Beneficiary Estate Form

What is the Beneficiary Estate

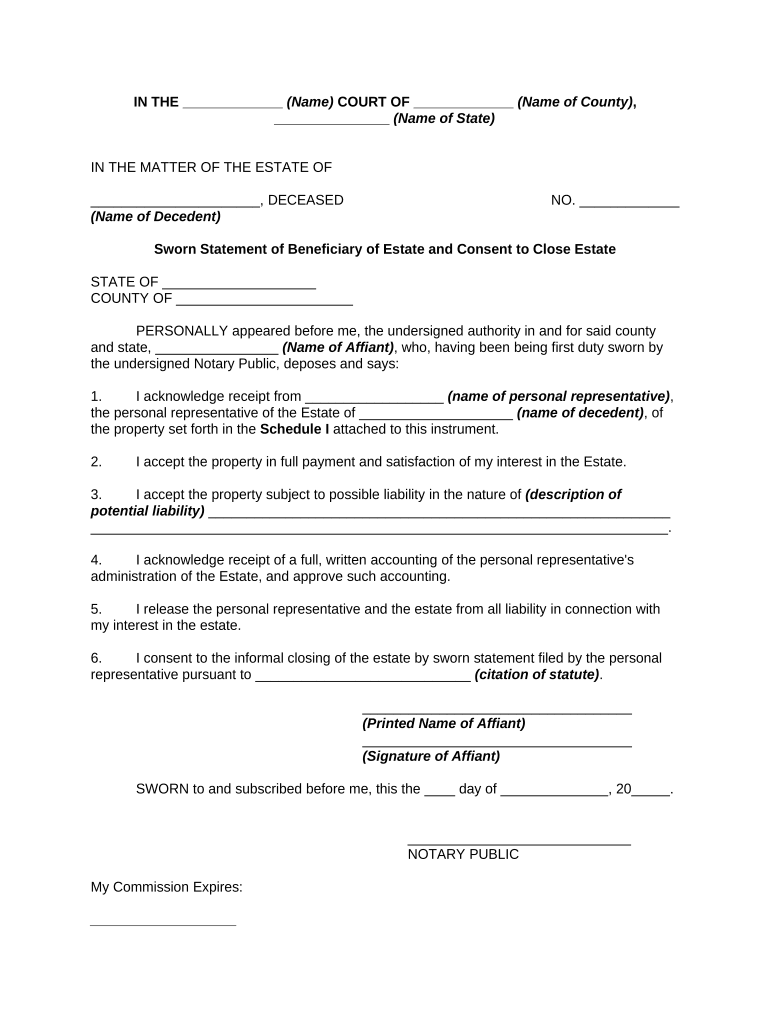

The beneficiary estate refers to the portion of a deceased person's estate that is designated to be distributed to specific individuals or entities, known as beneficiaries. This designation is typically outlined in a will or trust document. Understanding the beneficiary estate is crucial for ensuring that assets are transferred according to the deceased's wishes and in compliance with state laws.

Steps to complete the Beneficiary Estate

Completing the beneficiary estate involves several key steps to ensure that all legal requirements are met. Here is a general outline of the process:

- Identify the assets in the estate, including property, bank accounts, and investments.

- Review the will or trust to determine the designated beneficiaries.

- Gather necessary documents, such as the death certificate and any relevant financial statements.

- File the will with the appropriate probate court if required by state law.

- Notify beneficiaries about their inheritance and provide them with necessary documentation.

- Distribute the assets according to the terms outlined in the will or trust.

Legal use of the Beneficiary Estate

The legal use of the beneficiary estate is governed by state laws and regulations. It is essential to ensure that all actions taken in relation to the estate comply with these laws. This includes properly executing the will, adhering to probate procedures, and fulfilling any tax obligations. Failure to comply with legal requirements can result in disputes among beneficiaries or legal challenges to the estate's distribution.

Required Documents

To effectively manage the beneficiary estate, several key documents are typically required:

- Death certificate of the deceased individual.

- Last will and testament or trust documents.

- Financial statements for all assets within the estate.

- Any relevant court documents, such as probate filings.

- Identification documents for beneficiaries.

Who Issues the Form

The form related to the beneficiary estate is typically issued by the probate court or the relevant state authority overseeing estate matters. In some cases, financial institutions may also provide specific forms required to claim assets, such as bank accounts or insurance policies. It is important to obtain the correct forms to ensure compliance with legal requirements.

State-specific rules for the Beneficiary Estate

Each state in the U.S. has its own rules and regulations regarding beneficiary estates. These can affect how estates are administered, the probate process, and the rights of beneficiaries. It is advisable to consult with a legal professional familiar with the laws in the relevant state to ensure compliance and proper execution of the estate plan.

Quick guide on how to complete beneficiary estate

Effectively prepare Beneficiary Estate on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly substitute to conventional printed and signed documentation, as you can obtain the correct form and securely store it online. airSlate SignNow equips you with all the resources necessary to create, edit, and electronically sign your documents swiftly and without delays. Handle Beneficiary Estate on any platform using the airSlate SignNow Android or iOS applications and simplify any document-centric task today.

How to modify and electronically sign Beneficiary Estate effortlessly

- Locate Beneficiary Estate and click Get Form to begin.

- Use the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with features that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign feature, which takes only a few seconds and holds the same legal value as a traditional handwritten signature.

- Review all the information and click the Done button to save your modifications.

- Select how you wish to send your form, by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form navigation, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Beneficiary Estate and ensure outstanding communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a beneficiary estate and why is it important?

A beneficiary estate refers to the assets or property designated to a beneficiary upon the death of an individual. Understanding this is crucial for effective estate planning, as it ensures that your wishes are respected and your heirs receive their intended inheritance, avoiding potential disputes.

-

How does airSlate SignNow help in managing beneficiary estate documents?

AirSlate SignNow simplifies the process of signing and sharing beneficiary estate documents by providing an intuitive platform. Users can easily create, edit, and store essential documents securely, ensuring that all parties have access when needed, facilitating a smooth estate management process.

-

What features does airSlate SignNow offer for beneficiary estate management?

AirSlate SignNow offers features like legally binding eSignature capabilities, document templates, and secure cloud storage to manage beneficiary estate documents effectively. These tools help streamline the documentation process, saving users time and ensuring compliance with legal requirements.

-

Is airSlate SignNow suitable for both individuals and businesses managing beneficiary estates?

Yes, airSlate SignNow is suitable for both individuals and businesses. Whether you’re drafting a will or managing estate documents for clients, the platform is flexible enough to meet various needs related to beneficiary estate management, ensuring a user-friendly experience.

-

What pricing plans does airSlate SignNow offer for estate management?

AirSlate SignNow offers several pricing plans tailored to different needs, including a basic plan ideal for individuals managing their beneficiary estate and more comprehensive packages for businesses. Each plan includes essential features that facilitate the creation and management of legal documents.

-

Can I integrate airSlate SignNow with other applications for beneficiary estate management?

Yes, airSlate SignNow offers integrations with various applications, enhancing your ability to manage beneficiary estate documentation seamlessly. You can connect it with platforms like Google Drive, Dropbox, and CRM systems to streamline your documents and workflows effectively.

-

What are the benefits of using airSlate SignNow for beneficiary estate planning?

Using airSlate SignNow for beneficiary estate planning offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. The platform ensures that documents are signed quickly and stored securely, making it easier for you to manage your estate planning.

Get more for Beneficiary Estate

Find out other Beneficiary Estate

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free