West Shore Tax Bureau Online Form

What is the West Shore Tax Bureau Online

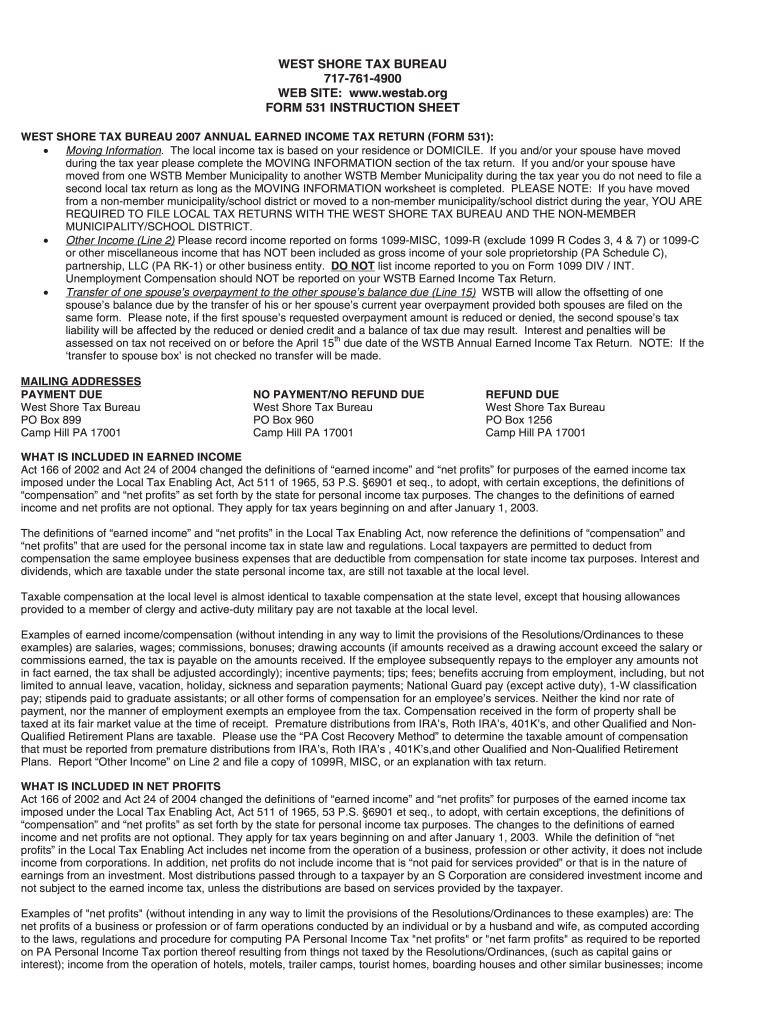

The West Shore Tax Bureau Online is a digital platform designed to facilitate the management and submission of local tax forms for residents of Mechanicsburg, Pennsylvania, and surrounding areas. This online resource allows taxpayers to access necessary forms, including the West Shore tax form and Form 531, and provides essential information regarding local income tax requirements. The platform aims to streamline the tax filing process, making it more efficient and user-friendly.

How to use the West Shore Tax Bureau Online

Using the West Shore Tax Bureau Online is straightforward. Taxpayers can visit the official website to access various forms and resources. Users can fill out forms digitally, ensuring that all required information is accurately entered. The platform supports eSigning, allowing individuals to sign documents electronically, which simplifies the submission process. After completing the necessary forms, users can submit them directly through the online portal, ensuring timely processing.

Steps to complete the West Shore Tax Bureau Online

To complete the West Shore Tax Bureau Online forms, follow these steps:

- Visit the West Shore Tax Bureau Online website.

- Select the appropriate tax form, such as Form 531 or the local income tax form.

- Fill out the form with accurate personal and financial information.

- Review the completed form for any errors or omissions.

- Use the eSignature feature to sign the form electronically.

- Submit the form through the online portal.

Required Documents

When using the West Shore Tax Bureau Online, certain documents are typically required to complete the tax forms. These may include:

- Your Social Security number or taxpayer identification number.

- Income statements, such as W-2 forms or 1099 forms.

- Documentation for any deductions or credits you plan to claim.

- Previous year’s tax return for reference.

Having these documents ready can help ensure a smooth and efficient filing process.

Form Submission Methods

The West Shore Tax Bureau Online offers multiple submission methods for tax forms. Taxpayers can choose to:

- Submit forms electronically through the online portal.

- Print completed forms and mail them to the West Shore Tax Bureau.

- Visit the bureau in person to submit forms directly.

Each method has its advantages, but electronic submission is often the fastest and most efficient option.

Penalties for Non-Compliance

Failure to comply with local tax regulations can result in penalties. Taxpayers who do not file their forms on time may face fines or interest on unpaid taxes. It is essential to be aware of deadlines and ensure that all forms are submitted accurately to avoid these consequences. The West Shore Tax Bureau provides guidelines to help taxpayers understand their obligations and the importance of timely filing.

Quick guide on how to complete west shore tax bureau 717 761 4900 form 531 instruction sheet

Your assistance manual on how to prepare your West Shore Tax Bureau Online

If you’re curious about how to generate and submit your West Shore Tax Bureau Online, here are some brief guidelines on how to simplify tax processing signNowly.

To begin, you just need to establish your airSlate SignNow profile to revolutionize how you manage documents online. airSlate SignNow is an exceptionally user-friendly and powerful document solution that empowers you to modify, draft, and finalize your tax forms effortlessly. With its editor, you can alternate between text, checkboxes, and eSignatures and revisit to adjust answers as necessary. Enhance your tax administration with advanced PDF editing, eSigning, and convenient sharing.

Follow the steps outlined below to complete your West Shore Tax Bureau Online in no time:

- Create your account and start working on PDFs within moments.

- Utilize our directory to obtain any IRS tax form; browse through versions and schedules.

- Click Get form to access your West Shore Tax Bureau Online in our editor.

- Complete the necessary fillable fields with your information (text, numbers, checkmarks).

- Employ the Sign Tool to insert your legally-recognized eSignature (if necessary).

- Review your document and correct any mistakes.

- Preserve changes, print your copy, submit it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Keep in mind that filing on paper can increase return errors and delay refunds. It’s essential to check the IRS website for filing regulations in your state before e-filing your taxes.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the west shore tax bureau 717 761 4900 form 531 instruction sheet

How to create an electronic signature for your West Shore Tax Bureau 717 761 4900 Form 531 Instruction Sheet online

How to generate an eSignature for your West Shore Tax Bureau 717 761 4900 Form 531 Instruction Sheet in Chrome

How to generate an eSignature for putting it on the West Shore Tax Bureau 717 761 4900 Form 531 Instruction Sheet in Gmail

How to make an electronic signature for the West Shore Tax Bureau 717 761 4900 Form 531 Instruction Sheet straight from your smart phone

How to generate an electronic signature for the West Shore Tax Bureau 717 761 4900 Form 531 Instruction Sheet on iOS

How to generate an electronic signature for the West Shore Tax Bureau 717 761 4900 Form 531 Instruction Sheet on Android devices

People also ask

-

What services does the West Shore Tax Bureau provide?

The West Shore Tax Bureau offers a variety of tax-related services, including property tax assessment and collection. They help residents understand their tax obligations and provide support for any queries regarding tax payments and procedures.

-

How does airSlate SignNow integrate with West Shore Tax Bureau services?

airSlate SignNow can streamline your interactions with the West Shore Tax Bureau by allowing you to electronically sign and send essential documents securely. This integration simplifies the paperwork process, making it easier to manage tax-related documents and communications.

-

What are the pricing options for airSlate SignNow when working with the West Shore Tax Bureau?

Pricing for airSlate SignNow is competitive and varies based on the plan you choose. Whether you're an individual taxpayer or a business, you can find a plan that fits your needs while ensuring seamless communication with the West Shore Tax Bureau.

-

Are there any specific features of airSlate SignNow that benefit users interacting with the West Shore Tax Bureau?

Yes, airSlate SignNow provides features like custom templates, real-time tracking of document status, and mobile accessibility. These features ensure that users can efficiently manage their tax documents required by the West Shore Tax Bureau, minimizing delays during tax season.

-

How can airSlate SignNow help with tax documentation for the West Shore Tax Bureau?

airSlate SignNow simplifies tax documentation by allowing users to create, sign, and store important forms securely. This can be especially beneficial for individuals dealing with the West Shore Tax Bureau, as it helps maintain accurate records and comply with filing deadlines.

-

Is there customer support available for users of airSlate SignNow related to West Shore Tax Bureau inquiries?

Absolutely! airSlate SignNow offers robust customer support to assist users with any questions or issues that may arise, including those related to the West Shore Tax Bureau. Our support team is dedicated to helping you navigate tax processes efficiently.

-

What benefits do businesses gain by using airSlate SignNow in relation to the West Shore Tax Bureau?

Businesses gain signNow efficiency by using airSlate SignNow to manage documents for the West Shore Tax Bureau. The ease of eSigning and document sharing ensures timely submissions, reduces paper waste, and enhances compliance with tax regulations.

Get more for West Shore Tax Bureau Online

- Legal documents for the guardian of a minor package maryland form

- New state resident package maryland form

- Commercial property sales package maryland form

- General partnership package maryland form

- Maryland directive form

- Contract for deed package maryland form

- Md statutory form

- Power of attorney forms package maryland

Find out other West Shore Tax Bureau Online

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed