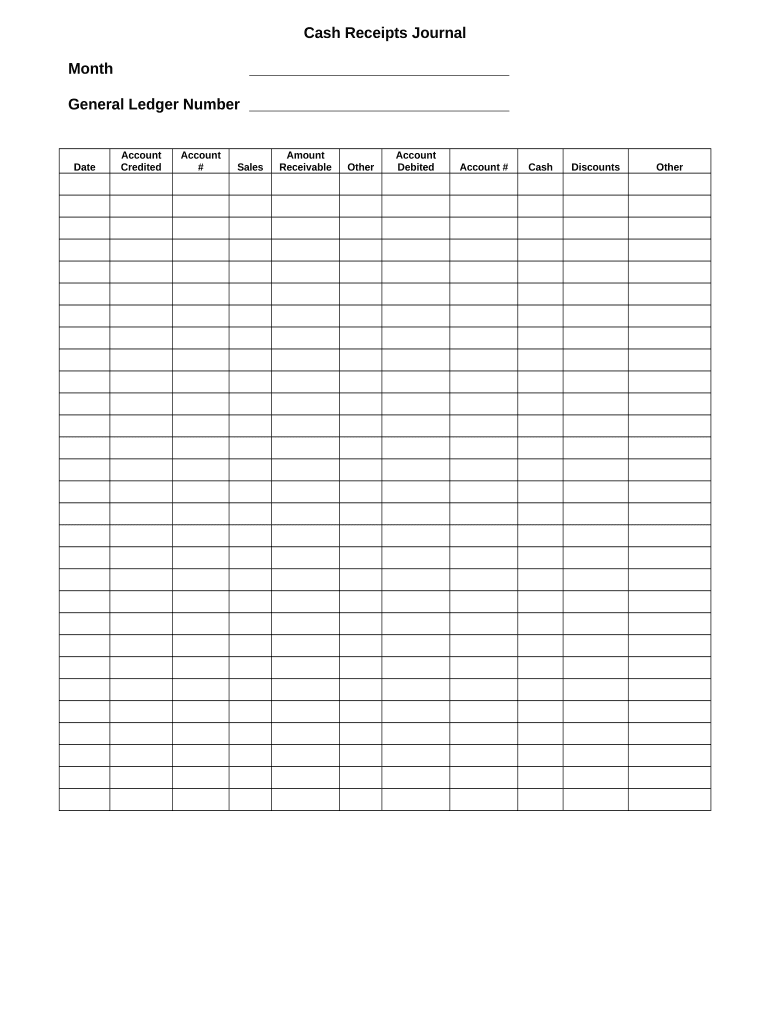

Cash Receipts Journal Form

What is the Cash Receipts Journal

The cash receipts journal is a specialized accounting record used by businesses to track all incoming cash transactions. This journal captures details such as the date of the transaction, the source of the cash, the amount received, and any relevant notes. It serves as a fundamental tool for maintaining accurate financial records and ensuring that all cash inflows are accounted for in the company's accounting system. By systematically recording these transactions, businesses can easily monitor their cash flow and prepare for financial reporting.

How to use the Cash Receipts Journal

To effectively use the cash receipts journal, follow these steps:

- Record the date of each cash transaction accurately.

- Document the source of the cash, such as customer payments or cash sales.

- Enter the amount received, ensuring it matches the payment method.

- Include any necessary notes for future reference, such as invoice numbers or customer details.

- Regularly review and reconcile the journal with bank statements to ensure accuracy.

Using a digital tool can streamline this process, allowing for easy updates and secure storage of records.

Steps to complete the Cash Receipts Journal

Completing the cash receipts journal involves several key steps:

- Gather all relevant documentation, including invoices and payment receipts.

- Open the cash receipts journal in your accounting software or on paper.

- Enter each transaction in chronological order, ensuring all fields are filled out correctly.

- Double-check the accuracy of the amounts and details entered.

- Save or file the journal securely for future reference and audits.

Legal use of the Cash Receipts Journal

For the cash receipts journal to be legally valid, it must adhere to specific guidelines. This includes accurate record-keeping practices and compliance with relevant accounting standards. In the United States, businesses are required to maintain financial records for a certain period, typically three to seven years, depending on the type of transaction. Proper documentation in the cash receipts journal can serve as evidence in case of audits or disputes, making it essential to ensure that all entries are complete and accurate.

Key elements of the Cash Receipts Journal

The cash receipts journal includes several key elements that are crucial for effective record-keeping:

- Date: The date the cash was received.

- Source: The entity or individual from whom the cash was received.

- Amount: The total cash received for the transaction.

- Payment Method: The form of payment, such as cash, check, or credit card.

- Notes: Any additional information relevant to the transaction.

Examples of using the Cash Receipts Journal

Examples of entries in the cash receipts journal can include:

- A customer payment for an invoice, detailing the invoice number and amount.

- Cash sales made at a retail location, including the total amount received.

- Refunds issued to customers, showing the amount returned and the reason for the refund.

These examples illustrate how the cash receipts journal can be utilized to maintain clear and accurate financial records for various types of transactions.

Quick guide on how to complete cash receipts journal

Manage Cash Receipts Journal effortlessly on any device

Digital document management has become increasingly prevalent among businesses and individuals. It presents an ideal eco-friendly substitute to conventional printed and signed documents, as you can obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly and without holdups. Handle Cash Receipts Journal on any platform using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Cash Receipts Journal with ease

- Locate Cash Receipts Journal and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Formulate your eSignature with the Sign tool, which takes mere seconds and carries the same legal force as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your needs in document management with just a few clicks from a device of your choice. Modify and eSign Cash Receipts Journal and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a cash receipts journal?

A cash receipts journal is a specialized accounting record used to track all cash inflows to a business. This journal consolidates cash transactions, offering a clear view of received payments. By using a cash receipts journal, companies can maintain accurate financial records, aiding in better cash flow management.

-

How does airSlate SignNow integrate with a cash receipts journal?

airSlate SignNow seamlessly integrates with various accounting systems that utilize a cash receipts journal. This integration enables users to automate the process of documenting cash inflows. Moreover, it ensures that all transactions are recorded accurately and securely, enhancing the reliability of financial reporting.

-

What are the benefits of using a cash receipts journal?

Using a cash receipts journal provides numerous benefits, including improved accuracy in tracking cash transactions and more efficient financial management. It helps businesses quickly identify discrepancies and monitor cash flow effectively. This tool also supports better decision-making by offering detailed insights into sales patterns and revenue streams.

-

Can airSlate SignNow help automate my cash receipts journal entries?

Yes, airSlate SignNow includes features that can help automate cash receipts journal entries, reducing manual data input. This automation minimizes errors and saves time, allowing your accounting team to focus on more strategic tasks. By integrating with your accounting software, airSlate SignNow ensures that all transactions are logged promptly.

-

What pricing options does airSlate SignNow offer for businesses managing a cash receipts journal?

airSlate SignNow offers flexible pricing plans tailored to businesses of all sizes that utilize a cash receipts journal. Pricing is typically based on the features and number of users, making it a cost-effective solution for managing document signing. Organizations can select a plan that best fits their needs and budget.

-

How secure is the information stored in a cash receipts journal using airSlate SignNow?

Security is a top priority for airSlate SignNow, ensuring that all information related to your cash receipts journal is protected. The platform employs advanced encryption and secure storage solutions to safeguard sensitive data. Businesses can confidently store and manage their financial documents, knowing they are in safe hands.

-

Is training provided for using airSlate SignNow in relation to cash receipts journals?

Yes, airSlate SignNow offers comprehensive training resources for users managing cash receipts journals. This includes tutorials, webinars, and customer support to facilitate a smooth learning experience. Users can quickly become proficient in utilizing the software for efficient financial operations.

Get more for Cash Receipts Journal

- W9 r092004 form

- Wy statement form

- Sd non disclosure form

- State of south dakota in circuit court ss form

- State of south dakota in circuit court ss county of form

- State of south dakota in the circuit court ss county form

- State of south dakota in circuit court in circuit court form

- South dakota state bar trust compliance form

Find out other Cash Receipts Journal

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free

- eSign Florida Legal Warranty Deed Safe

- Help Me With eSign North Dakota Insurance Residential Lease Agreement

- eSign Life Sciences Word Kansas Fast

- eSign Georgia Legal Last Will And Testament Fast

- eSign Oklahoma Insurance Business Associate Agreement Mobile

- eSign Louisiana Life Sciences Month To Month Lease Online

- eSign Legal Form Hawaii Secure

- eSign Hawaii Legal RFP Mobile

- How To eSign Hawaii Legal Agreement

- How Can I eSign Hawaii Legal Moving Checklist

- eSign Hawaii Legal Profit And Loss Statement Online

- eSign Hawaii Legal Profit And Loss Statement Computer

- eSign Hawaii Legal Profit And Loss Statement Now

- How Can I eSign Hawaii Legal Profit And Loss Statement

- Can I eSign Hawaii Legal Profit And Loss Statement

- How To eSign Idaho Legal Rental Application