SignNow streamlines the process of managing irrevocable trust documents through efficient eSigning and secure document sharing. This ensures that all parties can access and sign crucial paperwork quickly, helping to maintain the integrity and benefits of the irrevocable trust.

-

What are the pricing options for airSlate SignNow for managing irrevocable trust benefits?

airSlate SignNow offers flexible pricing plans that cater to various business needs, making it an accessible tool for managing irrevocable trust benefits. Depending on your required features, you can choose from several tiers, each designed to provide value while simplifying document management and eSigning.

-

Can airSlate SignNow integrate with other software for irrevocable trust administration?

Yes, airSlate SignNow integrates seamlessly with various software solutions, enhancing your ability to manage irrevocable trust benefits efficiently. Integrations with CRM systems, cloud storage, and accounting software improve workflow and ensure that your documents are always organized and readily available.

-

What key features should I look for when managing irrevocable trust benefits using airSlate SignNow?

When managing irrevocable trust benefits with airSlate SignNow, key features to look for include secure eSigning, customizable templates, and robust compliance with legal standards. These features ensure that your irrevocable trust documents are handled professionally and securely.

-

Are there any legal considerations I should be aware of concerning irrevocable trust benefits?

Yes, it's essential to understand legal considerations when establishing irrevocable trust benefits. Consult with legal experts to ensure that your trust complies with state laws and that all documents are processed correctly to uphold the trust’s terms.

-

How can airSlate SignNow help reduce costs associated with managing irrevocable trust benefits?

airSlate SignNow helps reduce costs associated with managing irrevocable trust benefits by providing an affordable eSigning solution that minimizes paper usage and administrative overhead. Streamlined workflows can save both time and money, making it a cost-effective choice for managing trusts.

Get more for Irrevocable Trust Spendthrift

- Atlanta metropolitan college form

- Valencia college transcript form

- Professional references form macomb community college macomb

- 2 research participant payment mou form university of maryland umresearch umd

- Onlinesocc form

- Cornell finaid application certification form

- University of massachusetts trademark and licensing form

- Rutgers sebs form

Find out other Irrevocable Trust Spendthrift

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online