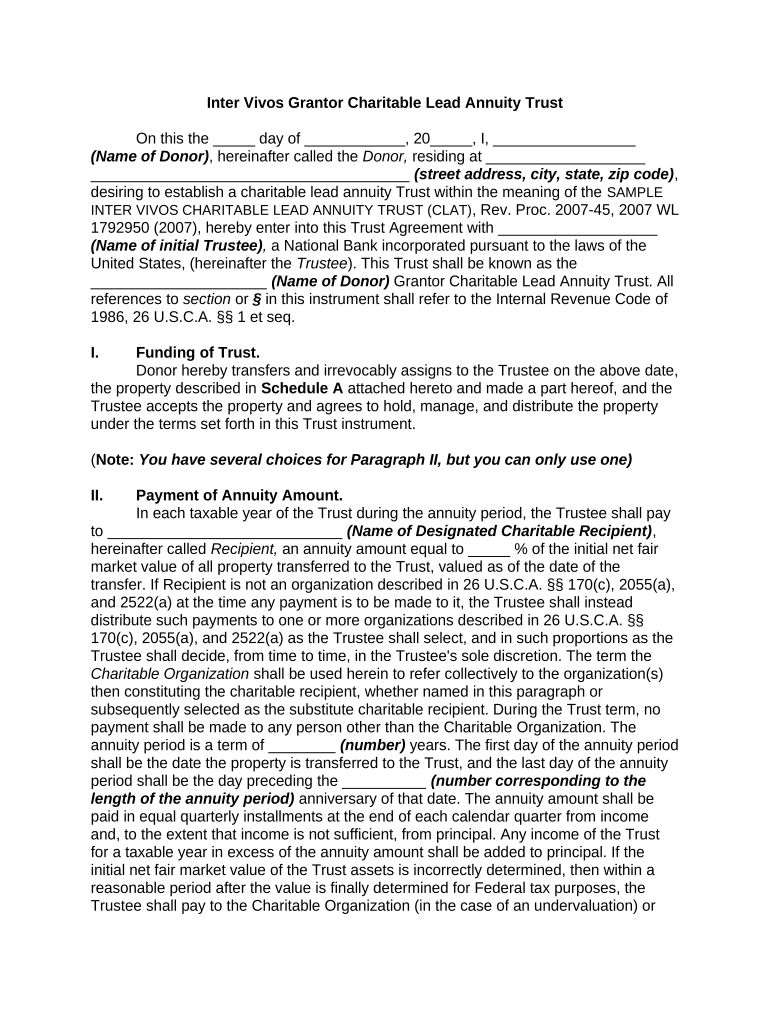

Charitable Lead Trust Form

What is the Charitable Lead Trust

A charitable lead trust is a financial arrangement that allows a donor to contribute assets to a trust, which then provides income to a designated charity for a specified period. After this period, the remaining assets are transferred to the beneficiaries, often family members. This type of trust can help reduce estate and gift taxes while supporting charitable causes. The income generated during the trust term typically goes to a qualified charity, making it a popular choice for philanthropists looking to make a lasting impact.

How to use the Charitable Lead Trust

To effectively utilize a charitable lead trust, individuals should first identify the charitable organizations they wish to support. Next, they must determine the duration of the trust and the amount of income to be distributed to the charity. It is essential to work with a financial advisor or attorney to draft the trust document, ensuring compliance with IRS regulations. Once established, the trust can hold various assets, including cash, stocks, or real estate, providing both charitable support and potential tax benefits.

Steps to complete the Charitable Lead Trust

Completing a charitable lead trust involves several key steps:

- Consult with a financial advisor or estate planning attorney to discuss your goals.

- Select the charitable organization(s) that will receive income from the trust.

- Determine the trust's term length and the income percentage to be distributed.

- Draft the trust agreement, specifying all terms and conditions.

- Fund the trust with the chosen assets.

- File any necessary tax forms with the IRS to ensure compliance.

Legal use of the Charitable Lead Trust

For a charitable lead trust to be legally valid, it must comply with federal and state laws governing trusts and charitable contributions. The trust must be irrevocable, meaning that once assets are placed into the trust, the donor cannot reclaim them. Additionally, the trust must meet specific IRS requirements to ensure that the income distributions to charities qualify for tax deductions. Proper documentation and adherence to legal guidelines are essential for maintaining the trust's validity and achieving the desired tax benefits.

IRS Guidelines

The IRS provides clear guidelines regarding charitable lead trusts, including rules on tax deductions and reporting requirements. To qualify for a charitable deduction, the trust must provide a guaranteed income stream to the charity for a specified term. The trust's structure must adhere to IRS regulations, including the valuation of assets and the calculation of the charitable deduction. It is advisable to consult IRS publications or a tax professional to ensure compliance with all relevant guidelines.

Required Documents

Establishing a charitable lead trust requires several important documents, including:

- The trust agreement, outlining the terms and conditions of the trust.

- Documentation of the assets being transferred into the trust.

- IRS Form 709, the United States Gift (and Generation-Skipping Transfer) Tax Return, if applicable.

- Records of the charitable organizations receiving income from the trust.

Eligibility Criteria

To establish a charitable lead trust, individuals must meet specific eligibility criteria. Generally, the donor must be at least eighteen years old and have the legal capacity to create a trust. Additionally, the trust must be established for a charitable purpose, with identifiable beneficiaries. It is essential to ensure that the chosen charitable organization is qualified under IRS rules to receive tax-deductible contributions. Consulting with a legal or financial professional can help clarify any eligibility requirements.

Quick guide on how to complete charitable lead trust

Complete Charitable Lead Trust effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect environmentally friendly alternative to conventional printed and signed papers, allowing you to access the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Charitable Lead Trust on any device using airSlate SignNow Android or iOS applications and enhance any document-related process today.

The simplest method to modify and electronically sign Charitable Lead Trust with ease

- Find Charitable Lead Trust and click Get Form to initiate.

- Use the tools we supply to complete your form.

- Highlight important sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign tool, which takes moments and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

No more concerns about lost or misplaced documents, tedious form navigation, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Modify and electronically sign Charitable Lead Trust to ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a charitable lead annuity trust?

A charitable lead annuity trust (CLAT) is a type of irrevocable trust designed to benefit both charitable organizations and individual donors. With a CLAT, a donor contributes assets to the trust, which then makes fixed annual payments to a designated charity for a specified term. After this term ends, the remaining assets are passed to the donor's beneficiaries, providing both charitable support and potential tax benefits.

-

How does a charitable lead annuity trust benefit me financially?

The financial benefits of a charitable lead annuity trust include potential income tax deductions, reduced estate taxes, and the ability to manage your charitable giving. By funding a CLAT, you can secure a charitable deduction based on the present value of the payments to be made to the charity, thereby reducing your taxable income. Additionally, it may decrease the size of your taxable estate, offering further financial advantages.

-

Are there any fees associated with setting up a charitable lead annuity trust?

Yes, establishing a charitable lead annuity trust may incur setup fees, which can vary depending on the complexity of the trust and the professionals involved. This could include legal fees for drafting the trust document and potentially fees for ongoing management or administration. However, the potential tax benefits often outweigh these costs, making a CLAT a worthwhile investment for many donors.

-

What features should I look for in a charitable lead annuity trust?

When evaluating a charitable lead annuity trust, consider features such as flexible payment terms, options for asset contributions, and the reliability of the charity beneficiaries. It's also important to ensure the trust structure complies with IRS regulations to maximize tax deductions. A well-structured CLAT will balance both the charitable and personal financial goals of the donor.

-

How does a charitable lead annuity trust affect my heirs?

A charitable lead annuity trust can impact your heirs positively by potentially lessening their inheritance tax burdens. After the charitable payments are made, the remaining trust assets are passed to your heirs when the trust term ends. This means your heirs can inherit a potentially larger sum, particularly if the assets have appreciated in value during the trust term.

-

Can I customize the terms of my charitable lead annuity trust?

Yes, one of the benefits of a charitable lead annuity trust is that you can customize its terms according to your preferences. This includes deciding the length of the trust, the amount of annual distributions, and the charities that will receive the funds. Working with a financial advisor can help tailor a CLAT to meet your specific charitable and financial goals.

-

Are charitable lead annuity trusts revocable or irrevocable?

Charitable lead annuity trusts are irrevocable, meaning that once they are established and funded, the terms cannot be changed or revoked. This characteristic is essential as it provides certainty for the charitable organization that will benefit from the trust payments. However, this also means you will need to commit to the terms and planned distributions fully.

Get more for Charitable Lead Trust

- 54b certified courts state hi form

- Notice of hearing frances yamada courts state hi form

- 5 jud form

- Connecticut advisement form

- Jd fm 164 form

- Order co termination of parental rights and appointment of statutory parentguardian jud ct form

- Templates listing a home in foreclosure form

- Dealer conveyance fee form ct dmv form

Find out other Charitable Lead Trust

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed