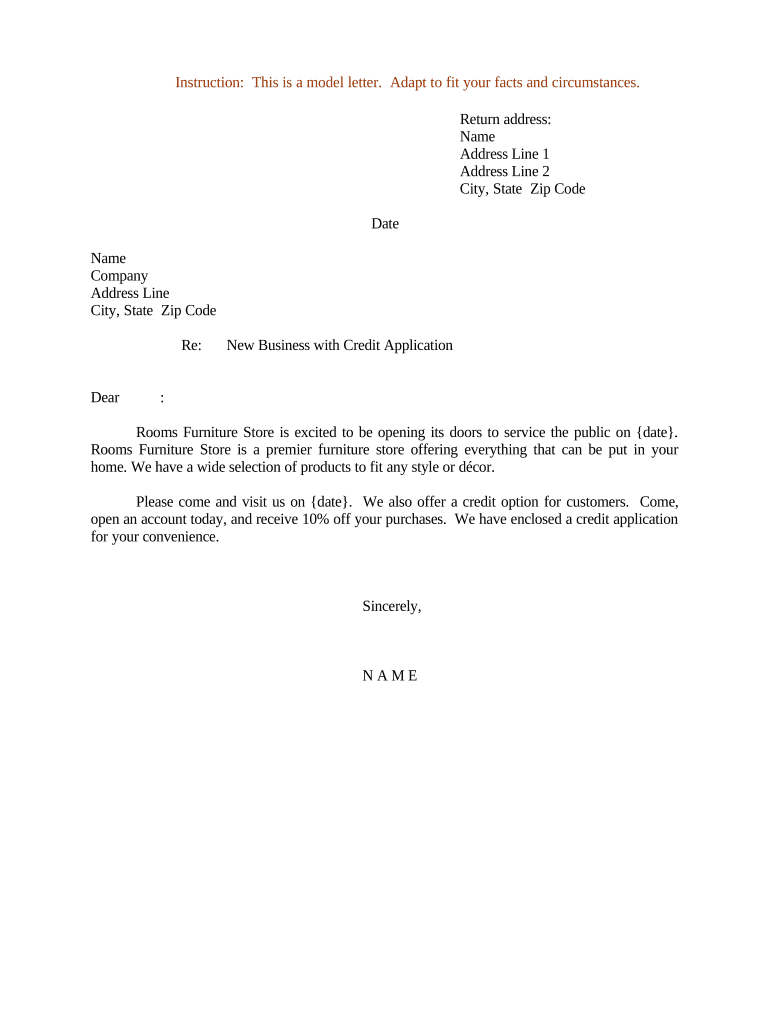

Letter Credit Application Form

What is the letter credit application?

The letter credit application is a formal request made by a business to a financial institution, seeking a letter of credit. This document serves as a guarantee of payment to suppliers or vendors, ensuring that the buyer's financial obligations are met. It is particularly useful for new businesses that may not have established credit histories. The letter credit application outlines the terms under which the credit will be issued, including the amount, duration, and conditions for payment.

Key elements of the letter credit application

When preparing a letter credit application, it is essential to include several key elements to ensure clarity and compliance. These elements typically include:

- Business Information: The name, address, and contact details of the business applying for the credit.

- Supplier Details: Information about the supplier or vendor who will receive the letter of credit.

- Credit Amount: The total amount of credit requested.

- Purpose of Credit: A brief explanation of why the credit is needed, such as purchasing inventory or equipment.

- Terms and Conditions: Specific terms under which the credit will be issued, including any collateral or guarantees required.

Steps to complete the letter credit application

Completing a letter credit application involves several steps to ensure that all necessary information is accurately presented. Follow these steps:

- Gather Required Information: Collect all relevant business and supplier information needed for the application.

- Fill Out the Application Form: Complete the application form with accurate details, ensuring that all sections are filled in correctly.

- Review for Accuracy: Double-check all information for accuracy and completeness before submission.

- Submit the Application: Send the application to the financial institution, either online or via mail, depending on their requirements.

How to use the letter credit application

Using the letter credit application effectively can streamline the process of obtaining credit. To utilize the application:

- Identify Your Needs: Determine the amount of credit required and the purpose for which it will be used.

- Complete the Application: Fill out the application accurately, ensuring that all necessary details are included.

- Submit to Your Bank: Provide the completed application to your financial institution and follow up as needed.

- Maintain Communication: Stay in touch with the bank to address any questions or additional requirements that may arise during the approval process.

Legal use of the letter credit application

The legal use of the letter credit application is governed by various regulations and standards. It is essential to ensure compliance with these legal frameworks to avoid potential issues. Key points to consider include:

- Compliance with UETA and ESIGN: Ensure that the application meets the requirements for electronic signatures and transactions.

- Adherence to Banking Regulations: Follow all banking regulations applicable to letters of credit, including those set forth by the Uniform Commercial Code (UCC).

- Documentation: Keep thorough records of all communications and submitted documents related to the application.

Examples of using the letter credit application

Understanding practical applications of the letter credit application can provide insights into its utility. Common examples include:

- Importing Goods: A new business may use a letter of credit to secure payment for imported goods, ensuring suppliers are paid upon shipment.

- Securing Financing: Businesses may apply for letters of credit to support financing arrangements with banks or investors.

- Building Supplier Relationships: Using a letter of credit can help new businesses establish trust with suppliers, facilitating better terms and conditions.

Quick guide on how to complete letter credit application

Effortlessly complete Letter Credit Application on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the correct form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents swiftly without delays. Manage Letter Credit Application on any gadget with airSlate SignNow Android or iOS applications and simplify any document-centric process today.

How to alter and eSign Letter Credit Application with ease

- Find Letter Credit Application and then click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and eSign Letter Credit Application to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter business with airSlate SignNow?

A sample letter business with airSlate SignNow is a template or example provided to help users create professional correspondence. This feature simplifies the document creation process, allowing businesses to quickly draft letters while ensuring all necessary details are included.

-

How can I create a sample letter business with airSlate SignNow?

To create a sample letter business with airSlate SignNow, you can start by selecting a pre-designed template from our library. You can customize this letter as per your requirements, adding specific content, logos, and recipient details before sending it for eSignature.

-

What features does airSlate SignNow offer for sample letter business with eSignatures?

airSlate SignNow provides various features for sample letter business with eSignatures, including customizable templates, multi-party signing capabilities, and the ability to track document status in real time. These features enhance the efficiency of document management and improve overall workflow.

-

Is there a cost involved in using sample letter business with airSlate SignNow?

Yes, there are pricing plans available for airSlate SignNow that cater to different business needs. While you can start with a free trial, paid plans unlock advanced features for creating and managing your sample letter business with eSignatures.

-

Are there benefits to using airSlate SignNow for sample letter business with electronic signatures?

Using airSlate SignNow for sample letter business with electronic signatures streamlines your document workflow and eliminates the need for paper. This not only saves time but also reduces costs associated with printing and mailing letters, making your business more environmentally friendly.

-

Can airSlate SignNow integrate with other software for sample letter business with automation?

Absolutely! airSlate SignNow supports integration with numerous third-party applications, allowing you to automate the process of managing your sample letter business with ease. This enhances your productivity by connecting your existing tools such as CRMs, project management software, and more.

-

What industries can benefit from sample letter business with airSlate SignNow?

Various industries, including legal, real estate, finance, and education, can benefit signNowly from sample letter business with airSlate SignNow. The platform is designed to meet diverse business needs by providing tailored solutions for document signing and management.

Get more for Letter Credit Application

- Hawaii county exemption form

- Form 1176

- St 388 50621077 6 5 2 1350 south carolina form

- St 389 instructions scgov form

- State sales and use tax return south carolina department of form

- Claim for refund st 14 sc department of revenue scgov form

- 2020 form 1099 g certain government payments

- Application for sales tax exemption under code section form

Find out other Letter Credit Application

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed