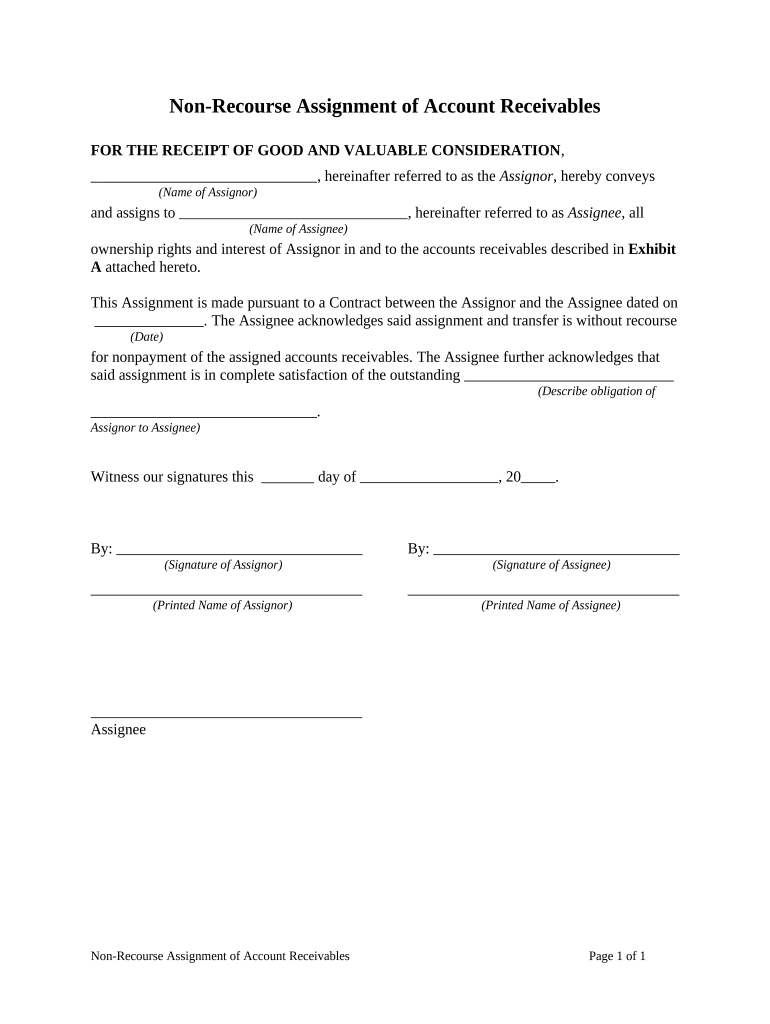

Nonrecourse Assignment of Account Receivables Form

What is the Nonrecourse Assignment Of Account Receivables

The nonrecourse assignment of account receivables is a financial arrangement where a business assigns its receivables to a lender or third party without retaining any liability for the debt if the receivables are not collected. This means that if the assigned accounts do not generate the expected cash flow, the lender cannot seek repayment from the business. This type of assignment is often used to secure financing while minimizing risk for the business owner.

How to use the Nonrecourse Assignment Of Account Receivables

To effectively use the nonrecourse assignment of account receivables, a business must first identify the receivables it wishes to assign. Next, the business should enter into an agreement with the lender, clearly outlining the terms of the assignment, including the specific receivables involved and the conditions under which the assignment is valid. Once the agreement is signed, the business can submit the necessary documentation to the lender, who will then provide the agreed-upon financing based on the assigned receivables.

Steps to complete the Nonrecourse Assignment Of Account Receivables

Completing the nonrecourse assignment of account receivables involves several key steps:

- Identify the receivables to be assigned.

- Draft a nonrecourse assignment agreement that details the terms of the assignment.

- Obtain any necessary approvals from stakeholders or partners.

- Sign the agreement electronically using a reliable eSignature platform.

- Submit the assignment documentation to the lender or third party.

Key elements of the Nonrecourse Assignment Of Account Receivables

Key elements of the nonrecourse assignment of account receivables include:

- Assignment Agreement: A legally binding document that outlines the terms and conditions of the assignment.

- Receivables List: A detailed list of the specific accounts receivable being assigned.

- Nonrecourse Clause: A stipulation that protects the business from liability if the receivables are not collected.

- Signatures: Valid signatures from all parties involved, typically facilitated through an electronic signature platform.

Legal use of the Nonrecourse Assignment Of Account Receivables

The legal use of the nonrecourse assignment of account receivables requires compliance with applicable laws and regulations. It is essential for businesses to ensure that the assignment does not violate any existing contracts or agreements. Additionally, the assignment should be documented properly to protect all parties involved. Utilizing electronic signatures can enhance the legal validity of the assignment, provided that the platform used complies with relevant eSignature laws such as the ESIGN Act and UETA.

Examples of using the Nonrecourse Assignment Of Account Receivables

Businesses across various industries utilize the nonrecourse assignment of account receivables as a financing tool. For instance:

- A small manufacturing company may assign its outstanding invoices to a lender to secure immediate cash flow for operational expenses.

- A service provider might use this arrangement to finance a new project while minimizing risk, knowing that if clients do not pay, they are not liable for repayment.

Quick guide on how to complete nonrecourse assignment of account receivables

Accomplish Nonrecourse Assignment Of Account Receivables effortlessly on any device

Digital document management has gained widespread adoption among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and electronically sign your documents swiftly without delays. Manage Nonrecourse Assignment Of Account Receivables on any device using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to modify and electronically sign Nonrecourse Assignment Of Account Receivables with ease

- Locate Nonrecourse Assignment Of Account Receivables and then click Get Form to begin.

- Take advantage of the tools we offer to fill out your form.

- Select important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, SMS, invite link, or download it to your computer.

Put an end to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management requirements in just a few clicks from any device you choose. Alter and electronically sign Nonrecourse Assignment Of Account Receivables to ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nonrecourse Assignment Of Account Receivables?

A Nonrecourse Assignment Of Account Receivables is a financial agreement where a business assigns its receivables to a lender without the risk of personal liability. If the assigned receivables are not paid, the lender cannot seek payment from the business itself. This arrangement is beneficial as it allows businesses to access immediate cash flow while minimizing financial risk.

-

How does airSlate SignNow facilitate Nonrecourse Assignment Of Account Receivables?

airSlate SignNow streamlines the process of sending and signing documents related to Nonrecourse Assignment Of Account Receivables. With its easy-to-use platform, users can securely eSign documents, ensuring that the entire assignment process is efficient and quick. This saves businesses valuable time and resources while managing their receivables.

-

What are the benefits of using Nonrecourse Assignment Of Account Receivables?

The primary benefits of Nonrecourse Assignment Of Account Receivables include improved cash flow, reduced financial risk, and simplified financing options. By assigning receivables without personal liability, businesses can maintain healthier financial stability. Additionally, it allows companies to focus on growth rather than worrying about collection issues.

-

What features does airSlate SignNow offer for managing Nonrecourse Assignment Of Account Receivables?

airSlate SignNow offers a variety of features for managing Nonrecourse Assignment Of Account Receivables, including customizable templates, secure eSigning, and document tracking. These tools enable businesses to create tailored agreements efficiently and monitor their status in real-time. The user-friendly interface makes managing complex transactions straightforward.

-

Is there a cost associated with using airSlate SignNow for Nonrecourse Assignment Of Account Receivables?

Yes, there is a cost associated with using airSlate SignNow, but it is designed to be affordable and cost-effective for businesses. Various pricing plans are available, which cater to different organizational needs and sizes. By leveraging airSlate SignNow, businesses can save on both time and resources in their Nonrecourse Assignment Of Account Receivables processes.

-

Can airSlate SignNow integrate with other financial software for managing Nonrecourse Assignments?

Absolutely! airSlate SignNow seamlessly integrates with various financial software solutions that assist in managing Nonrecourse Assignment Of Account Receivables. These integrations ensure that businesses can streamline their workflows and maintain accurate records across different platforms. This compatibility enhances efficiency and reduces errors in financial documentation.

-

Who can benefit from a Nonrecourse Assignment Of Account Receivables?

Businesses of all sizes, particularly those with outstanding receivables, can benefit from a Nonrecourse Assignment Of Account Receivables. This financing method is particularly useful for companies looking to improve cash flow without taking on additional debt or personal liability. By utilizing this strategy, businesses can allocate resources more effectively and plan for growth.

Get more for Nonrecourse Assignment Of Account Receivables

- Form pi e notification of change to qualified facilities tceq

- Form ac2709 fill online printable fillable blankpdffiller

- Va form 3288 request for and consent to

- Repayment assistance plan application sde0080e form

- This application form is to be used by individuals who are

- Immigrant investorstuart investments form

- Humanitarian and compassionate considerations under the form

- Order replacement stcw certificatesalt services form

Find out other Nonrecourse Assignment Of Account Receivables

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement