Loan Form Secured

What is the Loan Form Secured

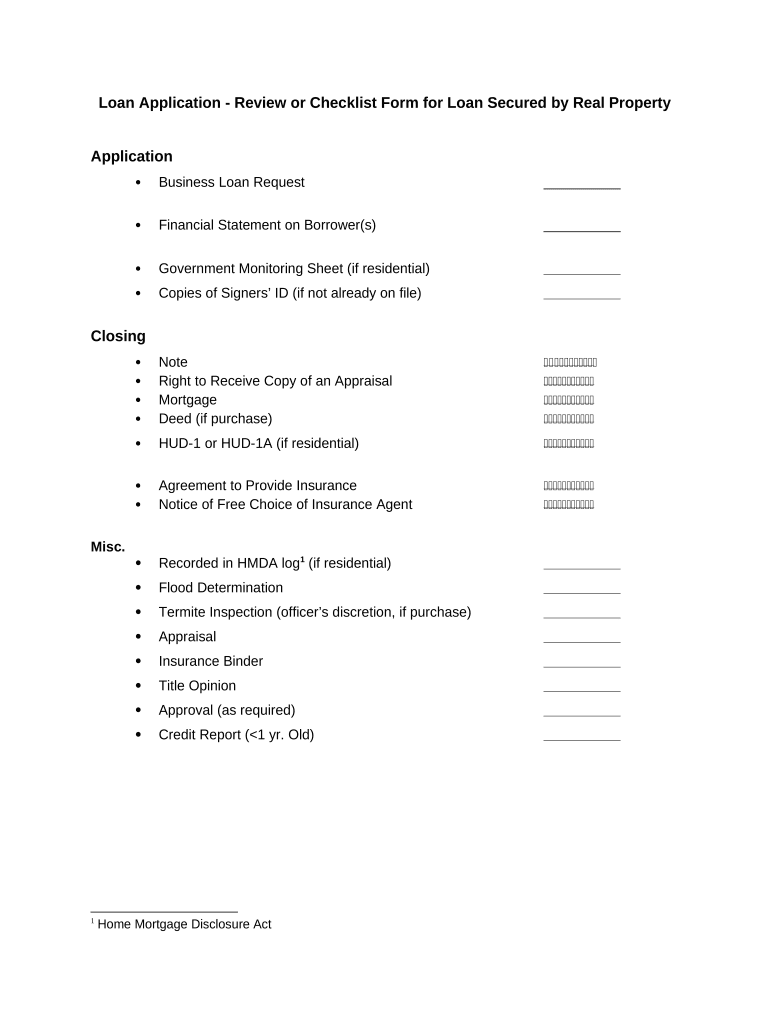

The loan form secured is a crucial document used in the loan application process. It serves as a formal request for funds from a lending institution, detailing the borrower's financial situation and the purpose of the loan. This form typically includes personal information, income details, and the amount requested. A properly completed loan form secured is essential for lenders to assess the borrower's creditworthiness and make informed lending decisions.

How to Use the Loan Form Secured

Using the loan form secured involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation, including proof of income, identification, and any relevant financial statements. Next, fill out the form carefully, providing complete and truthful information. Double-check for any errors or omissions before submission. Once the form is completed, it can be submitted electronically or in person, depending on the lender's requirements.

Key Elements of the Loan Form Secured

Understanding the key elements of the loan form secured is vital for a successful application. Important components typically include:

- Personal Information: Name, address, Social Security number, and contact details.

- Financial Details: Income sources, employment history, and existing debts.

- Loan Purpose: A clear statement of how the funds will be used.

- Collateral Information: Details about any assets offered as security for the loan.

Steps to Complete the Loan Form Secured

Completing the loan form secured involves a systematic approach to ensure all necessary information is provided. Follow these steps:

- Collect required documents, such as pay stubs and tax returns.

- Fill out the personal information section accurately.

- Detail your financial situation, including income and debts.

- Clearly state the purpose of the loan and any collateral offered.

- Review the completed form for accuracy before submission.

Legal Use of the Loan Form Secured

The legal use of the loan form secured is governed by various regulations that ensure the protection of both the lender and the borrower. It is important that the form complies with federal and state laws regarding lending practices. This includes providing accurate information and understanding the terms of the loan. Additionally, the form must be signed by all parties involved, indicating their agreement to the terms laid out in the document.

Required Documents

When submitting the loan form secured, certain documents are typically required to support the application. These may include:

- Proof of identity, such as a driver's license or passport.

- Income verification, including recent pay stubs or tax returns.

- Credit history report, which may be obtained by the lender.

- Documentation of any assets or collateral being offered.

Quick guide on how to complete loan form secured

Complete Loan Form Secured effortlessly on any device

Online document handling has gained popularity among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed documents, allowing you to obtain the appropriate format and securely save it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents quickly without hindrances. Manage Loan Form Secured on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and eSign Loan Form Secured seamlessly

- Find Loan Form Secured and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize key sections of the documents or conceal sensitive information with tools specifically designed by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which only takes seconds and holds the same legal significance as a traditional wet ink signature.

- Review all the information and click the Done button to store your changes.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your PC.

Eliminate concerns about lost or misfiled documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your chosen device. Edit and eSign Loan Form Secured and guarantee effective communication at any stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a loan application review?

A loan application review is the process of evaluating loan applications to ensure that all necessary documentation is complete and compliant with lender requirements. This step is crucial to determine eligibility and accelerate the approval process. Utilizing airSlate SignNow can streamline this review process through efficient document management and eSignature capabilities.

-

How can airSlate SignNow assist in the loan application review process?

airSlate SignNow provides an intuitive platform that simplifies the loan application review process. By allowing users to send, sign, and manage documents digitally, it accelerates the turn-around time for reviews. Detailed tracking and notifications ensure that every step is visible, helping you maintain focus on essential evaluations.

-

What features does airSlate SignNow offer for loan application review?

airSlate SignNow offers features like document templates, bulk sending, and in-app collaboration tools to enhance the loan application review process. These features help ensure that all documents are accurate and submitted on time. Additionally, the platform provides robust security measures to protect sensitive information during reviews.

-

Is airSlate SignNow cost-effective for small businesses managing loan application reviews?

Yes, airSlate SignNow is a cost-effective solution for small businesses looking to manage their loan application review process. The platform offers various pricing plans to fit different budgets and needs, allowing small businesses to benefit from its powerful features without breaking the bank. This enables companies to streamline their operations while saving on costs.

-

Can I integrate airSlate SignNow with other tools for loan application reviews?

airSlate SignNow provides seamless integration with various software tools commonly used in financial services, enhancing the loan application review process. You can easily connect it with CRM systems, cloud storage solutions, and other applications to ensure a comprehensive workflow management. This integration helps to keep all related documents and communications in one place.

-

What are the benefits of using airSlate SignNow for loan application reviews?

Using airSlate SignNow for loan application reviews offers numerous benefits, including improved efficiency, reduced processing time, and enhanced accuracy. Its user-friendly interface allows teams to collaborate easily, leading to faster decision-making on loan approvals. The eSignature feature also eliminates the need for physical documents, making it more environmentally friendly.

-

How secure is airSlate SignNow when it comes to loan application reviews?

Security is a top priority for airSlate SignNow, especially for sensitive processes like loan application reviews. The platform employs advanced encryption protocols to ensure that all data is secure and confidential. Regular audits and compliance with industry standards further enhance its reliability for handling sensitive financial documents.

Get more for Loan Form Secured

Find out other Loan Form Secured

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document