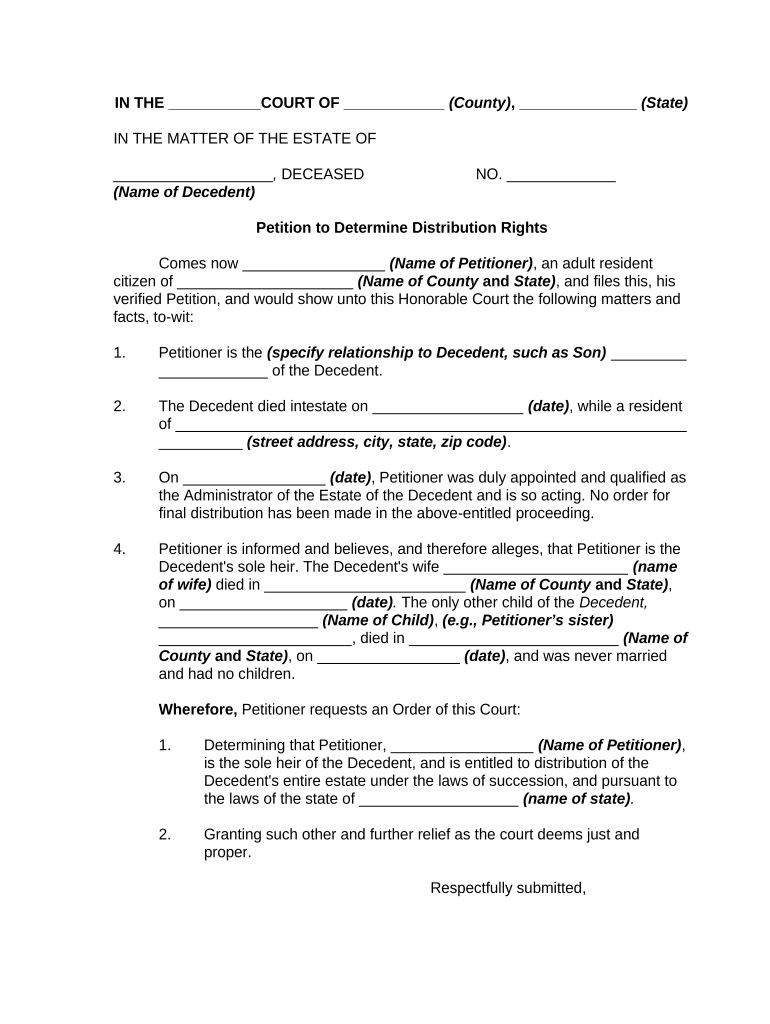

Distribution Assets Form

What is the Distribution Assets

The term "distribution assets" refers to the various properties and financial interests that are allocated to beneficiaries following the passing of a decedent. These assets can include real estate, bank accounts, investments, and personal belongings. Understanding distribution assets is crucial for beneficiaries to ensure they receive their rightful share according to the decedent's wishes, as outlined in a will or trust. The process of distributing these assets must comply with relevant state laws and legal frameworks to ensure that all parties are treated fairly and equitably.

How to use the Distribution Assets

Using distribution assets effectively involves understanding the legal processes and requirements for claiming these assets. Beneficiaries should first review the decedent's will or trust document to identify their entitlements. Next, they may need to engage with an estate executor or administrator to facilitate the transfer of assets. Depending on the type of assets involved, beneficiaries might need to complete specific forms or provide documentation to prove their identity and relationship to the decedent. Utilizing a reliable digital platform for document signing can streamline this process, ensuring that all necessary paperwork is completed accurately and efficiently.

Steps to complete the Distribution Assets

Completing the distribution of assets typically involves several key steps:

- Review the decedent's will or trust to understand asset distribution.

- Identify the executor or administrator responsible for managing the estate.

- Gather necessary documentation, such as the death certificate and identification.

- Complete any required forms related to the distribution of assets.

- Submit the forms to the appropriate legal authority or estate executor.

- Receive confirmation of asset distribution and ensure proper transfer of ownership.

Legal use of the Distribution Assets

The legal use of distribution assets is governed by state laws and regulations. Beneficiaries must ensure that the distribution process adheres to these legal frameworks to avoid potential disputes or penalties. This includes understanding the rights of beneficiaries, the role of the executor, and any obligations related to taxes or debts associated with the estate. Engaging with legal professionals can provide clarity on these matters, ensuring that all actions taken are compliant with the law and that beneficiaries' rights are protected.

Required Documents

To facilitate the distribution of assets, several key documents are typically required:

- The decedent's will or trust document.

- A certified copy of the death certificate.

- Identification for all beneficiaries.

- Any court documents related to the probate process, if applicable.

- Documentation of assets, including titles, bank statements, and investment records.

Form Submission Methods

Distribution assets may require various forms to be submitted through different methods. Common submission methods include:

- Online submission via designated state or county websites.

- Mailing forms to the appropriate probate court or estate office.

- In-person submission at local government offices or court locations.

Quick guide on how to complete distribution assets 497331744

Complete Distribution Assets seamlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers a fantastic environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely keep it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any holdups. Manage Distribution Assets on any device using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

The easiest way to alter and eSign Distribution Assets with ease

- Locate Distribution Assets and click on Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or obscure sensitive information with tools designed by airSlate SignNow specifically for this purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all details and click on the Done button to save your changes.

- Select how you wish to send your form, whether via email, text message (SMS), or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, time-consuming form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and eSign Distribution Assets and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are distribution assets and how can airSlate SignNow help with them?

Distribution assets refer to resources that are used to manage the distribution of products or services. airSlate SignNow provides a seamless platform for businesses to manage these assets by enabling efficient document creation, signing, and tracking, which enhances overall distribution processes.

-

How does airSlate SignNow improve the management of distribution assets?

By utilizing airSlate SignNow, companies can streamline their document workflows related to distribution assets. The platform allows for quick eSigning, reducing the time taken to approve and distribute important documents, ultimately improving the efficiency of asset management.

-

Is airSlate SignNow a cost-effective solution for small businesses managing distribution assets?

Yes, airSlate SignNow is designed to be a cost-effective solution tailored for businesses of all sizes, including small businesses managing distribution assets. With competitive pricing plans, companies can harness the power of electronic signing without breaking the bank.

-

Can airSlate SignNow integrate with other tools for managing distribution assets?

Absolutely! airSlate SignNow offers integrations with various software applications that assist in managing distribution assets. This includes CRM systems, project management tools, and more, allowing for a cohesive ecosystem that enhances productivity.

-

What are some key features of airSlate SignNow that benefit distribution asset management?

Key features of airSlate SignNow include customizable eSigning workflows, templates for common documents, and tracking capabilities that keep you informed on the status of your distribution assets. These features help businesses maintain control and oversight of their documents.

-

How can I ensure the security of documents related to distribution assets in airSlate SignNow?

airSlate SignNow prioritizes document security by employing advanced encryption methods and secure cloud storage. This ensures that all documents related to distribution assets are kept confidential and protected from unauthorized access.

-

What benefits does airSlate SignNow offer for remote teams managing distribution assets?

For remote teams, airSlate SignNow provides a user-friendly interface that allows users to access and sign documents from anywhere. This facilitates real-time collaboration on distribution assets, ensuring that project timelines are met even when teams are geographically dispersed.

Get more for Distribution Assets

- Ar 25 50 sample memoampquot keyword found websites listing form

- Ngb wtc form 100 ampquotarmy national guard warrior training

- Dph 11 004 oal approval california department of public form

- Authorization washington state department of social and form

- Health insurance transaction form ps 404

- Iscissa illinois department of human services form

- Uniform disclosure statement assisted livingresidential care facility

- Form db 681 ampquotself insurers annual report for calendar year

Find out other Distribution Assets

- eSignature Tennessee Construction Contract Safe

- eSignature West Virginia Construction Lease Agreement Myself

- How To eSignature Alabama Education POA

- How To eSignature California Education Separation Agreement

- eSignature Arizona Education POA Simple

- eSignature Idaho Education Lease Termination Letter Secure

- eSignature Colorado Doctors Business Letter Template Now

- eSignature Iowa Education Last Will And Testament Computer

- How To eSignature Iowa Doctors Business Letter Template

- Help Me With eSignature Indiana Doctors Notice To Quit

- eSignature Ohio Education Purchase Order Template Easy

- eSignature South Dakota Education Confidentiality Agreement Later

- eSignature South Carolina Education Executive Summary Template Easy

- eSignature Michigan Doctors Living Will Simple

- How Do I eSignature Michigan Doctors LLC Operating Agreement

- How To eSignature Vermont Education Residential Lease Agreement

- eSignature Alabama Finance & Tax Accounting Quitclaim Deed Easy

- eSignature West Virginia Education Quitclaim Deed Fast

- eSignature Washington Education Lease Agreement Form Later

- eSignature Missouri Doctors Residential Lease Agreement Fast