Second Mortgage with Mortgagor's Recertification of Representations, Warranties and Covenants in First Mortgage Form

What is the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

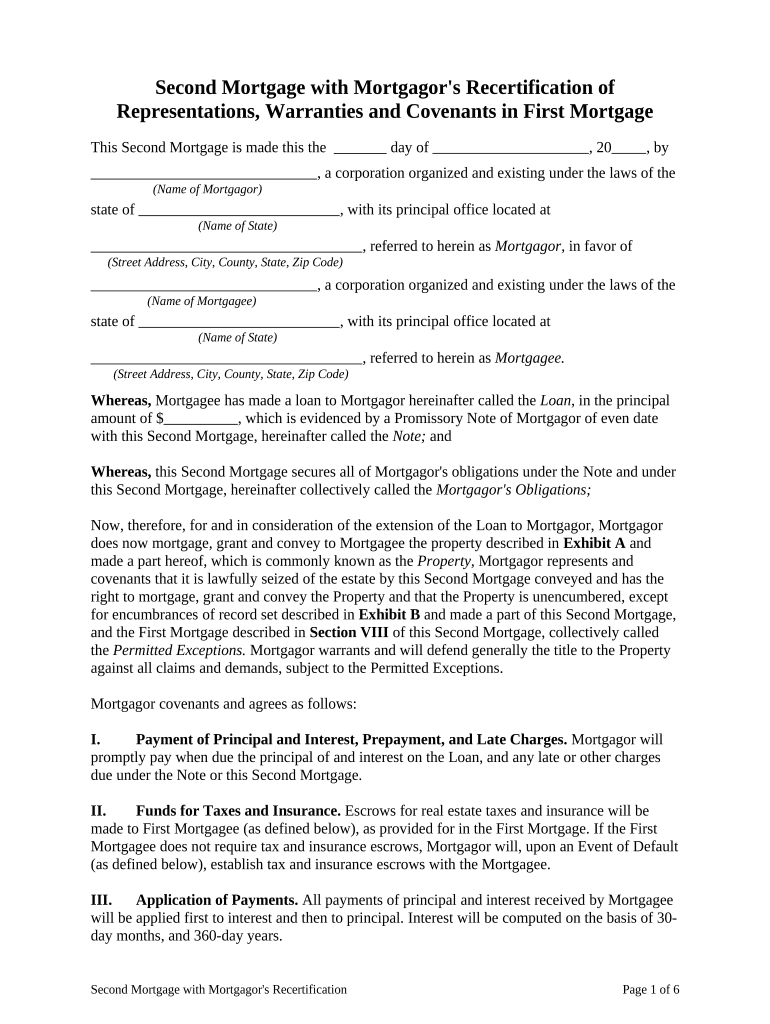

The second mortgage with mortgagor's recertification of representations, warranties, and covenants in first mortgage is a legal document that allows a borrower to secure additional financing against their property while maintaining an existing first mortgage. This form is crucial for lenders, as it ensures that the borrower reaffirms their commitments and the conditions of the first mortgage. By recertifying these representations, borrowers provide lenders with updated assurances regarding their financial status and the condition of the property, which can influence the terms of the second mortgage.

How to use the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

Using the second mortgage with mortgagor's recertification involves a few key steps. First, borrowers must gather all necessary financial documents and details about the existing first mortgage. Next, they complete the form by providing accurate information regarding their current financial situation, property details, and any changes since the original mortgage was signed. Once completed, the form must be signed, either physically or digitally, to ensure its legal validity. Utilizing a reliable digital signing platform can streamline this process and enhance security.

Steps to complete the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

Completing the second mortgage with mortgagor's recertification form involves several steps:

- Review the existing first mortgage agreement to understand the terms and obligations.

- Gather relevant financial documents, including income statements, tax returns, and property appraisals.

- Fill out the form accurately, ensuring all information is current and complete.

- Sign the document using a secure eSignature solution to ensure compliance with legal standards.

- Submit the completed form to the lender for review and approval.

Legal use of the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

The legal use of the second mortgage with mortgagor's recertification is governed by various laws and regulations that ensure the document's enforceability. It must comply with federal and state laws regarding mortgage lending and eSignatures. This includes adherence to the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Proper execution of this form provides legal protection for both the borrower and the lender, ensuring that all representations and warranties are upheld.

Key elements of the Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

Key elements of this form include:

- Identification of the borrower and lender, including contact information.

- Details of the existing first mortgage, such as the loan amount and terms.

- Updated financial information from the borrower, including income and debts.

- Specific representations and warranties that the borrower must recertify.

- Signatures of all parties involved, confirming their agreement to the terms.

Eligibility Criteria

Eligibility for obtaining a second mortgage with mortgagor's recertification typically includes the following criteria:

- The borrower must have a satisfactory credit history.

- The property must have sufficient equity to secure the second mortgage.

- The borrower must demonstrate stable income and the ability to repay both mortgages.

- Compliance with any additional lender-specific requirements.

Quick guide on how to complete second mortgage with mortgagors recertification of representations warranties and covenants in first mortgage 497332703

Easily create Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage on any device

The management of documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documentation, as you can find the appropriate form and securely save it online. airSlate SignNow provides you with all the necessary tools to generate, modify, and electronically sign your documents swiftly without delays. Manage Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and electronically sign Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage effortlessly

- Find Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage and click on Get Form to begin.

- Use the tools provided to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, time-consuming form searches, or errors that require reprinting new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and electronically sign Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a second mortgage with mortgagor's recertification of representations, warranties, and covenants in first mortgage?

A second mortgage with mortgagor's recertification of representations, warranties, and covenants in first mortgage refers to a secondary loan secured by your home, which includes verified representations and commitments related to the first mortgage. This process ensures that the borrower remains compliant with the original loan's terms, providing additional security to lenders. By resignNowing these elements, it minimizes risk and enhances the chances of loan approval.

-

How does airSlate SignNow simplify the process of obtaining a second mortgage with recertification?

AirSlate SignNow streamlines the documentation and signing processes for obtaining a second mortgage with mortgagor's recertification. The platform allows users to easily upload and eSign vital documents, ensuring compliance with necessary representations and covenants. This efficiency saves time and reduces errors, making the second mortgage application process smoother and more straightforward.

-

What pricing options does airSlate SignNow offer for managing second mortgage documents?

AirSlate SignNow offers competitive pricing plans tailored to businesses handling second mortgage documents. These plans are designed to accommodate various needs, ensuring affordability while delivering robust features. By opting for airSlate SignNow, you can effectively manage the complexities of second mortgages without breaking the bank.

-

What are the key benefits of using airSlate SignNow for second mortgage management?

Using airSlate SignNow for second mortgage management offers numerous benefits, including enhanced efficiency, better compliance tracking, and improved document security. The platform's user-friendly interface helps users easily navigate the complexities of second mortgages with mortgagor's recertification. This not only saves time but also enhances overall workflow.

-

Can I integrate airSlate SignNow with other financial software for managing second mortgages?

Yes, airSlate SignNow can seamlessly integrate with various financial software applications to facilitate the management of second mortgages with mortgagor's recertification. This interoperability helps streamline operations and improves data accuracy across platforms. With built-in API and integration capabilities, you can customize your document workflows to fit your specific needs.

-

What features does airSlate SignNow offer for tracking second mortgage documents?

AirSlate SignNow provides robust tracking features that allow users to monitor the status of second mortgage documents in real-time. You can easily see when documents are sent, viewed, and signed, ensuring transparency throughout the process. This level of tracking is particularly useful for managing the compliance aspects required in second mortgages with mortgagor's recertification.

-

Is airSlate SignNow compliant with regulations for second mortgages?

Yes, airSlate SignNow is designed to meet regulatory standards applicable to second mortgages, including those involving mortgagor's recertification of representations, warranties, and covenants. The platform adheres to industry best practices for document security and compliance, helping users avoid potential legal issues. Trust in airSlate SignNow to maintain your compliance while managing second mortgages efficiently.

Get more for Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

Find out other Second Mortgage With Mortgagor's Recertification Of Representations, Warranties And Covenants In First Mortgage

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer

- eSignature Wyoming LLC Operating Agreement Later

- eSignature Wyoming LLC Operating Agreement Free

- How To eSignature Wyoming LLC Operating Agreement

- eSignature California Commercial Lease Agreement Template Myself