Checklist Health and Disability Insurance Form

What is the Checklist Health And Disability Insurance

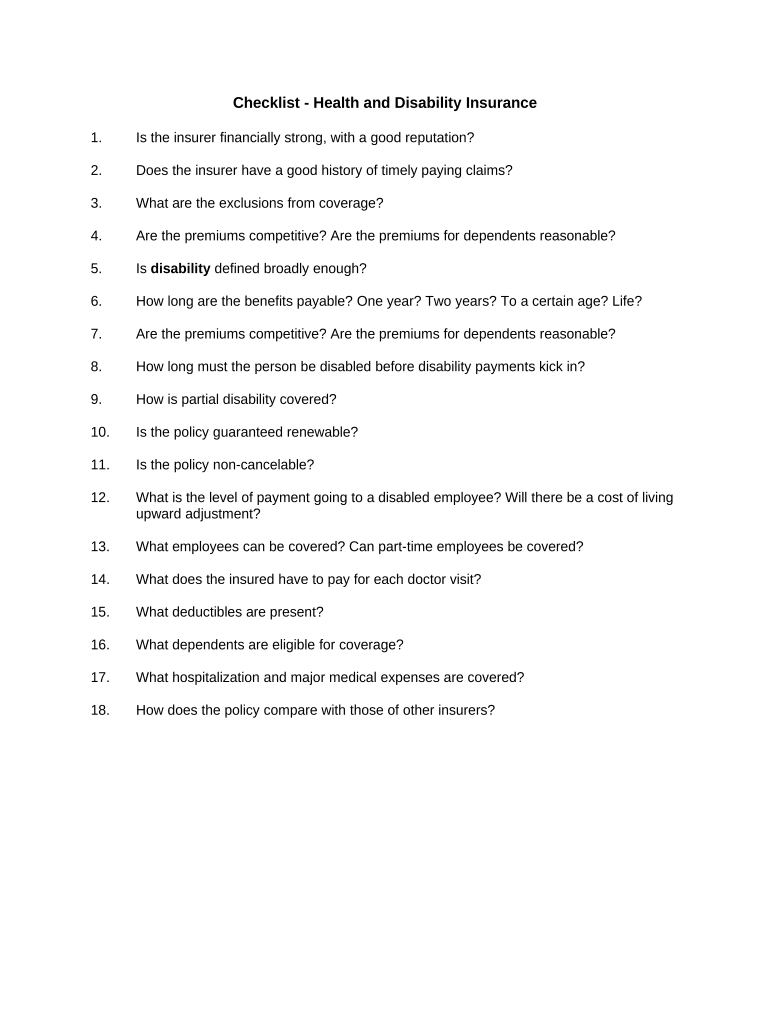

The Checklist Health and Disability Insurance is a crucial document designed to guide individuals through the process of assessing their health and disability insurance needs. This checklist helps ensure that individuals consider all necessary aspects when selecting or reviewing their insurance policies. It typically includes sections that cover coverage options, premium costs, policy limits, and specific conditions that may affect eligibility.

How to use the Checklist Health And Disability Insurance

To effectively use the Checklist Health and Disability Insurance, begin by gathering all relevant personal and financial information. This includes current health conditions, existing insurance coverage, and financial obligations. Review each item on the checklist carefully, marking off completed sections as you gather information. This organized approach will help you identify gaps in coverage and ensure that you are adequately protected against health-related expenses and potential disabilities.

Steps to complete the Checklist Health And Disability Insurance

Completing the Checklist Health and Disability Insurance involves several key steps:

- Identify your current health status and any pre-existing conditions.

- List all existing health and disability insurance policies.

- Assess your financial situation, including income and expenses.

- Research available health and disability insurance options that meet your needs.

- Compare coverage details, premiums, and policy terms.

- Consult with an insurance advisor if needed to clarify complex terms.

- Finalize your selections and document your decisions for future reference.

Key elements of the Checklist Health And Disability Insurance

The Checklist Health and Disability Insurance includes several key elements that are essential for comprehensive coverage:

- Coverage Types: Understand the differences between health insurance and disability insurance.

- Premium Costs: Evaluate how much you can afford to pay for coverage.

- Policy Limits: Be aware of maximum payout amounts and any exclusions.

- Eligibility Criteria: Know the requirements for obtaining coverage.

- Renewal Terms: Review how policies can be renewed and any changes in premiums.

Legal use of the Checklist Health And Disability Insurance

The legal use of the Checklist Health and Disability Insurance is governed by various regulations that ensure its validity. When completed correctly, this checklist serves as a formal record of your insurance needs and choices. It is important to retain this document as it may be required for future insurance applications or claims. Furthermore, adherence to federal and state regulations regarding health and disability insurance is essential to ensure compliance and avoid legal complications.

Eligibility Criteria

Eligibility for health and disability insurance can vary based on several factors. Common criteria include:

- Age: Many policies have age limits for coverage.

- Health Status: Pre-existing conditions may affect eligibility.

- Employment Status: Some disability insurance options are tied to employment.

- Income Level: Certain plans may require proof of income to qualify.

Understanding these criteria is essential for selecting the right insurance coverage that meets your needs.

Quick guide on how to complete checklist health and disability insurance

Effortlessly prepare Checklist Health And Disability Insurance on any device

Digital document management has become increasingly favored by businesses and individuals. It serves as an ideal environmentally-friendly alternative to traditional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents rapidly without delays. Manage Checklist Health And Disability Insurance on any device using the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign Checklist Health And Disability Insurance with ease

- Locate Checklist Health And Disability Insurance and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize key sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Checklist Health And Disability Insurance and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Checklist Health And Disability Insurance?

The Checklist Health And Disability Insurance is a valuable tool that outlines essential steps and considerations to ensure you're adequately covered in case of health or disability-related events. It serves to guide individuals and businesses in evaluating their insurance options and understanding policy benefits. By following this checklist, you can make informed decisions that align with your financial and personal health needs.

-

How does airSlate SignNow support health and disability insurance documentation?

airSlate SignNow streamlines the process of managing health and disability insurance documents by allowing you to send and eSign paperwork digitally. This efficiency ensures that everything from application forms to policy agreements can be handled seamlessly online. With our platform, you can also easily integrate your checklist for health and disability insurance into your workflow.

-

What are the pricing options for airSlate SignNow's services related to Checklist Health And Disability Insurance?

airSlate SignNow offers competitive pricing tailored for businesses and individuals utilizing the Checklist Health And Disability Insurance. Our flexible subscription plans ensure that you can choose a package that best fits your needs and budget. We also provide a free trial to help you explore our features before committing.

-

What features does airSlate SignNow offer for managing health and disability insurance documents?

Our platform offers a range of features designed for managing Checklist Health And Disability Insurance documents, including customizable templates, secure eSigning, and real-time collaboration. These tools enhance document accuracy and speed up the review process, ensuring you and your clients can easily access and sign necessary paperwork. Additionally, you can track document status for peace of mind.

-

Can I integrate airSlate SignNow with other software for my health and disability insurance needs?

Yes, airSlate SignNow supports integration with various software platforms commonly used in health and disability insurance management. This includes Customer Relationship Management (CRM) systems and document storage solutions. These integrations enable seamless data flow, improving access to your Checklist Health And Disability Insurance documents and streamlining workflows.

-

How can airSlate SignNow benefit my organization in managing health and disability insurance documents?

By utilizing airSlate SignNow for your Checklist Health And Disability Insurance documentation, your organization can save time and reduce administrative burdens. The platform simplifies the process of sending and eSigning documents, allowing your team to focus more on client engagement rather than paperwork. This efficiency translates into improved service delivery and enhanced customer satisfaction.

-

Is airSlate SignNow secure for handling sensitive health and disability insurance information?

Absolutely. airSlate SignNow utilizes industry-standard encryption and secure server practices to protect sensitive information associated with Checklist Health And Disability Insurance. We prioritize data security and compliance with regulations to ensure that all your documents remain confidential and secure throughout the signing process. With us, you can trust that your data is in safe hands.

Get more for Checklist Health And Disability Insurance

Find out other Checklist Health And Disability Insurance

- How To Sign Maine Healthcare / Medical PPT

- How Do I Sign Nebraska Healthcare / Medical Word

- How Do I Sign Washington Healthcare / Medical Word

- How Can I Sign Indiana High Tech PDF

- How To Sign Oregon High Tech Document

- How Do I Sign California Insurance PDF

- Help Me With Sign Wyoming High Tech Presentation

- How Do I Sign Florida Insurance PPT

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form