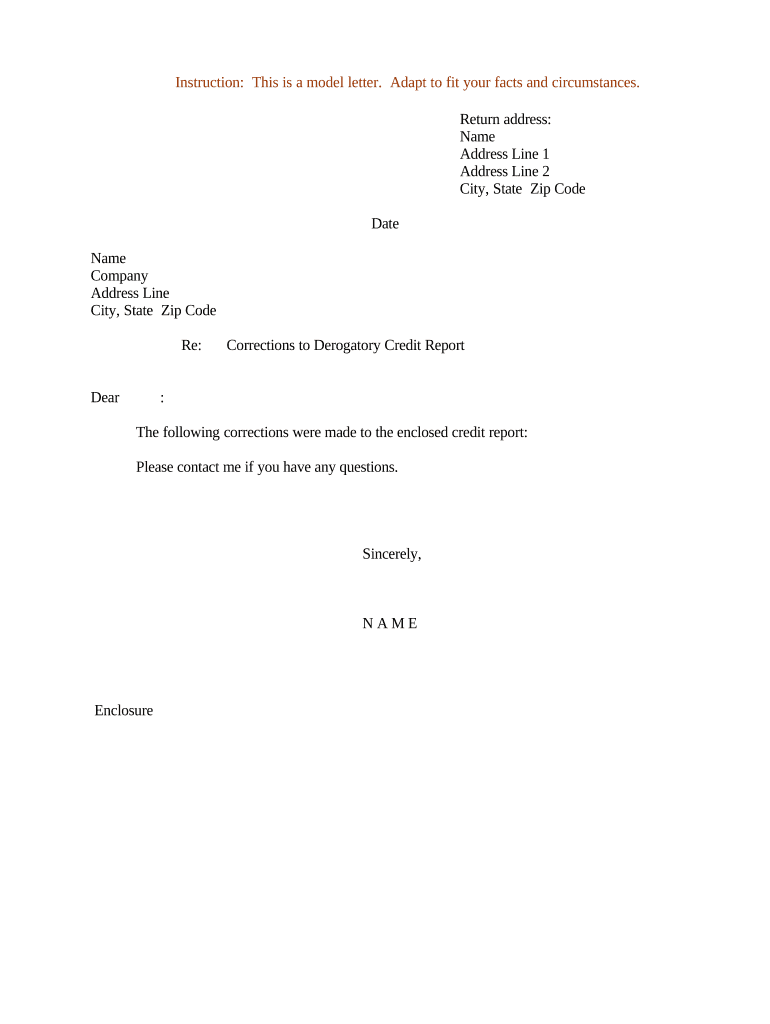

Sample Credit Report Form

What is the Sample Credit Report Form

The sample credit report form is a document used to request a detailed report of an individual's credit history. This form plays a crucial role in various financial transactions, including loan applications, rental agreements, and employment screenings. It typically includes information on the individual's credit accounts, payment history, and any outstanding debts. Understanding this form is essential for consumers who wish to monitor their credit status and ensure accuracy in their financial records.

How to Use the Sample Credit Report Form

Using the sample credit report form involves several straightforward steps. First, gather all necessary personal information, such as your full name, address, Social Security number, and date of birth. Next, fill out the form accurately, ensuring that all details match your official identification. Once completed, submit the form to the appropriate credit reporting agency. This submission can often be done online, by mail, or in person, depending on the agency's guidelines. After processing, you will receive your credit report, which you can review for accuracy.

Steps to Complete the Sample Credit Report Form

Completing the sample credit report form requires careful attention to detail. Follow these steps:

- Step One: Gather your personal identification information.

- Step Two: Accurately fill in the required fields on the form.

- Step Three: Review the form for any errors or omissions.

- Step Four: Submit the completed form to the credit reporting agency.

- Step Five: Await confirmation of your request and access your credit report.

Legal Use of the Sample Credit Report Form

The sample credit report form is governed by various federal and state laws that protect consumer rights. Under the Fair Credit Reporting Act (FCRA), individuals have the right to request their credit report at least once a year from each of the major credit reporting agencies. This legal framework ensures that consumers can verify the accuracy of their credit information and dispute any inaccuracies. Understanding these legal protections is vital for anyone using the sample credit report form.

Key Elements of the Sample Credit Report Form

When filling out the sample credit report form, certain key elements must be included to ensure its validity. These elements typically consist of:

- Personal Information: Full name, address, Social Security number, and date of birth.

- Identification Verification: A copy of a government-issued ID may be required.

- Signature: Your signature to authorize the request.

- Contact Information: A phone number or email address for follow-up communication.

Who Issues the Form

The sample credit report form is issued by major credit reporting agencies, including Experian, TransUnion, and Equifax. These agencies are responsible for compiling and maintaining consumer credit information. Each agency may have its specific version of the form, but all serve the same fundamental purpose of providing consumers with access to their credit reports. It is advisable to check the specific agency's website for the most current version of the form and any additional requirements.

Quick guide on how to complete sample credit report form

Effortlessly Prepare Sample Credit Report Form on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect sustainable alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents quickly without delays. Manage Sample Credit Report Form on any device using the airSlate SignNow applications for Android or iOS and enhance any document-based workflow today.

How to Edit and Electronically Sign Sample Credit Report Form with Ease

- Locate Sample Credit Report Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize key sections of your documents or conceal sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your PC.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your preferred device. Modify and electronically sign Sample Credit Report Form to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a letter credit report form?

A letter credit report form is an essential document used in financial transactions, specifically for confirming the creditworthiness of a buyer. It serves as proof that financial institutions can guarantee payment to the seller upon fulfilling certain conditions. Using airSlate SignNow, you can easily create and manage your letter credit report form electronically, simplifying your documentation process.

-

How can I create a letter credit report form using airSlate SignNow?

Creating a letter credit report form with airSlate SignNow is a simple process. Just log into your account, select the template for the letter credit report form, and fill in the required fields. Once completed, you can send it out for signatures with just a few clicks, ensuring a streamlined workflow.

-

Is airSlate SignNow's letter credit report form customizable?

Yes, the letter credit report form provided by airSlate SignNow is highly customizable. You can add your branding, adjust the layout, and include specific fields to meet your business requirements. This flexibility ensures that the letter credit report form aligns perfectly with your organizational needs.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers various pricing plans to accommodate different business sizes and needs. Our plans are designed to provide access to features like the letter credit report form, eSigning, and document storage at competitive rates. Choose a plan that fits your budget and start enjoying the benefits of efficient document management.

-

What features does airSlate SignNow offer for the letter credit report form?

airSlate SignNow provides several features for managing your letter credit report form effectively. These include eSignature capabilities, secure storage, template creation, and integration with various applications. These tools enhance your document workflow, making it efficient and user-friendly.

-

How does airSlate SignNow integrate with other software for letter credit report forms?

airSlate SignNow seamlessly integrates with popular software applications, enhancing your workflow when handling letter credit report forms. You can connect it with CRM systems, cloud storage services, and productivity tools, allowing you to streamline your document management processes. This integration ensures that your letter credit report forms are easily accessible and manageable.

-

What are the benefits of using airSlate SignNow for letter credit report forms?

Using airSlate SignNow for your letter credit report forms offers numerous advantages, such as increased efficiency, improved document security, and reduced turnaround time on signatures. Furthermore, its user-friendly platform enables teams to collaborate easily, ensuring a smooth process from creation to completion of the letter credit report form.

Get more for Sample Credit Report Form

Find out other Sample Credit Report Form

- Sign Wisconsin Healthcare / Medical Contract Safe

- Sign Alabama High Tech Last Will And Testament Online

- Sign Delaware High Tech Rental Lease Agreement Online

- Sign Connecticut High Tech Lease Template Easy

- How Can I Sign Louisiana High Tech LLC Operating Agreement

- Sign Louisiana High Tech Month To Month Lease Myself

- How To Sign Alaska Insurance Promissory Note Template

- Sign Arizona Insurance Moving Checklist Secure

- Sign New Mexico High Tech Limited Power Of Attorney Simple

- Sign Oregon High Tech POA Free

- Sign South Carolina High Tech Moving Checklist Now

- Sign South Carolina High Tech Limited Power Of Attorney Free

- Sign West Virginia High Tech Quitclaim Deed Myself

- Sign Delaware Insurance Claim Online

- Sign Delaware Insurance Contract Later

- Sign Hawaii Insurance NDA Safe

- Sign Georgia Insurance POA Later

- How Can I Sign Alabama Lawers Lease Agreement

- How Can I Sign California Lawers Lease Agreement

- Sign Colorado Lawers Operating Agreement Later