Monthly Bank Reconcilation Form

What is the Monthly Bank Reconciliation

The monthly bank reconciliation is a crucial financial process that ensures the accuracy of a business's financial records. It involves comparing the company's internal financial records to the bank statement for a specific month. This process helps identify discrepancies, such as missing transactions or errors, ensuring that the company's cash balance aligns with the bank's records. Regular reconciliations contribute to better financial management and help prevent fraud.

Steps to Complete the Monthly Bank Reconciliation

Completing a monthly bank reconciliation involves several systematic steps:

- Gather documents: Collect the bank statement and internal records, including the cash book or accounting software reports.

- Compare transactions: Review each transaction listed on the bank statement against the company's records to identify any discrepancies.

- Adjust for outstanding items: Note any outstanding checks or deposits that have not yet cleared the bank.

- Calculate adjusted balances: Adjust the bank statement balance and the company's cash balance to account for outstanding items.

- Identify discrepancies: Investigate any differences between the adjusted balances and document the reasons for these discrepancies.

- Finalize the reconciliation: Ensure that both balances match, and prepare a reconciliation report for your records.

Legal Use of the Monthly Bank Reconciliation

The monthly bank reconciliation is not only a best practice but also a legal necessity for businesses. Accurate financial records are essential for compliance with tax regulations and financial reporting standards. In the event of an audit, having a well-documented reconciliation process can demonstrate the integrity of the financial statements. Additionally, maintaining accurate records can protect the business from potential legal issues related to financial discrepancies.

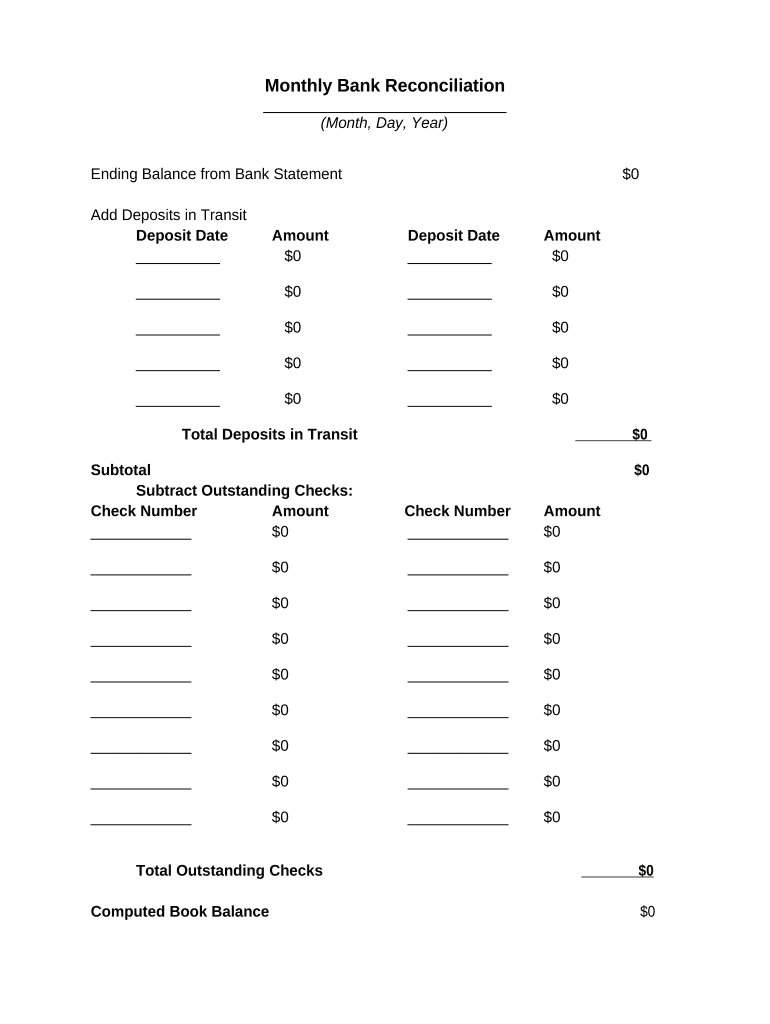

Key Elements of the Monthly Bank Reconciliation

Several key elements are essential for an effective monthly bank reconciliation:

- Bank statement balance: The ending balance reported by the bank at the end of the month.

- Company cash balance: The balance recorded in the company's financial records.

- Outstanding checks: Checks issued by the company that have not yet cleared the bank.

- Deposits in transit: Deposits made by the company that are not yet reflected in the bank statement.

- Adjustments: Any necessary corrections to either the bank or company records to ensure accuracy.

Examples of Using the Monthly Bank Reconciliation

Practical examples of monthly bank reconciliation can illustrate its importance:

- A small business owner discovers a discrepancy between their cash book and bank statement, leading to the identification of a bank error.

- A nonprofit organization uses bank reconciliation to ensure that donations received match the amounts deposited, enhancing transparency.

- A freelancer reconciles their bank statement to confirm that all client payments have been accurately recorded, preventing potential cash flow issues.

Form Submission Methods

The monthly bank reconciliation can be documented and submitted in various ways, depending on the business's preferences and requirements:

- Online: Many accounting software solutions offer digital reconciliation tools that streamline the process.

- Mail: Printed reconciliation reports can be mailed to stakeholders or retained for record-keeping.

- In-person: Some businesses may prefer to conduct reconciliations during financial meetings, allowing for immediate discussion of discrepancies.

Quick guide on how to complete monthly bank reconcilation

Prepare Monthly Bank Reconcilation effortlessly on any device

Online document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary file and securely keep it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents quickly and without hassle. Manage Monthly Bank Reconcilation on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

How to modify and electronically sign Monthly Bank Reconcilation effortlessly

- Find Monthly Bank Reconcilation and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for this purpose.

- Create your signature with the Sign feature, which only takes moments and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message, or invitation link, or download it to your computer.

Say goodbye to misplaced documents, tedious form searching, and the need for reprinting when mistakes occur. airSlate SignNow manages all your document administration needs in just a few clicks from your preferred device. Alter and electronically sign Monthly Bank Reconcilation to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is Monthly Bank Reconciliation and how does it work?

Monthly Bank Reconciliation is the process of matching and comparing your bank statements with your company's financial records. airSlate SignNow offers tools that simplify this process, allowing you to easily track discrepancies and ensure accurate financial reporting. By integrating with your bank accounts, you can streamline your reconciliation workflow.

-

How can airSlate SignNow help with Monthly Bank Reconciliation?

airSlate SignNow provides an efficient solution for Monthly Bank Reconciliation by automating key elements of the process. Our platform enables you to collect electronic signatures on necessary documents, making account verification faster and more secure. This ultimately saves time and reduces the potential for errors.

-

What are the pricing options for airSlate SignNow related to Monthly Bank Reconciliation?

We offer various pricing plans tailored to your business needs for the Monthly Bank Reconciliation features. Each plan provides different levels of access, from basic eSignature tools to advanced integrations for financial management. Visit our pricing page for detailed information on costs and features.

-

Can I integrate airSlate SignNow with my accounting software for Monthly Bank Reconciliation?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, making Monthly Bank Reconciliation a hassle-free experience. This integration allows you to directly synchronize your financial data, ensuring you have the most accurate information available for reconciliation processes.

-

What are the benefits of using airSlate SignNow for Monthly Bank Reconciliation?

Using airSlate SignNow for Monthly Bank Reconciliation offers several benefits, including reduced manual errors and improved efficiency in your financial workflow. Our user-friendly platform makes it easy to obtain necessary signatures and automate tasks, which helps streamline the review process. Ultimately, this leads to faster reconciliations and better financial oversight.

-

Is airSlate SignNow compliant with financial regulations for Monthly Bank Reconciliation?

Yes, airSlate SignNow complies with industry regulations such as GDPR and eIDAS, ensuring that your Monthly Bank Reconciliation process is secure and trustworthy. We adhere to best practices in data protection and electronic signature validation, giving you peace of mind when conducting financial transactions.

-

How does airSlate SignNow ensure the security of my documents during Monthly Bank Reconciliation?

airSlate SignNow employs advanced security measures, including encryption and secure cloud storage, to protect your documents during Monthly Bank Reconciliation. Our platform ensures that sensitive financial information remains confidential while allowing for easy access when you need to review or sign relevant documents.

Get more for Monthly Bank Reconcilation

Find out other Monthly Bank Reconcilation

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free

- eSign Colorado Doctors Operating Agreement Computer

- Help Me With eSign Florida Doctors Lease Termination Letter

- eSign Florida Doctors Lease Termination Letter Myself