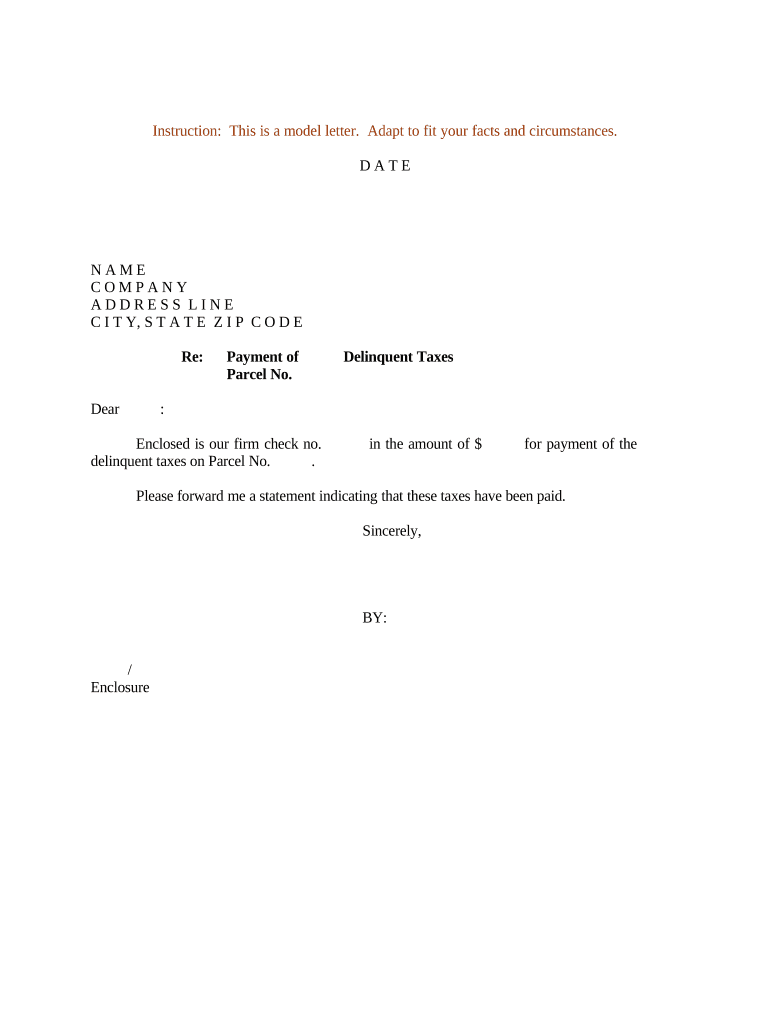

Delinquent Tax List Form

What is the Delinquent Tax List

The Delinquent Tax List is a comprehensive record maintained by local tax authorities that identifies properties with unpaid property taxes. This list is crucial for both property owners and potential buyers, as it outlines the status of tax payments and any associated penalties. Properties listed may face tax sales, where they can be auctioned to recover owed taxes. Understanding this list is essential for anyone involved in real estate transactions or tax-related matters in Blount County, TN.

How to Use the Delinquent Tax List

Using the Delinquent Tax List effectively requires familiarity with its format and contents. Property owners can check their status to ensure they are not listed, while potential buyers can identify properties available for tax sale. The list typically includes details such as the property address, owner information, and the amount of taxes owed. Users should pay close attention to deadlines for tax payments or redemption periods to avoid losing property.

Steps to Complete the Delinquent Tax List

Completing the Delinquent Tax List involves several key steps. First, gather all relevant property information, including the parcel number and owner details. Next, verify the outstanding tax amounts and any penalties associated with the property. Once all information is collected, ensure that the list is updated regularly to reflect any changes in payment status or ownership. This process is vital for maintaining accurate records and ensuring compliance with local tax regulations.

Legal Use of the Delinquent Tax List

The Delinquent Tax List serves a legal purpose in the context of property tax enforcement. It is used by local governments to notify property owners of their tax obligations and to initiate tax sales if necessary. Understanding the legal implications of this list is important for property owners, as failure to address delinquent taxes can result in loss of property rights. Additionally, buyers interested in purchasing properties from the list should be aware of the legal processes involved in tax sales.

Required Documents

To address issues related to the Delinquent Tax List, property owners may need to provide specific documents. These can include proof of payment, tax assessments, and any correspondence with tax authorities regarding delinquency. For buyers interested in properties on the list, documentation such as identification and proof of funds may be required during the tax sale process. Ensuring all necessary documents are prepared can facilitate smoother transactions and compliance with legal requirements.

Penalties for Non-Compliance

Failure to comply with tax obligations can lead to significant penalties. Property owners listed on the Delinquent Tax List may face additional fees, interest on unpaid taxes, and ultimately, the risk of losing their property through tax sales. Understanding these penalties is crucial for property owners to take timely action and avoid further financial repercussions. It is advisable to consult with a tax professional if there are uncertainties regarding compliance and payment options.

Quick guide on how to complete delinquent tax list

Effortlessly Create Delinquent Tax List on Any Platform

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent environmentally friendly alternative to conventional printed and signed documents, enabling you to locate the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to generate, modify, and electronically sign your documents swiftly and seamlessly. Handle Delinquent Tax List on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to Edit and Electronically Sign Delinquent Tax List with Ease

- Locate Delinquent Tax List and select Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to finalize your modifications.

- Choose your preferred method for sending your form, whether via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Delinquent Tax List to ensure excellent communication throughout your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the chancery court for Blount County TN delinquent tax owners consolidated tax case tax sale 27 item no 19?

The chancery court for Blount County TN delinquent tax owners consolidated tax case tax sale 27 item no 19 refers to a specific legal process dealing with delinquent property taxes in Blount County, Tennessee. It allows for the consolidation of tax cases for properties that have not paid their taxes, leading to a potential tax sale for those delinquent owners.

-

How can airSlate SignNow assist with document management related to the chancery court for Blount County TN?

airSlate SignNow simplifies the document management process associated with the chancery court for Blount County TN delinquent tax owners consolidated tax case tax sale 27 item no 19. With our platform, you can easily create, send, and eSign important documents that may be required during tax sale proceedings.

-

What features does airSlate SignNow offer for handling legal documents?

airSlate SignNow offers essential features such as eSignature capabilities, document templates, automated workflows, and secure storage. These features are particularly beneficial for legal documents related to the chancery court for Blount County TN delinquent tax owners consolidated tax case tax sale 27 item no 19, ensuring compliance and efficient processing.

-

Is airSlate SignNow cost-effective for small businesses dealing with tax cases?

Yes, airSlate SignNow is designed to be a cost-effective solution for small businesses, especially those managing legal matters like the chancery court for Blount County TN delinquent tax owners consolidated tax case tax sale 27 item no 19. Its pricing plans are competitive and cater to varying needs, making document management affordable.

-

Can airSlate SignNow integrate with other business tools for legal processes?

Absolutely! airSlate SignNow offers integrations with numerous business tools such as CRM systems, cloud storage services, and other legal software. This ensures that your processes related to the chancery court for Blount County TN delinquent tax owners consolidated tax case tax sale 27 item no 19 are streamlined and efficient, enhancing overall productivity.

-

How secure is airSlate SignNow for handling sensitive legal documents?

Safety is a priority for airSlate SignNow. Our platform employs advanced security measures including encryption and secure access controls, making it ideal for sensitive legal documents tied to the chancery court for Blount County TN delinquent tax owners consolidated tax case tax sale 27 item no 19. You can trust that your documents are protected throughout the eSigning process.

-

What benefits does eSigning bring to the chancery court tax sale process?

eSigning through airSlate SignNow accelerates the process of handling documents related to the chancery court for Blount County TN delinquent tax owners consolidated tax case tax sale 27 item no 19. It allows for quick approvals, reduces the need for physical signatures, and helps manage document workflows more effectively, ensuring timely compliance with court requirements.

Get more for Delinquent Tax List

- Eskom apprenticeship 2020 form

- Uif forms

- Prasa job application form pdf 2020

- Thekwini fet college springfield campus durban form

- Mankwe college online application for 2021 form

- Mercedes benz bursary form

- Khanyisa nursing college online application 2021 form

- Open capitec account online application form

Find out other Delinquent Tax List

- eSignature Maine Business purchase agreement Simple

- eSignature Arizona Generic lease agreement Free

- eSignature Illinois House rental agreement Free

- How To eSignature Indiana House rental agreement

- Can I eSignature Minnesota House rental lease agreement

- eSignature Missouri Landlord lease agreement Fast

- eSignature Utah Landlord lease agreement Simple

- eSignature West Virginia Landlord lease agreement Easy

- How Do I eSignature Idaho Landlord tenant lease agreement

- eSignature Washington Landlord tenant lease agreement Free

- eSignature Wisconsin Landlord tenant lease agreement Online

- eSignature Wyoming Landlord tenant lease agreement Online

- How Can I eSignature Oregon lease agreement

- eSignature Washington Lease agreement form Easy

- eSignature Alaska Lease agreement template Online

- eSignature Alaska Lease agreement template Later

- eSignature Massachusetts Lease agreement template Myself

- Can I eSignature Arizona Loan agreement

- eSignature Florida Loan agreement Online

- eSignature Florida Month to month lease agreement Later