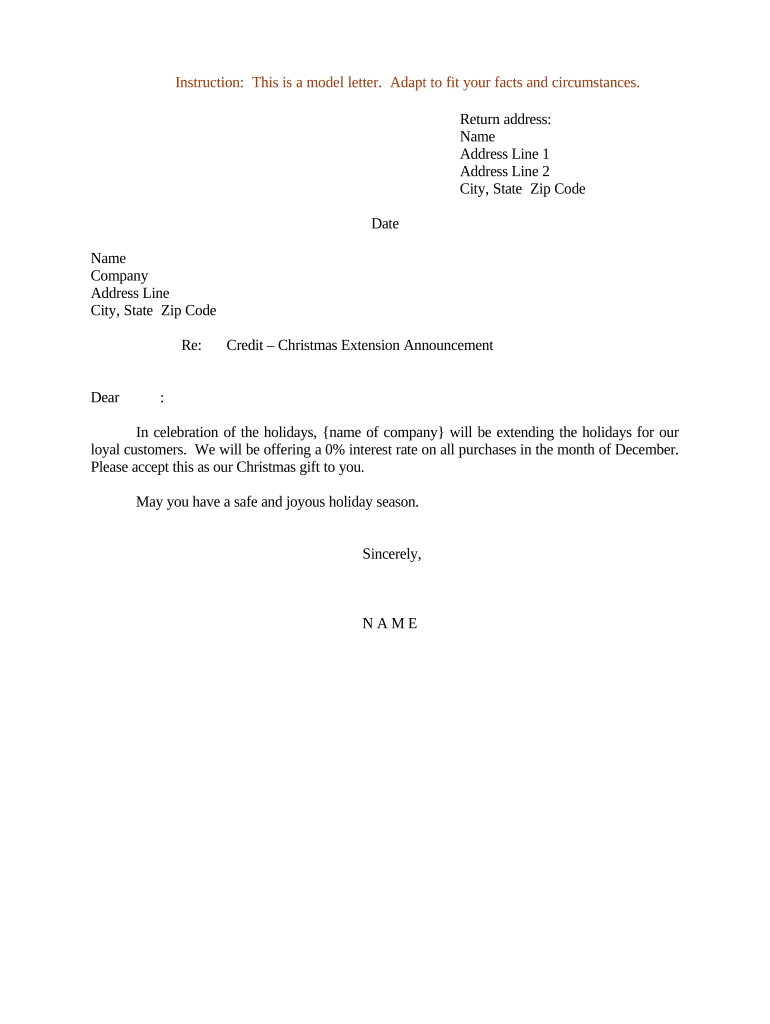

Credit Extension Form

What is the Credit Extension

A credit extension is a formal request made by a business to an existing or potential creditor to increase the amount of credit available or to extend the payment terms. This can be essential for managing cash flow, especially for businesses looking to invest in growth or manage unexpected expenses. The credit extension allows businesses to maintain their operations without immediate financial strain, providing them with the flexibility to pay suppliers or vendors over a longer period.

Key elements of the Credit Extension

When drafting a letter to extend credit terms, several key elements should be included to ensure clarity and effectiveness:

- Business Information: Include the name, address, and contact details of both the requesting business and the creditor.

- Reason for Request: Clearly state why the extension is needed, such as cash flow issues or upcoming projects.

- Proposed Terms: Specify the desired new payment terms, including the length of the extension and any changes to interest rates or payment schedules.

- Financial Information: Provide relevant financial data or documents that support the request, such as recent financial statements.

- Assurances: Offer reassurances regarding the ability to meet the new terms, possibly including references or guarantees.

Steps to complete the Credit Extension

Completing a credit extension letter involves several steps to ensure that the request is clear and professional:

- Gather Information: Collect all necessary information about your business and the creditor.

- Draft the Letter: Begin writing the letter, ensuring all key elements are included.

- Review Financials: Attach any relevant financial documents that support your case.

- Edit for Clarity: Proofread the letter for clarity, grammar, and professionalism.

- Send the Letter: Choose a method of delivery, whether by email or traditional mail, and send the letter to the creditor.

Legal use of the Credit Extension

To ensure that a credit extension is legally binding, it is important to adhere to specific legal requirements. The letter should clearly outline the terms agreed upon by both parties and be signed by authorized representatives. Additionally, compliance with relevant laws such as the Uniform Commercial Code (UCC) may be necessary, as it governs commercial transactions in the United States. Utilizing a reliable electronic signature platform can enhance the legal validity of the document.

How to use the Credit Extension

Using a credit extension effectively involves understanding the terms and conditions outlined in the agreement. Businesses should keep track of the new payment schedule and ensure timely payments to maintain a good relationship with creditors. It is also advisable to communicate proactively with creditors about any potential issues that may arise during the payment period. This transparency can help in negotiating further extensions in the future if needed.

Examples of using the Credit Extension

Credit extensions can be beneficial in various scenarios. For instance:

- A small business facing seasonal fluctuations in sales may request an extension to manage cash flow during slower months.

- A startup may seek extended payment terms from suppliers to conserve cash for operational expenses.

- A company undergoing expansion might request a credit extension to finance new projects without immediate out-of-pocket costs.

Quick guide on how to complete credit extension

Complete Credit Extension effortlessly on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without any holdups. Manage Credit Extension on any platform with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

How to edit and electronically sign Credit Extension with ease

- Find Credit Extension and then click Get Form to initiate the process.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or redact sensitive data with tools that airSlate SignNow specifically provides for this purpose.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the information and then click the Done button to finalize your changes.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you choose. Modify and electronically sign Credit Extension to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a sample letter to extend credit terms?

A sample letter to extend credit terms is a template that businesses can use to request longer payment periods from their suppliers or clients. This letter typically outlines the reasons for the request and includes details about the terms being proposed. Using a sample letter can help ensure that the request is professional and persuasive.

-

How can I effectively use a sample letter to extend credit terms?

To effectively use a sample letter to extend credit terms, personalize the template to fit your specific situation. Clearly state your current credit relationship, the reasons for your request, and any relevant financial information to support your position. This approach can enhance your chances of getting approval from your creditors.

-

Are there any benefits to extending credit terms?

Extending credit terms can benefit businesses by improving cash flow and allowing more time to manage expenses. It can also strengthen relationships with suppliers and clients, showcasing a commitment to maintaining a strong business partnership. A well-crafted sample letter to extend credit terms can facilitate these beneficial negotiations.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow provides a seamless electronic signature solution that allows users to sign documents quickly and securely. It features customizable templates, workflow automation, and real-time tracking, ensuring that important documents, like a sample letter to extend credit terms, can be processed efficiently. These features can signNowly enhance your business’s operational efficiency.

-

How does airSlate SignNow help in managing credit terms documentation?

airSlate SignNow helps manage credit terms documentation by allowing users to create, send, and eSign necessary documents with ease. With features like cloud storage and access to a library of templates, including a sample letter to extend credit terms, businesses can streamline their documentation process. This reduces confusion and speeds up transactions.

-

Is airSlate SignNow cost-effective for small businesses?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses of all sizes, including small businesses. With various pricing plans and features that cater specifically to smaller operations, users gain access to professional-grade tools without breaking the bank. This value can be particularly advantageous when drafting a sample letter to extend credit terms.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various popular applications like Google Drive, Dropbox, and others. This means you can easily incorporate your document management system with eSignatures, making it convenient to use templates like a sample letter to extend credit terms within your existing workflows.

Get more for Credit Extension

Find out other Credit Extension

- Electronic signature Louisiana Car Dealer Lease Template Now

- Electronic signature Maine Car Dealer Promissory Note Template Later

- Electronic signature Maryland Car Dealer POA Now

- Electronic signature Oklahoma Banking Affidavit Of Heirship Mobile

- Electronic signature Oklahoma Banking Separation Agreement Myself

- Electronic signature Hawaii Business Operations Permission Slip Free

- How Do I Electronic signature Hawaii Business Operations Forbearance Agreement

- Electronic signature Massachusetts Car Dealer Operating Agreement Free

- How To Electronic signature Minnesota Car Dealer Credit Memo

- Electronic signature Mississippi Car Dealer IOU Now

- Electronic signature New Hampshire Car Dealer NDA Now

- Help Me With Electronic signature New Hampshire Car Dealer Warranty Deed

- Electronic signature New Hampshire Car Dealer IOU Simple

- Electronic signature Indiana Business Operations Limited Power Of Attorney Online

- Electronic signature Iowa Business Operations Resignation Letter Online

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself